Tweety Is Unwell

Thirawatana Phaisalratana/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

No We Aren’t Team Elon. Yes We Do Think Twitter Should Be Sold.

Twitter (NYSE:TWTR) joined the public markets around eight and a half years go, with first day peak price in the $50 zip code. Since then it has spent less than a year and a half – cumulatively – above that $50 level. For the most part the story of Twitter stock has been one of disappointment followed by a burst of new hope followed by being let down once more.

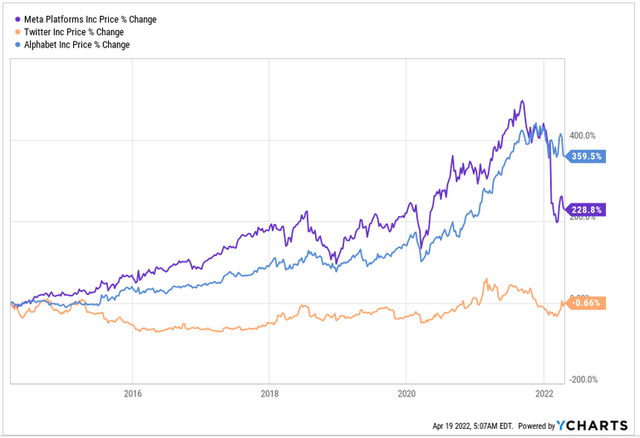

One cannot blame the market for this. Since the Twitter IPO in late 2013, consumer Internet stocks have positively mooned. If you pick two other names whose value also depends on the ability of advertisers to monetize a free-at-the-point-of-use consumer service, being Meta Platforms (FB) and Google (GOOG) (GOOGL) you can see just how dreadful an investment TWTR has been.

TWTR vs FB vs GOOG (YCharts.com)

Now, the company’s fundamentals are a little better than that chart would have you believe.

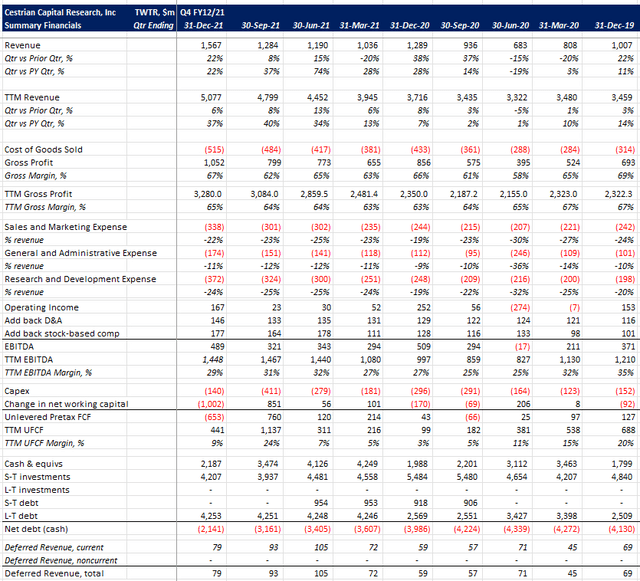

TWTR Financials (YCharts.com, Cestrian Analysis)

The company has grown most quarters, gross margin has held steady, the business model is cash generative and the net cash position on the balance sheet is material.

Ultimately though, the business has not monetized its audience in the same way that the other Internet giants have achieved. What you don’t see above is the combination of high revenue growth and high unlevered pretax free cash flow margins that features so prominently at FB or GOOG or for that matter Apple (AAPL) or Microsoft (MSFT).

At whose feet should the blame be laid here? Well, tough to say of course, since there’s rarely one culprit. Perhaps the business model simply doesn’t lend itself to the oligopolistic free-money economics generated by its peers.

Our own view though is that the board of directors of Twitter ought to be taking a long hard look at its own decisions. We say this with no dog in the fight save owning a few TWTR shares in staff personal accounts, and even then only in anticipation of a sale. We have no political position on the “who can publish on Twitter” question – we don’t care, it’s just a stock like any other. So our critique is not based on the interventions from the company about whose account should and should not be permitted, not least because they are hardly alone in such interventions – FB also dances a very careful line between not being a publisher (to avoid publishing regulations) and being a publisher (to avoid hosting content they prefer to not host).

No, our observation would be: If you, the board of directors of company X, valued in the many billions, with public shareholders to whom you owe fiduciary responsibilities, are content to chew through multiple CEOs then settle on having a part time CEO who spends much of his time also running another public company valued in the many billions? Then we think your approach to HR is, let’s say, unusual. Think about it. If you were to go into work this morning and ask your (delete as appropriate) limited partners / CEO / line manager / board of directors whether you could also go do another job that looks just like yours, get paid the same again or more, and just pop into the office maybe Tuesdays and Thursdays, oh and catch up on stuff on the weekend if you get behind? How do you suppose this would go?

