JHVEPhoto/iStock Editorial via Getty Images

Introduction

Foot Locker Inc. (NYSE:FL) is a specialized retail store that sells shoes and apparel for active/sportswear. It is headquartered in New York City and has operations in more than 28 countries. It has more than 3000 stores worldwide (most of them in malls). It is part of the Fortune 500 list (no. 385 in 2021) with a total revenue of 7.5B (2021).

Latest Stock Trend

The stock price of Foot Locker tanked more than 30% in one day due to an earnings report that included the following news for its shareholders:

- Nike is putting all its efforts to develop a DTC (direct to customer) distribution channel that bypasses Foot Locker as the “middle person”;

- Foot Locker will now have to contend with much lower inventory from Nike as compared to previous years, which would lead to lower sales from Nike branded products;

- It has possibly reached a peak EPS for the medium term.

Investors obviously did not like this news. They made their dissatisfaction known by dropping the stock from the 40’s to the 20’s in a single trading session.

Shareholders of FL seem to think that there can’t be any growth in FL without Nike. In-fact, the valuation of FL seems to assume that the business outside of Nike is worthless and the assets it has are equally worthless. This is strange since the market clearly has, in my opinion, misunderstood the business of Foot Locker outside of Nike!

Valuation Metrics

This big drop in the stock price warrants a revisit to the valuation of Foot Locker to see if there is some merit to this drop in stock price or if it is just sentiment driven.

The valuation metric at $30 USD/share makes the Foot Locker’s market cap about $3.0B, which is a fraction of the sales it generates.

Here is the snapshot of the current valuation:

Share price: $30.01; USD Market Cap: $3.0B; P/E Ratio: 3.54; Dividend Yield: 5.25%.

The above metrics should give an investor some comfort on initiating an investment. At a P/E of 3.54 and a Price to Sales (P/S) of less than 0.4, a lot of what can go wrong has gone wrong.

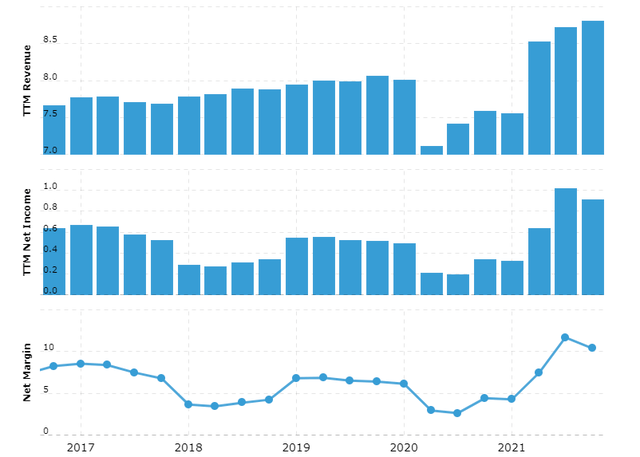

Below charts shows what Foot locker has done in the past few years in terms of Total Revenues, Net Income and Net Margins. Setting aside the pandemic years, there is good growth overall for the brand with some fluctuations in the margins due to market condition. In a normal year, we can assume that there is a growth of about 5-6% in sales with a Net income of 6-7% average.

Financial metrics (macrotrends.net)

Before we move further, lets address the “Nike problem” that FL has.

There is a lot of noise around Nike and what impact it has on the Valuation of Foot Locker, so let’s approach this situation a different way: Let’s try to assume the Nike account is no longer part of this company.

Today, Nike accounts for 60% of Foot Locker’s business, so removing that you would probably reach sales of about $3B in yearly revenue. If you took an average 7% Net margin (similar to current business outside of pandemic), you get $210M in net profit. Take this together and you have a company that will be at a P/E of 14 and a P/S of 1.

This is what the company is worth outside of the Nike business. However, we still need to account for the massive cash that has been generated over the years and is sitting in the company’s balance sheet as of today. The company has a net cash balance of ~$400M and a robust cashflow of more than $800M (this will be reduced if we remove the Nike business out).

This cash balance makes a compelling case for investing in FL. You are talking about almost 15% market cap of the company held as cash in the balance sheet and generating cash flows every year to the tune of approx. 30% of the market cap.

Now take into account that Nike will continue to be part of FL for the next few years, albeit, a dying business going forward – this will continue to generate a lot of cash and help to fund the future growth of the company through investments in other brands (see below).

Another aspect that has made this a very juicy investment is the dividend yield that has gone past 5.4% and now gives enough reason to hold the stock and wait for Mr. Market to realize the mismatch in the price.

Future Growth

The company has spent money in acquiring 2 companies (ATMOS and WSS) in the recent past and although I feel they did overpay for these, i believe the management understood that the over-reliance on Nike had to stop and this was the best way to do it. The management feels they can get over $1.5B in sales from these 2 new acquisition at a healthy 15% EBIT margin by 2025. This should help replace the lost sales from Nike in the next few years.

Further to this, considering the off mall strategy being followed by FL, the company should be able to expand on their gross margins similar to Kohl’s (KSS).

Future acquisitions in other regions will always be on the cards with the kind of balance sheet that they have. Acquiring smaller companies like WSS and ATMOS can only add to their growth and can be one in “all cash” deals rather than all relying of debt or share dilution.

Future growth in stock price is further boosted by the management’s decision to conduct a share repurchase program to the tune of $1.2B. Let’s understand this, the company wants to reward its shareholders by repurchasing almost 40% of its market cap. I will not be surprised if the management takes the opportunity to buy back a lot of its shares at the current valuation.

Finally, there is always hope of some other retailer taking over Foot Locker to expand their footprint and/or business. It is a cash machine and there are very few retailers who can boasts of such metrics. It is not often you get a company that can be purchased for less than $3.0B which can generate such cashflows. Any retailer (or company trying to get into retail) could benefit from this kind of cash generation to power other businesses that they currently have.

Conclusion

If the company continues to have such strong cashflow and it uses it to return cash back to the shareholders by buyback and dividends, this stock will automatically get re-rated by analysts soon. You cannot have a company that generates $800M in cash each year trade at less than $3.0B market cap. In 4 years, the company will generate more cash than what the company is currently worth today and that seems like a mispriced stock.

I would say there is enough safety in the stock price and it’s time to take a position in the stock at these levels. The risk reward is very favorable and there is a good chance to see this stock back up to the 50’s. The question is: will the market spot it before you do?

Be the first to comment