Leon Neal/Getty Images News

Elevator Pitch

I assign a Buy investment rating to BP p.l.c. (NYSE:BP). In five years’ time, BP should witness strong growth from its convenience and fuels business, and an increase in shareholder capital return via both dividends and buybacks. Also, BP’s share price has lagged that of its peers due to its Russian exposure, and BP should play catch-up when it divest its stake in Rosneft (OTCPK:RNFTF). This supports my bullish views on BP.

BP Stock Key Metrics

The key metrics for BP p.l.c. stock that investors should be concerned with are the company’s year-to-date share price performance and its geographic exposure.

BP’s Stock Price Performance In 2022 Year-to-date

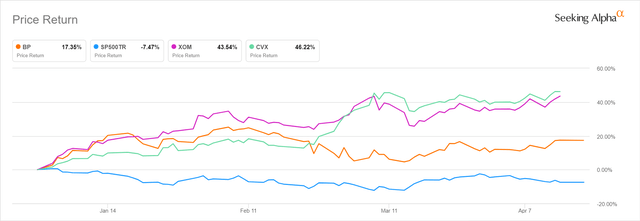

BP’s share price grew by +17.4% in 2022 thus far, and this was much better than the S&P 500’s -7.5% decline over the same period. It is no surprise that BP’s shares have done well on an absolute market and also outperformed the broader market. This is because BP is one of the global oil supermajors, which has made it one of the listed proxies for the rise in energy prices.

But it is noteworthy that BP’s year-to-date share price performance has been inferior to that of its key peers, Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX). Year-to-date, the stock prices of XOM and CVX have surged by +43.5% and +46.2%, respectively.

This brings our attention to another one of BP’s key metrics, geographic exposure, or more specifically the company’s exposure to the Russian market.

BP is estimated to have Russia accounting for approximately 9% of its NAV according to analysis by JPMorgan (JPM) analysts; while a late-February 2022 Wall Street Journal article highlights that “BP relies on Rosneft for roughly one-third of its oil-and-gas production.”

On February 27, 2022, Seeking Alpha News reported that BP “will exit its 19.75% shareholding in Rosneft (one of Russia’s leading oil & gas companies).” A news article published by The Associated Press on the same day also mentioned that BP “will take two non-cash charges in the first quarter to reflect the change, including an $11 billion charge for foreign exchange losses.”

In other words, BP’s year-to-date share price performance has lagged that of its peers because of its meaningful exposure to Russia and expectations of write-downs relating to its Russian assets.

What Are BP Catalysts To Watch For?

The key re-rating catalysts for BP p.l.c. that investors should watch for are the successful divestment of Rosneft and an increase in capital returned to shareholders.

BP “has reached out to state-backed firms in Asia and the Middle East” as part of the company’s search for a buyer of its 19.75% equity interest in Rosneft, according to a March 30, 2022 Seeking Alpha News article which cited a report from Bloomberg.

As highlighted in the preceding section, BP’s shares have underperformed Chevron and Exxon Mobil by a very wide margin this year, and this suggests that the market is factoring BP’s write-down of its stake in Rosneft into the stock’s valuations to a very large extent. If and when BP is able to successfully dispose of its equity interest in Rosneft, this should prompt a re-rating of BP’s valuations.

The first catalyst (sale of Rosneft) for BP is also closely linked to the second catalyst (higher-than-expected shareholder capital return) as I will explain below.

There is a good chance that BP’s future share buybacks and dividends might exceed market expectations.

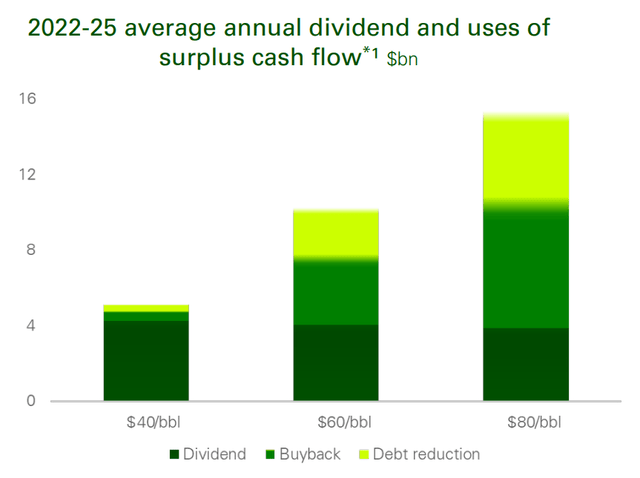

At the company’s Q4 2021 results call on February 8, 2022, BP guided for “an annual increase in the dividend per ordinary share of around 4%” and “buybacks of around $4 billion per annum through 2025” based on a $60/bbl oil price assumption. As per the chart below, BP could possibly do more share repurchases between 2022 and 2025, assuming that average oil prices going forward turn out to be higher than expected.

BP’s Various Capital Allocation Scenarios Based On Different Oil Price Assumptions

BP’s Q4 2021 Earnings Presentation

Separately, BP might also possibly return part of the divestment proceeds relating to the sale of its interest in Rosneft to shareholders as special dividends.

Where Will BP Stock Be In 5 Years?

BP’s management guidance at the Q4 2021 investor briefing is for the company to deliver an EBITDA of $40 billion in fiscal 2025. This assumes that BP’s EBITDA contribution from resilient hydrocarbons is sustained at around the $33 billion level for FY 2025, as compared to $33.5 billion and $32 billion in EBITDA generated for this business in FY 2021 and FY 2019, respectively. BP also has to increase its EBITDA derived from convenience and mobility from $4.4 billion in FY 2021 to $7 billion in FY 2025 to meet the company’s overall EBITDA goal.

Specifically, BP stressed at the company’s fourth-quarter earnings call that its “convenience and fuels business” will “drive most of the growth through 2025.” However, the market seems unconvinced about BP’s ability to meet its EBITDA growth targets in the next five years. The Wall Street analysts’ consensus fiscal 2025 EBITDA forecast for BP is $34.5 billion, which is -14% below the company’s guided FY 2025 EBITDA of $40 billion. In my opinion, this provides an opportunity for BP to beat market expectations in the next few years, if it delivers on its growth plans for the convenience and fuels business.

BP has set a target of growing the number of “BP retail sites in growth markets” from 2,700 in 2021 to 5,000 in 2025, as indicated in its Q4 2021 results presentation, with its Indian Jio-bp joint venture being a key driver. The company also emphasized at the Q4 2021 earnings briefing that “the non-fuel element of our convenience business” is a key growth driver, and highlighted its expectations of the UK convenience market expanding “at 12.5% per annum over the next five years.”

More importantly, BP’s convenience and fuels business has done well in growing its loyalty program and promoting its digital app, bpme, and these two groups of customers tend to spend more than the average consumer. As of end-2021, BP’s convenience and fuels business boasted 16 million loyalty customers, and its number of customers using the bpme app has grown by three times in the last two years.

Taking into account the positive outlook for the convenience and fuels business, I have confidence that BP can exceed market expectations in terms of its EBITDA growth in the next five years.

Is BP Stock A Buy, Sell, Or Hold?

BP stock is a Buy. BP’s underperformance relative to CVX and XOM should reverse in time to come, when the company sells its stake in Rosneft and surprises the market with a larger-than-expected amount of excess capital returned to shareholders. In five years’ time, the better-than-expected performance of BP’s convenience and fuels business should help the company to exceed market expectations and meet its FY 2025 overall EBITDA guidance.

Be the first to comment