Drew Angerer/Getty Images News

The Investment Thesis

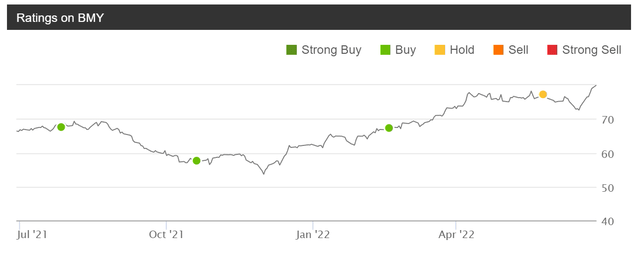

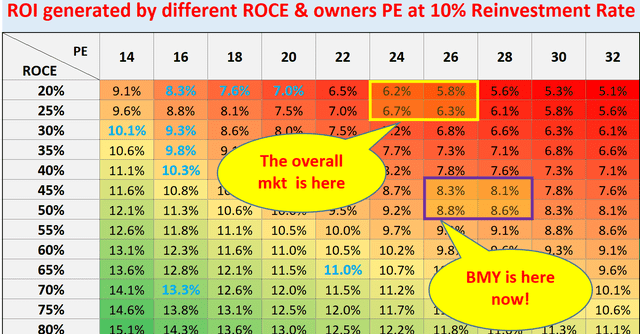

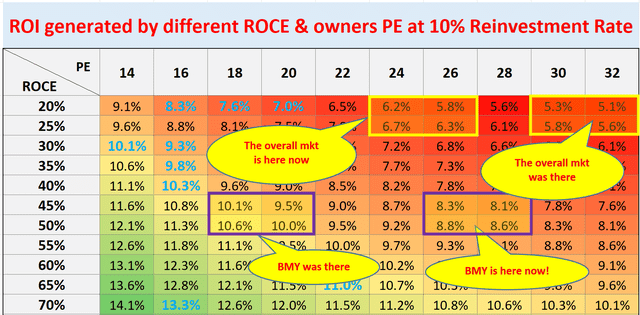

I have been a long-time bull on Bristol-Myers Squibb (NYSE:BMY). As you can see from the following chart, I’ve been publishing my bull thesis on it since July last year. Indeed, the stock has delivered handsome returns (the average total return was more about 30% based on the prices when I published). However, you can also see that I have changed my thesis recently to hold, given such large price advancement. Overall, I see the stock still offers a more attractive total return than the overall market, and hence more attractive to hold than the overall market. But the margin of safety is thinner now, only about 2% now. As you can see from our investing roadmap (the second chart below). BMY is projected to provide about 8% annual return (“ROI”) in the long term under its current conditions, and the overall market is only about 6%. Such a 2% margin of safety is a lot thinner compared to more than 5% when I wrote my bullish articles, as to be detailed in the remainder of this article.

Our Roadmap

First, a bit of background on the roadmap. We use it in all our investment decisions to keep us thinking like business owners, not stock traders. As detailed in our earlier article:

- The long-term ROI for a business owner is simply determined by two things: A) the price paid to buy the business and B) the quality of the business. More specifically, part A is determined by the owners’ earning yield (“OEY”) when we purchased the business. And that is why PE is the first dimension in our roadmap. Part B is determined by the quality of the business and that is why ROCE, the most important metric for profitability, is the second dimension in our roadmap.

- Now, the long-term growth rate is governed by ROCE and the Reinvestment Rate. These are the two most important growth engines, and they mutually enhance each other. High ROCE means every $1 reinvested can lead to a higher growth rate, which leads to more future profits and more flexible capital allocation to fuel further growth, and so on. So to summarize:

- Longer-Term ROI = valuation + quality = OEY + Growth Rate = OEY + ROCE*Reinvestment Rate

How Did Our Roadmap Perform?

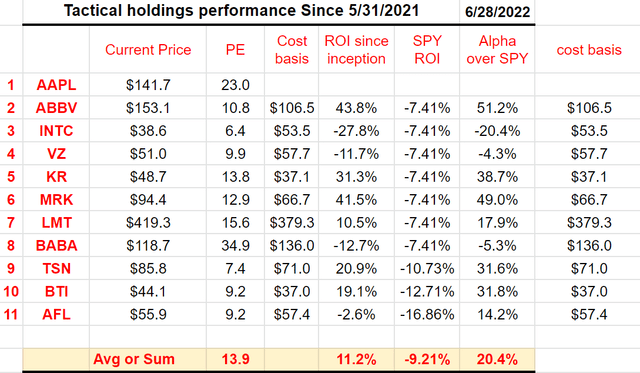

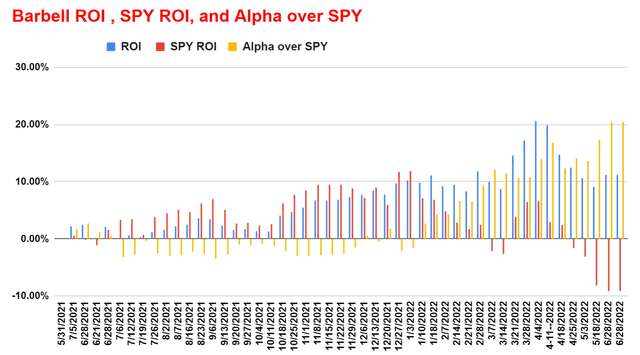

Of course, you must be wondering if it works. Currently, our stock portfolio holdings are shown in the next chart. Using the date I first published it on 5/31/2021 as the inception date, its performance relative to the S&P 500 (represented by SPY) is shown below. SPY has lost an average of 9.21% since then, and our stock holdings have gained an average of 11.2%. As a result, at the current levels, our stock holdings are leading the SPY by about 20.4%. Also note that:

- AAPL has been a legacy holding and its returns are not included in these charts (otherwise, it will completely dominate the picture).

- These returns did not include dividends, so the actual returns from our holdings are slightly better than reported here because they have a higher average dividend yield than SPY.

A few highlights related to BMY. First, we are long-term investors and as a result, even our tactical holdings tend to have a timeframe of a few years. We haven’t sold any of our stock positions since May last year. Second, as you can see, we hold two healthcare stocks in our portfolio, AbbVie (ABBV) and Merck & Co (MRK). Both have also enjoyed handsome returns (both more than 40%). They are also becoming less attractive as the healthcare sector rallies. We are holding them primarily for tax considerations, and also we view them as more attractive than other alternatives, such as BMY as you will see later next.

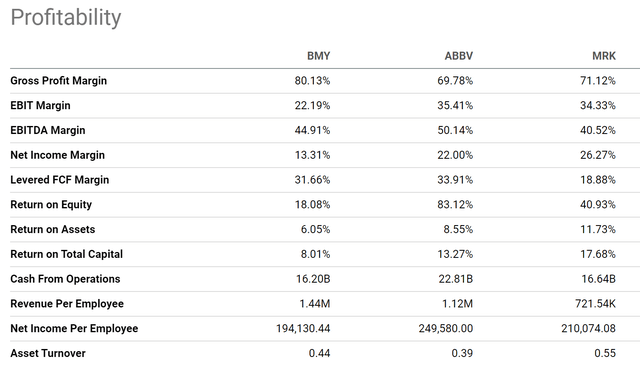

Bristol-Myers Squibb: Consistent And Healthy Profitability

As you can see from the following chart, BMY’s profitability is quite healthy (actually terrific) in all metrics. Not only in absolute terms, but also relative to its peers such as ABBV and MRK.

Take the gross margin as an example. BMY features a gross margin of around 80%, a truly astronomical margin even among pharmaceutical companies (which could also be a risk, as to be detailed later). It is about 200 bps higher than ABBV and almost 100 bps above MRK. Moving on to net margin. BMY’s current net margin is about 13.3%. Admittedly, it is lower than ABBV (22%) and MRK (26%). But note that A) its net margin is higher on average in the longer term, and B) its 13.3% net margin is still a very competitive level. Its net margin has been around 15% in the past few years. A 13.3% net margin is more than 30% above the average profit margin of the overall economy (which typically fluctuates between 8% to 10%).

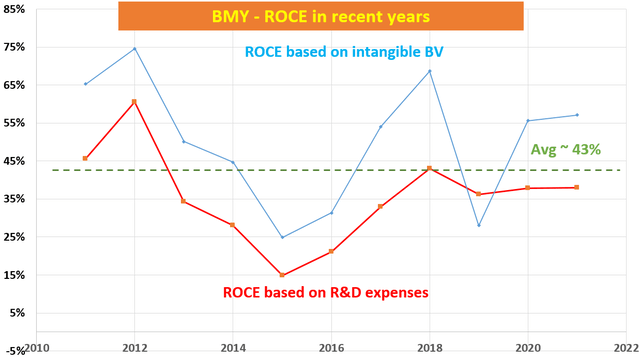

As aforementioned, the most important profitability metric in my opinion is ROCE because it measures the return of capital actually employed in a business. Details of BMY’s ROCE analyses have been provided in my early articles already, and its average ROCE in the long term has been about 43%.

Seeking Alpha Source: author based on Seeking Alpha data

BMY: Business Outlook And Growth Potential

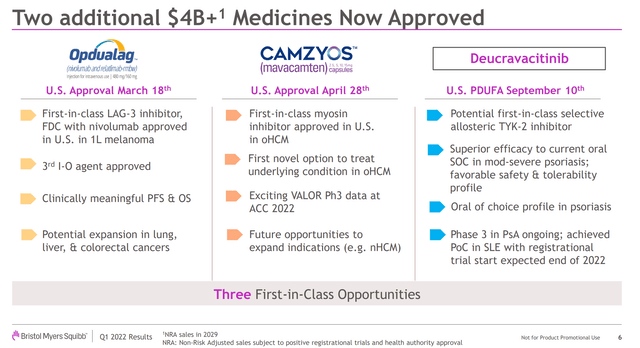

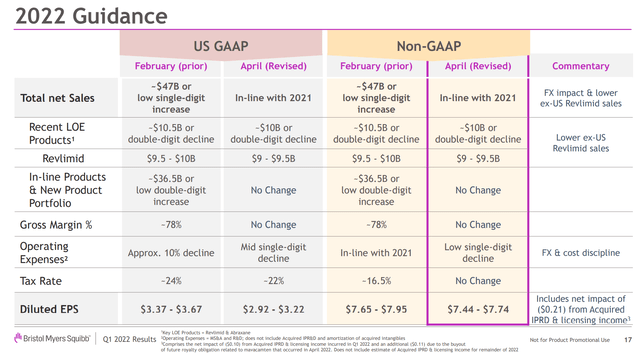

Looking ahead, the business enjoys bright prospects and healthy growth potential thanks to its strong drug portfolio and robust pipeline. Notably, it just received approval for two additional medicines (Opdualag and Camzyos). These medicines are expected to generate $4B+ sales in the near future. To put things under perspective, BMY’s guidance for total sales is about $47B for 2022. These drugs also pave the groundwork for BMY to explore other important opportunities in lung, liver, and colorectal cancers as CEO Giovanni Caforio commented (abridged and emphasis added by me):

So far, two of those new products, Opdualag and Camzyos received FDA approval. Many of our new products have significant expansion opportunities… While we are still in the early days, I can say that the Opdualag launch is going very well. We believe this medicine has the opportunity to become a new standard of care for melanoma patients. In addition to melanoma, Opdualag has the potential for new indications. And we are exploring important opportunities in lung, liver and colorectal cancers.

BMY earnings presentation BMY earnings presentation

BMY: Back To The Roadmap

Now, with their ROCE and growth potential assessed, we can go back to the roadmap. At its current price levels, the OEY (owner earnings yield) is ~3.7% for BMY. Note that here, I used the GAAP EPS guidance as an approximation for the owners’ earnings. The growth rate is projected to be about 4.3% for BMY by assuming a 10% reinvestment rate and 43% average ROCE in the long term (long-term growth rate = ROCE * reinvestment rate = 43% * 10% = 4.3%).

As a result, the total expected return in the long term is about 8.6%, with a 50-50 split between OEY and organic growth. As aforementioned, it is more attractive than the overall market by about 2% (whose total return should be about 6.5% under the current conditions). But the margin of safety is a lot thinner now than before.

Final Thoughts And Risks

In this article, I am downgrading my thesis on BMY from buy to hold. Overall, I see the stock still more attractive to hold than the overall market. When I published my bullish articles earlier, the overall market was more expensively valued and only provided a 5.5% return potential, while BMY was more undervalued and provided a 10.5% annual return potential, creating a thick margin of safety around 5%. Now, this margin of safety has shrunken to only about 2%.

Finally, BMY also faces some other risks. As aforementioned, BMY enjoys super profitability (80%+ gross margin). Several of its major drugs (e.g., Revlimid, Opdivo, and Eliquis) enjoys high demand and little competition, and hence BMY was able to charge higher selling prices. However, such pricing power may backfire and not be sustainable, especially considering the ongoing social and political pressure against untenable high drug prices.

Be the first to comment