alexei_tm/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to discuss the ProShares Ultra S&P500 (NYSEARCA:SSO) as an investment option at its current market price. This is a fund I follow closely, but buy selectively, because it is a leveraged ETF that can be highly volatile. Specifically, it is designed to offer a “return that is 2x the return of its underlying benchmark for a single day, as measured from one NAV calculation to the next”. This benchmark is the S&P 500, so SSO is the right move for those expecting large-cap U.S. equities to rise.

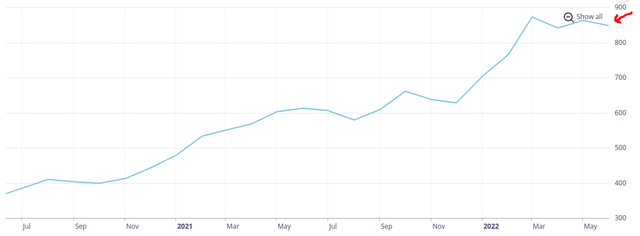

With this in mind, I saw some value in this option about two and a half months ago when the market began to sell off. I suggested buying in, and SSO has indeed performed pretty well since that review:

Fund Performance (Seeking Alpha)

While the short-term gain has been nice, I am starting to get a bit concerned that the market is rallying too aggressively given the macro-environment. It appears some risks are now being discounted. While I will remain long equities as a whole, because that is my general bias and the best value in the market today in my opinion, I don’t think it is the right time to start buying up SSO. Therefore, I am shifting my rating to “hold”, and will explain why below.

Defensive Areas Are Still Winning

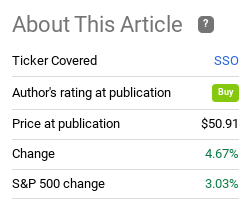

To start, I want to give some context on the broader market with respect to sector investing. 2022 has been a difficult year to navigate in many ways, with losses across a variety of asset classes. The major indices are down, and most sectors are not just down but seeing heavy losses. Yet, there are some bright spots that should not be discounted. Energy has been the big winner, of course, but other defensive sectors such as Utilities and Consumer Staples are holding their own. By contrast, the more cyclical sectors have taken a beating:

Sector Performance (Charles Schwab)

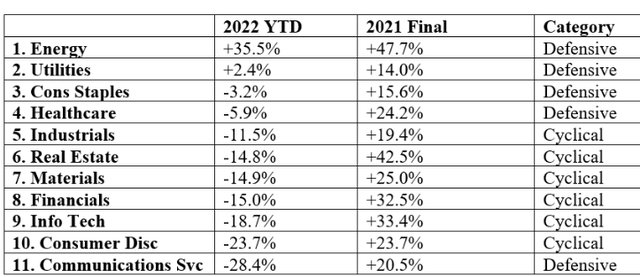

To be sure, past performance – no matter how recent – does not guarantee future results. But it does give us some insight into what has been working this year, and what hasn’t. With this in mind, it helps explain why we want to approach SSO cautiously, or at least selectively, for the time being. The reason behind this outlook is that SSO, since it tracks the S&P 500 index, is heavily tilted towards the Info Tech sector, along with other discretionary areas:

SSO Sector Breakdown (ProShares)

The emphasis here is to illustrate that the S&P 500, and SSO by extension, are probably going to continue facing volatility in the second half of the year. Many of the say pros and cons exist as when we started the year in January, so it is reasonable to expect amplified ups and downs in the Tech space. This would also be relevant to other discretionary and cyclical areas, many of which are overweight in SSO as well. The point is not to suggest owning this or buying this is “bad”, but it reiterates the need to selectively and to buy on weakness, not necessarily at all times. Given the run the fund has had of late, it supports taking that more cautious tone now, in my opinion.

Inflation & Supply Chain Issues. Improving, But Not Improved

The next topic to discuss is the headline story of 2022. This is inflation, which took hold with a firm grip and has not yet go. This has caused turmoil in the markets especially, save in a few spots (energy/commodities being a notable exception). However, markets have started rallying recently because there are signs inflation may be “peaking”. Now, I am going to say there are indeed some signs this could be true. But we have to remember the same people who are telling us it is peaking now, are the ones who told us inflation would be “transitory” last year. And we all know how that turned out. My suggestion here is not to try and tell you when inflation is going to peaked or whether it already has. But rather to be open-minded to the idea that even the most senior economists and market forecasters have not been getting this right, so it is safe to suggest anything could happen in Q3 – Q4 with respect to inflation.

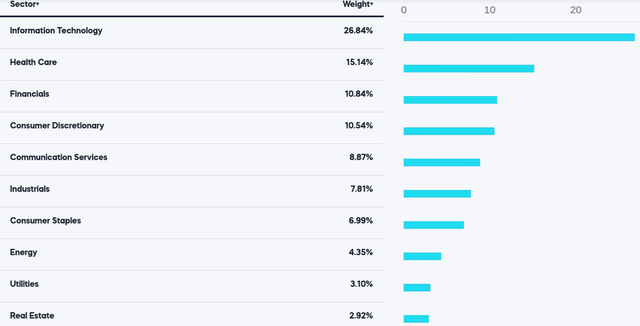

Pointedly, we should recognize that inflation in core goods remains stubbornly high. This has been pressuring consumer spending as more household allotments go towards staples and less on discretionary items. Recent headlines are suggesting that inflation may be peaking and prices may be normalizing, which has been bullish for equities. But this future forecast should not discount that the PCE index actually rose in June, and inflation-adjusted spending has been very weak as a result:

Inflation and Spending Figures (Bureau of Economic Analysis)

I am trying to convey that whether or not inflation is indeed peaking is not that comforting in the immediate moment. Does it offer a positive signal that bodes well for the broader macro-environment? Yes, it does. But it is not a trend that has firmly taken hold where we can take money to the bank on it – yet. Readers should understand inflation remains a major pain point for American and global consumers, no matter the optics coming out of central banks or government figures. This presents a challenge for more equity gains.

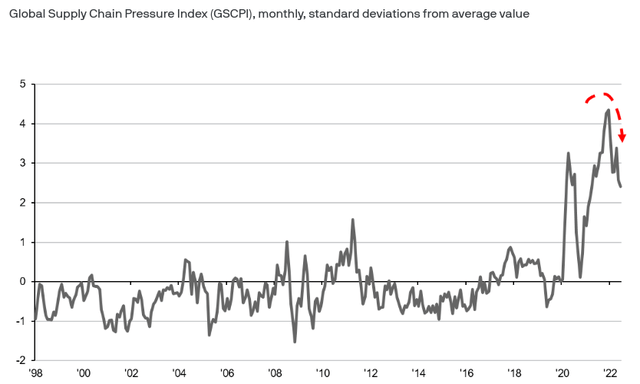

A similar story unfolds when we look at the supply-chain issues facing manufacturers, distributors, and producers, which eventually works its way down to end consumers. Supply-chain pressures are starting to ease, suggesting that issues may have or currently be “peaking”, just like inflation. With commodity prices easing, more people entering the labor force, and economies continuing to open up world-wide (most notably in China), the Global Supply Chain Pressure Index has been falling in the short-term. This means the potential supply chain disruptions has decreased recently:

Supply Chain Pressure Index (JPMorgan Asset Management)

This is just one metric, but it could be used to suggest the “worst is over” mentality is justified. However, just like inflation, “better” does not translate to “great”. While it is a positive to see the pressure index ease, readers likely recognize it remains at a high level historically. That is a source of concern.

At this juncture I do want to be clear I am not “bearish” on stocks right now. Broad market sell-offs present opportunities, and should be reasons to buy, not sell in fear. But what I am suggesting is that SSO is a leveraged, and therefore more risk-on, play on equities when the environment remains challenged. So while I will keep on holding stocks – whether in Energy, Tech, or the S&P 500 as a whole – I’m not plunking cash down in a leveraged bet anymore.

A More Dovish Fed Is Supporting Markets

I have thus far pointed out a few concerns I have about equities and why that supports a more neutral stance on SSO. But I think it is just as important to reflect on why equities have been having a strong run as of late. After all, SSO has pumped up some solid gains, so maybe that trend can continue. With equities still heavily in the red for the year, the rebound could have much further to go if stocks try to reclaim former highs. So, in that light, plenty of upside could exist. The question here is – why?

A primary reason has to do with economic data that is just so-so. Does that sound counter-intuitive? It should. But the reality behind it is that weaker than expected economic figures and/or slowing price growth could actually be good for stocks. In normal times that may not make sense, but we are not in normal times. We are in the middle of a Fed rate hiking cycle that has been pressuring long-term growth and earnings forecasts. Economic data that suggests the Fed’s actions have already cooled the economy, or fears that more action could cool it too much, could force the Fed’s hand to pump the brakes. If the brakes are applied – in this case, a more dovish rate hiking cycle – then the growth/tech heavy S&P 500 could continue to rally.

