imaginima/E+ via Getty Images

Gray Television (NYSE:NYSE:GTN) is the nation’s largest owner of top-rated local television stations in the United States, which operates in 113 television markets representing about 36% of the total US television households.

The company’s portfolio consists of 80 markets with top-rated television stations and about 100 markets with first and second-highest rated television stations. This shows that the company has a significantly strong presence in the cable television industry.

Also, the company focuses on developing a talented local team to provide strong local news and information programming, which helps the company to sustain its leading position in the local markets, and as a result of its growing strength, the company is expected to produce more than $500 million from political advertising revenue till the end of the year.

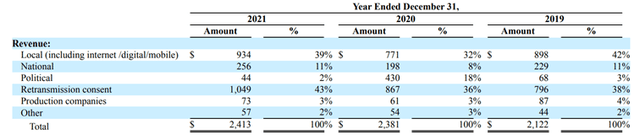

revenue segments (annual report)

Local stations and retransmission consent has been a major revenue stream for the company. Over time, these segments have performed very well for the company, resulting in significant cash flow generation.

Due to the significant concerns about the business model and the current adverse economic conditions, the stock has dropped more than 52%. I think there is a high chance that it might drop further if the profitability can’t be sustained.

The business model is substantially robust and, in the past, has produced huge cash flows for the company. Still, the future prospect of the industry, along with significantly high debt obligations, puts the business at substantially high risk. Therefore, I think it is better to stay away; I assign a sell rating to the stock.

Historical performance

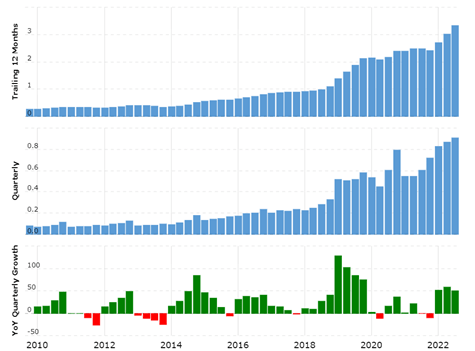

revenue growth (macrotrends.net)

In the last ten years, revenue grew more than six times from $404 million in 2012 to about $2.4 billion by 2021. Such phenomenal growth is a result of consistent development and acquisitions.

As the revenue increased significantly, net profits also jumped and reached an all-time high of $410 million in 2020 but again fell to about $90 million in FY 2021. The significant growth in net profit during 2020 is wholly attributed to the covid related increase in viewership and advertising expenses; therefore, there is a high chance that the margins might not be sustained at these levels.

Also, outstanding shares have diluted significantly during the same period, from 57 million to about 95 million. But due to the significant growth in net profits, EPS grew desirably despite huge dilution.

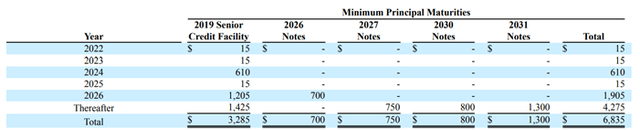

As a result of aggressive acquisitions from 2018 onwards, debt started rising and reached about $6.4 billion to date, whereas liquid assets are considerably low. Having such a significant debt puts the business at significantly higher risk. Also, the company doesn’t have many fixed assets. Instead, it has more than $8.7 billion in intangibles, which might affect its credit ratings in my view.

Strength in the business model

The business model has a significant strength, which is why the company could attain the #1 position in the industry.

FCC regulations

The Federal communications commission is the primary regulatory body that limits the number of broadband licenses in any area. As a result, the company gets a moat around its castle, protecting the business from unusually intense competition. Over the period, regulation has played a significant role in controlling competitors in the industry, and as a result, existing players have enjoyed considerable cash flows.

#1 stations

The company has diversified networks, and out of 113 markets, it has a leading position in more than 80 markets. Such a strong position gives the company considerable negotiation power over its major network affiliates. Also, it provides a significant advantage in attracting top talents, further bringing quality to the business model.

Over the period, due to its leading position, the company has negotiated with various entities, and as a result, its profit margins remain higher than its peers.

Risk

Having various regulations controlling the business growth along with huge debt obligations potentially puts the business at risk.

Restricted further growth

The company has grown significantly, and due to consistent acquisitions, Gray tv has reached about 36% of us households, giving the company a leading position in the industry. But as per stated in the annual report, FCC regulates all tv station operations, and according to their rules, one company should not exceed its reach to more than 39% of US households. Therefore, this regulation will hamper the company’s growth in the coming year, and the company could not grow its operations further, limiting revenue growth.

Also, investors most likely can’t expect further growth in the company because current debt obligations are significantly high and creditors might impose restrictions on further acquisition activities. Now, it has become clear to me that growth in the company is unlikely to happen.

Huge debt obligation

There isn’t any significant debt that is due till 2024, but after that large number of debt obligations are due.

Also, due to its presence in the declining market, the company might face significant trouble in obtaining debt financing, and the company doesn’t even have that many fixed assets or liquid assets through which it could comply with the debt obligations; therefore, such a financial condition potentially brings a lot of trouble.

Declining market

Due to the sharp rise in streaming services along with changing preferences of consumers, the cable tv industry is expected to decline significantly in the upcoming quarters. from the last five years, cable tv lost about 25% of households, and being in such a rapidly declining industry brings significant concerns to the company.

Upcoming contract expiry

Network affiliate agreements with the big four broadcast networks that contribute significantly to the revenue are going to expire at various dates through December 2024. and current deteriorating cable tv prospects might affect the company’s ability to sign new contracts at a desirable price; in such cases, revenue might decline significantly.

But also consider that viewership on its tv stations is solid despite being in a declining industry. And due to its strong position, the company might be able to sign new contracts, but still, significant uncertainties come due to its presence in the rapidly changing entertainment industry.

Recent development

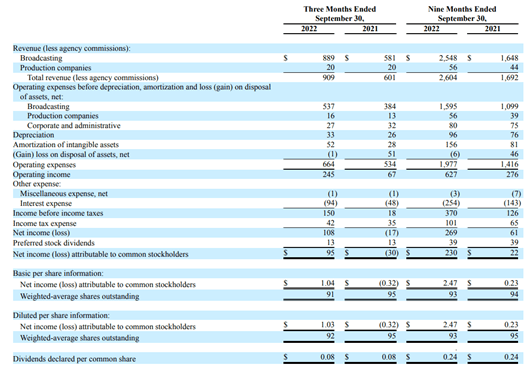

quarterly results (quarterly report)

Q3 2022, was one of the best quarters for the company due to substantially strong political advertising revenue as compared to the last election of 2018, and is expected to increase significantly to about $500 million by the end of the year.

The excellent results in political revenue of about 200% compared to the last nine months and approximately 30% as compared to the previous election led the company’s profitability to significantly higher levels. But the major concern is the current profit margin and revenue might not sustain in upcoming years because the growth was primarily led by the election period.

Also, the management is focusing mainly on reducing debt; about $250 million has been paid by the company during the last nine months.

Despite the strong performance in the last nine months, I assign a sell rating due to the high debt obligations and future uncertainty about the cable industry, which can hamper overall profitability.

Be the first to comment