We don’t know why the board at Twitter, which comprises many folks you would presume to be grownups, thought its best bet was a part time cofounder to run the business when trouble had already hit. We also don’t know why when the time came to switch it up, they promoted a technical leader when the company has had many problems with the technology platform. Harder to lead the whole company than just the tech, and the tech had hardly gone well.

Companies need leadership, and Twitter has been notable for an absence of anything that could be called conventional leadership. You can say, well, SpaceX and Tesla (TSLA) share a CEO – and they do, but can you also say that each company lacks leadership? We don’t think that’s the case. Whatever goes on below the waterline at the TSLA management team, Musk is a consistent headline act for the business, and at SpaceX he has a very visible and well-regarded number two in Gwynne Shotwell. We don’t cover Block (SQ) so cannot comment on whether having a part-time CEO there was a good idea or not, but we have between us all here at Cestrian sat on an awful lot of company boards of directors and we can say that we never yet saw a company where having a part time CEO was the best idea for that particular company. Maybe we need to open our minds some, who knows, but last time we looked it seemed like there was a relationship between level of focus and success of outcomes.

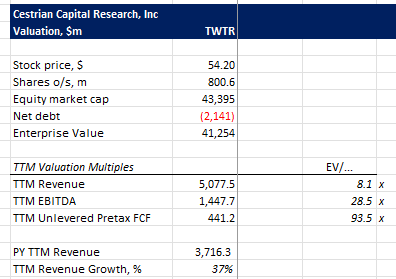

We think that the consequence of lack of leadership at TWTR – which in our view is squarely the fault of the board, since that is the body tasked with appointing leaders on behalf of shareholders – is that the stock price has been weak for the best part of a decade, and that leaves the company way open to an acquisition. We would be surprised if Twitter’s audience could not be better monetized by a management team put in place by someone – whether that’s Elon Musk or a private equity shop or a corporate buyer (we anticipate potential corporate acquirors will surface at some point). And at the $54.20 bid on the table – placeholder bid really, since Musk doesn’t seem to be 100% committed to going ahead with it – all a new owner would be paying is 8.1x TTM revenue / 28.5x TTM EBITDA.

TWTR Valuation (YCharts.com, Cestrian Analysis)

If you thought you could ramp EBITDA margins to say 40% – still way less than Meta Platforms – then that multiple comes down to 20x EBITDA … and if you could also ramp up growth from the current 37% to say 45% by better monetization … then the whole thing is looking a lot more buyable than the headlines suggest.

What price would a buyer have to pay to win the day here? Well, confidence in the market is very low right now and so a properly-funded rifle-shot yes-we-are-serious-about-buying-this buyer doesn’t have to pay big premia if sellers believe they will deliver. As we noted with last week’s announced sale of SailPoint Technologies (SAIL) to Thoma Bravo Private Equity.

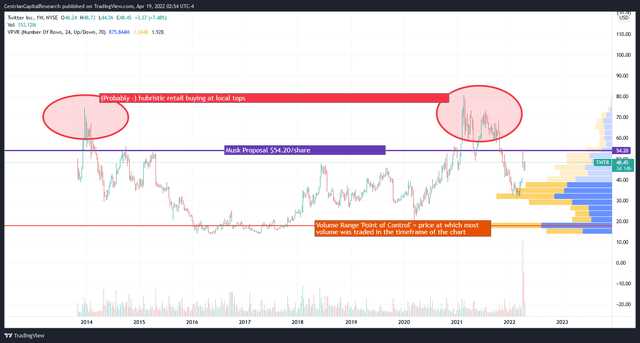

Let’s take a look at the TWTR stock price history. (You can open a full page version of this chart, here.)

TWTR Stock Chart (TradingView, Cestrian Analysis)

Plenty of guess work in here of course but looking at the volume profile and the times in the market when the stock peaked, we’d say that the two spike levels were likely to be just overconfident retail buyers piling in at just the wrong moment. We’d say that the average institutional buyer has a blended cost basis significantly below that $54.20 posited bid. And we’d say that given the inability of Twitter to generate value on its own, that poison pill notwithstanding, institutions would be piling on the pressure to the board to accept a cash deal in the $60-$70/share range, which we think would generate a solid or better return for most such shareholders.

We have never much cared for TWTR as a business, but in staff personal accounts we started to accumulate a little stock once the whole is-it-on-the-block question bubbled up. Anything can happen of course, the stock could crater tomorrow if everyone suddenly finds out there is a good reason (other than just lack of focus and/or ability) why the user base has not been better monetized, but, our guess is, the company gets sold, and for a bigger price than the initial Musk joust.

And with that in mind we rate TWTR at Buy but only speculatively. One, there probably isn’t huge upside from the current stock price, and two, if all buyers walk away, hoo, watch out below. So a stop loss might be in order here if you consider opening or maintaining a long position.

Cestrian Capital Research, Inc – 19 April 2022

Be the first to comment