JHVEPhoto/iStock Editorial via Getty Images

McKesson Corporation (NYSE:MCK) has been in our family portfolio for over four years. MCK stands out as a defensive healthcare services provider in an unstable market for investors focused on enduring companies whose stocks are trading at value prices.

I had initially covered MCK in a mid-2017 Seeking Alpha Editor’s Pick article:

In this updated primary ticker research report, I put McKesson and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

A compelling margin of safety with predictable revenues and cash flow, and reasonable valuation should continue to deliver compound annual growth for years to come.

My current overall rating: Buy.

Unless noted, all data presented is sourced from Seeking Alpha and YCharts as of the market close on June 17, 2022; and intended for illustration only.

Leading Position in 21st Century Healthcare

McKesson Corporation is a dividend-paying large-cap stock in the health care sector’s distributors industry.

The company provides healthcare services in the United States and internationally through four segments: U.S. Pharmaceutical, International, Medical-Surgical Solutions, and Prescription Technology Solutions. McKesson Corporation was founded in 1833 and is headquartered in Irving, Texas, USA.

Of note, sales to McKesson’s ten largest customers account for approximately 52% of total revenues. Sales to its largest customer, CVS Health Corporation (CVS), account for approximately 21% of total consolidated revenues. (Source: Form 10-K Annual Report for the period ending 03/31/22.)

My value proposition elevator pitch for McKesson:

Best of breed in legal drug distributor oligopoly, which includes peers AmerisourceBergen (ABC) and Cardinal Health (CAH), should equate to a long-term competitive position for McKesson in the healthcare-dominated 21st century.

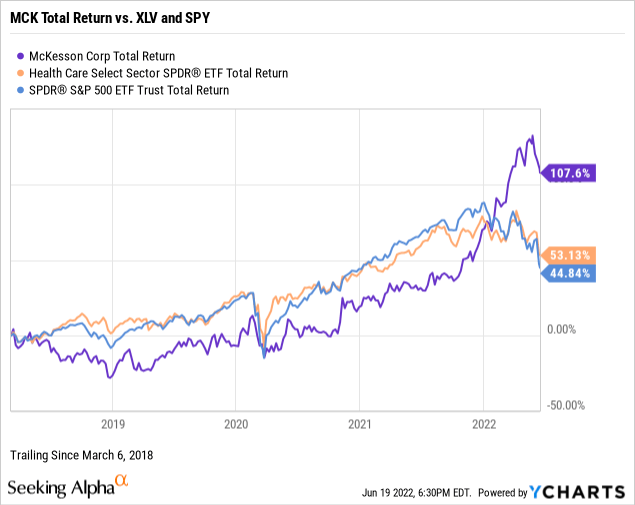

The chart below illustrates the stock’s performance since I added the shares to our family portfolio on March 6, 2018, against the Health Care Select Sector SPDR Fund ETF (XLV) and the SPDR S&P 500 ETF Trust (SPY).

Ultimately, investing in individual common stocks should aim to beat the benchmark indices over time. For example, MCK has nearly doubled the total return of its sector and more than doubled the return of the mid- to large-cap U.S. market.

The most significant jump occurred after McKesson and its health care distributor peers settled the nationwide opioid crisis lawsuits.

My value proposition rating for MCK: Bullish.

Compelling Free Cash Flow Yield

As part of my due diligence, I average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-year Treasury benchmark note. In other words, what is the equity bond rate of the common shares?

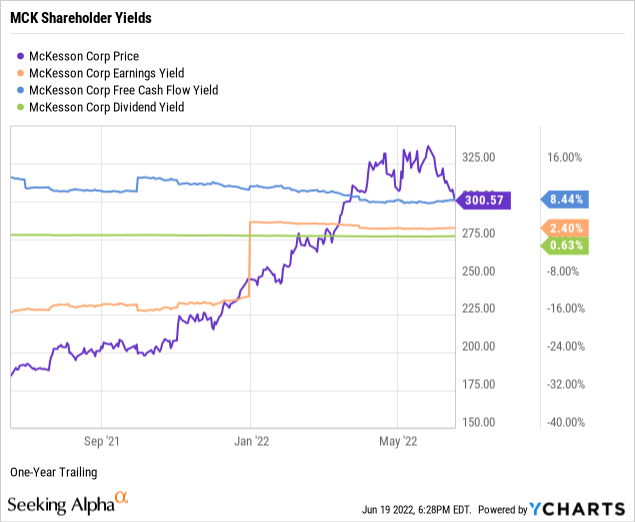

I target an earnings yield greater than 6 percent or the equivalent P/E multiple below 17 times, and MCK is well below the floor at 2.40%, as demonstrated in the below chart.

I target a free cash flow yield or FCFY of 7 percent and higher or the equivalent of fewer than 15 times the inverted price-to-free cash flow multiple. At 8.44%, MCK exceeds the threshold.

Although not a dividend investor by definition, I prefer dividend-paying stocks for compensation in the short term while waiting for capital gains to compound over time. McKesson offers a modest dividend yield of 0.63% with a conservative 7.72% payout ratio, well below my 60% payout ratio ceiling, thus indicating a safe, well-covered dividend with plenty of room for increases.

I prefer high dividend yields only when calculated on a cost basis, and MCK was yielding 1.30% on my adjusted cost basis of $144.79 per share, or double the current forward yield.

Next, I take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 3.23% on the 10-year Treasury benchmark note. The average shareholder yield for MCK was 3.82%, or 4.05% using dividend yield on cost. Arguably, equities are deemed riskier than U.S. bonds. However, securities that reward shareholders at higher yields than the government benchmark, despite a narrow spread, such as MCK, favor owning the stock instead of the bond.

Remember that earnings and free cash flow yields are inverses of valuation multiples and suggest the MCK is overvalued to earnings but undervalued to cash flow. I’ll further explore valuation later in this report.

My shareholder yields rating for MCK: Bullish.

Superior Overall Management Performance

Let’s explore the fundamentals of McKesson, uncovering the performance strength of the company’s senior management.

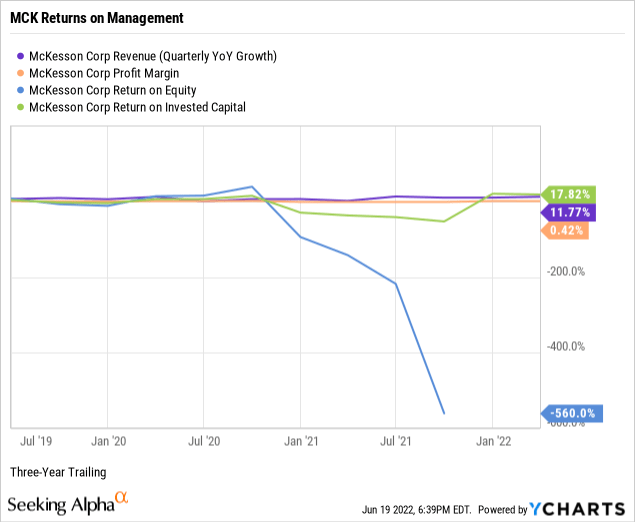

When analyzing a business, I’m biased toward established growth instead of executive guidance and sell-side analyst projections. For example, per the below chart, McKesson had three-year revenue growth of 11.77%, more than double the 5.85% median growth for the health care sector.

McKesson had a trailing three-year pre-tax net profit margin of 0.42%, exceeding the sector’s negative median net margin of -1.93%. I screen for profitable companies to avoid unnecessary speculation, as witnessed in the money-losing disruptive growth stocks.

Return on equity or ROE reveals how much profit a company generates from shareholder investment in the stock. I target an ROE of 15 percent or higher to discover shareholder-friendly management. Unfortunately, MCK was producing negative trailing three-year returns on equity of -560% against a median ROE of -35.64 for the sector. Based on net income, MCK’s ROE may have resulted from recent losses due to the opioid litigation and settlement.

I target a return on invested capital or ROIC above 12%. At 17.82%, McKesson exceeds the threshold and the sector’s negative median ROIC of -19.74%, indicating that senior executives are highly efficient capital allocators. Return on invested capital measures how well a company invests its resources to generate excess returns.

ROIC needs to exceed the weighted average cost of capital or WACC by a comfortable margin, giving management’s ability to outperform its capital costs. MCK had a trailing WACC of 5.55% (Source: GuruFocus). Despite the ROE issues, the ample spread between ROIC and WACC combined with positive growth, competitive net profit margins, and compelling returns on capital indicate superior management performance at McKesson.

My fundamentals rating for MCK: Bullish.

Underbought to Sales and Free Cash Flow

I rely on four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

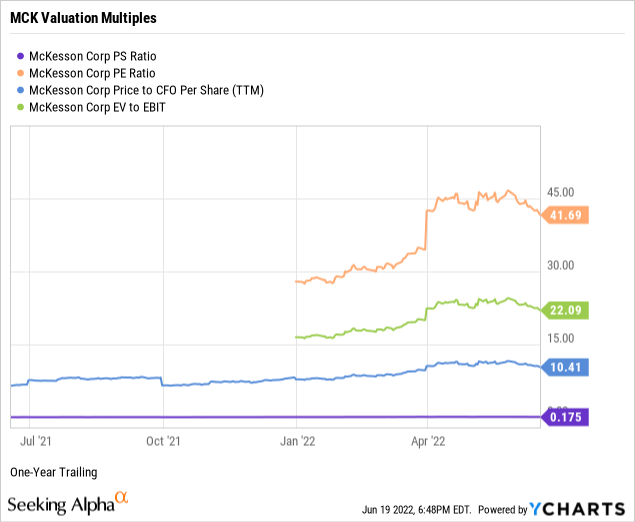

The price-to-sales ratio or P/S measures the stock price relative to revenues. I target fewer than 2.0 times, and at 0.18, MCK was trading well below the ceiling. In addition, the trailing P/S ratio was 4.11 times for the healthcare sector and 2.53 times for the S&P 500. Thus, the weighted industry plus market sentiment suggests the stock is undervalued relative to McKesson’s topline.

