InfinitumProdux

Thesis

Leading dry bulk shipping company Star Bulk Carriers Corp. (NASDAQ:SBLK) has seen its stock continue consolidating since our previous update. Notably, analysts’ estimates have been slashed further into Q1’23 as the rate compression continues, given worsening consumer and industrial demand.

However, SBLK had nearly given up all its gains on a YTD total return basis at its September lows. Hence, the market has justified its de-rating on point yet again, well ahead of the analysts’ cuts. In addition, investors need to consider that the market is a forward-discounting mechanism, as it anticipated that Star Bulk Carriers would not be immune to a global recession.

Therefore, leading container shipping company Maersk’s recent dire warning of “plenty of dark clouds on the horizon” for shipping companies corroborated the market’s prescience. The market had rejected further buying upside in SBLK at its June highs, despite seemingly “cheap” valuations. Thus, we encourage investors to encompass a holistic framework of looking at fundamentals, valuations, and price action to assess their opportunities/risks.

Our analysis indicates that SBLK remains at a critical juncture heading into its Q3 earnings release on November 16. SBLK’s valuations remain configured for a recessionary scenario, but we believe it’s unlikely to be re-rated higher in the near term.

Therefore, SBLK’s price action needs further buying support to retake its medium-term bullish bias, which has been lost. However, SBLK remains relatively well-supported above its 200-week moving average, which buyers must defend resolutely.

We remain optimistic about Star Bulk’s prospects through the cycle, as we expect structural tailwinds to remain constructive in the medium term. Moreover, SBLK’s reversal from its long-term downtrend also undergirds our conviction that long-term buying support remains favorable. Hence, we view the consolidation phase as a potential accumulation opportunity for investors looking to buy through the recession.

Maintain Buy, with a price target (PT) of $24.

Street Analysts Slashed SBLK’s Forward Estimates

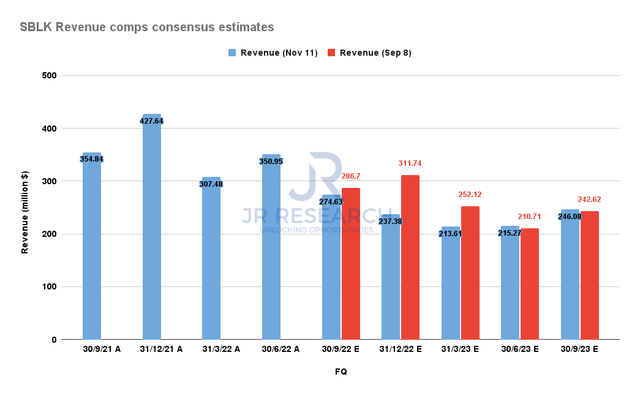

Star Bulk Revenue comps consensus estimates (S&P Cap IQ)

As seen above, the Street analysts have finally awakened to the prospects of a recession that could significantly impact the company’s ability to sustain its remarkable revenue growth from FY21.

Coupled with falling charter rates that could stretch into FY23, given worsening demand, Wall Street lowered the bar for Star Bulk’s Q3 revenue estimates by nearly 4% but by almost 24% for Q4.

Star Bulk highlighted it had secured 61% of available days at a $29K daily rate at its previous earnings release, which helped provide visibility for its Q3 earnings.

However, the market needs to de-risk its execution risks for Q4, which could explain why the market battered SBLK into its September lows. Furthermore, the declining trend of charter rates into November needs to be reflected accordingly by the Street in their projections. Hence, we believe Star Bulk’s forward guidance has likely been de-risked to a certain extent by the market.

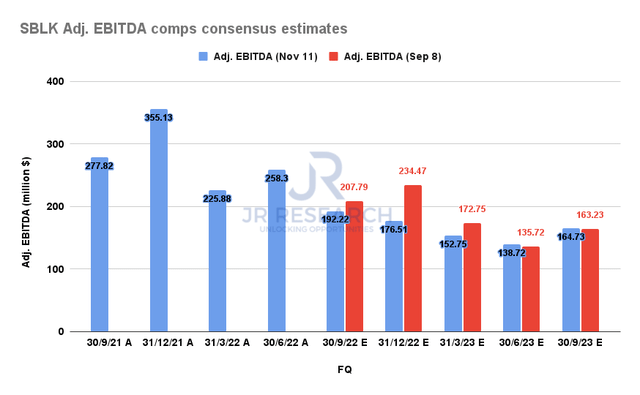

Star Bulk Adjusted EBITDA comps consensus estimates (S&P Cap IQ)

However, investors need to parse the likely impact on its profitability, as it’s critical for the sustainability of its distribution policy.

