Annie Otzen/DigitalVision via Getty Images

Federal Regulation Updates

The U.S. House of Representatives passed the Marijuana Opportunity Reinvestment and Expungement Act (the “MORE Act”) on April 1, voting 220-204. A 2020 version of the bill was passed by the House in December 2020, only to be rejected by the Senate.[1] Significant headwinds caused by the U.S. Senate may thus be met again. If passed, the MORE Act would end the federal ban on cannabis, leave legalization up to the states and decriminalize marijuana. Notwithstanding, the MORE Act would allow banks and other financial institutions to more confidently navigate the federal-state conflict that has left many reluctant to work with cannabis businesses.

Currently, obstacles preventing banks from having a clear, professional relationship with marijuana companies remain. Financial institutions that provide banking services to legitimate and regulated cannabis businesses are currently subject to criminal prosecution under federal law. As a result, cannabis companies that operate in accordance with state laws are frequently kept out of the banking system and are forced to operate as cash-only businesses in an industry with billions of dollars in transactions. The Secure and Fair Enforcement Banking Act of 2021 (“SAFE” or the “SAFE Act”) aims to harmonize federal and state law by prohibiting federal regulators from taking punitive action against financial institutions that provide banking services to legitimate cannabis-related businesses and the ancillary businesses that serve them.

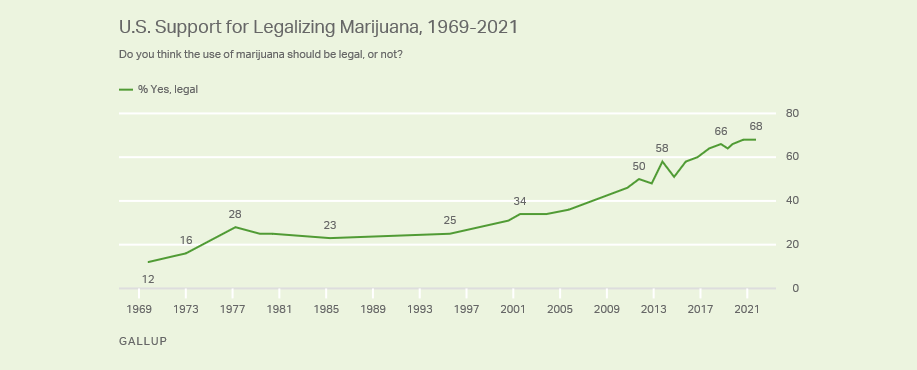

In February, House members voted to include SAFE banking provisions in the Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength Act (the “COMPETES Act”), advancing SAFE banking to the Senate. However, the SAFE banking provisions were not included in the Senate version of the COMPETES Act, which passed last week, implying that federal legalization is unlikely to happen anytime soon.[2] This sentiment contrasts with the overall American population’s preferences. A recent poll from the American Bankers Association found that a majority (65%) of Americans believe that marijuana firms should be allowed access to traditional banking services in states where cannabis is legal without the threat of federal penalties. Sixty-eight percent (68%) of respondents support Congress passing legalization that would allow such access.[3] Further, U.S. support for legalizing marijuana reached an all-time high of 68% last year.

Gallup News

U.S. support for legalizing marijuana, 1969-2021. [4]

State Regulation Updates

While federal legalization still faces hurdles, state-level momentum is projected to continue this year after an eventful 2021. In 2021, we saw adult-use legalization in Connecticut, New Mexico, New York, and Virginia, bringing the total to 18 states, plus DC and Guam. New Mexico cannabis sales topped $5.2 million within the first weekend, while Colorado sales hit $12.3 billion over the last seven years.[5] In total, states collected over $3.7 billion in recreational marijuana tax revenue last year.[6] New Jersey Governor Phil Murphy announced recreational marijuana sales will start at 13 dispensaries across the state on April 21 of this year.[7]

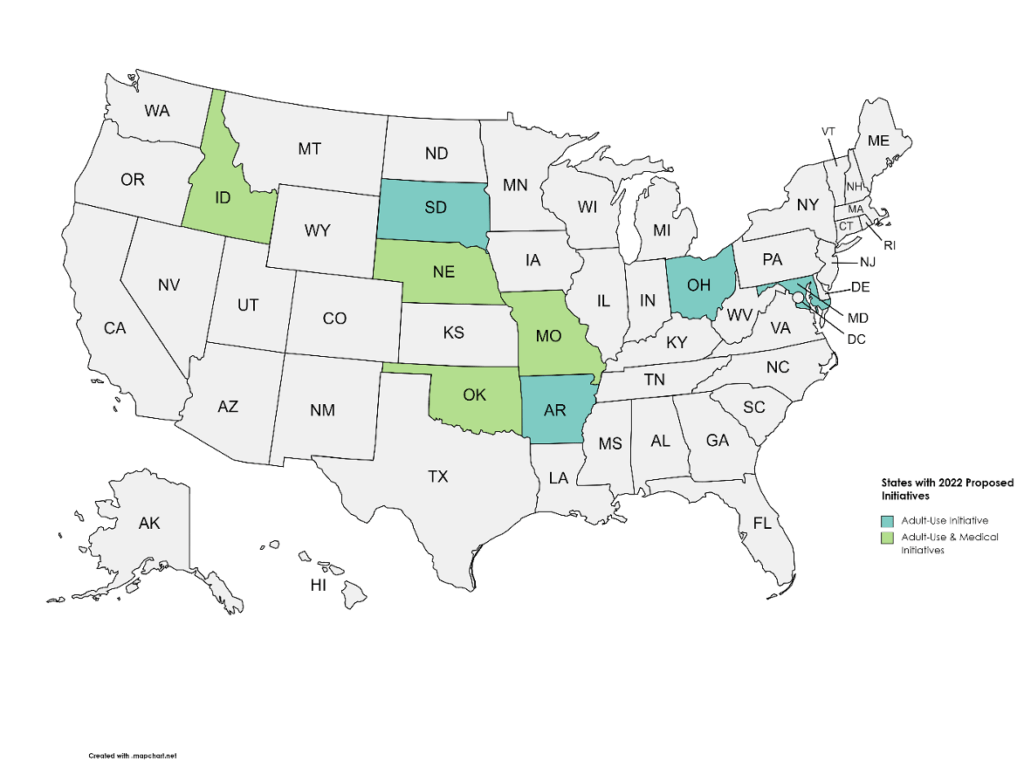

2022 may face tailwinds, as mid-term elections have traditionally resulted in a rise in the number of states legalizing cannabis, owing to the potential to legalize cannabis through ballot initiatives.[8] In fact, adult-use ballot initiatives have been proposed in Arkansas, Maryland, Ohio, and South Dakota. Further, there are both adult-use and medical ballot initiatives proposed in Idaho, Missouri, Nebraska, and Oklahoma. Below is a brief exploration of current pending legalization efforts.[9]

Author

States with 2022 proposed initiatives.

ARKANSAS: The Arkansas Recreational Marijuana Initiative and the Arkansas Decriminalize Marijuana, Create Regulations and Grant Limited Immunity to Cannabis Businesses Initiative are two adult-use initiatives being proposed in this year’s midterm elections. A survey of 961 Arkansas voters by Talk Business & Politics and Hendrix College found that approximately 54 percent of respondents favor full adult-use legalization, compared to 32% who said it should be legal for medicinal use only.[10] Arkansas has already approved the use of marijuana for medical purposes at the time of writing.

IDAHO: The Idaho Marijuana Legalization Initiative for adult-use and the Idaho Medical Marijuana Initiative for medical use are also being proposed in this year’s midterm elections. With one of the nation’s strictest anti-marijuana laws, Idaho is just one of three states where marijuana is not legal in any form. Marijuana for medical purposes is supported by 72 percent of Idahoans.[11]

MARYLAND: The Maryland Marijuana Legalization Amendment is on the ballot in Maryland as a legislatively referred constitutional amendment where voters will have the opportunity to decide on the legalization of marijuana for adult-use. A poll from Goucher College shows that voters in Maryland support recreational marijuana legalization by a 2-to-1 majority, including majorities of Republicans, Democrats, and independents.[12]

MISSOURI: The Missouri Marijuana Legalization and Automatic Expungement Initiative, the Missouri Marijuana Legalization and Commercial Facilities Initiative, and the Missouri Marijuana Legalization Initiative are three adult-use initiatives being proposed in the state. The outlook looks strong – Gov. Mike Parson said in an interview that the legislative route over a ballot initiative said would “probably” pass.[13] Rep. Ron Hicks took a similar position, stating that legalization is “coming no matter what.”[14] Medical use of marijuana is already legal in Missouri, but the Missouri Changes to Medical Marijuana Program Initiative may appear on this year’s ballot, allowing voters to decide on changes to the existing legislation.

NEBRASKA: Nebraska is another state where marijuana is not legal in any form. The Nebraska Medical Marijuana Regulation Initiative, the Nebraska Medical Marijuana Program Initiative, Nebraska Medical Marijuana Initiative, and the Nebraska Marijuana Legalization Initiative are three medical use and one adult-use initiatives, respectively, being proposed on this year’s ballot. Activist group Nebraskans for Medical Marijuana (NMM) is leading the campaign in support of the medical use initiatives. Each is currently cleared for signature gathering.[15]

OHIO: The Ohio Marijuana Legalization Initiative for adult-use marijuana legalization may appear on the ballot in 2022 allowing voters to decide on legislation surrounding the cultivation, processing, sale, purchase, possession, home growth, and use of recreational marijuana for adults 21 years of age or older. A recent survey conducted by Emerson College found that a slim majority (50.4%) of Ohio voters support adult-use legalization, compared to 39.7% who are opposed.[16]

OKLAHOMA: Oklahoma State Question 818, the Cannabis Commission and Medical Marijuana Regulation Initiative for medical use may appear on the Oklahoma ballot this year. The initiative would create the State Cannabis Commission to replace the Oklahoma Medical Marijuana Authority and to regulate medical marijuana, cannabis, and hemp.[17] Further, the Oklahoma Marijuana Legalization Initiative and the Oklahoma Marijuana Legalization and Taxation Initiative are two adult-use initiatives being proposed.

SOUTH DAKOTA: The South Dakota Marijuana Legalization Initiative for adult-use marijuana legalization would look to voters to decide on the legalization of marijuana use, possession, and distribution for individuals 21 years old and older if enough signatures are collected to add it to this year’s ballot. A recent poll by the University of South Dakota found that 51 percent of respondents disapprove of Gov. Kristi Noem’s (R) handling of marijuana legalization.[18] Noem has publicly opposed the legalization of adult-use marijuana,[19] counter to what most voters have stated they wanted.

Market Implications & 2022 Outlook

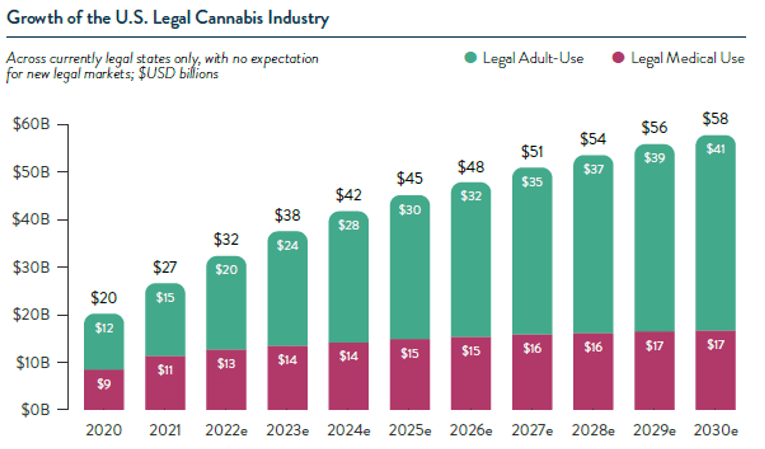

In 2021, the legal cannabis market was estimated to be worth $26.5 billion, with annual sales expected to reach $32 billion in 2022. Annual legal cannabis sales in the United States are expected to expand at a compound annual growth rate (CAGR) of 11% between 2020 and 2030, surpassing $57 billion, attributable to robust consumer demand and newly operational legal state markets.[20]

New Frontier Data

Growth of the U.S. legal cannabis industry. [21]

Mergers & Acquisitions

As the industry awaits passage of the SAFE Act, we at ETFMG expect M&A activity to increase over the coming years. Private equity investments are often easier to come by for larger cannabis companies, providing them with the capital to acquire smaller competitors. Two major deals were announced just this March. First, Chicago-based Cresco Labs announced its proposed acquisition of Columbia Care in a nearly $2 billion all-stock merger.[22] The transaction is expected to close in the fourth quarter of 2022, subject to customary closing conditions and required regulatory approvals, and would result in cannabis cultivation and retail giant with projected annual sales of more than $1.4 billion.[23] The second deal announced was Australia’s Incannex Healthcare’s bid to wholly acquire biotech company APIRx Pharmaceutical USA, LLC in a $93.3 million all-stock transaction.[24],[25] While two very different transactions in their own rights, they each emulate cannabis M&A trends and industry development that we’ve seen over the past few years.

2022 Cannabis Trends

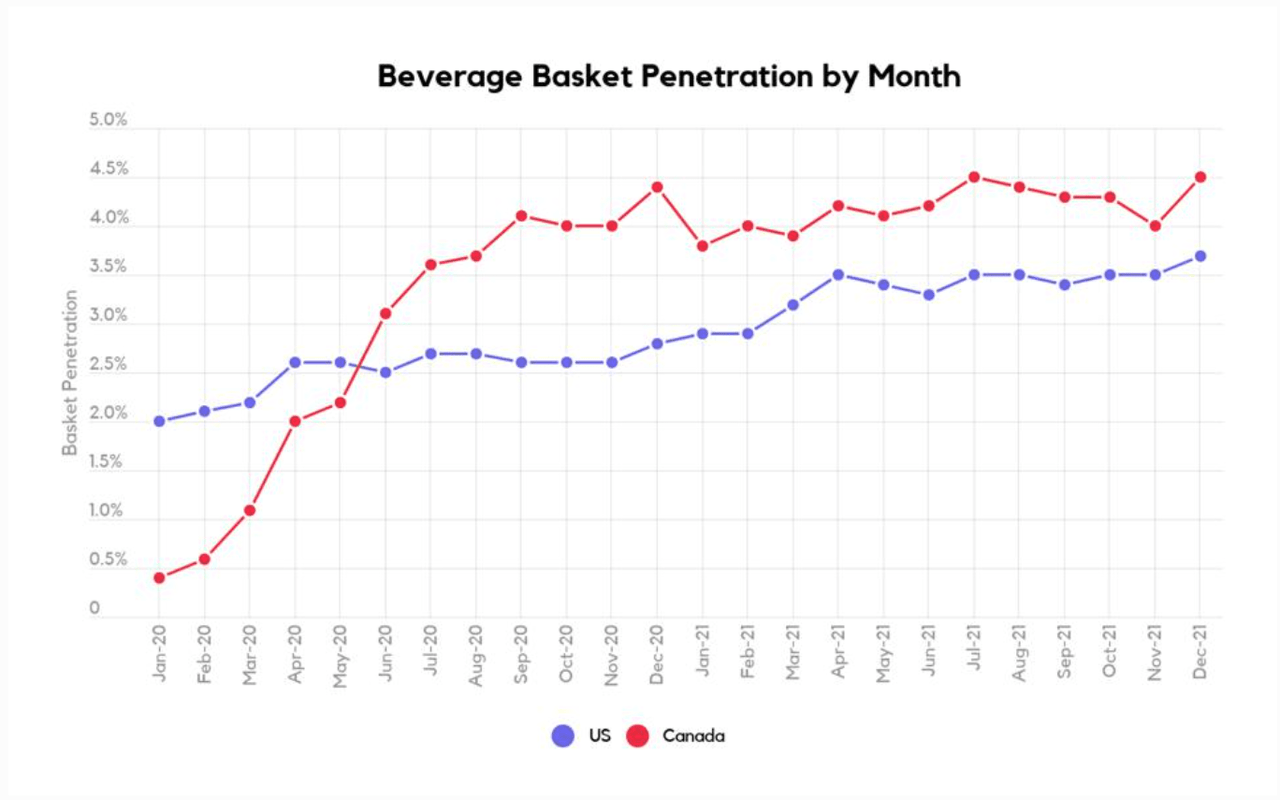

An interesting trend to watch out for in 2022 is growth in the cannabis-infused beverages market. With easing recreational restrictions and health-conscious consumers looking for an alternative to hangover-inducing alcoholic beverages, cannabis-infused drink makers have a unique opportunity. According to BDSA’s U.S. Cannabis Market Forecast, cannabis edibles are expected to reach $4 billion in sales in 2022 across all legal U.S. markets and are projected to grow to a total of approximately $6 billion by 2025. Based on their Retail Sales Tracking data, beverages specifically have seen strong sales growth, the largest growth in percentage share of sales among edibles in fact, but still only make up about 5% share of larger edible sales in the dispensary channel.[26] We expect to see beverages continue to expand their share of the market, bolstered further by consumer preferences for lower sugar alternatives to edible confectionaries such as cannabis-infused brownies, gummies, chocolates, and cookies.

Forbes

Beverage basket penetration by month. [27]

In addition to new cannabis products being introduced to the market, we expect to see a more diverse range of cannabis consumers as adoption of the substance becomes more mainstream. Women and Generation Z are two of the most rapidly increasing and shifting demographics in the cannabis industry right now. According to Akerna, a cannabis trend research business, women now account for one-third of all cannabis consumers in the United States, with over half of them under the age of 40.[28] Currently, only a small percentage of Gen Z can legally partake (due to age restrictions in US recreational markets), but data shows that this demographic alone has more than tripled its market share year over year.[29] A report by Headset, a cannabis data firm, states that cannabis sales among Gen Z consumers increased by 127% in 2020, compared to just 46% and 29% by their Millennial and Gen X counterparts, respectively.[30] As more Gen Zers turn 21, this demographic will likely continue to drive exponential growth.

ETFs to Access the Cannabis Market

While marijuana remains illegal at the federal level, U.S. support for legalizing marijuana and granting access to marijuana-related banking is at an all-time high. Recent legislation reform initiatives at the state level for both medical and adult marijuana use are on the rise, which may act as a tailwind for legalization at the federal level. As more states ease legislation surrounding the substance and new consumers enter the market, new and existing cannabis companies will have the opportunity to provide innovative product offerings, scale their operations, and expand their distributions.

The ETFMG Alternative Harvest ETF (MJ) tracks the Prime Alternative Harvest Index (HARVEST), which uses a proprietary methodology to track the performance of the global cannabis industry and provides a means for efficient access to dozens of leading and emerging companies within the cannabis space.

The ETFMG U.S. Alternative Harvest ETF (MJUS) tracks the Prime US Alternative Harvest Index (USHRVST), which focuses on cannabis companies operating in the United States, including multi-state operators (MSOS) directly involved in the cultivation, production, marketing, and distribution of cannabis or cannabis-related products.

The ETFMG 2X Daily Alternative Harvest ETF (MJXL) seeks daily investment results, before fees and expenses, of 200% of the performance of the Prime Alternative Harvest Index (HARVEST).

The ETFMG 2X Daily Inverse Alternative Harvest ETF (MJIN) seeks daily investment results, before fees and expenses, of -200% of the performance of the Prime Alternative Harvest Index (HARVEST).

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s statutory and summary prospectus, which may be obtained by calling 1-844-383-6477, or by visiting www.etfmg.com/MJ. Read the prospectus carefully before investing. Securities mentioned may or may not be current holdings in the Fund and are subject to change without notice.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Narrowly focused investments typically exhibit higher volatility. The possession and use of marijuana, even for medical purposes, is illegal under federal and certain states’ laws, which may negatively impact the value of the Fund’s investments. Use of marijuana is regulated by both the federal government and state governments, and state and federal laws regarding marijuana often conflict. Even in those states in which the use of marijuana has been legalized, its possession and use remains a violation of federal law. Federal law criminalizing the use of marijuana pre-empts state laws that legalizes its use for medicinal and recreational purposes. Cannabis companies and pharmaceutical companies may never be able to legally produce and sell products in the United States or other national or local jurisdictions.

The Fund’s investments will be concentrated in an industry or group of industries to the extent that the Index is so concentrated. In such event, the value of the Fund’s shares may rise and fall more than the value of shares of a fund that invests in securities of companies in a broader range of industries. The consumer staples sector may be affected by the permissibility of using various product components and production methods, marketing campaigns and other factors affecting consumer demand. Tobacco companies, in particular, may be adversely affected by new laws, regulations and litigation. The consumer staples sector may also be adversely affected by changes or trends in commodity prices, which may be influenced or characterized by unpredictable factors.

Investing in an ETFMG 2x Daily Leveraged ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The ETFMG 2x Daily Leveraged ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment as frequently as daily. The Fund’s returns for periods longer than a single day will very likely differ in amount, and possibly even direction, from the Fund’s 2x the return of the Index for the same period. For periods longer than a single day, the Fund will lose money if the Index’s performance is flat, and it is possible that the Fund will lose money even if the level of the Index rises.

ETF Managers Group LLC is the investment adviser to the Fund.

The Fund is distributed by ETFMG Financial LLC. ETF Managers Group LLC and ETFMG Financial LLC are wholly owned subsidiaries of Exchange Traded Managers Group LLC (collectively, “ETFMG”). ETFMG is not affiliated with Prime Indexes.

[2] US Senate Excludes SAFE Banking Language from America COMPETES Act – NORML

[4] Support for Legal Marijuana Holds at Record High of 68%

[5] Weekly Stash The Cannabis Industry

[6] Weekly Stash The Cannabis Industry

[8] Weekly Stash The Cannabis Industry

[9] All approved and proposed ballot initiatives sourced from Marijuana on the ballot on 4/11/22

[11] Idahoans’ support for medical marijuana has grown, but it might not be reflected in the Legislature

[12] Majority of Maryland residents support legalizing marijuana, poll shows

[13] The push to legalize marijuana in Missouri begins in earnest

[14] Witnesses urge legalization of recreational marijuana

[15] Ballotpedia

[17] Oklahoma State Question 818, Cannabis Commission and Medical Marijuana Regulation Initiative (2022)

[20] New Frontier Data 2022 U.S. Cannabis Report: Industry Projections & Trends

[21] New Frontier Data 2022 U.S. Cannabis Report: Industry Projections & Trends. Chart depicts the projected growth of the U.S. Legal Cannabis Industry. There is no guarantee that the industry will grow to the levels indicated or at all.

[22] As of 4/11/22, Cresco Labs represented approximately 4.74% of the ETFMG U.S. Alternative Harvest ETF’s assets (position held in swap).

[23] Cresco Labs to Become the New Leader in Cannabis with the Acquisition of Columbia Care

[24] As of 4/11/22, Incannex Healthcare represented approximately 1.47% of the ETFMG Alternative Harvest ETF, and Incannex Healthcare loyalty options represented approximately 0.02% of the ETFMG Alternative Harvest ETF

[25] Incannex Healthcare rallies after airing plan to buy cannabis medicine company APIRx

[26] 2022 State of the Cannabis-Infused Food and Beverage Industry: Steadily Expanding

[27] The Top Cannabis Industry Trends To Watch For 2022

[28] https://www.clutchcreativeco.com/cannabis-consumer-trends-for-2022/

[29] Cannabis trends and insights behind Generation Z | Headset

[30] Cannabis Dispensary Insights: Cannabis Consumer Trends

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment