TonyBaggett/iStock via Getty Images

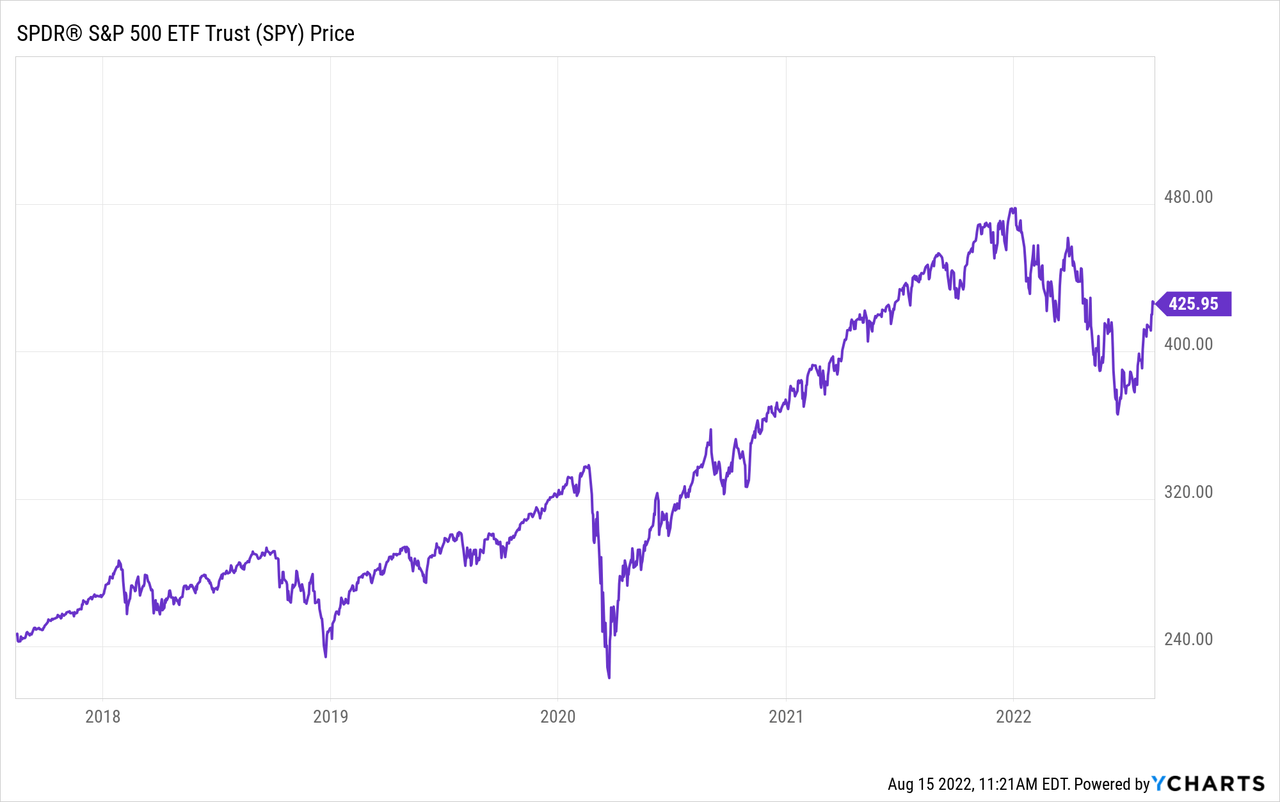

The S&P 500 (NYSEARCA:SPY) has rallied sharply since mid-June, driven by better-than-feared earnings and the price of gasoline falling. Market bulls like BMO’s Brian Belski have called for stocks to surge to all-time highs, while bears like Michael Burry and Jamie Dimon have sounded the alarm to expect a futile bear market rally. Interestingly, the stock market and the bond market are in increasing disagreement over the path of the economy. Stocks have rallied sharply, indicating investor optimism in the economy, while Treasury yields have plunged as massive bets come in on a deepening U.S. and global recession. And bad news has been good news as weak economic data has the market betting that the Fed will be forced to cut rates and do more QE in an attempt to jack up stock prices. So is it time to go on offense or to use the current rally to find shelter?

In the long run, it’s a bull’s world. If you look at how wealth is created, by and large, people who get rich do so from owning businesses or getting hefty stock grants in public companies. Nobody is buying $5-$10 million beachfront homes by investing in CDs! But history also shows that simply sitting and buying index funds has failed in a lot of countries’ stock markets over the last 25 years. There are clear warning signs in the economy right now that suggest that buy-and-hold, regardless of price, may not be a very effective strategy going forward.

Structural Problems With The U.S. Economy

The S&P 500 has rallied sharply over the past five years while growth has slowed below trend and wage growth has stalled. Wages are actually trailing inflation by about 3.6% annually as of the latest report. Despite a bit of month-over-month improvement, this is a red flag for index earnings going forward.

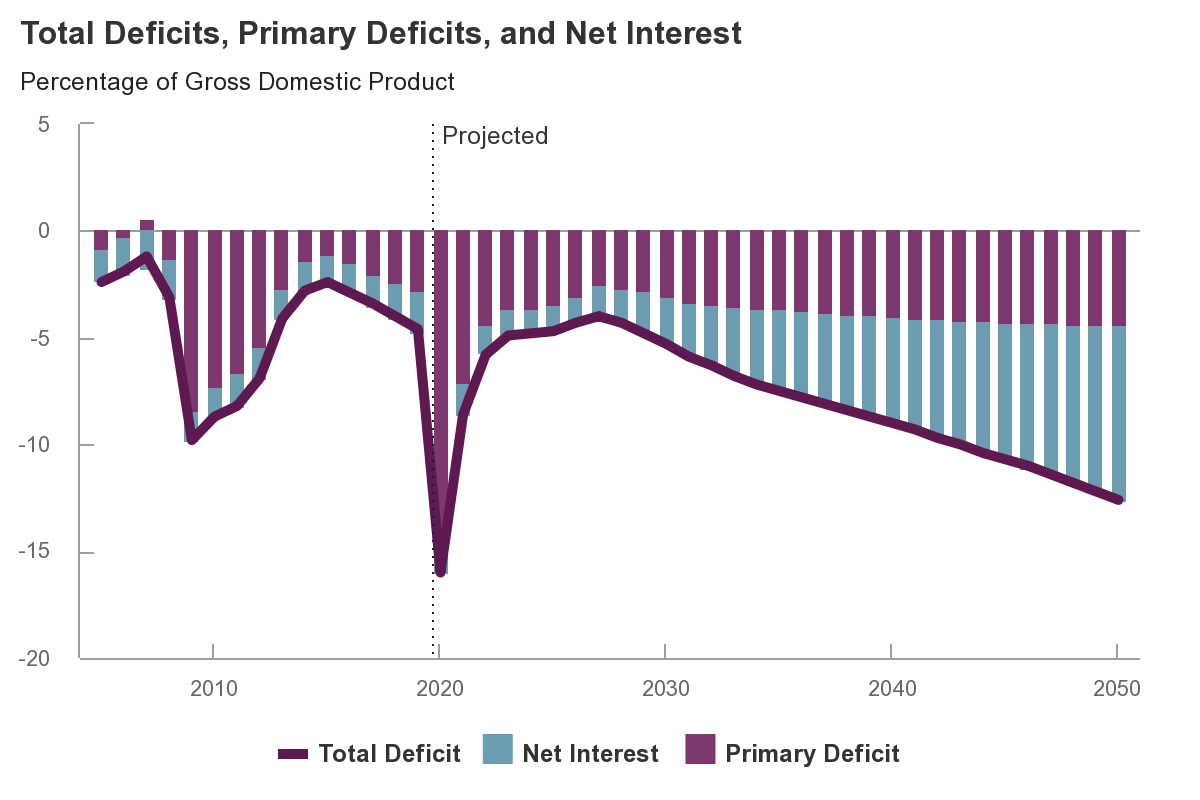

How could this be? Tax cuts, stimulus, and QE have more than made up the difference for consumers facing stagnant wages. But the problem is that none of these are sustainable. During this time, government debt went from a little unsustainable for the US to a major problem, with debt now around 125% of GDP. Borrowing more is showing that will result in the classic economic problems of “crowding out,” while trying to monetize the debt by forcing the Fed to buy it causes runaway inflation. It’s a lose-lose.

US Budget Deficit (Wikipedia)

To this point, the government debt situation is actually even worse than it looks because they’re on the hook for a massive amount of underfunded entitlement spending that’s tied to inflation as birth rates continue their grinding downtrend. As America rapidly ages, it’s going to be really hard to avoid ending up in the same boat as Japan and Europe, which have seen 20 years of sideways stock markets. In any case, taxes need to go up and spending needs to go down, taking away the secret sauce from index fund investors.

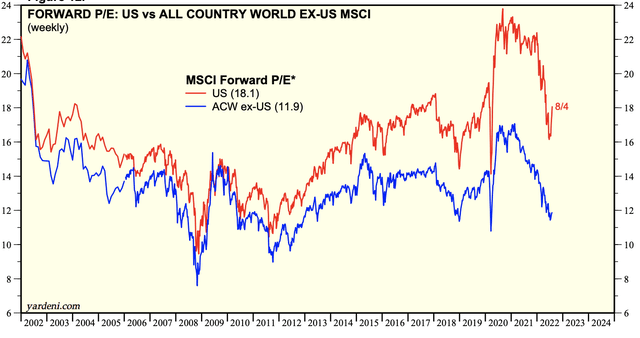

If you have a great business, your tax rate going from say, 30% to 50% will slow you down, but won’t block your path to getting rich. However, debt and demographics are going to be a huge headwind for the overall market trading at a high valuation. If stocks are going to go up, they’re going to have to do it the old-fashioned way-by increasing productivity. Technology does continue to improve, allowing us to do more with fewer workers. The stock market boom was driven by stimulus, QE, and tax cuts, all of which are dead and gone. On the other hand, increasing productivity is actually a very incremental process with no shortcuts, but it creates sustainable growth. In the long run, I think things will be okay. But all of this points to stock returns being much lower over the next 10 years than they were over the last 10. And while Europe and Japan still face this same demographic/debt problem, the difference between their markets and ours is that ours is a lot more expensive!

US Vs. World Valuation (Yardeni Research)

A quick glance at the top 10 stocks in the S&P 500 reveals just how expensive mega caps are. Paying huge multiples on earnings for tech companies has never really worked before-not in the Go-Go 1960s, nor in the dot-com boom in the late 1990s. Will the third time be the charm, or is this yet another widely ignored warning sign? Of these stocks, the only ones trading close to fair value in my opinion are Google (GOOG) and Microsoft (MSFT). Amazon (AMZN) and Tesla (TSLA) are discounting rates of return that have historically been impossible for large companies, and Apple (AAPL) is trading for nearly triple the multiple it did 5-7 years ago.

My hope here is that investors can see that nothing that has happened since June has structurally fixed the long-term economic problems that we face, and mega-cap stocks remain very expensive on a historical basis. With rising taxes and higher rates, they’re not going to be able to grow their after-tax earnings nearly as fast as exuberant investors believe. Therefore, my base case is very low returns over the next decade unless stocks fall to levels where you’re getting a more reasonable compensation for your risk (roughly a ~20-25% lower price on the S&P 500). Otherwise, you’re almost taking this long-term risk for free, because if tax cuts and stimulus can’t drive the market anymore, the price is not anywhere near where the fundamentals need it to be.

Will The Fed Bail Out Stocks?

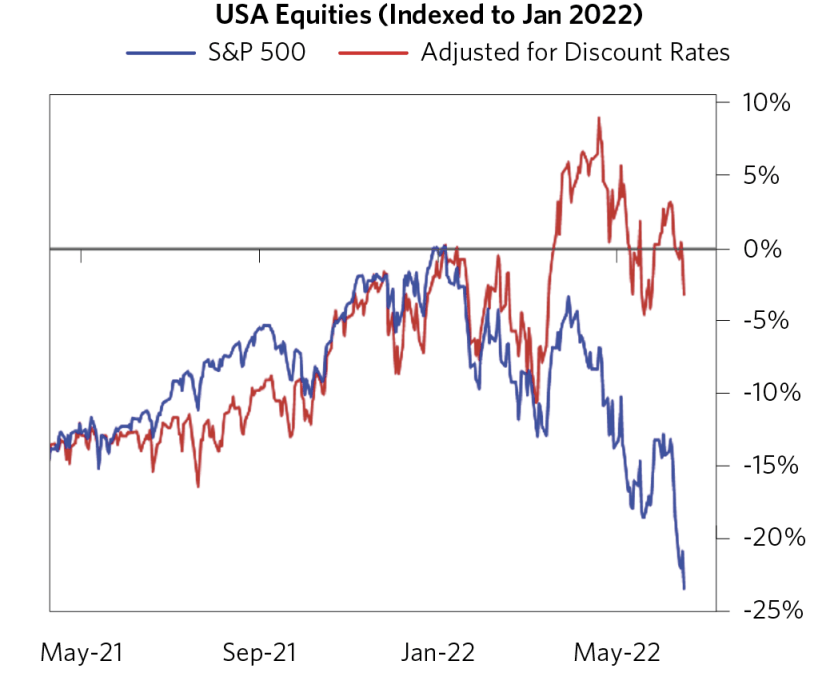

Markets have rallied sharply since June. There are two main reasons that this is so. One reason is earnings being a bit better than feared, but the main reason is that investors have begun to price a more friendly Fed.

This graph from Bridgewater shows the situation through Mid-June- roughly when markets bottomed.

Earnings Vs. Multiples (Bridgewater)

Nearly all of the move down in stocks was driven by a decrease in the multiple of the S&P 500, and not by earnings estimates being revised down. The market generally leads earnings estimates down, but it’s really rare for there to be as big of a gap between what analysts think businesses are capable of earning and the price the market assigns to stocks. Similarly, there’s a huge gap in what the bond market sees (big recession bets) and what stocks see (nirvana). For what it’s worth, I don’t think earnings will hold up with the underlying fuel of stimulus removed, and the realization that earnings aren’t invincible will push multiples lower as well. Far more of consumers’ incomes in 2021 was stimulus than is commonly appreciated. Cutting spending to adjust to what they actually earn is going to be an issue. This doesn’t really jibe with earnings estimates for this Christmas expected to top last year, which crushed 2019’s record. Wages are trailing inflation. Without stimulus, it’s not clear where people will get the money to make this the strongest holiday season ever as Wall Street is betting on.

The Fed has repeatedly said that it’s not willing to cut rates to bail out stocks. On a near-daily basis, someone from the Fed will be on TV saying they want financial conditions to tighten. However, since June, financial conditions have done nothing but loosen. The markets insist on fighting the Fed, emboldened by the 2010s experience of the Fed rescuing the market every time it stubbed a toe. The trouble for the Fed is that financial conditions are how they steer the economy. The more the market bets on rate cuts and bids up stock prices, the less likely the Fed is to actually do it. The Fed is likely going to have to call the market’s bluff. There’s no evidence that the Biden administration is going to pressure the Fed to cut rates, and the entire country is pretty much in agreement that money needs to be tighter. Yet the bets continue to pour in on steep rate cuts that no one wants the Fed to do. Crazy!

July CPI wasn’t as bad as feared, but a large part of why it wasn’t was because the market actually was taking the Fed seriously in June, and financial conditions had tightened. Higher mortgage rates, higher credit spreads, and lower stock prices all worked in concert to help bring inflation down. Now with the market defying the Fed, the Fed has to find a way to get financial conditions to tighten again, and none of this points to a bailout of stocks, a resumption of QE, or cutting rates back to zero.

In the 1970s, the Fed cut rates as soon as the data got a bit better, and every time they did, inflation roared back stronger than before. Getting inflation down this time is not going to take two months, and people betting on the Fed to pivot need to realize that if they’re right, the recession will be deep enough that their stocks will be far lower than the prices they’re paying now.

How To Invest When Stocks Are Overvalued

I’ve recently written that US stocks are 20-25% overvalued at current prices and that the bottom likely isn’t in. However, scaring you isn’t useful unless you can actually do something productive with it. Instead, I’d like to give you strategies that you can use in a falling market so you’re staking everything on US stocks bucking the trend of structural weakness seen in Europe and Japan after their debt gets big and their population starts to get old.

1. Take inventory of other asset classes and see what could be undervalued.

After taking inventory, you have a roadmap to diversify across asset classes and tilt towards what you think offers better compensation. During the dot-com bubble, bonds were severely undervalued, and cash offered nearly the same return as stocks. Moreover, small caps and non-tech stocks had better valuations than the stupid prices that mega-cap tech had at the time. In 2007, bonds and cash saved the day again. Late 2021 was a little trickier because stocks and bonds were both objectively overvalued, and cash paid zero. Similarly, real estate was at its most overvalued level ever early this year, and is now starting to correct.

To take a basic inventory here, the S&P 500 is 20-25% overvalued, but small caps (IJR) are about at fair value. Similarly, most real estate markets in the US are overvalued by 10% to 40%. Treasury bonds (TLT) are overvalued by about 15% (without the Fed manipulating it, the fair yield on the 30-year should be about 4%, or ~2% real yield and 2% long-term inflation compensation for Treasuries broadly). Preferred stocks (PFFD) are roughly at fair value. International stocks (VEA) might be a tad below their fair value with heightened uncertainty over the war in Ukraine. How I’m getting these numbers is a topic for another article, but I’m basing stock valuations on earnings yields and guessing profit growth numbers, and basing bond yields on inflation and credit risk. The main point here is to get the heck away from concentrating all of your money on mega-cap tech names. Not a lot is undervalued at the moment, but some areas of the market are priced rather fairly, while others are badly overpriced.

2. Consider whether holding cash is worth it for you.

3-month T-bills are now paying 2.6% with rock-solid liquidity. You can buy them through your broker. And in three months, you can roll into more T-bills at a higher rate. I think they’ll be paying 4% with no risk by year-end as the Fed tries to slow down the party. Given the structural problems present with the US economy, I’d think about taking this until valuations make more sense. The Fed is only going to keep hiking until inflation is under control. For reference, stocks are priced to return maybe 8.5% annually, so getting half the return for none of the risk with the upside of getting even more if the Fed is forced to slam on the brakes appeals to me. I bonds can fill in here too, if you’re married you can toss $20,000 in for the year and get a 9.62% risk-free return. TINA was the theme of 2021, but now TINA has been replaced by TIA. There is an alternative, and anyone who thinks the market is dicey can cash all or part of their stash in and be earning around 2.6% annualized now and likely 4% annualized by year-end. This isn’t all or nothing- taking 25-35% of your portfolio and investing in cash equivalents if it’s going to be paying 4% seems like a no-brainer to me.

3. Consider using options to bet against overvalued companies.

Being long only severely limits the opportunities you can take, and leaves you dependent on the economy growing over time. Short selling outright can get you short squeezed and doesn’t work very well unless you have institutional access (short interest rebate, etc), but buying puts can give you a lot of bang for your buck. The upshot of higher interest rates is that it makes buying puts cheaper and calls more expensive. You can take advantage of this by selling overpriced calls on companies you own through index funds and buying puts cheaply to hedge your downside. For example, you might use this strategy to sell calls on Apple and Tesla, and then use the money to buy puts against weak companies like Carnival Cruise Lines (CCL) and AMC Entertainment (AMC). Done right, this can allow you to reduce your concentration to expensive mega-cap names and bet against the companies most vulnerable to recession. So many companies are running on business models where they are completely reliant on the Fed having rates at zero to stay in business. Dozens of companies that have more liabilities than assets and negative earnings will likely be gone by 2024. I’ll likely offer a few plays soon for my readers.

A sample allocation to this strategy might be to spend 50-100 bps of your portfolio annually betting against junk stocks, depending on how bearish you are. You can largely finance this by selling calls on big index holdings if you think they’re overvalued.

Key Takeaways

- Stocks have rallied to erase most of the year’s decline, but as long as the structural issues facing stocks remain, the rally is likely to break down and fail in the end.

- History shows that the US is in a similar position now to countries with stock markets that have had negative returns for decades due to debt and changing demographics. At the very least, this will drag down future returns.

- Fortunately, investors are far from helpless against the stock market being overvalued.

- Good strategies available to you include tilting away from mega-caps into profitable small caps (IJR), profitable mid-caps (IJH), and international stocks (VEA), investing in T-Bills, and I Bonds, and using options to bet against weak companies.

- Don’t stress about the stock market keeping up the blistering pace of returns of the past 5-10 years. It’s not going to happen. Instead, expand your horizons and focus on what you can do to keep your portfolio moving in the right direction. This will reduce your stress over uncontrollable trends and increase your long-run chances of reaching your goals.

Be the first to comment