seb_ra/iStock via Getty Images

Introduction

Estimating value is essential to assess the potential returns of an investment, the probability of those returns, and the risks involved.

The best risk-management occurs at the individual stock level; therefore, developing strong qualitative and quantitative analytical skills, and understanding the shortcomings of each method of valuation, is crucial to long-term investment success.

We learn different methods of valuation in business school or from reading popular textbooks such as Valuation: Measuring and Managing the Value of Companies by McKinsey. These quantitative foundations give us the formulas and theory behind valuation methods; however, performing practical valuation with money on the line is quite different. Estimating value in practice is about forecasting – and estimating is what you do when you do not know.

Businesses have been bought and sold for centuries and there must have been methods to come up with a fair and mutually agreed upon price of the transactions in the distant past. Perhaps it was a multiple of free cash flow from the business or the value of the assets, plus a discount or premium.

Methods of valuation have evolved since the distant past, particularly in the 20th century. Legendary economists Irving Fisher developed the idea of internal rate of return (IRR) in his books The Rate of Interest (1907) and The Theory of Interest (1930). John Burr Williams then wrote The Theory of Investment Value (1938), in which he introduced the idea of companies having an “intrinsic value” and using a mathematical formula to calculate this, which he called the “present value of future cash flows”.

Discounted Cash Flows is undoubtedly the correct way to calculate the true worth of an asset, bond, or business. However, as we will discuss, it has limitations when applied to valuing businesses. In fact, all methods of valuation have their limitations and it is important to understand those limitations or we run the risk of being victims of “false precision”.

A common rule for valuation is that it is better to be approximately right than precisely wrong. In other words, valuation requires a range of calculations based on future variables that are impossible to predict with certainty. Valuation can be described as iffy: “if so-and-so happens, then the cash flows should be so-and so, then the company is worth this much.” Shortcuts to valuation have evolved over time as well. Traditional measures such as the Price-to-Book ratio, Dividend Yield, and Price-to-Earnings ratio are now just a few of the dozens of metrics analyzed: Enterprise Value-to-EBITDA ratio, Free Cash Flow Yield, Price-to-Sales ratio, PEG Ratio, Replacement Value, Adjusted Earnings, Return on Invested Capital, and so on.

Before we get into the methods of valuation, we must first understand four critical concepts: price versus value, margin of safety, dislocations of value, and drivers of value creation.

Part I: Important Concepts

Critical Concept #1: Price and Value

“Long ago, Ben Graham taught me that ‘Price is what you pay, value is what you get.” – Warren Buffett, 2008 Berkshire Hathaway Shareholders’ Letter

There are three important concepts when it comes to “value”: value of a bet, returns, and intrinsic value.

Investing is putting up money today with the expectation of getting the money back in the future, plus a profit. When it comes to investing in businesses, the outcomes are not guaranteed, which is a way of saying that investors are placing bets. Every investment into a business is speculative, but there are varying degrees of speculation. One way to reduce the speculative nature of bets on businesses is through careful analysis of the value of the bet and being highly selective, only betting when (1) the odds of losing money are low, (2) the losses are low if you lose money, and (3) the odds of making attractive returns are high.

The Internal Rate of Return (IRR) on a bet incorporates all cash flow distributions to an investor and provides an annualized return on the investment. Investors forecast IRRs of investments to assess whether to participate in the investment. IRR, however, does not tell us the probability of that return or the level of risk for the investment. Claiming that an investment generated a high IRR, therefore it was “undervalued”, is not sensible reasoning. For example, if you double your money on an investment (i.e. bet) very quickly, you can argue that you are gifted and the bet was undervalued at the time of placing the bet. However, you may be wrong. If I offer you double or nothing on a coin flip for $1,000, the value of the bet is not $2,000 just because you won. And the value of the bet was not $0 if you lost the bet. Based on probabilities and expected returns, the value of the bet was $1,000 whether you won or lost. The outcome of a bet does not determine the riskiness or value of the bet.

Intrinsic value of an asset can be defined as the “true worth” of an asset, typically expressed as the net present value of all future cash flows. While the discount rate or opportunity cost varies among investors, the cash flows on bonds are very precise and predictable, making them easier to value.

The bond markets also provide a clear example of the difference between price and intrinsic value. Imagine you buy a zero-coupon bond in a high-quality company with a maturity in three years. After the purchase, the cash flows will be delivered as scheduled, but the price will fluctuate up and down as buyers and sellers trade in and out. One may argue that the discount rate or opportunity cost changes over time and that accounts for the price fluctuations, but investors’ opportunity cost are different; the value to you has not changed, only the price.

Defining intrinsic value gets complicated for assets that do not produce cash flows. Consider a painting, for example. A painting does not generate periodic cash flows, it is only worth as much as the highest bid at the time of a sale. In other words, value equals the highest price someone is willing to pay at any given moment. A building or house, by contrast, does have different methods of valuation: replacement value, land value, and a possible cash flow value if it is rented out.

Investors need to be aware of the false precision of formulas used to value businesses. Businesses do not have a precise value, nor do they have a fixed value over time. The prices of businesses, especially publicly traded companies in the stock market, fluctuate as well. However, just because both value and price fluctuate, does not mean that they are equal. In fact, it means that companies are almost always mispriced relative to their value.

A recent illustration of the disconnect between price and value in businesses was in March of 2020, when the S&P 500 fell roughly 35% from its February high, but then finished the year up over 18%. The future earnings power and intrinsic value of the 500 companies in the S&P 500 did not fluctuate nearly that much in 2020. High volatility creates big dislocations of value.

The most unbiased way to value a company is to begin without looking at its current price and past prices. However, nearly all investors, including those that say they are “fundamental investors” and do not perform technical analysis, use the current price and past prices as an anchor. If you are looking at prices, you must understand the biases it creates. A stock that has gone down a lot from its high is not necessarily undervalued and a stock that has gone up a lot recently is not necessarily overvalued.

It is remarkable how many people come up with valuations almost entirely based on prices, including Wall Street analysts. If a stock goes up a lot, they raise the price target. If the stock goes down, they lower the price target. During market corrections and rebounds this can be especially amusing as their price targets fly around in reaction to the sharp stock price swings. If an analyst had a price target on a stock of $50 and the stock doubled to $100, he or she would likely raise the target to $110 or $120 to reflect his or her continued confidence in the company. If the stock was $100 and fell to $50, he or she might lower the price target to $60 or $70 to reflect continued confidence. It is important to keep in mind that analysts’ 12-month target prices are not calculations of intrinsic value, they are potential future prices and should be ignored entirely.

Critical Concept #2: Margin of Safety

Margin of safety is one of the most important concepts in investing and is a term coined by Benjamin Graham in the 1949 first edition of The Intelligent Investor. He devoted an entire chapter to the concept and wrote:

“In the old legend the wise men finally boiled down the history of mortal affairs into the single phrase, “This too will pass.” Confronted with a like challenge to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY. This is the thread that runs through all the preceding discussion of investment policy-often explicitly, sometimes in a less direct fashion.”

In other words, valuation is not precise, and the future cash flows are not perfectly predictable. What matters when doing valuation is not that you come up with the correct calculation of intrinsic value (you cannot), but that there is a sufficient margin of safety relative to the price you pay. This is another way of saying you should seek payoffs that are low risk and high reward.

Value investors scoff at the idea of growth investors claiming that they look for a margin of safety in their investments. However, Ben Graham said himself that he believed this was possible but challenging. He wrote in The Intelligent Investor:

“Thus the growth-stock approach may supply as dependable a margin of safety as is found in the ordinary investment-provided the calculation of the future is conservatively made, and provided it shows a satisfactory margin in relation to the price paid.”

The danger in a growth-stock program lies precisely here. For such favored issues the market has a tendency to set prices that will not be adequately protected by a conservative projection of future earnings. (It is a basic rule of prudent investment that all estimates, when they differ from past performance, must err at least slightly on the side of understatement.)

The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price. If, as we suggest, the average market level of most growth stocks is too high to provide an adequate margin of safety for the buyer, then a simple technique of diversified buying in this field may not work out satisfactorily. A special degree of foresight and judgment will be needed, in order that wise individual selections may overcome the hazards inherent in the customary market level of such issues as a whole.

In other words, Graham thought that one may occasionally find individual high growth stocks that are providing a margin of safety, but it would be difficult to buy dozens or hundreds of them that are providing a sufficient margin of safety, especially in a hot market. There is truth to what Graham said, but it is also exceedingly difficult to find dozens or hundreds of slow growing stocks that provide a satisfactory margin of safety and potential for high returns. Therefore, a case is made for heavy concentration of investments when there is a large margin of safety and durable high growth.

Hear others, but do not let others think for you. Always keep in mind that many of the most successful companies and best investments are constantly called overvalued or “priced for perfection” by the media and other investors. If you can find hyper-growth companies with outstanding management, high future operating margins, that meet qualitative criteria, and that are building a moat in an industry that will have durable growth for decades, you may be able to invest with limited downside and substantial upside.

Some companies do one thing great and build a wide moat in a big space, but investors can also earn incredible returns investing into companies with “optionality”, which means companies that can expand into new areas or make acquisitions to create unexpected growth and value. If you study the history of many great companies, they often created tremendous value through acquisitions: Alphabet (GOOG) (GOOGL), Microsoft (MSFT), Facebook (META), Cisco (CSCO), Salesforce (CRM), Adobe (ADBE), etc. It is difficult to put a value on optionality because it is extremely difficult to predict. However, when it comes to valuing future leaders in large spaces with optionality, the common mistake is that the optimistic scenarios are usually not optimistic enough.

When you invest into companies with durable high growth, the intrinsic value increases substantially over time. A margin of safety is required for absorbing the effect of miscalculations or poor luck, but there is long-term safety in durable growth.

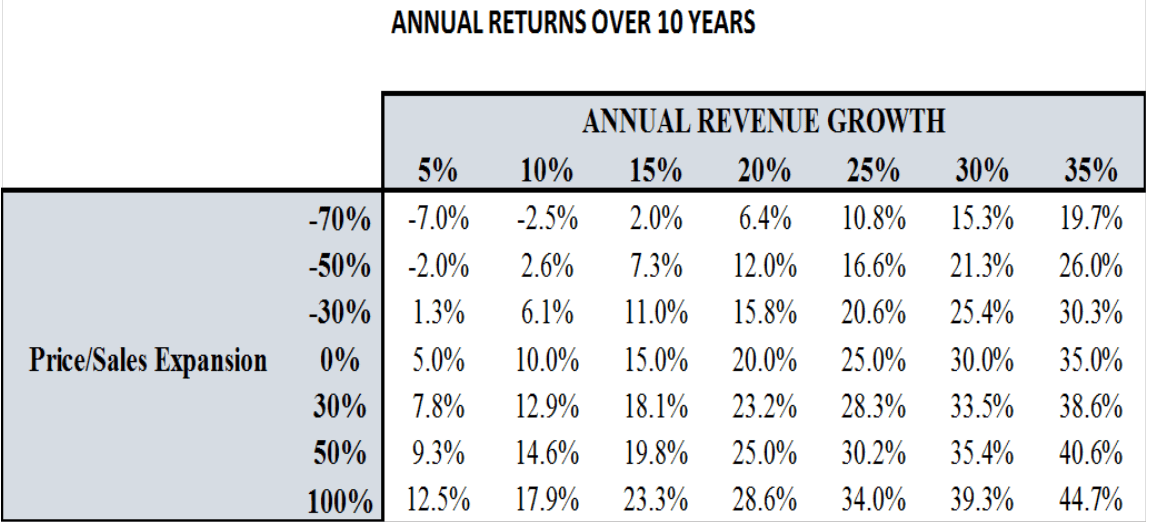

Luca Capital

In the short-run, valuation multiples are the primary driver of stock performance. In the long-run, growth of intrinsic value is the primary driver of stock performance.

Critical Concept #3: Dislocations of Value

“If I was teaching a class at business school, on the final exam I would pass out the information on an Internet company and ask each student to value it. Anybody that gave me an answer, I’d flunk.” – Warren Buffett, Lecture at the University of Florida Business School, October 15th, 1998

An unfortunate amount of people today, especially in the academic community, believe that markets are efficient and that stocks are perfectly priced. This is nonsense that does not pass basic logic tests, yet some people with a lot of schooling from top universities believe it to be true.

No one can value companies and estimate expected returns with precision. I would be willing to wager a bet for someone to value 20 stocks and calculate their expected returns over the next 10 years, and a decade from now we can look at how accurate he or she was on those 20 calculations. My guess is that nearly all the estimates would be off by a wide margin.

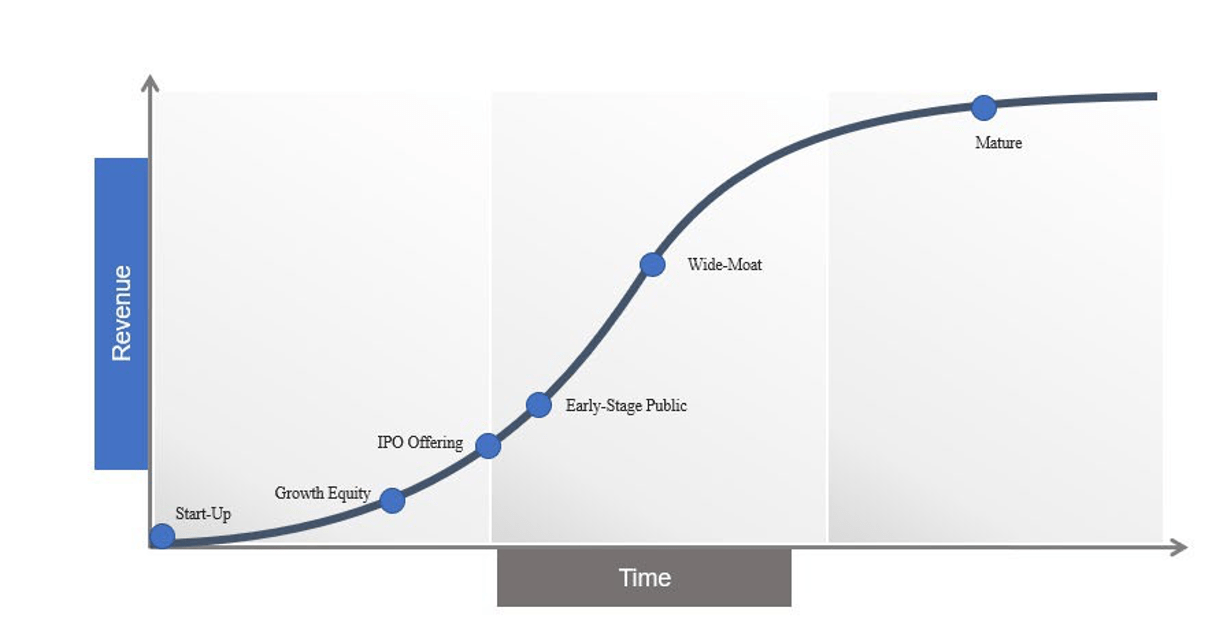

The companies that are the easiest to value are the slow, predictable ones with wide moats. The most difficult companies to value-the companies with the greatest dislocations of value-are ones with excessive debt, highly cyclical companies, micro-cap stocks with poor reporting and little competitive advantages, and hyper-growth companies.

Angel investors cannot conduct valuation analysis. Early VCs also have an extremely difficult time trying to value companies with little revenue and a high probability of not surviving until an exit. Even in public markets, young companies are extremely difficult to value. Imagine trying to value Amazon (AMZN) in 1997 or Netflix (NFLX) in 2002. It gets easier to make assumptions about the future as you go up the S-curve of a company’s revenue life. If you want to find genuinely great “forever investments” you should look for exceptional companies with large total addressable markets, run by extraordinary people, and seemingly unlimited upside.

Luca Capital

What sense is there in attempting to value companies and estimate expected returns if the numbers are going to be incorrect? The purpose is to come up with a range of valuations. If the low-end of the range is an acceptable return and the mid-point is a great return, then it may prove to be an attractive opportunity.

Critical Concept #4: Drivers of Value Creation

“The guiding principle of value creation is that companies create value by investing capital they raise from investors to generate future cash flows at rates of return exceeding the cost of capital… The faster companies can increase their revenues and deploy more capital at attractive rates of return, the more value they create. The combination of growth and return on invested capital (ROIC) relative to its cost is what drives value. Companies can sustain strong growth and high returns on invested capital only if they have a well-defined competitive advantage. This is how competitive advantage, the core concept of business strategy, links to the guiding principle of value creation.” – Valuation: Measuring and Managing the Value of Companies (5th Edition), Page 4, by Tim Koller, Marc Goedhart, and David Wessels

The principles of value creation imply that a company’s primary task is to generate cash flows at rates of Return on Invested Capital (ROIC) greater than the cost of capital. ROIC is a common metric used by investors. However, it can result in misleading calculations due to accounting measures for earnings. Therefore, many investors also use Cash Flow Return on Investment as another measure of a company’s rates of return on invested capital.

In the past few decades, there has been the adoption of a useful metric to measure economic value being created at companies: the ratio of Lifetime Value of Customer-to-Customer Acquisition Cost, abbreviated to LTV/CAC. This is an especially important concept for companies still experiencing hyper-growth, which are often unprofitable and difficult to value.

The Lifetime Value (LTV) is all the expected cash flows generated from a customer in the future. Companies that have “sticky” relationships with customers will often have high LTV/CAC ratios. For example, a software company would measure how much they expect to make a year from the average new customer, including any expected price increases or expanded services, and how many years the relationship would last. Consider an over-simplistic example for an Investment Advisor, where the average client is retained for 10 years and brings in $10,000 in profit each year. The Lifetime Value is $100,000 per customer.

The Customer Acquisition Costs (CACs) are the total marketing costs for acquiring new customers divided by the number of customers acquired. If the Investment Advisor spent $50,000 and acquired 5 new clients, then the CAC is $10,000.

The Investment Advisor would be wise to spend money on marketing because he or she is spending $10,000 per acquired customer to generate $10,000 a year in profit for 10 years. You cannot get those types of return on invested capital in the stock market.

This leads us to an important concept employed by many hyper-growth stocks today: blitzscaling. The term was popularized by Reid Hoffman, the co- founder of LinkedIn and PayPal. Blitzscaling means that companies want to be the first mover or winner in their space and gain market share as rapidly as possible to develop competitive advantages. This often means being very unprofitable when young to spend heavily on Sales and Marketing. The LTV/CAC is especially important for these types of companies because it measures how much value is created by using capital to acquire customers very quickly.

The growth of free cash flow (FCF) generation is what drives intrinsic value in the long run. But what drives FCF? In the long run it is revenue and FCF margins that drive FCF. If margins are maintained, revenue drives FCF growth.

Investors today seem to obsess over competitive advantages. Even new companies talk about their supposed competitive advantages in their pitch decks to VCs, before the company has any revenue. Competitive advantages are so important because they ensure durability and protect intrinsic value. Young companies can show high revenue growth, but never achieve profitability in the distant future. Many internet companies did not survive after the 2000 crash because they did not have high gross margins and durable revenue to allow them to scale into free cash flow generating businesses. Software, digital advertising, digital payments, and health technology companies today typically have 65%-80% gross margins and the potential to have 30%-40% operating margins. There are some incredible companies building moats in these industries today.

Part II: Methods Of Valuation

“So what is it that elevates forecasting to superforecasting? As with the experts who had real foresight in my early research, what matters most is how the forecaster thinks…broadly speaking, superforecasting demands thinking that is open-minded, careful, curious, and-above all-self-critical. It also demands focus. The kind of thinking that produces superior judgment does not come effortlessly. Only the determined can deliver reasonably consistently, which is why our analyses have consistently found commitment to self-improvement to be the strongest predictor of performance.” – Philip E. Tetlock and Dan Gardner, Superforecasting: The Art and Science of Prediction

Valuation Method: Discounted Cash Flows

Whenever you learn something new, it is wise to study the great people before you. Many novice investors are drawn to Warren Buffett because he was one of the richest people on earth and made all his money managing an investment fund and then allocating capital at Berkshire Hathaway (BRK.A) (BRK.B).

There is much more written about Buffett than any other investor, or businessman. There are dozens of books dedicated to explaining his past investments, his biggest successes and mistakes, and how he thinks about a variety of investing topics. One thing stands out though: Buffett called himself a “value investor” but he never gives an estimate about a company’s intrinsic value. You want to learn how Buffett values companies, but he never talked about his estimates and how he came to those estimates. Why?

The answer, of course, is that valuation is not precise. If you ask 10 people to come up with a precise calculation of intrinsic value for a company, you will get 10 different answers-and all 10 may be wrong!

Buffett supposedly uses Discounted Cash Flows (DCF) to calculate intrinsic value. Charlie Munger, his partner of more than 50 years, says he has never seen Buffett do a DCF calculation though. If DCF valuation is so critical, you would think that the partners would share their calculations and discuss their inputs.

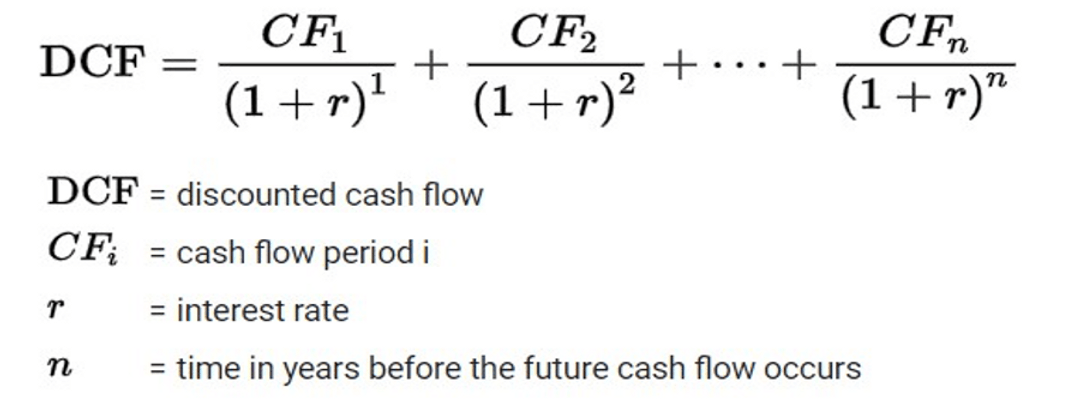

The formula for DCF is as follows:

Wikipedia

The model works, but you must be careful about creating false precision; the inputs could be wildly off. For example, if you calculate that a company will earn future cash flows that are not what they really earn, then your calculation is wrong.

Another challenge with DCF is that most of a company’s DFC value is generated in the distant future. Can you really project what a company is going to be earning 10, 20, and 30 years from now? Not with any reasonable degree of precision.

There is a calculation to overcome this obstacle, called the perpetuity method of terminal value. Investors use DCF to calculate the forecast period, usually 10 years, then add a terminal value. The formula is as follows:

Terminal Value = (FCF * (1 + g)) / (d – g)

Where:

FCF = Free cash flow

g = Terminal growth rate

d = discount rate

Terminal value has a major flaw though: the numbers we enter are not reliable! Let us use an example. If a company had $1 million in FCF and grew in perpetuity at 3% annually, but had a 2% discount rate, the company would be worth infinity. Therefore, the discount rate must be higher than the terminal growth rate. What is the correct terminal growth rate and discount rate? No one knows. Rather than use a perpetuity terminal value calculation, in practice investors usually assign an exit multiple and exit period to their investment to assist them in their valuation calculation.

Another obstacle with DCF is the interest or discount rate. Buffett has said that he uses a 10-year Treasury rate, but that was when interest rates were higher. At the time of this writing, 10-year Treasury rates are near 1.5% and would significantly inflate the value of companies if that were considered an acceptable opportunity cost. Other investors say you should use your required rate of return as your interest rate, but different investors have different required returns and will therefore come up with different calculations of intrinsic value.

The required IRR method is useful, however, in giving you a price you should pay to earn your required rate of return-if you can accurately calculate future cash flows.

Many novice investors think Buffett has had an edge on valuing companies, which is why he is so talented as an investor. However, he does not have an edge; he has the same margin of error that other experienced investors have. The biggest difference between Buffett and other investors when it comes to valuation is that he religiously applies the principle of “margin of safety”.

Valuation Method: Future Market Cap or Exit Price Method

One way to think about valuing young companies is trying to estimate the market cap of the company down the road. Ask yourself, given the opportunity in its market, what is the probability this company will have a $10 billion, $30 billion, $50 billion, or $100 billion market cap in the future? Then try to figure out how long it would take for the company to reach that potential.

If a company is currently at a $2 billion valuation and it is probable it becomes a $20 billion company one day based on qualitative factors, the market potential, and its future market share, the stock should do well even if it falls short of your projections. It is unlikely to know exactly how many years it will take to get there, if they will realize their full potential or only reach a $10 billion market cap, but if there is high conviction it will at least become $10 billion then it will still provide high annual returns. If you get your qualitative analysis right, this type of investment should be low-risk and high-reward for the long-term owner. You cannot come up with a precise intrinsic value or expected return, but you can come up with a range of numbers based on reasonable expectations.

In today’s stock market, many technology companies are trading at high prices and are not showing any earnings. DCF is especially challenging when it will be years before a company has FCF. One method that investors use for certain industries is a potential EV/Sales future multiple or exit multiple; however, as investor Bill Gurley famously wrote in 2011, not all revenue is created equal.

When using the EV/Sales valuation multiple, it is important for investors to estimate future operating margins. For software companies, we can look at mature companies and see what their operating margins are for a point of reference. The large, more mature companies such as Adobe, Microsoft, Oracle (ORCL), and Intuit (INTU) have operating margins of 35%-42%. Other high-quality software companies have operating margins around 30%. Knowing this provides us with a reasonable range of future expectations for young software companies that are spending heavily on Sales & Marketing, R&D, and expanding personnel to grow as quickly as possible and gain competitive advantages.

Management of software companies will sometimes give long-term targets of the operating margins they expect at scale. Not surprisingly, these estimates are often in the 30%-40% range. We can use current revenue and assign the company a 25%, 30%, 35%, and 40% operating margin to see what the EV/Operating Profit is today if the company achieves its long-term target margins. For example, a company with a $10 billion EV and $1 billion in revenue trades at an EV/Sales of 10. That multiple does not tell us much though. If the company has 80% gross margins, we may feel confident the company will achieve 30% operating margins in the future, which would be $300 million in operating profit today if it earned those margins. Therefore, the company is theoretically trading at 33.3 times operating profit. If the company is growing 35% a year with slow deceleration of growth, we may find this price attractive.

As an investor, you want to identify low-risk and high-reward opportunities. Qualitative analysis is critical because young companies often do not have wide moats, they are still building their moats. Ideally, you want to invest into companies that are emerging as winners in their space and are already building some competitive advantages. These companies should also have a path to high profitability, even if it is many years away. All growth rates come down eventually, so accessing the future operating margins, durability of growth, and the rate of deceleration of growth is extremely important.

As long-term investors, we want to buy companies we can own for a decade or longer, but what if the stock soars 300% after a year? Knowing when to sell is often more difficult than knowing when to buy.

One of the biggest regrets and mistakes we hear from other investors is that they sold an incredible company because it got too expensive by traditional metrics or it went up too much, too quickly. The future market cap method can help guide us as to how big the company can get and to determine if it has become so expensive that its long-term potential returns are no longer attractive.

Valuation Method: Probabilistic Returns

Investing into a business is a form of placing a bet. As with poker, there are certain probabilities and expected returns on these bets we place on businesses. Unlike poker, we do not have a 52-card deck so we cannot know these probabilities for certain.

Valuation through this method starts with scenario analysis. There are many variables and scenarios to consider, which often are described by analysts as the Bullish Scenario, Base Scenario, and Bearish Scenario. The variables or factors that go into these scenarios can vary widely: the founder of the company leaves, stronger competition emerges, the company loses or gains a major customer, acquisitions, valuation multiples of peers, macroeconomic factors, and so on. As we learned in 2020, unexpected scenarios such as a global pandemic can also occur and severely impact the values of companies.

Predicting future cash flows and exit prices under different scenarios is a daunting task. To further complicate this method, we must assign probabilities to each of the scenarios-probabilities that we do not really know. We do not want to be overconfident in our probabilities, but we also do not want to be too timid to assign probabilities at all. As with other methods of valuation, while it may be difficult to implement in practice, this method is crucial for its theoretical framework. There is never a “true value” of a company because the value of a company depends on the future, which is unknowable with certainty. However, there are probable valuations.

Another important aspect of this framework is refuting hindsight bias. How many times have you heard someone argue that a stock was undervalued or mis-priced at a point in the past because the stock has been up substantially since then? What these investors fail to understand is that the future was not certain in the past.

Consider a popular example in Amazon. Jeff Bezos told his initial investors they had a 70% chance of losing all their money. What if Borders and Barnes & Noble had put all their weight behind e-commerce early on? What if Walmart (WMT) wanted to become an “everything store” much earlier? Amazon came dangerously close to running out of credit and capital in the early 2000s, what if Amazon failed to raise capital to fund expansion? What if Jeff Bezos suffered had a heart attack or suffered a fatal accident? Could you have predicted the creation and success of Amazon Web Services and Prime Video in the early 2000s?

It is easy to measure the outcome of something that has already happened; it is much more difficult to predict the future. And as investors our job is to make predictions, and projections, based on probabilities.

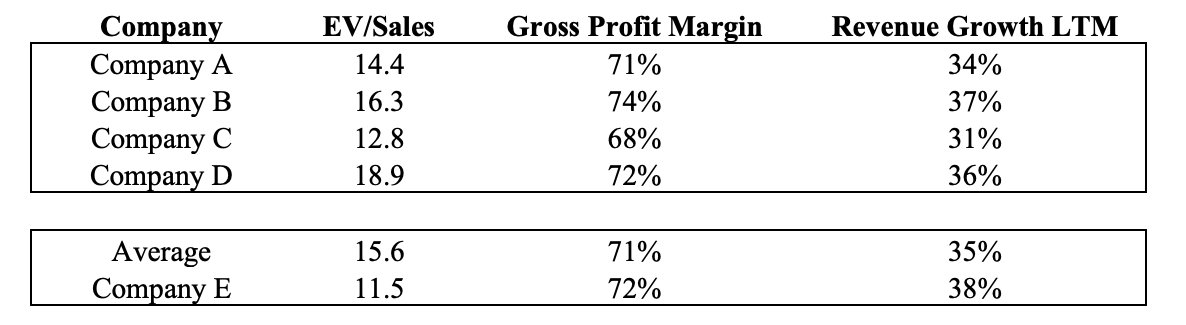

Valuation Method: Relative Valuations

Absolute valuation is when you evaluate the company on its own, without comparing it to peers. The most common method of absolute valuation is Discounted Free Cash Flows. Many in the financial community also use P/E, P/TBV, EV/EBITDA, and EV/Sales as other methods of absolute valuation, but they are limited. Much of the analysis using valuation-multiples depends on reversion to the mean, based on the stock’s historical multiples.

Relative valuation is when you evaluate the company relative to its peers, which may be competitors or companies of similar quality, size, or growth in the industry.

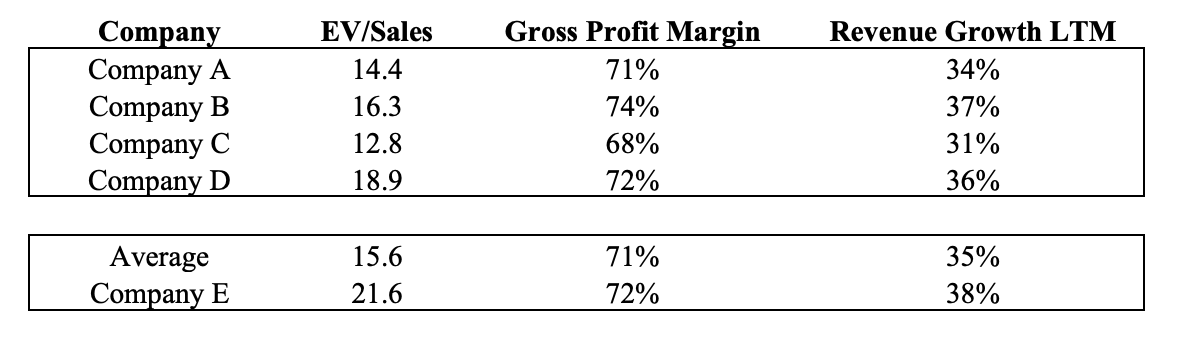

The tables below are common to see from analysts and company presentations. If given Table 1, it is common to hear management or analysts argue that Company E is undervalued and the market is not recognizing its full potential as it trades below peers. If given Table 2, it is common to hear arguments that the market is recognizing the superiority of Company E relative to peers and that is why it deserves the premium.

Table 1

Luca Capital

Table 2

Luca Capital

A mistake often made when doing relative valuation is to assume that if a stock is cheaper relative to its peers, it is therefore cheap. However, if the industry valuation-multiples are above historical norms, the multiples for the entire industry may fall. You should not just look to comparable companies and their valuation multiples today; you should look at historical valuation multiples and where the comparable companies could be in the future.

Over recent years, we’ve heard that valuation does not matter much with growth stocks. We disagree. Microsoft was a monopoly, an incredible business growing revenue 29% in fiscal 1999. However, from its high in 1999 to 2015 the stock price returned nearly 0%. Cisco was also a remarkable business, developing the infrastructure for the internet. It peaked at a market cap of around $550 billion in 2000 after growing revenue 43% in fiscal 1999… today the market cap is $190 billion in 2022.

Relative valuations tell you where a company “could” trade at today if it trades similarly to peers, it does not tell you what a company is worth.

The purpose of valuation is to assess the opportunity and the risk. It is the calculation of probable returns based on forecasting variables in the future. Being disciplined as an investor means that you will miss out on some opportunities that prove to be fruitful, but also means you will avoid serious blunders. Investors should never regret passing on a high-risk and low-visibility investment that turns out to provide strong returns.

Be the first to comment