Olemedia

The Chilean-based Sociedad Química y Minera de Chile S.A. (NYSE:SQM) is a diversified specialty-chemical producer with extensive operations throughout the country. It produces inputs for a wide assortment of products used by multiple industries all over the world. They range from the iodine used in the production of pharmaceuticals such as neuromuscular blocking agents to sodium nitrate used in the making of food additives.

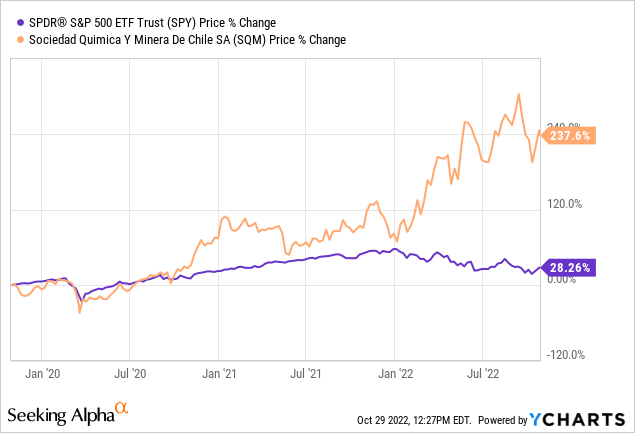

As most readers are probably well aware, the stock has been on quite a run over the last few years. Its performance has easily outpaced that of the S&P 500 and, unlike the broader market, its stock price kept rising throughout most of this year.

Part of that increase is attributable to higher fertilizer prices that came about as a result of the Ukrainian war. But one commodity has by far had an outsized impact on SQM’s stock price: lithium. The surge in the price of carbonate and its impact on SQM’s gross profit is impossible to ignore. For that reason, this article will focus on SQM’s lithium operations and discuss how future developments at the company may impact its share price going forward.

Company Backgrounder

SQM is the world’s second largest lithium miner in terms of market cap after US-based Albemarle Corporation (ALB). But unlike Albemarle’s globally distributed assets, SQM has chosen to focus mostly on developing production within its home county of Chile. And while SQM has for many years been one of the world’s largest lithium producers, the white metal has not always been so central to its operations.

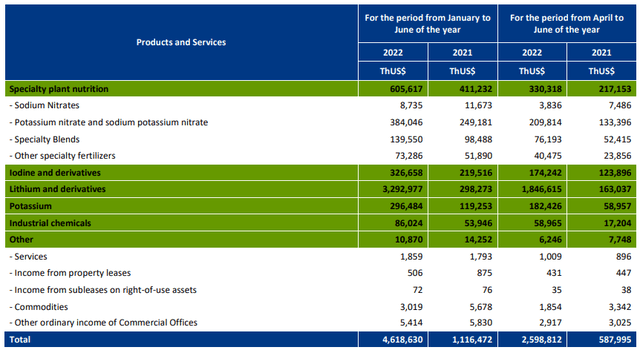

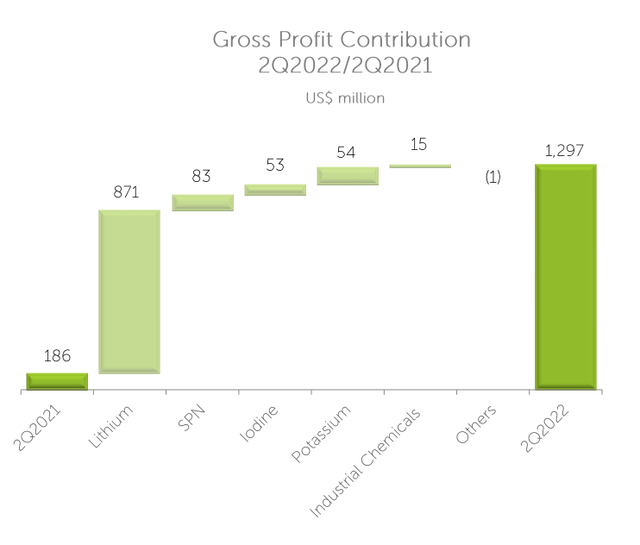

In fact, if we look back no further than Q2 of last year, we see that lithium made up barely a quarter of the company’s revenue on a TTM basis. But that changed radically over the course of the last year as the price of lithium surged. At the end of Q2 this year, lithium accounted for almost $3.3 billion of SQM’s $4.6 billion revenue on a TTM basis or almost 75%. The numbers are even more impressive on quarter-over-quarter basis, as Q2FY22 lithium revenue came in 11x times higher than that of the corresponding quarter last year; $1.8 billion versus $163 million.

Changes in Gross Profit and EBITDA have been just as impressive. EBITDA went from $212 million in Q2 of last year to $1.3 billion this year, and gross profit climbed from $186 million to just under $1.3 billion during the same time period.

SQM is clearly benefitting from the profound changes currently occurring in the automotive and lithium industries. But what I wanted to know, however, was whether or not management was making adequate plans to take advantage of this historic lithium supply deficit. What actions are they taking in order to get while the getting’s good. And when I looked into their expansion plans, I wasn’t disappointed.

Expansion

Management is well aware of the opportunity that the energy transition has put in front of the company. During the Q2 call Ricardo Ramos, SQM’s CEO, mentioned how the company was beginning to hit a production run rate of 180k tpa LCE during some months. He discussed how they were fine tuning the production process, and said that, “I do expect that, there will be a continuous production close to the 180,000 metric tons probably September onwards.” In addition to that, the company will also produce 21k tonnes of lithium hydroxide this year. SQM has more than tripled production since 2017 when it produced 50.4kt LCE and 6,468t of hydroxide.

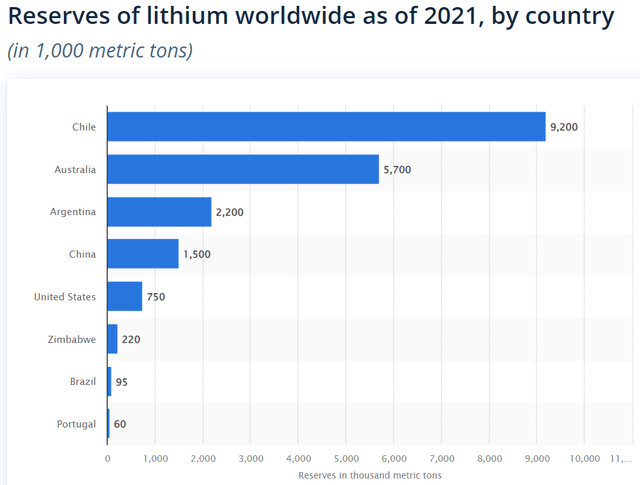

However, the company doesn’t plan to stop there. Chile is the country with the world’s largest lithium reserves; outpacing second place Australia by a significant margin. The abundance of lithium in the country is one of the reasons why SQM’s expansion plans have so far been Chile-centric.

But in recent years the company has been making more efforts to begin diversifying its assets geographically. Last year, it formed a joint venture with the Australian company Wesfarmers Limited (OTCPK:WFAFF) that initially planned for the construction of a mine capable of producing 350ktpa LCE per year and a conversion facility capable of producing 50ktpa of hydroxide. The Mt Holland property would see the mine begin production at the end of next year while first production at the conversion facility would occur by H2 2024. But during the Q2 call, SQM’s management indicated that discussions are underway to increase the hydroxide amount to 100ktpa.

There are also additional plans to grow its midstream capacity by investing in China. Details have been few, probably because the deal was being negotiated, but reports indicate that SQM plans to purchase a conversion facility in Sichuan, China for $140 million. The facility would produce 20ktpa of hydroxide and 30ktpa of carbonate from lithium sulfate shipped from Chile.

In addition to that, management fully intends to continue growing Chilean LCE production in the years to come. Plans have already been made to increase production buy 30ktpa in 2023, and the company has indicated that CapEx and growth plans covering the next 3 years may be released along with Q3 results.

All of this makes SQM a very good potential investment for anyone looking to gain exposure to growth in a lithium industry. However, there are some risks that come from owning the stock.

Potential Countervailing Factors

In addition to the risk that comes from a fall in lithium prices, investors should be aware that the company has faced a difficult regulatory and legislative environment in its home market over the last year. The country’s socialist government has attempted to nationalize assets, raise taxes and royalty payments, as well as create a government-owned national lithium company.

However, most of the government’s major policy objectives have failed to become law, and last month voters rejected a major overhaul to the country’s constitution. But numerous disagreements between the mining industry and the government continue to exist and these could affect share prices.

Takeaway

SQM continues to expand yearly lithium production at a brisk pace, and its efforts to grow midstream production will allow the company to more fully benefit from rising hydroxide and carbonate prices. The ability and willingness to grow production so aggressively in a tight market and rising price environment points to the high likelihood of a continued rise in its stock price.

Be the first to comment