As seen above, Star Bulk’s Q3 adjusted EBITDA projections have been marked down by nearly 8%. Moreover, its Q4 estimates have been slashed by almost 25%. Therefore, we believe investors need to expect the potential for dividend cuts in the near term, giving some space for Star Bulk to recover its earnings power in the medium term.

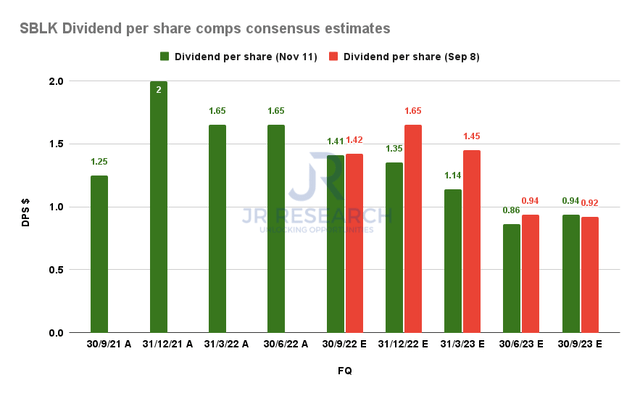

Star Bulk Dividend per share comps consensus estimates (S&P Cap IQ)

Hence, we deduce that the reduction of its dividend per share (DPS) projections through H1’23 is credible to reflect the recessionary headwinds. The critical question is whether the market is anticipating a mild-to-moderate base case or a severe recession over the next twelve months.

That’s a challenging question, as no one has a crystal ball. Notwithstanding, we are leaning into the mild-to-moderate camp for now. October CPI data also seems constructive enough for the Fed to consider pausing its record hiking cadence after one or two more hikes through early 2023.

That should help support our base case thesis, reducing the headwinds that could impact Star Bulk’s near-term rate compression.

Is SBLK Stock A Buy, Sell, Or Hold?

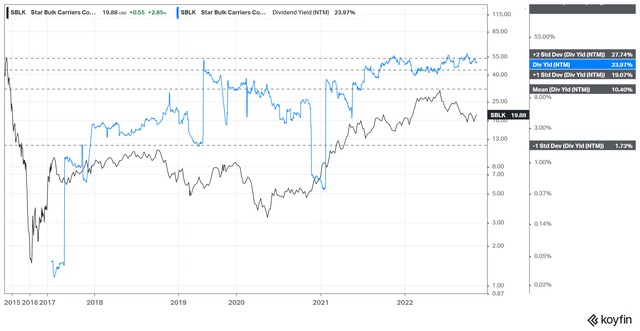

SBLK NTM Dividend yields % valuation trend (koyfin)

Given the cut in forward dividend projections, SBLK’s NTM dividend yield of 24% remains under the two standard deviation zone below its average. Hence, the de-rating by the market was justified to keep SBLK’s yield within that zone.

We believe the market is unlikely to re-rate SBLK much higher until there’s more visibility on the severity of the coming recession. Despite that, the probability of a 50 bps hike for the upcoming December FOMC has been lifted markedly to 80.6%. Hence, we believe the near-term upside in the equity markets has been reflected after yesterday’s more “modest” CPI release.

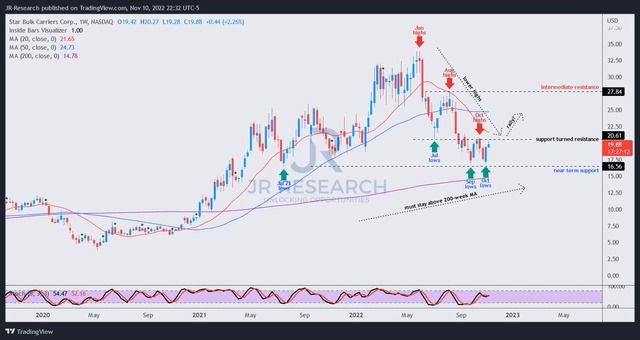

SBLK price chart (weekly) (TradingView)

As seen above, SBLK remains supported above its 200-week moving average (purple line) or 200-week MA. It’s the critical “final defense line” that long-term buyers need to defend resolutely to maintain SBLK’s nascent long-term uptrend bias.

Notwithstanding, we gleaned that a series of resistance zones remain in SBLK’s path to retake its bullish momentum. Selling pressure remains robust at its October highs, which has prevented SBLK from moving to retake its 50-week MA (blue line). If SBLK cannot muster enough buying momentum to retake that line, its bullish momentum has likely been weakened decisively, forcing SBLK into a consolidation zone for some time.

For now, we parse it’s prudent for investors to add positions closer to its near-term support. Therefore, if you are more conservative, you can consider a pullback first from the current levels.

Still, we remain constructive at the current levels and anticipate a further rally toward the $25 zone in the medium term.

Maintain Buy with a PT of $24.

Be the first to comment