Altayb/iStock via Getty Images

STAG Industrial (NYSE:STAG) is trading at one of its cheapest valuations ever despite posting some of its strongest results ever. Given that STAG is benefiting tremendously from macro trends with no end in sight, we rate it a Strong Buy on the dip. In this article, we discuss the risks as well as detail why we believe STAG is a Strong Buy right now.

STAG Stock: Incredibly Cheap Valuation

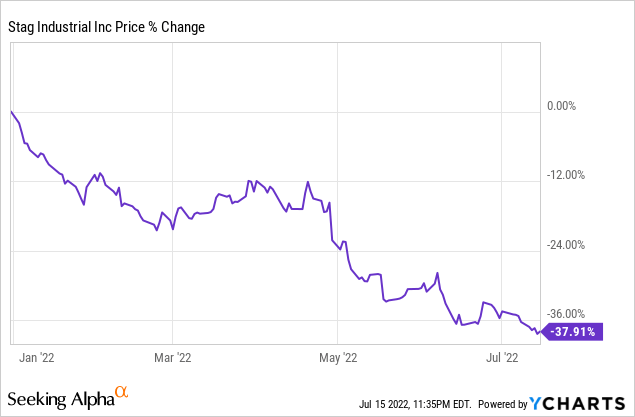

Thanks to its share price plunging by nearly 40% year-to-date, STAG is currently valued at just 13.5x forward FFO and 15.3x forward AFFO.

This is extremely cheap when compared to its five-year average P/FFO of 16.27x and its five-year average P/AFFO of 17.37x. Furthermore, its EV/EBITDA is only 15.5x compared to its five-year average EV/EBITDA of 17.4x and its forward dividend yield is 5% compared to its five-year average of 4.75%. Perhaps most shocking of all is that it is currently trading at just 0.7x NAV, despite historically trading right in line with NAV.

STAG Stock: Strong Fundamentals

With such a steep decline in the share price and such a deep discount on each of its valuation metrics, you would think that the fundamentals were suffering. However, this could not be further from the truth. Last year, on top of paying out a solid dividend, STAG grew AFFO per share at a 9.8% clip and this year it is expected to grow AFFO per share at a whopping 10.4% rate.

If there is one major complaint that can be levied at STAG it is that dividend growth has been anemic. Since 2015, it has only grown at a 1% CAGR. However, there is a good reason for this: STAG operates in a high growth industry with near limitless attractive opportunities to deploy capital to increase shareholder value. As a result, STAG has chosen to retain more of its cash flow in order to maximize its ability to take advantage of these opportunities.

As an industrial REIT, STAG benefits from several macro tailwinds:

- The ongoing e-commerce boom

- Supply chain logjams that put well-located industrial real estate at a premium

- Onshoring of supply chains in the wake of Russia’s invasion of Ukraine and China’s zero COVID-19 policy

As a result, STAG is able to command strong pricing power from tenants, with renewal leases being signed at 8.9% weighted average increases and new leases seeing a weighted average increase of 25% (overall weighted average cash rent change of +15.2%).

STAG Stock Risks

While the price sure looks cheap and the fundamentals remain very strong, the long-term growth story is a bit murkier. First and foremost, if we get hit with a severe and/or long recession, demand for new industrial real estate may very well slow. Leading e-commerce giant Amazon (AMZN) – STAG’s largest tenant – has already announced that it has overbuilt its logistics infrastructure and is going to have to scale back some. This could very possibly foreshadow similar moves by other e-commerce related companies.

Another big risk is that with interest rates soaring and STAG’s share price trading below NAV, its cost of capital is quite high at the moment. Given that cap rates have not moved up much yet, STAG will likely have a more challenging time sustaining its growth rate beyond this year. This becomes even more pronounced when considering that AMZN and possibly others could be pulling back. This then compounds further by meaning that STAG will be even less likely to accelerate its dividend growth given that capital is now more valuable than ever to it.

Finally, given that its properties are of lower quality and/or in less desirable locations than some of its peers’, STAG might suffer more during a recession as some of its tenants may be less likely to renew their leases with them or even vacate their properties in the event of financial distress.

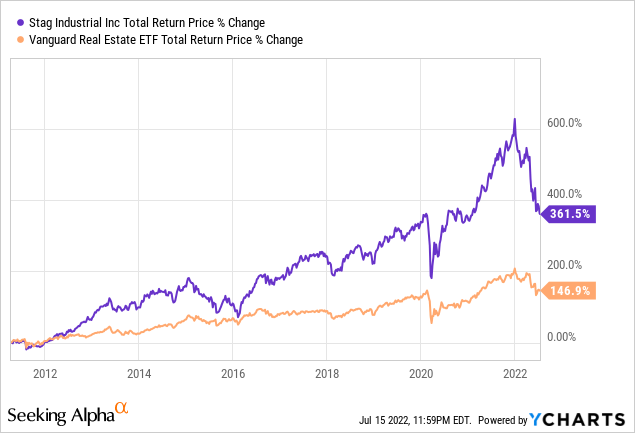

STAG has generated strong market crushing shareholder returns since inception despite its share price recently falling off a cliff:

It has done this by effectively implementing a value-add strategy where it buys lower quality assets on a value basis and then improves the assets and the tenant quality. Sometimes it even acquires a vacant property and brings in a fresh tenant. It then either simply holds the asset and benefits from the improved risk-adjusted returns or it opportunistically sells the asset and recycles the capital into a fresh value-add opportunity.

While this strategy has worked exceptionally well during a boom period for industrial real estate, how well it will fare in a recessionary environment is yet to be determined.

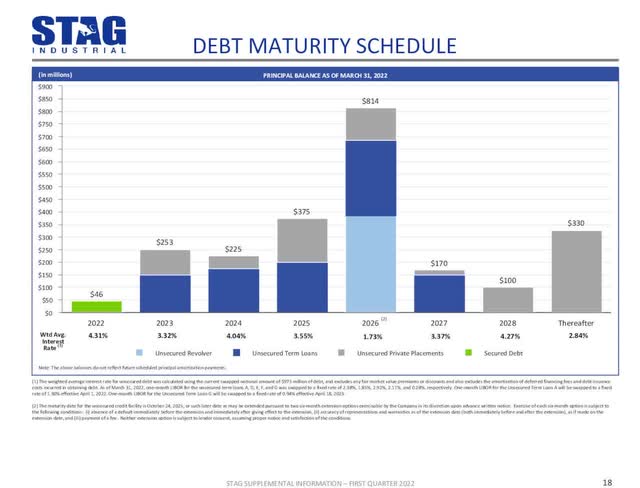

Another important consideration is that its debt maturity schedule is fairly favorable, with the only debt due this year being its highest weighted interest rate debt to begin with and it is quite minimal at just $46 million.

Balance Sheet (STAG Investor Presentation)

However, maturities increase beginning in 2023 and the weighted average interest rates look like they will have to be refinanced at much higher interest rates if current interest rates conditions persist. This could take a meaningful bite out of the bottom line.

Investor Takeaway

STAG stock is looking cheaper than ever thanks to a steep sell-off year to date. The dividend yield has reached the 5% level, which is typically a great time to buy shares and the stock trades at a steep 30% discount to NAV. The business is also booming at the moment.

However, with interest rates rising, sector cap rates remaining flattish, recession risks rising and leading e-commerce tenants beginning to pull back on their aggressive logistics infrastructure buildout, the future for STAG and its secondary and tertiary properties and locations is somewhat uncertain, especially beyond this year.

That said, while the risks are there, STAG has an investment grade balance sheet, a pretty well-laddered debt maturity schedule, and is trading at a steep discount to NAV. As a result, we believe it warrants a Strong Buy rating and is likely to deliver attractive risk-adjusted returns over the next five to ten years.

Be the first to comment