Although often a hit or miss multiple, I target price-to-trailing earnings or P/E multiples fewer than 17 times or below the target stock’s sector averages. MCK had a price-to-earnings multiple of 41.69 times against a sector P/E of 25.31, indicating investor sentiment places a premium on the stock price relative to earnings per share. Further, the stock was trading at a premium to the S&P 500’s recent overall P/E of 20.33 (Source of S&P 500 P/E: Barron’s).

I target single-digit price-to-operating cash flow multiples for the best value. At 10.41 times, MCK was trading just above my ceiling but below the sector’s median of 17.37, indicating the market discounts the stock price relative to current cash flows.

Enterprise value to operating earnings or EV/EBIT measures whether a stock is overbought, a bearish signal, or oversold, a bullish signal, by the market. I target an EV/EBIT of fewer than 15 times. Against the broader sector median of 19.67 times, MCK was trading at 22.09 enterprise value to operating earnings signaling the stock was overbought by the market.

The weighting of my preferred valuation multiples suggests the market discounts McKesson’s stock price to sales and free cash flow but is buying the stock at a premium to earnings and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this report, risks and potential catalysts notwithstanding, I would call MCK the reasonably-priced stock of a quality operator within the health care distributors industry.

My valuation rating for MCK: Bullish.

Below Average Downside Risk Profile

When assessing the downside risks of a company and its common shares, I focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment. Hence, I assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none.

Morningstar assigns McKesson a narrow moat rating.

We assign a narrow moat rating to McKesson, stemming from switching costs associated with prime vendor contracts and a degree of stickiness from an embedded relationship with its largest customers, specifically its joint venture generic sourcing programs with Walmart and long-standing distribution agreement with CVS Health’s mail-order and specialty pharmacy. While we do see elements of efficient scale and cost advantage related to the company’s substantial market share, these aspects are shared by the other two leading wholesalers, who altogether effectively comprise the entire industry.

– Dylan Finley, CFA, Equity Analyst, September 13, 2021

A favorite of the legendary value investor Benjamin Graham, long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. Generally, at least one-and-a-half times current assets to long-term debt is ideal. Notably, as reported on its March 2022 quarterly financial statements, McKesson’s long-term debt coverage of 9.38 was more than six times the threshold. Thus, the company provides ample liquidity necessary to cover its longer-term leveraging needs.

Current liabilities coverage or current ratio measures the short-term liquidity of the balance sheet. I target higher than 1.00, and MCK’s short-term debt coverage was 0.95. Thus, the balance sheet provides sufficient liquid assets to pay down its current liabilities, such as inventory, prepaid expenses, restricted cash, income taxes, accrued expenses, and unearned revenue.

As a long-term investor, I use a five-year beta trend line and screen for stocks lower than 1.25 or no more than 125% volatility in the market. MCK’s trailing beta was a stable 0.67. At the shorter 24-month time frame, the beta was 0.97. With price volatility lower than the S&P 500 standard of 1.00, the health care distributor presents as a stable holding across market cycles.

The short interest percentage of the float for MCK was 2.27%, well under my 10% ceiling. Perhaps the near-sighted bears view the stock as a predictable revenue and cash flow staple in institutional and retail portfolios, and whose most significant negative catalyst, the opioid crisis, has waned.

In my view, McKesson is a fundamentally sound company with an attractive risk profile.

My downside risk rating for MCK: Below Average.

MCK Catalysts and Final Thoughts

Catalysts confirming or contradicting my overall bullish investment thesis on McKesson Corporation and its common shares include, but are not limited to:

- Confirmation: Distribution of pharmaceuticals and other healthcare products will remain a staple operation in the healthcare century. Being part of the best of the three-company oligopoly is a good thing for MCK shareholders.

- Contradiction: Although seemingly resolved within the company’s expectations and legal reserves, opioid-related litigation and claims from states and territories not participating in the announced settlement could still haunt the industry. Full disclosure, I came close to selling out our family holding in MCK over its role in the opioid epidemic.

Along with disruptive technology, the healthcare industry is evolving in the 21st Century to what the auto and fossil fuel industries were to the 20th Century: The leading barometers of the domestic economy. As I focus on enduring companies whose stocks are trading at reasonable prices, McKesson remains an attractive healthcare staple in an unstable market.

Be the first to comment