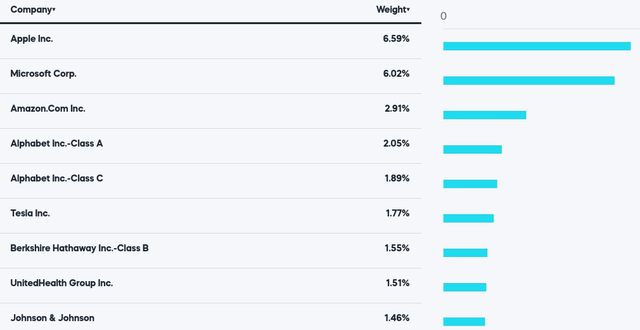

Some metrics to look at when evaluating the likelihood of a more dovish Fed were already discussed in this review. For example, the downward trend in the Fed’s Global Supply Chain Pressure Index is one attribute the Fed could use to support being less hawkish. Another is the recent fall in commodity prices. The Fed’s ambition to cool inflation relies heavily on commodity prices falling since rising energy, food, and other input costs are driving the inflation figures the most. With the commodity price index finally coming off its highs recently, there is an argument to be made for the Fed to be less aggressive with rate increases later this year:

All-Commodity Price Index (World Bank)

With some price pressure easing, coupled with the Fed already hiking rates this year, (including just a week ago when the benchmark rate was raised to 2.25%-2.50%), there could be an argument for a bit of a pause.

In my view, this was probably not the last rate hike. But Powell’s comment that we may be in “neutral” territory is giving investors time to re-think what the interest rate movements are going to be in the second half of the year. Specifically, Powell was quoted:

We’re at 2.25 to 2.5 and that’s right in the range of what we think is neutral”

This was a bit of a change in tone and could be a catalyst for large-cap Tech companies if indeed the Fed pumps the brakes a bit. For example, the S&P 500 is Tech heavy and still down 13% for the year even with the recent uptick:

S&P 500 YTD Loss (Google Finance)

A good part of the reason for this decline is the Fed’s rate hike ambitions, which extends to the projection that the economy will slow. This has pressured Tech and Growth names – like the ones that dominate the S&P 500 and SSO. If this story is coming to an end with the Fed pausing rate hikes or raising them less aggressively, then it stands to reason the S&P 500 will continue to see a reversal and move higher.

Beyond that, earnings season is underway and the large-cap Tech names are actually registering better than expected performance. So while the macro-interest rate outlook may help equities overall, SSO could see more gains in particular because its top holdings are delivering on revenue and profits.

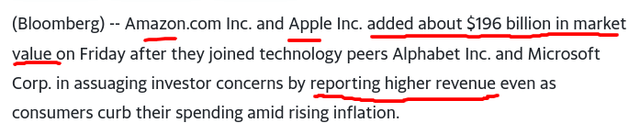

For example, SSO’s top holdings are the famous Tech names like Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), among a few other familiar faces:

A handful of these companies announced earnings last week and the results were roundly positive. Shares shot up, and investors were put at ease over longer term projections from management. For perspective, consider this excerpt from Bloomberg:

Q2 Earnings Excerpt (Bloomberg)

The takeaway for me is that there are bullish catalysts out there. The Fed’s words and actions will continue to dominate markets. If the hawkish course that was plotted in the first half of the year wanes in the second half, that bodes well for SSO. Whether it will or not remains to be seen, but there is definitely a scenario where SSO can keep on moving higher. When investors want to take that risk at this moment is up to them.

Bottom-line

SSO has had a rough 2022 overall since the underlying index has fallen. Yet, there have been moments of greatness peppered in. Since this ETF offers 2X the returns of the S&P 500, when the index catches a bid higher, it can really do well. Case in point is the 5% gain in the past few months, nothing to sneeze at in this environment. While there is certainly merit to riding the wave in case it keeps going higher, I’d strike a more cautious tone.

The market has rallied partly on earnings, the potential for inflation peaking, and a less hawkish Fed in the months ahead. I think all of these attributes are a bit ambitious to continue unabated in the next few quarters. Having inflation peak and the Fed pause simultaneously seems like an unlikely scenario. If it happens, great, but if not then market gains will be more difficult to come by. The Russia-Ukraine conflict remains a sore spot for supply-chains, energy and commodity prices, and broader investor sentiment. This geo-political risk could continue to weigh on sentiment, and I also think the recent headlines reminding the world about China’s ambitions in Taiwan should be a hint that the world remains as inter-connected as ever. If conflicts flare up around the globe, U.S. markets are going to feel the heat.

The conclusion I draw here is to stay optimistic on U.S. equities, but not to take too much risk. SSO is a riskier play that I use when the market is falling on fear. When that backdrop changes, I exit, as I have done now. For the time being, I will sit on the sidelines with respect to a leveraged S&P 500 play until the market sees another drawdown. Therefore, I am lowering my rating on this fund to “hold”, and suggest readers approach it selectively at this time.

Be the first to comment