double_p

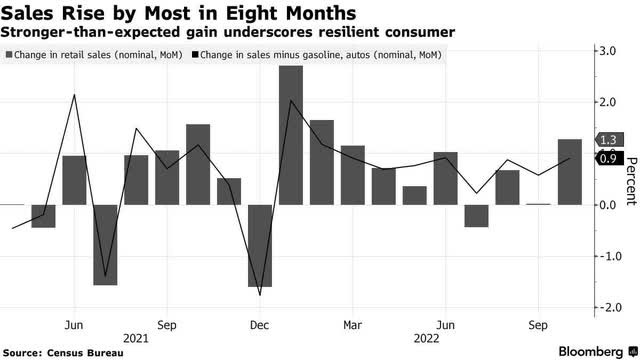

A disappointing earnings report from Target sent retail stocks reeling yesterday, feeding fears that consumers are pulling back and that the economy could be on the cusp of a recession. Yet retail sales for October told a different story, rising by the most in eight months. Unfortunately, a strong economic report does us no favors, because it ignites concerns about more aggressive monetary policy. In my view, Target’s problems are company specific, and poor execution by management is to blame. Consumer spending remains resilient, but not to the extent that the Fed needs to be more aggressive in its rate-hike cycle. In fact, steady consumer spending levels in combination with better-than-expected inflation reports, as we have had recently, should be music to the ears of Chairman Powell who is targeting a soft landing in 2023.

Finviz

The consensus was quick to converge on yesterday’s retail sales report with the assertion that its strength gives the Fed more room to be aggressive in raising rates. That is nonsense. The Fed is only concerned about economic vitality to the extent that it fuels inflation. I don’t see yesterday’s report as doing that. Regardless, that sentiment seemed to rule the day, and it was further fueled by hawkish rhetoric from Fed governors Mary Daly and Christopher Waller. I think the market has been looking for reasons to pullback from overhead resistance in recent days after its double-digit gains, and retail sales was a good excuse.

Bloomberg

Where I think the consensus on Wall Street is mistaken is the assumption that consumer savings and wage growth is the driving force behind today’s inflation. To the contrary, both are helping to mitigate the financial stress caused by higher prices, and the price increases should abate in the coming year as the one-time factors helping to fuel them fade. My reasoning is based on the fact that consumers are not purchasing goods and services in greater volumes today than they were a year ago. Nearly all of the increase in consumer spending over the past 12 months is due to price increases.

The sales for “core” items, which exclude the most volatile categories of autos, gasoline, and building materials, rose 0.9% in October and are up 7.9% over the past year. Overall retail sales are up 8.3% over the past year. Both figures are a smidge higher than the 7.7% increase in the Consumer Price Index for the same period. Therefore, it looks to me more like consumers are simply accepting higher prices, based on expectations that they are temporary and their ability to pay, rather than fueling them with greater demand.

As a result, I think we are in a race to see whether savings and wage gains will outlast higher prices over the coming year. I am optimistic. The savings boosted by Covid-related transfer payments will surely dry up, but wage gains should be far more sustainable. As the rate of inflation falls below the rate of wage growth, real wage gains should maintain very modest consumer spending growth, which is how we source the majority of our economic growth. That is the bedrock of my outlook for a soft landing in 2023.

On a final note, it occurred to me that Warren Buffet just initiated a $5 billion position in Taiwan Semiconductor, as seen in the latest quarterly filing for Berkshire Hathaway. That does not seem like the kind of cyclical bet that such a shrewd investor would make in advance of a global economic downturn or U.S. recession.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment