LinearWorld/iStock via Getty Images

Letter from the Managing Director

Our Performance: General Commentary

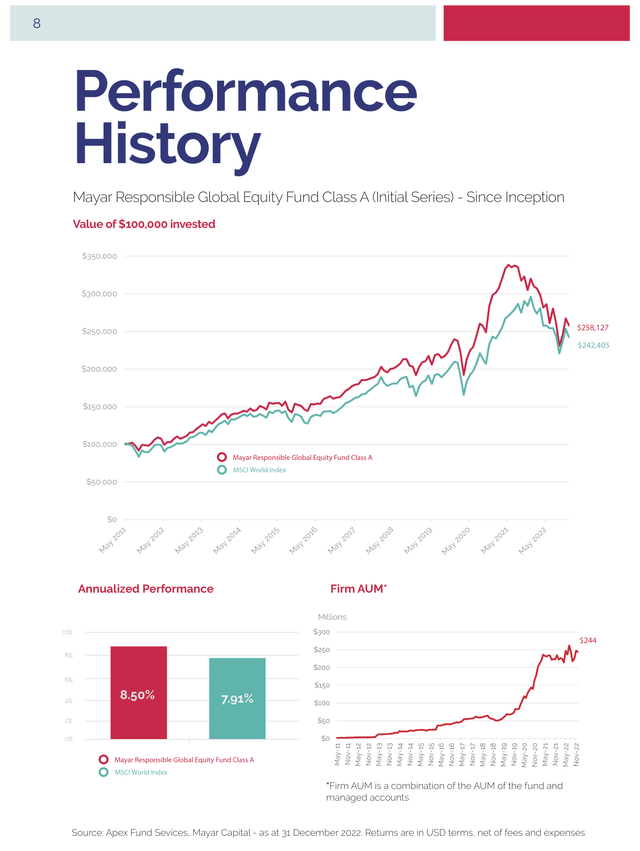

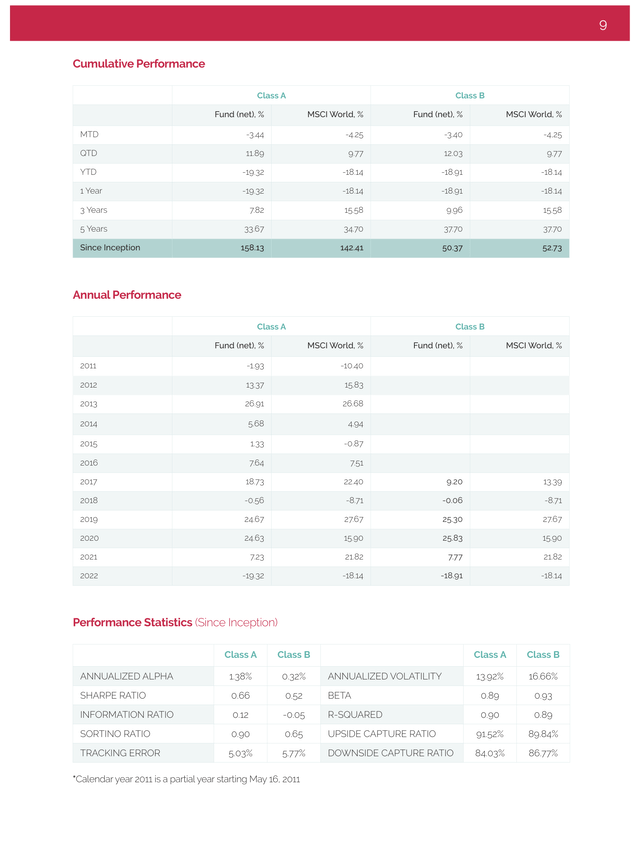

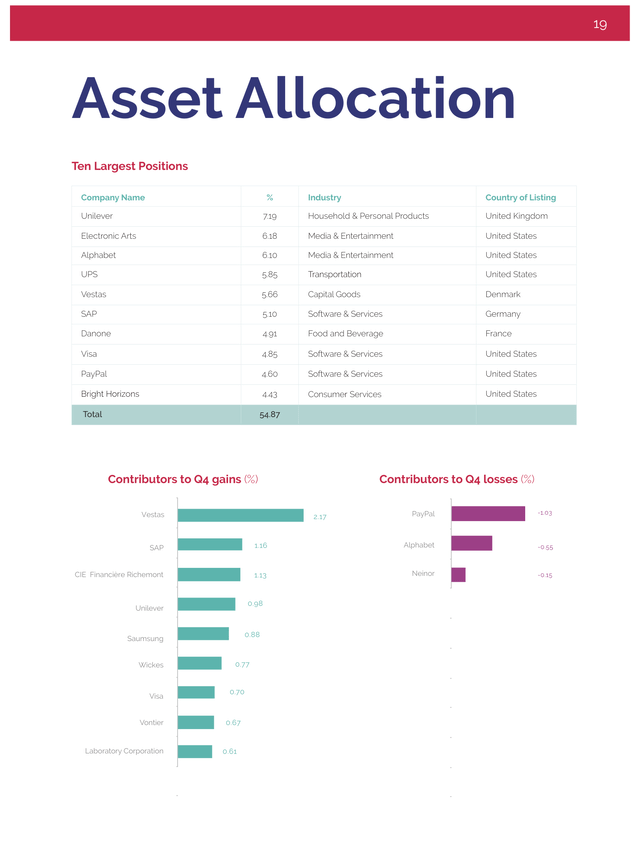

For the twelve months ending 31 December 2022, the Mayar Responsible Global Equity Fund (Class A) was down 19.32% net of all expenses and fees, while the MSCI World Index declined by 18.14% in the same period. Since its inception in May 2011, the Fund has seen a 158.13% increase versus a 142.41% increase for the MSCI World. This corresponds to a 8.50% annualized rate of return for the Fund, compared to 7.91% for the MSCI World.

Like the economy, our companies entered 2022 with a lingering Covid overhang still impacting certain operations; supply chains in particular. Next came a big hit from the war in Ukraine – and the fastest hikes in interest rates ever recorded. Company management teams struggled to deal with all these challenges at once, while the Mayar research team and I endeavored to steer our way through it all to detect the signal in all the noise.

Markets were equally perplexed, making dozens of big moves throughout the year. Perhaps, the most surprising thing of all is how well the global economy has held up in the face of all these pressures. This has certainly been a very challenging year intellectually for me and the team.

While global equity markets ended the year with big declines, with the MSCI World Index down 18% for the year, the S&P 500 -19%, the MSCI Europe -14.4%, and the Nikkei -21% (the latter two in US Dollar terms), they were all well off their October lows when the MSCI World was down 28%, the S&P500 – 25%, MSCI Europe -30% and the Nikkei -29%,

The tech-heavy Nasdaq took the biggest blow, ending the year down 33%, a result that actually hides the carnage in the wide swath of tech names that had bubbled up during the Covid years. Stocks such as Tesla (TSLA) were down 70%, Zoom (ZM) -85%, Amazon (AMZN) -55%, NVIDIA (NVDA) -56%, Netflix (NFLX) -57%, Robinhood (HOOD) -88%, ROKU -92%, Shopify (SHOP) -80% and Peloton (PTON) -95% from their 2021 peaks. Once the era of abundant free money had ended, many investors in the once high-flying stocks discovered how their beloved disruptors were, in fact, subject to certain laws just like everything else. As trees cannot keep growing without water and sunlight, so the basic rules of economics demand that a business generates cash and achieves a good return on its capital in order to prosper (and neither can keep growing indefinitely).

The biggest bubble to burst this year by far is that of cryptocurrencies. Roughly $2 trillion of value was lost during the year. I use the word “lost” reluctantly because it could imply that the value was actually there in the first place, but I assume the reader understands what I mean. In addition to valuation losses, crypto investors suffered a host of bankruptcies, thefts, and frauds. As is the case throughout history, speculative bubbles attract fraudsters who are keen to take advantages of investors that are blinded by their greed. Crypto visionaries promising historic world-changing revolutions turned out to be nothing more than a handful of hipster leeches feeding off their victims.

I wish I could say this experience would prove to be a lesson not to be forgotten. Sadly, I suspect that the same behavior will be repeated with equal gusto the next time someone promises quick riches. Some people never learn. At Mayar, our preference is for our investments to remain dull, boring, and low risk. In the words of Paul Samuelson, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Lots of ink has and will no doubt be spilled describing and analyzing the politics and economics of 2022, while slicing and dicing every economic metric available. I struggle to see how I can add any value to that conversation. Instead, a walk through our performance during 2022 might be more informative, even if that denies me the opportunity to appear smart by using complicated concepts with lots of Greek letters and acronyms.

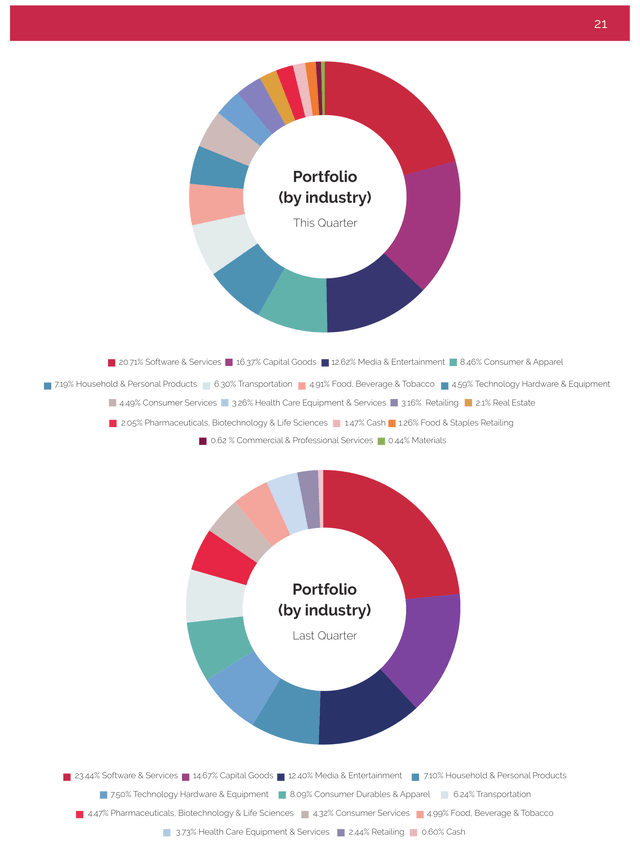

Most companies have dealt reasonably well with the challenges they faced in 2022. Supply chain disruptions and inflation were probably the worst. Supply chains have been mostly disentangled, especially in the latter part of the year. Inflation remains a challenge, but things are improving. Many of our companies struggled to pass on higher costs earlier in the year, but most seem to have caught up in the two latter quarters – demonstrating once again the importance of investing in companies with a strong competitive advantage.

Unlike the operational performance of our companies, the stocks we own are a mixed bag. Some have held up very well with small gains or only slight declines such as Visa (V), Mastercard (MA), Dropbox (DBX), Unilever (UL), Vestas (OTCPK:VWDRY), Electronic Arts (EA), and Johnson & Johnson (JNJ). Others such as Alphabet (GOOG, GOOGL) , SAP, Samsung (OTCPK:SSNLF), Howden (OTCPK:HWDJF), Vistry (OTCPK:BVHMF), and LabCorp (LH), saw big falls.

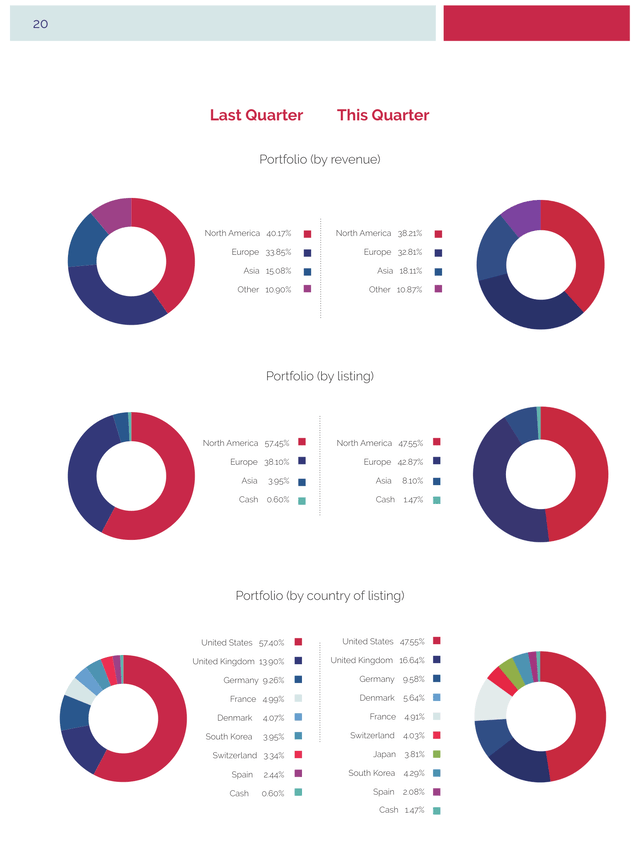

While we strongly believe that twelve months is too short a time to evaluate our performance, it was disappointing nonetheless. Although periods of underperformance are inevitable from time to time, we’d normally expect our portfolio to hold up better than the market in declining periods. During the first half of the year our portfolio behaved in the way we’d expect; declining by 17.5% compared to a 20.5% decline in the MSCI. That was followed by a 4-month period when our high exposure to the Euro and British Pound—through our stocks in these geographies— caused our portfolio to significantly underperform the index by a chunky six percentage points. This underperformance was mostly reversed in November and December though, as currencies recovered from their October lows, causing our portfolio to end the year with declines roughly similar to the market overall.

Every successful strategy will inevitably have short periods of underperformance. That fact does not make those periods any less disappointing when they occur. We must not allow disappointing short-term performance to distract us. We must continue to adhere to our strategy. We must remain faithful to our process. If we can do these things, then I am confident that we will prevail.

Our Portfolio

The recovery in equity markets since I wrote to you in October has certainly made them less mouth-watering since then, but we still continue to find many interesting investment opportunities across the globe and remain fully invested. Our portfolio companies are doing well operationally, and their strong balance sheets give us confidence in their ability to weather the storm. Further, our holdings are trading below what we believe is a conservative estimate of their intrinsic value and we thus see a lot of upside from current levels.

We initiated several new investments during the quarter. We purchased shares of Helical plc, a London-based real estate investment trust that owns one of the highest quality portfolios of office buildings with the top amenities and environmental standards as well as a solid base of tenants. As an added bonus, many of Helical’s buildings are a short walk from Mayar headquarters—next to Farringdon Station—so the team and I can keep a close eye on them, making sure lobbies are shipshape and windows are gleaming (only half joking).

We also invested in a couple of Japanese companies which we’re actively buying into at present, so I’ll defer my discussion of these until my next quarterly letter.

We added to some of our existing investments in Alphabet and Bright Horizons (BFAM), trimming other holdings during the quarter to raise cash because we were already fully invested. To take advantage of what we view as better investment opportunities, we pruned our holdings in Howden, LabCorp, Johnson & Johnson, Visa, and Mastercard.

Last and certainly not least, we fully exited our investment in Vontier (VNT) after concluding that the investment had been a mistake. We know the right thing to do in such cases is to fully exit the investment, irrespective of the price, as we’d lost confidence in our thesis. We had to sell at the significant loss of 31%. The team and I went through our usual post-mortem exercise after selling Vontier and I can summarize our top three mistakes as follows:

- We built our analysis of future demand for pumps on assumptions about the age of vehicles currently on the road and on the rate of hybrid and EV penetration forecasts. We failed to properly account for the distribution of miles driven across different vehicle “vintages”, however, which skews much more heavily towards newer cars. This means that higher EV penetration over the next couple of years would cause a much bigger drop in the demand for gasoline, and by extension for pumps, than we’d initially forecasted. We’d assumed that miles driven were much more equally distributed across vehicle vintages.

- We underestimated the overlap in demand drivers and common risks between Vontier’s different business lines. For example, the correlation between pointof-sale volume at the convenience store, the number of cars getting washed, and the volume of gasoline pumped was much higher than we expected.

- We explained away the cheapness in the stock simply as a result of exuberant investors chasing hot green stocks in 2021. This value investors’ “self-righteousness” biased our analysis of the bear thesis on the business.

This experience illustrated once again the challenges of investing in a business that is no longer growing and potentially in secular decline. This is especially true when one doesn’t fully control the business – and by extension its capital allocation decisions. Berkshire Hathaway (BRK.A, BRK.B) would have gone bankrupt a long time ago if Warren Buffett hadn’t had control, which allowed him to allocate capital away from the declining business.

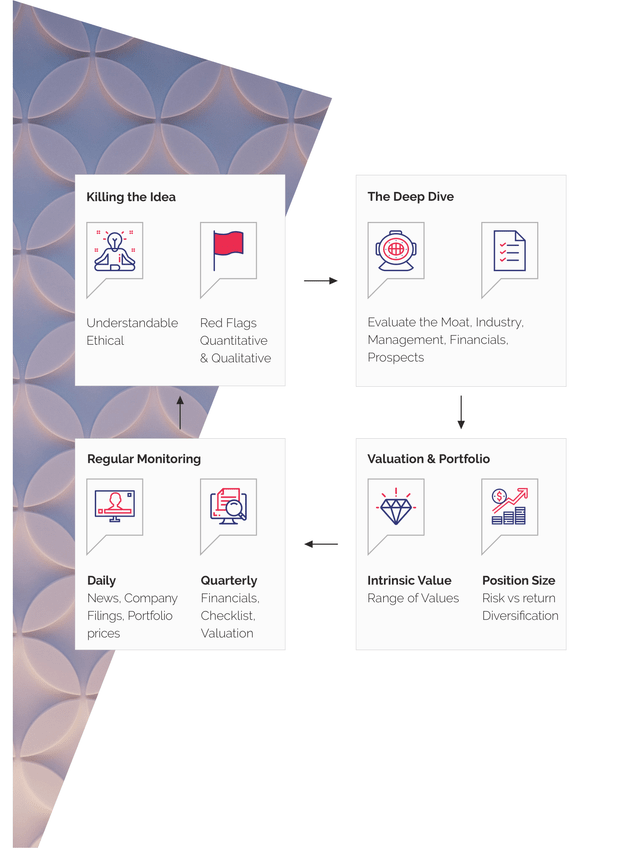

The team and I have spent a lot of time contemplating this experience. We’ve learned the lessons from it and incorporated them into several of our checklists to avoid repeating the same mistake.

The Fund and The Company

We welcomed a new member to our team in November when Rachael Alisedaghat joined Mayar Capital as my executive assistant. Previously, Rachael was an executive assistant to the co-founder at Consilium Strategic Communications, a financial communications and investor relations firm serving the healthcare sector. Prior to that, Rachael held various administrative support posts based in London. Rachael replaced Hanna Mutawa who left us to pursue another opportunity.

We also welcomed several new investors this year, many of whom were referred by existing ones. This continues to be our preferred way of growing in what we view as partnerships with like-minded investors. If you know anyone you think would be a great fit, we’d appreciate you sending them our way.

Mayar Capital ended the quarter with $244 million in Assets Under Management (AUM).

As always, if you have any questions, please don’t hesitate to reach out to us.

Thank you for your continued support and trust.

Best regards,

Abdulaziz A. Alnaim, CFA, Managing Director

Headquarters: Essen, Germany

Founded: 1874 as an egg wholesale business in Berlin and entered the chemical distribution business in 1912

In his book Antifragile: Things That Gain From Disorder, Nassim Taleb describes the robustness of things through time with reference to the Lindy Effect also known as Lindy’s Law. In short, the longer something has been around, the longer we can expect it to last into the future. This interesting phenomenon bears keeping in mind in the arena of business analysis and investment – if priority number one is to not lose money, Lindy’s Law would suggest that if a business has been around for a long time, it is likely (ceteris paribus) that it will continue into the future.

On this (rather circuitous) note, we would like to give you a brief overview of one of our portfolio companies, Brenntag. This company will celebrate its 150th birthday next year. That is a lot of candles.

Brenntag is the world’s largest third-party chemical distributor. During the course of business, the company bulk-buys chemicals from large manufacturers and sells them to its almost 200,000 customers.

Often these customers are small and medium-sized enterprises and rely on chemical distributors like Brenntag to find them the right products (sometimes even blended and mixed by Brenntag), package them into the appropriate size, and deliver them in an efficient manner.

There are two key drivers of operating earnings for this business. The first is the gross profit Brenntag is able to earn per tonne of chemicals supplied. This is driven partly by the market value of the chemicals themselves, but also by the value Brenntag provides to suppliers and customers alike. Below the gross profit line are operating expenses, which net off to leave operating profit.

It is Brenntag’s position as a scaled intermediary which, we believe, give it an advantaged position as a business with a strong value proposition for both customer and supplier.

While a large chunk of chemical manufacturers’ product is sold directly to very large customers, the large producers are simply not geared up to sell directly to the long tail of smaller customers. With an average order value of EUR 3,000, distributors like Brenntag give them an effective channel to this market, without the headache of supply chain and cash management for hundreds of thousands of small clients.

Likewise, Brenntag’s customers benefit from the company’s ability to procure chemicals from large producers and blend and package them in the correct quantities. Customers also benefit from Brenntag’s significant expertise in chemical formulations.

This business exhibits a strong degree of customer stickiness. Often, the chemicals Brenntag supplies to its customers are critical to their production processes (often with a ‘design-in’ element), giving Brenntag – and others like it – a loyal customer base. Separately, there are also considerable cost benefits to a distributor of having a dense group of customers in each area it serves. For these two reasons, this industry lends itself to a fragmented structure of small ‘local leaders’ – small distributors which dominate in a particular location. Brenntag, for example has just a 5% share globally despite being the number one player. This all translates into a profitable business model, and Brenntag is able to comfortably earn over its cost of capital, with returns exhibiting a strong degree of stability, too.

Given the highly fragmented nature of the industry, as well as the entrenched nature of chemical distributors, Brenntag makes use of acquisitions to fuel inorganic growth. In fact, it has spent almost half of its free cash flow over the last decade on acquisitions. That the business is dominated by small players is not to say that there are no benefits to scale – operating profit is in part dictated by the level of fixed costs, and larger businesses like Brenntag benefit from a greater degree of fixed cost absorption.

Likewise, an increasingly strict regulatory environment should advantage Brenntag over smaller peers.

Combining Brenntag’s inorganic growth with the structural growth of the ‘third party’ chemical distribution industry as manufacturers increasingly exit the distribution segment, we believe this business should exhibit moderate, above-GDP growth in the medium to long term.

Of course, not all acquisitions are made equally – and we note with interest Brenntag’s now-aborted desire to acquire Univar, the next-largest (and publicly traded) peer. Big M&A is always tricky to execute, and this deal would likely have resulted in some significant revenue dis-synergies, and with a tried-and-tested model of acquiring small distributors, perhaps Brenntag would better serve its shareholders by sticking to its knitting.

DisclaimerThis document is prepared by Mayar Capital® Ltd., an investment manager which is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom. Mayar Capital® Ltd. is the appointed investment manager of Mayar Capital UCITS ICAV, an open-ended Irish collective asset-management vehicle with variable capital and segregated liability between funds registered with and authorised by the Central Bank of Ireland. Mayar Responsible Global Equity Fund is a sub-fund of Mayar Capital UCITS ICAV. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Within the EEA the Fund is only available to Professional Investors as defined by local Member State law and regulation. Outside the EEA, the Fund is only available to Professional Clients or Eligible Counterparties as defined by the FCA, and in compliance with local law. This document is not intended for distribution in the United States (“US”) or for the account of US persons, as defined in the Securities Act of 1933, as amended, except to persons who are “Accredited Investors”, as defined in that Act and “Qualified Purchasers” as defined in the Investment Company Act of 1940, as amended. It is not intended for distribution to retail clients. This document is provided for information purposes only and should not be regarded as an offer to buy or a solicitation of an offer to buy shares in the fund. The prospectus and supplement of the fund are the only authorised documents for offering of shares of the fund and may only be distributed in accordance with the laws and regulations of each appropriate jurisdiction in which any potential investor resides. Investment in the fund managed by Mayar Capital® Ltd. carries significant risk of loss of capital and investors should carefully review the terms of the fund’s offering documents for details of these risks. Mayar Responsible Global Equity Fund (A sub-fund of Mayar Capital UCITS ICAV) follows a long- term investment strategy. Short-term returns will vary considerably and will not be indicative of the strategy’s merits. This document does not consider the specific investment objectives, financial situation or particular needs of any investor and an investment in the fund is not suitable for all investors. Investors are reminded that past performance should not be seen as an indication of future performance and that they might not get back the amount that they originally invested. Comparison to the index where shown is for information only and should not be interpreted to mean that there is a correlation between the portfolio and the index. The views expressed in this document are the views of Mayar Capital® Ltd. at time of publication and may change over time. Where information provided in this document contains “forward-looking” information including estimates, projections and subjective judgment and analysis, no representation is made as to the accuracy of such estimates or projections or that such projections will be realised. Nothing in this document constitutes investment, legal tax or other advice nor is it to be relied upon in making an investment decision. No recommendation is made positive or otherwise regarding individual securities mentioned herein. No guarantee is made as to the accuracy of the information provided which has been obtained from sources believed to be reliable. The information contained in this document is strictly confidential and is Intended only for use of the person to whom Mayar Capital® Ltd. has provided the material. No part of this document may be divulged to any other person, distributed, and/or reproduced without the prior written permission of Mayar Capital® Ltd. This communication is confidential and is intended solely for shareholders of Mayar Responsible Global Equity Fund. Mayar Capital Ltd., provides investment and asset management services to institutions, family offices, and high net-worth individuals. Mayar Capital Ltd. is an investment manager, which is authorised and regulated by the Financial Conduct Authority in the UK. Mayar Capital Ltd., 27-31 Clerkenwell Close, Office 108, Clerkenwell Workshops, London EC1R 0AT, United Kingdom |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment