Alfribeiro/iStock Editorial via Getty Images

MercadoLibre (NASDAQ:MELI) is one of those stocks that I did not expect to get outright cheap. Yet, that is exactly what has happened amidst the ongoing tech crash. MELI offers an investment thesis as the clear leader of Latin America ecommerce, which I expect to be a secular growth story for the next decade and longer. While there are legitimate concerns regarding the credit performance of their credit portfolio, the stock is priced for strong returns as valuations in the tech sector normalize. I rate shares a buy for long-term investors.

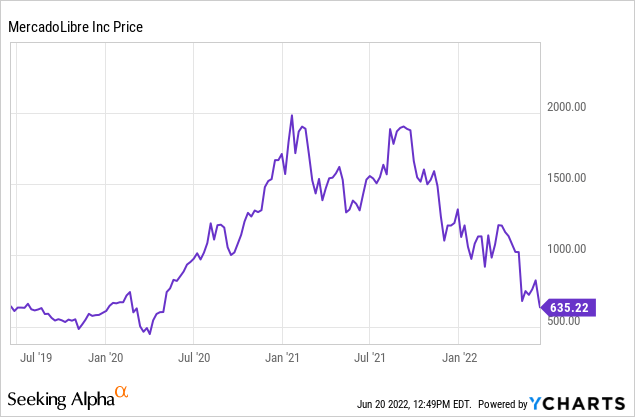

MELI Stock Price

MELI peaked near $2000 per share but now trades just above $600 per share.

The stock is now back to pre-pandemic levels in spite of e-commerce operators being a primary beneficiary of the pandemic.

What is MercadoLibre?

MELI is the top e-commerce operator in Latin America – some have even called it the “Amazon of Latin America.”

MercadoLibre

In addition to its e-commerce marketplace and logistics infrastructure, MELI also has a fast-growing fintech division.

MELI Stock Key Metrics

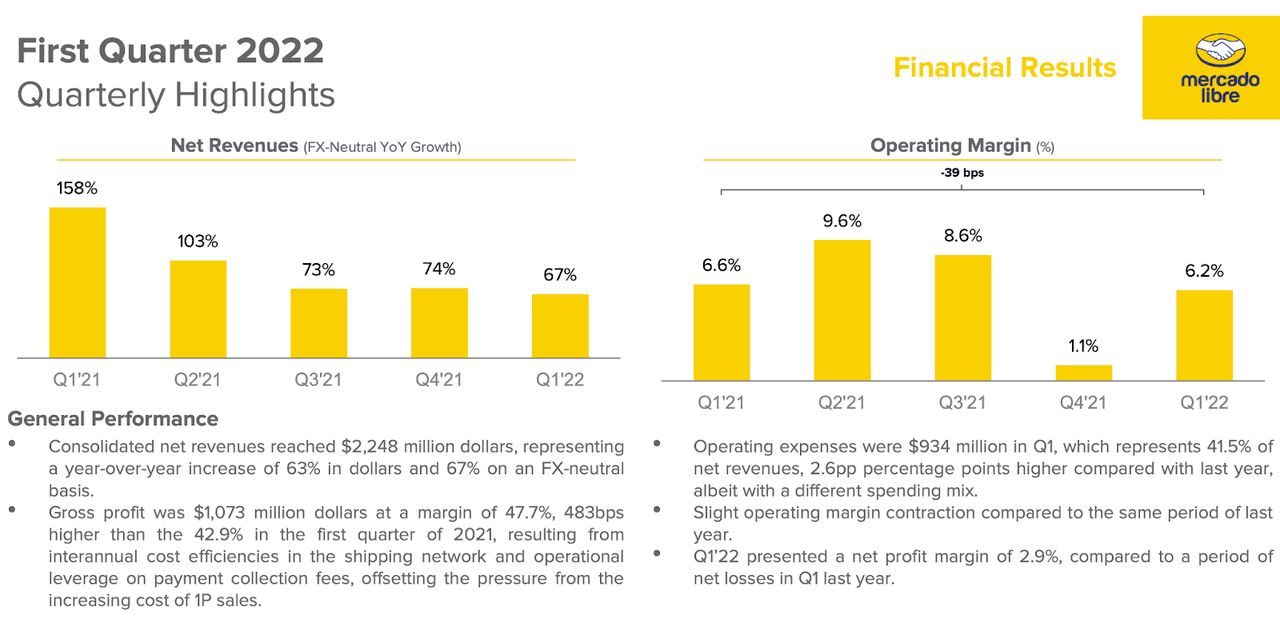

While many e-commerce operators are showing muted or even negative growth due to the tough pandemic comparables, MELI continued to drive strong growth with 67% revenue growth this past quarter.

2022 Q1 Presentation

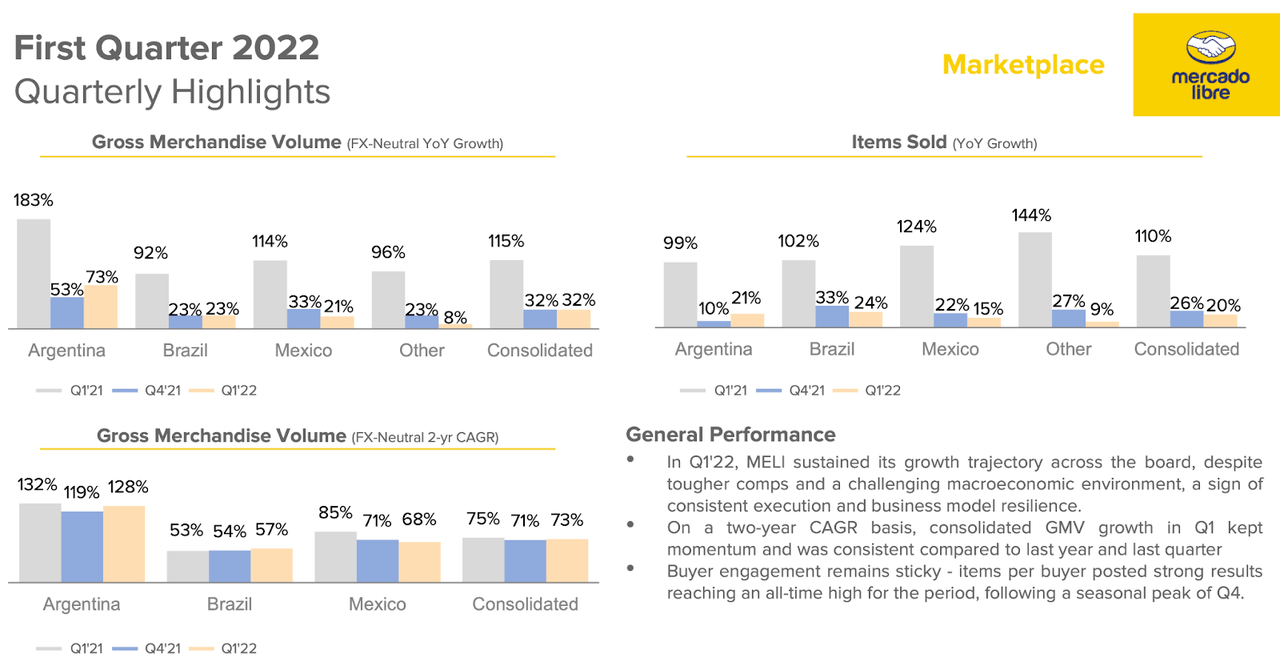

Gross merchandise volume growth slowed to 32%, though the 2-year growth rate remained steady at 73%.

2022 Q1 Presentation

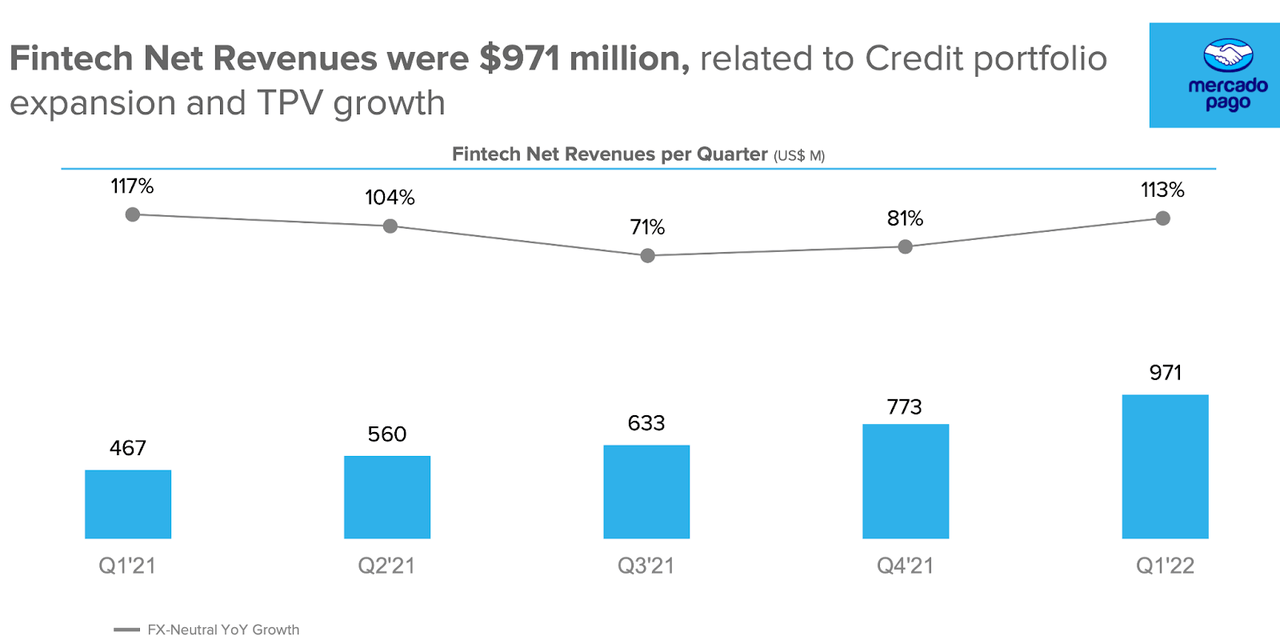

MELI was able to offset that slowing marketplace growth with continued hyper-growth in its fintech division, which grew by 113% year over year.

2022 Q1 Presentation

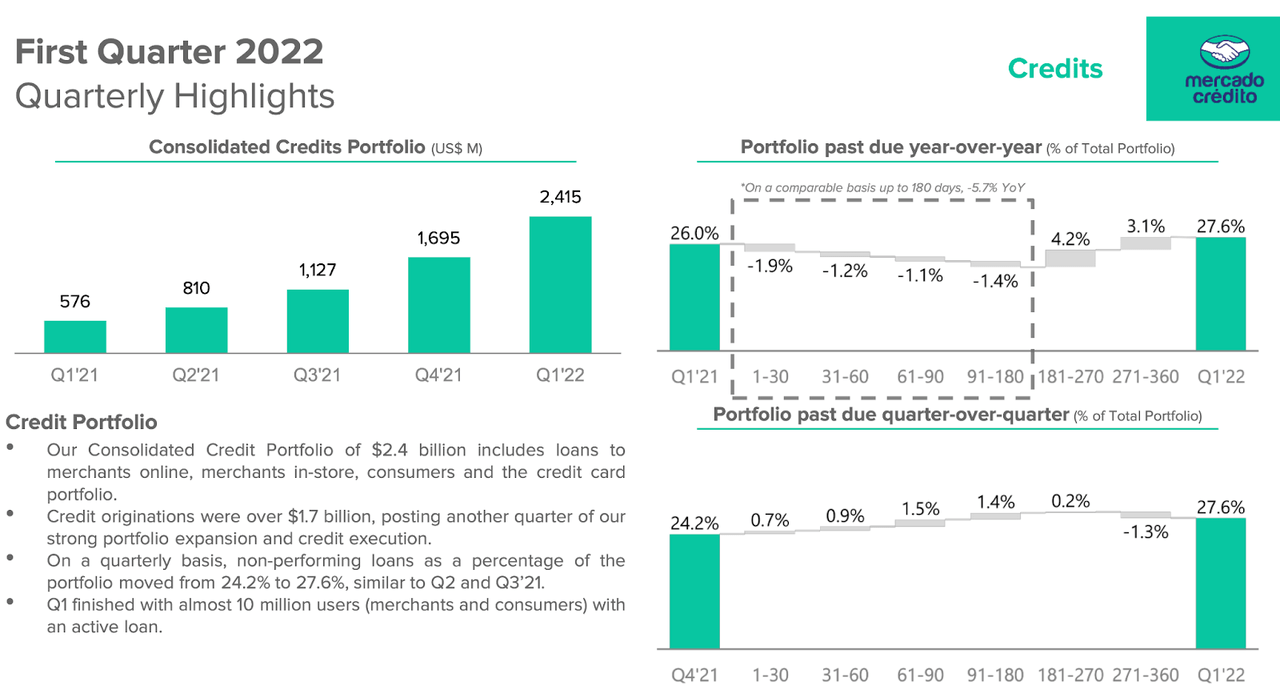

A key driver of that fintech growth has been rapid growth in its credits portfolio. Some investors may have concerns that the credits portfolio is growing too fast, as non-performing loans have been steadily growing from 21.3% in the first quarter of 2020 to 27.6% this latest quarter.

2022 Q1 Presentation

On the conference call, management reiterated their confidence in the sustainability of their growth as follows:

The significantly largest portion of the increase in NPLs are a consequence of product mix, and only a smaller portion of the NPL increases are driven by improvement in existing products. So less than a third of the NPL dis-improvements.

We continue to believe that the data we have on consumers, the touch points with consumers, the collections operations we have built are competitive advantages that help our underwriting. But notwithstanding, I think we need to continue to deliver on that and continue to grow the books in line with our confidence in our underwriting, and then we will see what happens going forward. But so far, all the signs continue to be positive and executing to plan.

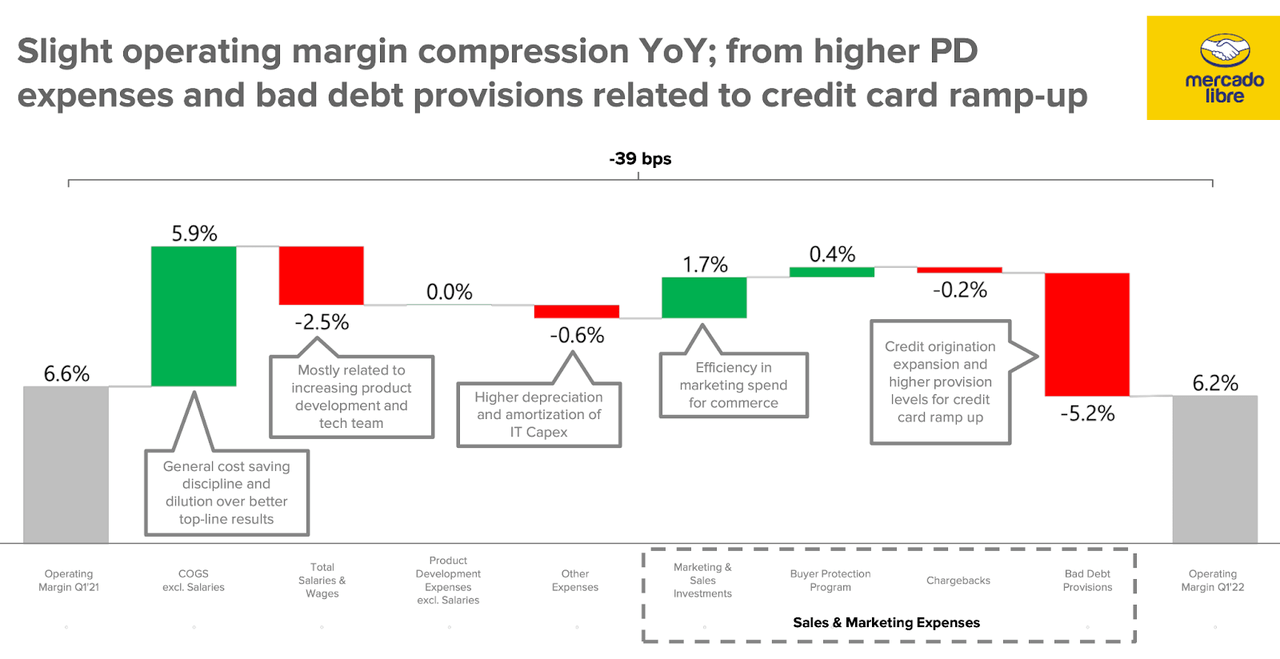

My personal view reflects less confidence – I am hopeful for non-performing loans to decline over time. That increase in provision levels for losses was the primary detractor from operating leverage, as operating margins declined year over year in spite of sizable cost-saving initiatives.

2022 Q1 Presentation

MELI ended the quarter with $3 billion of cash and short-term investments versus $2.6 billion of debt, as well as $4.2 billion in its loan book versus an equivalent amount of associated liabilities.

Is MELI Stock A Buy, Sell, Or Hold?

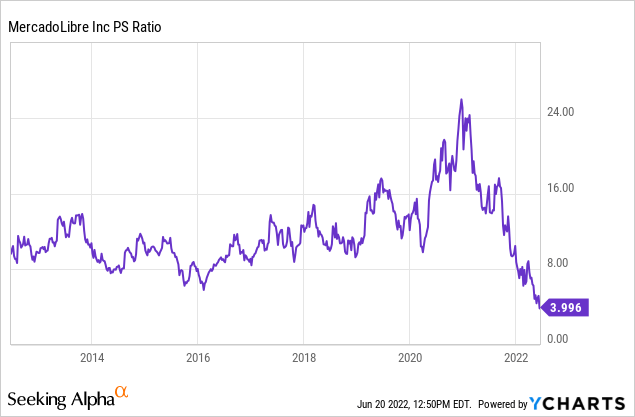

MELI stock is still up sizably over the past 10 years, but it has grown so rapidly during this time that the stock is trading at its cheapest levels.

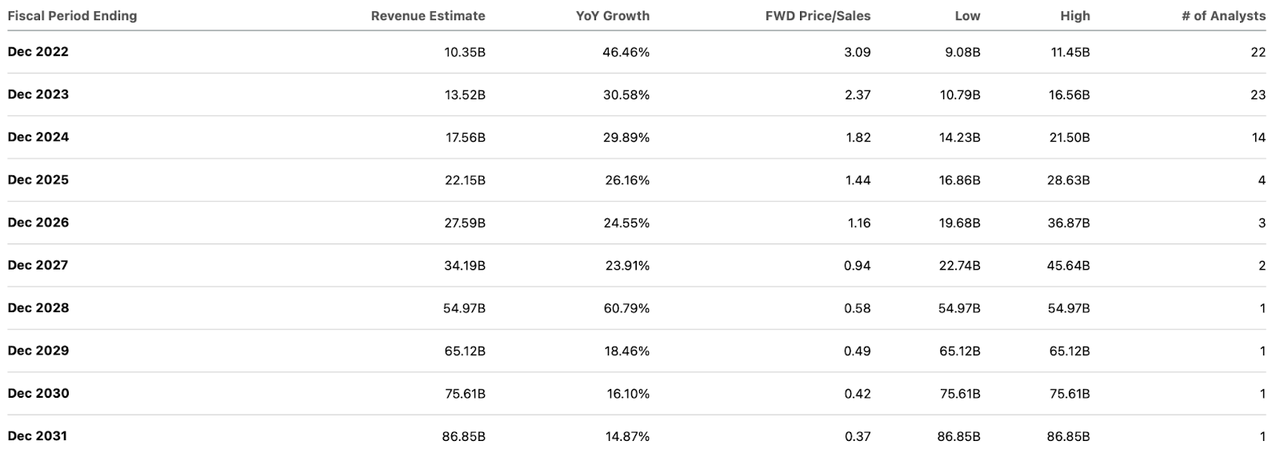

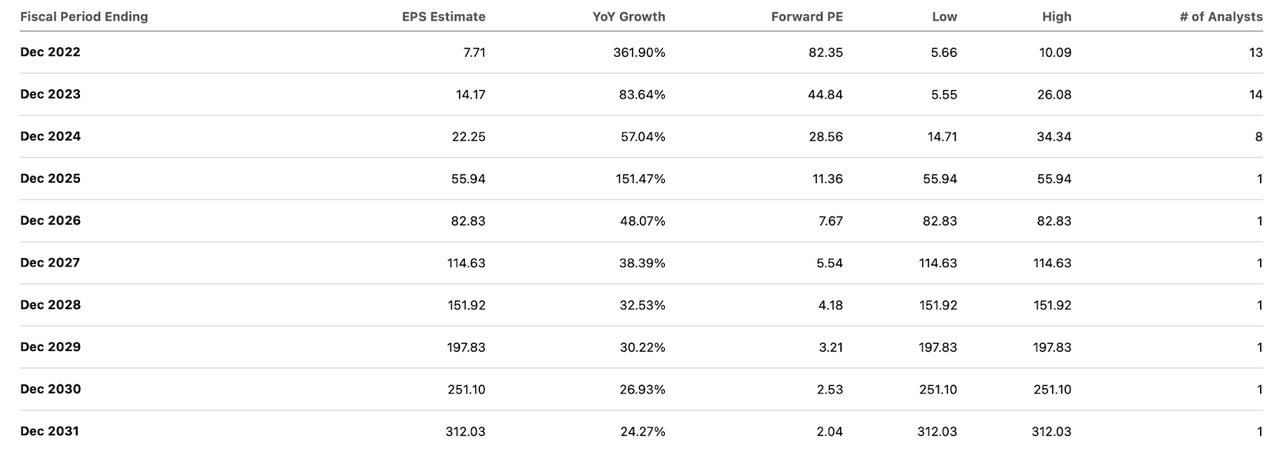

Consensus estimates call for robust double-digit revenue growth over the next decade.

Seeking Alpha

MELI is expected to realize operating leverage, eventually achieving an 18% net margin by 2031.

Seeking Alpha

Based on a 14% exit growth rate, I could see MELI trading at 20x earnings or greater by 2031. That implies a stock price of $6,350 per share, or 10x higher from current levels. That valuation would be arguably conservative considering it would imply a price-to-earnings growth ratio (‘PEG ratio’) of only 1.4x. There are plenty of risks here. Their credits portfolio could underperform in a weak economy, and the company may not have enough cash on hand to fully cover any losses. Due to MELI being an international company, there is also currency risk if the US dollar shows relative strength. As of the last year, 55.3% of their net revenues were denominated in Brazilian Reais, 21.7% in Argentine Pesos and 16.6% in Mexican Pesos. Finally, there are legitimate concerns regarding competition. Sea Limited (SE), a dominant e-commerce operator in Southeast Asia, has been trying to compete in Latin America – this competition may lead to take-rate compression and reduce long-term margin assumptions. It is possible that the rising interest rate environment may ironically help reduce SE’s growth ambitions, but SE has proven to be willing to invest with losses for long time periods. The current stock price appears to price in much of these risks, leading me to rate the stock a buy for long-term investors.

Be the first to comment