everythingpossible

In our follow-up article on the ROBO Global Robotics and Automation Index ETF (NYSEARCA:ROBO), we will take a look at how this ETF has performed under a severe tech market sell-off so far in 2022. In addition, we are highly interested in whether large players in the Robotics & Automation industry have been capable of maintaining their earnings generation abilities, or maybe the entire industry has been negatively impacted by the current global challenges. The latter is predominantly driven by the COVID-19 pandemic, heightened inflation, and the supply chain crunch of key electronic and semiconductor components. Overall, we remain bullish about this ETF over the long run (more than 10 – 15 years), however, investors should still closely monitor the performance of their holdings in the short run. Hypothetically speaking, what good is our bullish long-term view about digitization & automation of every aspect of our daily lives and key business processes if those companies which are in our ETF, might end up going bankrupt due to unexpected market shocks?

Portfolio Characteristics

seeking alpha

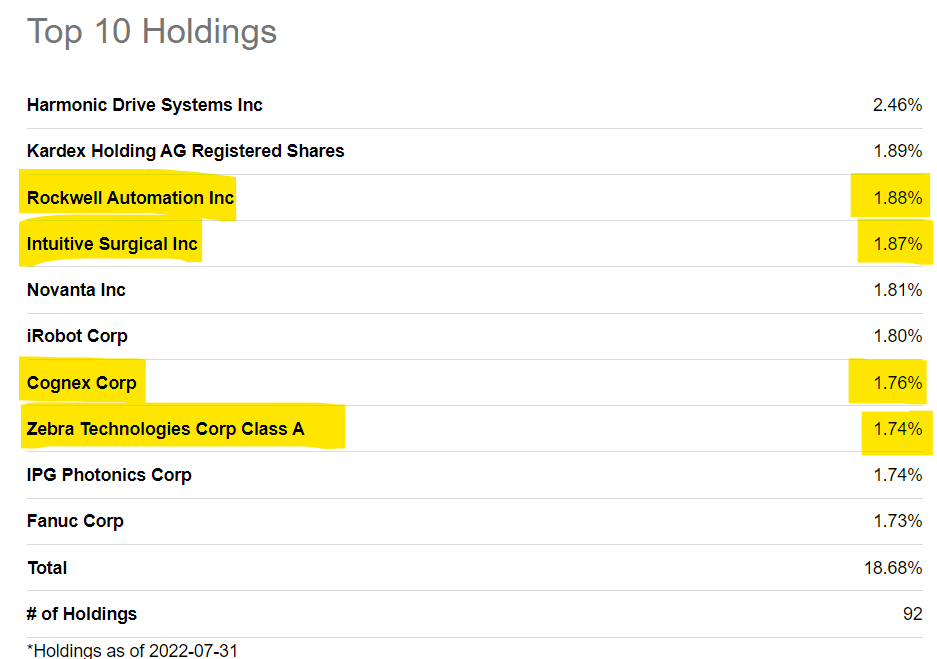

We like the fact that ROBO is a well-diversified ETF with a number of total holdings – 92, while the top ten holdings have an individual weight in the range of 1.7% – 2.5%. We can find the following mid to large-cap U.S tech companies on the top 10 list that might be more familiar names to retail investors: Rockwell Automation (ROK), Intuitive Surgical (ISRG), Cognex Corp. (CGNX), Zebra Technologies (ZBRA) and iRobot Corp (IRBT).

ycharts

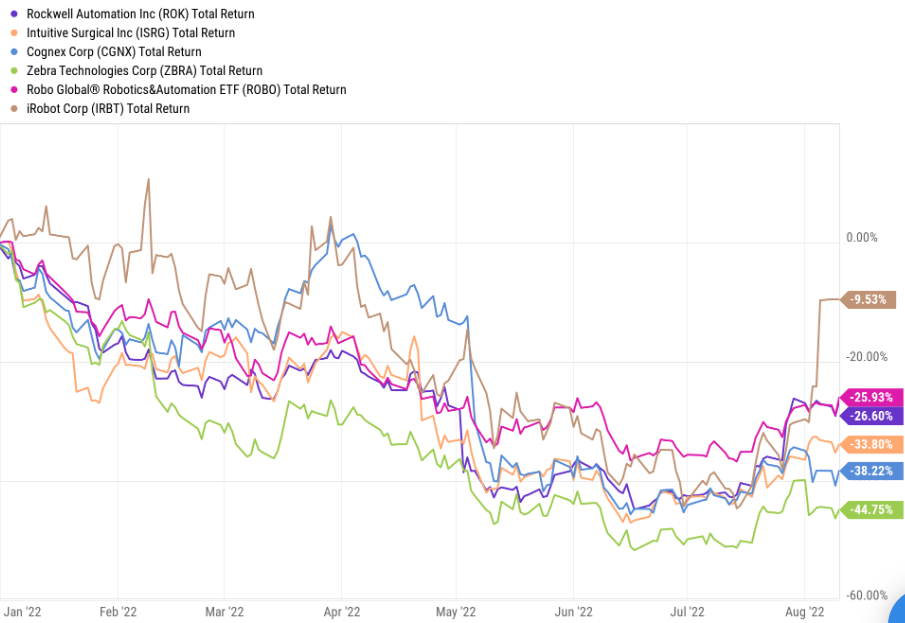

According to the figure above, all of the previously mentioned companies except IRBT have achieved a negative total return of more than 25% so far in 2022. If we take into account that ROBO has achieved a negative total return of roughly 26% YTD, then we can see why it is good to have a well-diversified portfolio with a less than 5% in individual holdings during times of sharp selloffs and unprecedented volatility. For instance, if ROBO had been highly exposed to its top 10 holdings list then most likely its total return would have been significantly lower, as companies like ZBRA and CGNX have achieved a negative total return of 44.7% and 38.2%, respectively. Now an interesting question arises whether it is now time to buy the dip in the universe of automation stocks and ETFs or not. To make things simple, we’d like to take a look into forward P/E multiples and what management of companies included in our analysis has most recently stated during earnings calls.

ycharts

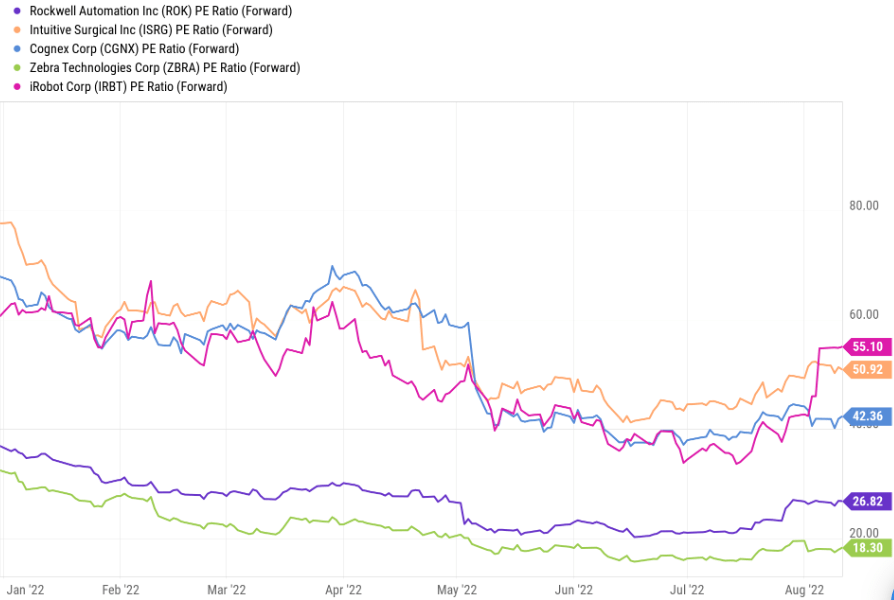

According to the figure above, all companies except IRBT have a forward P/E ratio significantly higher compared to the present S&P 500 P/E Ratio Forward Estimate of 18.22. For instance, ROK is one of the largest companies in ROBO ETF and has a current forward PE ratio of 26.82 or more than 8.5 higher compared to S&P 500. Things get even more interesting if we take a look into IRBT and ISRG as both of them have a forward P/E ratio of more than 50. We believe that our readers should not see a higher forward P/E ratio as an immediate red flag. For instance, particular companies might be able to exceed Wall Street consensus earnings expectations within the next 12 months, thus driving multiples down over time. That’s why we like to use Seeking Alpha’s tools like earnings revisions to check whether Wall Street analysts have been lately bullish about future earnings generation or maybe they have started to lower their EPS estimates over the last couple of months.

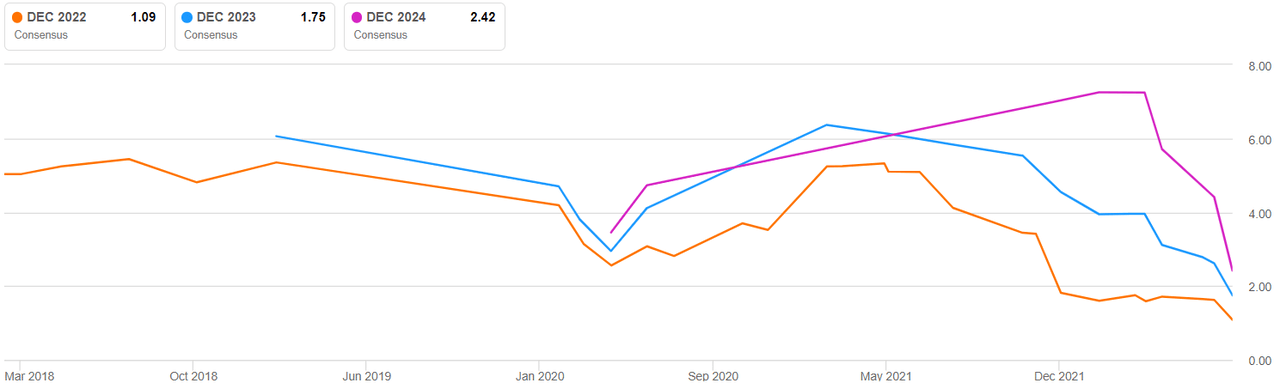

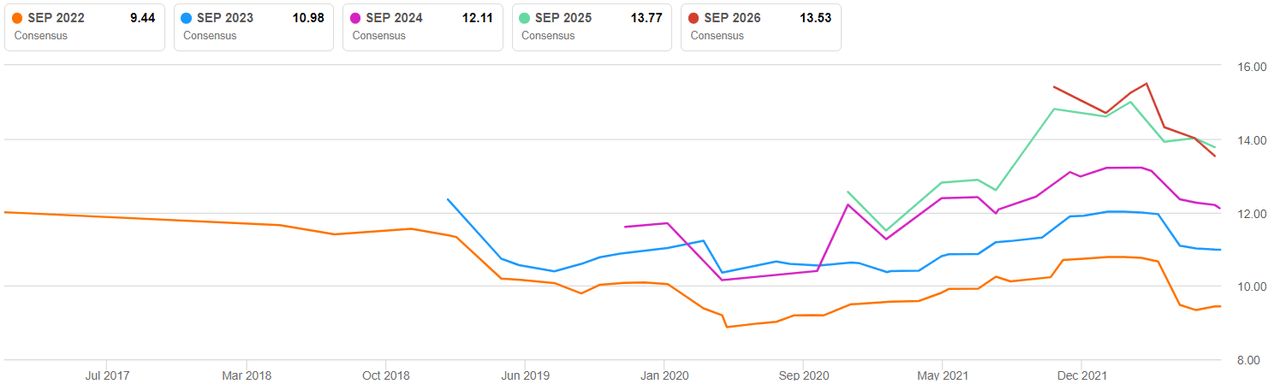

Intuitive Surgical

Seeking Alpha

iRobot Corp.

Seeking Alpha

Rockwell Automation

Seeking Alpha

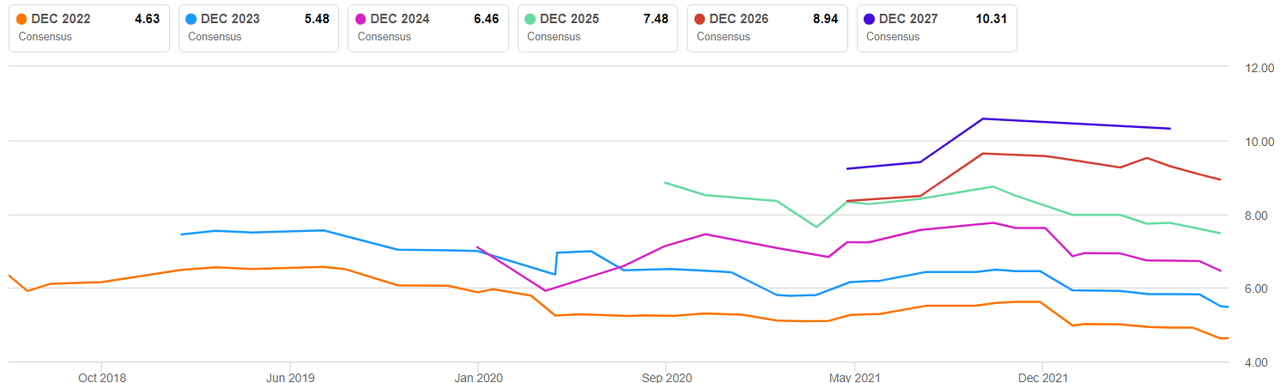

According to the three figures above, we can identify that all three companies IRBT, ROK, and ISRG have consensus estimates to generate higher EPS each calendar year over the next 5 years. However, they have also been facing negative earnings revisions since the end of 2021. Unfortunately, Wall Street analysts have been consistently lowering their EPS estimates for calendar years 2022, 2023, and 2024 so far year to date. Now that we know that Wall Street is maybe not so optimistic about future earnings growth, maybe it is time to check what management has been saying lately. We believe that as long-term investors, the most we can do is to invest our money and hope that the management of the company fulfills its long-term financial & operational goals and other commitments to generate value for shareholders in the end.

While we continue to expect strong double digit year-over-year and sequential organic sales growth in Q4, resulting in double digit growth for the full year, we’re reducing the midpoint of our organic growth range to 11%. Our revised guidance reflects ongoing supply chain volatility in this environment, especially for business operations and suppliers located in Asia. The supply of electronic components is gradually improving, but remains volatile.

(Source: Q3 Earnings Transcript)

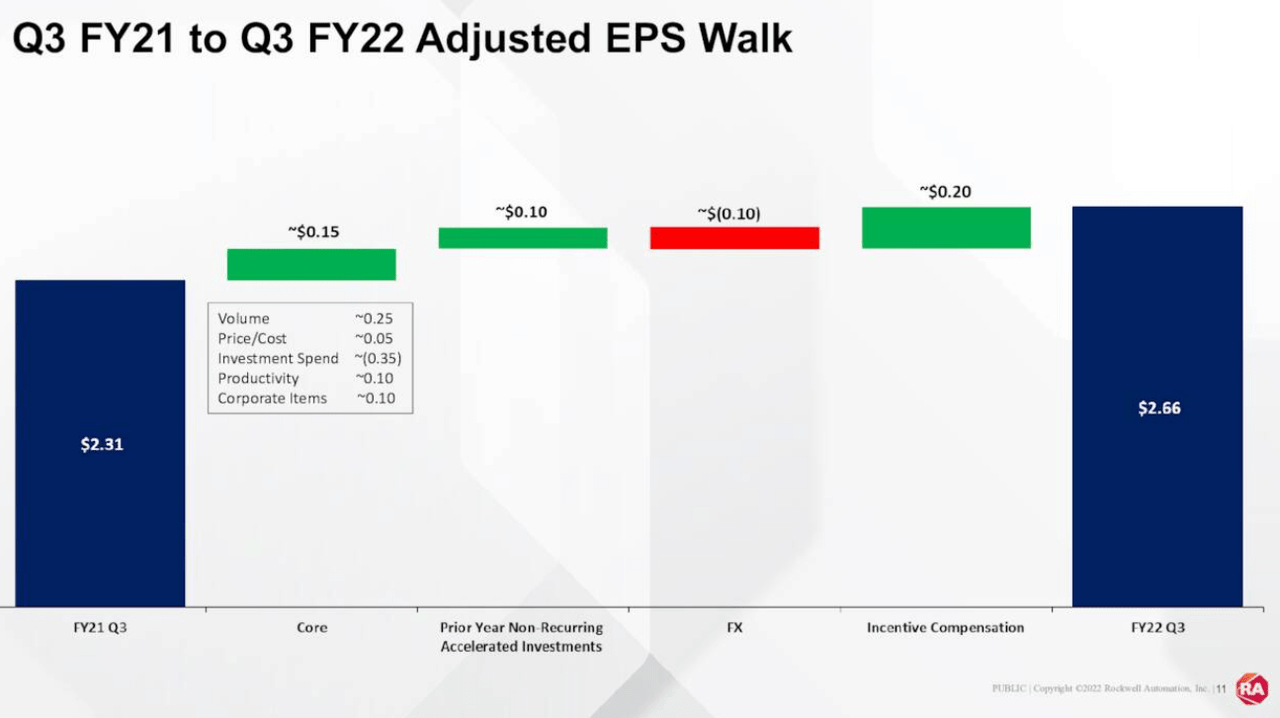

Rockwell Automation

The ROK management has labeled the following key challenges: (1) higher inflation leading to sharp increases in costs related to purchasing of raw materials and goods transportation while driving down firms’ capabilities for future investments (i.e. Acquisitions become too expensive), (2) FX related losses due to stronger U.S. dollar compared to Euro driving down gross sales of the European market, (3) COVID-19 lockdowns in China leading to volatility in the global supply chain of hardware, material and other electronic components essential for robotics manufacturing. That is also one of the reasons why the management of the company has decided to narrow down its FY 2022 EPS estimates with midpoint guidance of 9.50 per share.

Intuitive Surgical

Question

But just thinking through, okay, no earnings this year, in terms of your commitment to shareholders, is it okay for you not to grow earnings next year, too? Would that become a bigger focus for you just given how this year has gone? How do you think about earnings growth after kind of what this year is going to end up looking like? Thanks.

Answer:

Yes. So, we’re not going to get specific about 2023 at this point. You’ll obviously see us provide our outlook on the January call. What we’re doing with respect to R&D currently is investing in multiyear projects and investments. You see that in our newer platforms, Ion and SP. We have obviously investments in digital, many of which are at an early stage. And we do continue to invest in the fourth generation ecosystem. And we look at the returns on those investments carefully and have confidence in them.

(Source: Q2 22 Earnings Call)

In the case of ISRG, we can see that the company has a long-term view of R&D investments in emerging technologies that will help the company to drive down costs over time and increase margins. However, in the short-run management is concerned about the global pandemic that is triggering global supply chain delays of certain semiconductor components. Higher inflation is also leading to stricter capital budgeting policies, thus limiting investments into high-growth projects. This is a very important factor to remember, as companies in the universe of robotics & automation industry without sufficient R&D investments or smart acquisitions target will not be able to justify their current high forward earnings expectations.

iRobot

Our top line performance benefited from solid 33% growth in the U.S. and 25% growth in Japan. This helped us largely offset a decline in EMEA as we lapped an exceptionally strong quarter in that region 1 year ago. We also made important strategic progress that we believe will contribute to our anticipated revenue and EPS growth in FY ’22. However, our FY ’22 growth prospects are complicated by ongoing disruptions to the consumer marketplace, particularly in EMEA, due primarily to a combination of heightened inflation and reduced customer confidence stemming from the Russia-Ukraine war. Although these emerging dynamics will limit our FY ’22 top line growth ambitions, we have slightly increased the high end of our full year operating profit and EPS targets.

As we look ahead, it is important to remember that our second half 2022 outlook will compare against the prior year period that was impacted by limited availability of components. Our ability to support this year’s second half revenue targets are underpinned by existing inventory levels and the steps we’ve taken to improve supply chain continuity and resiliency.

(Source: Q1 2022 Earnings Call)

As was the case with ROK and ISRG, IRBT has also faced global supply chain issues, the geopolitical situation in Europe, and the overall ability to become resilient to all of those external factors. Management has also a difficult task to provide an exact EPS guidance for FY 22, because no one really knows how things will evolve when it comes down to the COVID-19 pandemic, Monkeypox, and other geopolitical events like a potential Chinese military operation in Taiwan.

To sum it up, we could really sense a lot of uncertainties about what will be the future supply chain of key electronic components, whether inflation can limit further investments which could deteriorate the growth rates of companies listed in this ETF, and whether can the spread of COVID-19 and monkeypox spread over the next 12 months. Now that we are aware of all of the challenges and issues companies listed in ROBO will most likely face over the next 12 months, we believe that there is a higher probability of their market prices falling than they can beat earnings expectations. In our view, the only way we can see high forward P/E multiple companies we have previously analyzed to come down is through the loss of market capitalization.

Key Risks

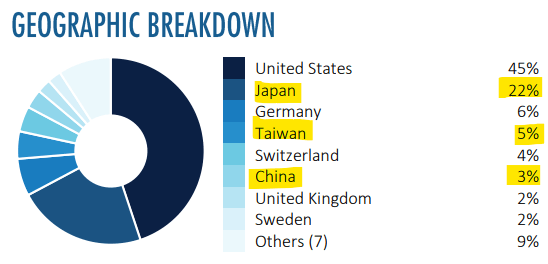

In our previous chapter, we have highlighted key market risks which will most likely have a significant impact on the future short-term performance of this ETF. However, we are highly concerned about what could happen in the global supply chain of electronic components and semiconductors if the Chinese decide to use military force and intervene in Taiwan. First of all, it would have a devastating impact on the entire ASEAN region (especially China, Taiwan, South Korea, and Japan) when it comes down to investor confidence and overall business performance. Secondly, in the case, the West decided to use a Russian type of model to sanction China and the Chinese decide on counter-measures then we have no idea how would U.S. companies get essential raw materials and electronic & semiconductor components to manufacture their robotic and automation related products. Third, it would most likely trigger even heightened inflation worldwide, thus limiting the capabilities of U.S. companies to acquire smaller competitors or build new production plants overseas. In our view, it could return the U.S. robotic evolution back to ground 0 with an uncertain period of time, when things could normalize again.

Robo Investor Website

According to the figure above, 30% of holdings of this ETF come from Japan, Taiwan, or China. Therefore, in the case of a major geopolitical crisis in Asia, ROBO shareholders face a significant risk of facing sharp losses in market valuations of individual holdings listed in particular countries.

To sum it up, we advise our readers to follow key developments that could limit the semiconductor manufacturing or supply chain of key electronic components in Asia closely. In the worst-case scenario, if the Russian-Ukrainian type of scenario ends up with China-Taiwan followed by Western Sanctions maybe it would not be so bad to pull a handbrake and sell a significant portion of this ETF. We fear such an event could lead to a decade-long geopolitical tension between the BRICS-NATO bloc, which would dry up an inventory of key components and materials for robotics and automation manufacturing and assembly in the West.

Market Performance and Dividend Scorecard

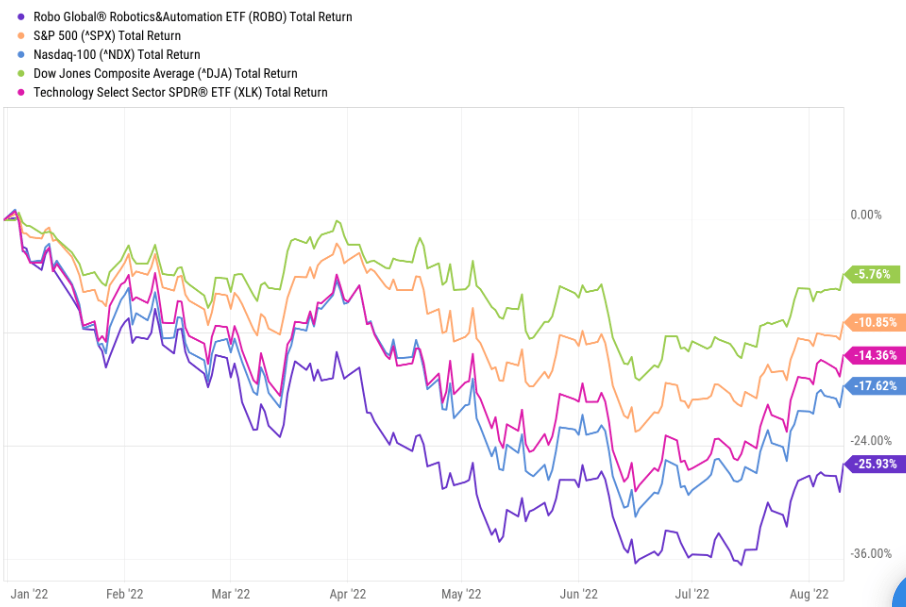

YCHARTS

According to the figure above, ROBO has underperformed its broader tech-related ETF peer on the market – the Technology Select Sector SPDR Fund (XLK) by more than 10 percentage points YTD. Furthermore, compared to the S&P 500 index (SPY) and the Nasdaq 100 index (QQQ) this gap stands at approximately 15 percentage points and 8 percentage points, respectively year to date. In our view, the key reason for relative underperformance lies in the fact that ROBO’s portfolio construction primarily consists of small-to-mid-sized tech and other growth companies, which have been under severe pressure this year so far due to a general broader market sell-off and rotation out of growth stocks. However, we do believe that once geopolitical and other economic challenges return back to normal and investors start to regain back their risk appetite, ROBO has a large upside potential to outperform its broader market benchmarks.

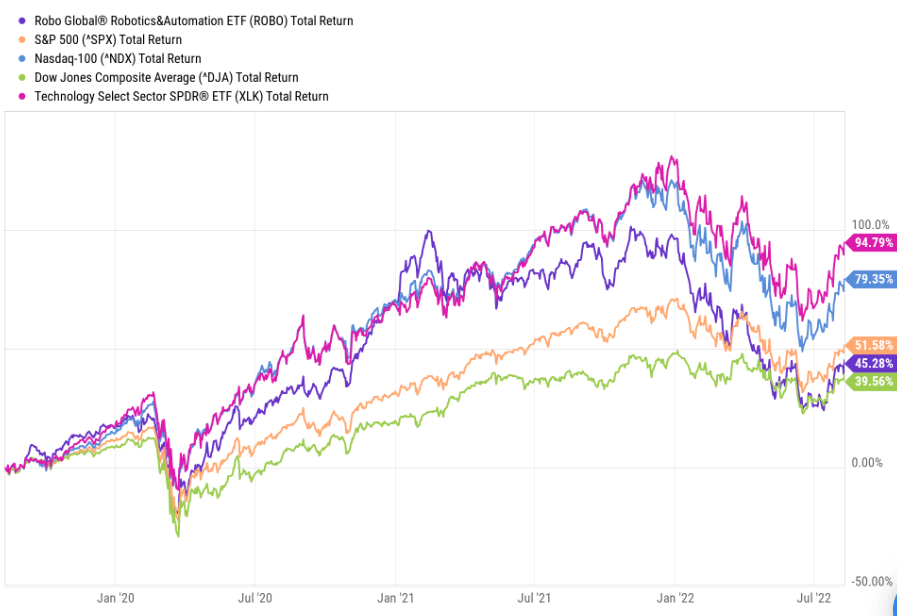

YCHARTS

If we take a look over a longer time period of the last 3 years, then ROBO has reflected that it is quite vulnerable during unprecedented turbulent times like it has seen so far for the last 3 years. For instance, it has lagged behind SPY and XLK by roughly 34 percentage points and 50 percentage points, respectively. As we have previously described automation & robotics is a high-growth industry that requires a positive investor sentiment, minimal economic, social, and political risks, with a lot of available capital on the market for future investments. Now, when the economic climate deteriorates investors, they start to fear their investors with higher risk & reward and start to invest money in safer asset classes like government bonds or large-cap defensive stocks.

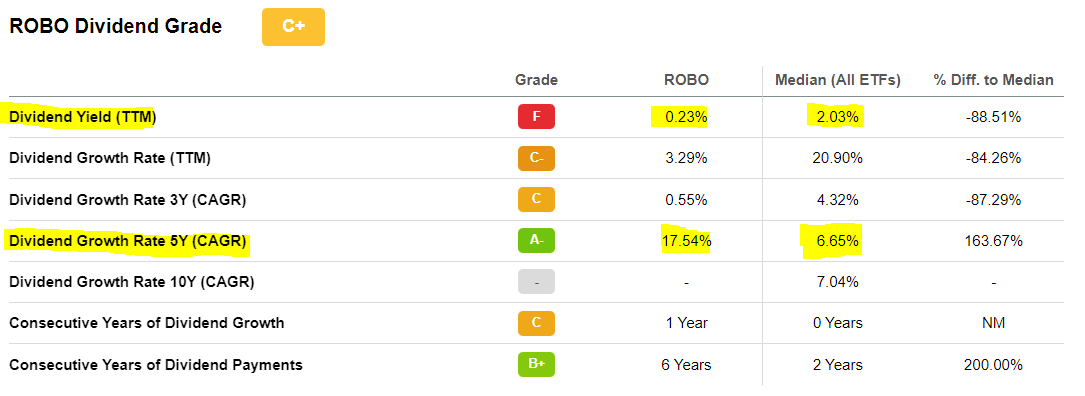

Given that ROBO is a tech-related ETF, we can expect that a dividend yield will be at a very low level compared to other broader related ETFs like SPY for instance. Seeking Alpha has an excellent tool called a dividend grade which grades the health and consistency of dividend payments of various equities and funds, which are in the Seeking Alpha system.

SEEKING ALPHA

According to the figure above, ROBO has a current dividend yield of 0.23% as of 08-12-2022 compared to the 2.03% which is the median of all ETFs. If we expand this relative analysis even further than ROBO lacks behind the 10Y U.S. treasury yield of 2.838%, SPY offers a current dividend yield of 1.41% while a tech large-cap like Microsoft (MSFT) offers now a dividend yield of 0.85%. In our view, ROBO pays an expected dividend yield for a high-growth tech ETF, however, our readers should keep in mind that it is way behind the current inflation rate we are facing in the U.S., U.K., or Western Europe. Nonetheless, long-term investors who believe in the future market growth potential of the automation & robotics industry should maybe not worry so much about the current short-term unexpected global economic challenges and relative underperformance of this ETF compared to the broader market index.

Conclusion

We would like to maintain a BUY rating for this ETF, primarily driven by the long-term market potential of the automation & robotics industry, which we have described in our first article back in July 2020 here. ROBO has relatively underperformed the broader market year to date and over the last 3 years, which is quite normal due to the characteristics of the industries in which it is invested. However, the most important thing is whether companies in this ETF are capable of earnings generation going forward. Our brief analysis has shown that management is concerned about supply chain issues like lack of key components and about heightened inflation, which might deter some capital-intensive investment projects for future growth, but nonetheless, companies are still capable of growing and making money. Nonetheless, we would like to warn our investors that nobody knows what will be the challenges and shape of the global economy over the next 6 – 9 months due to the COVID-19 pandemic, monkeypox, and other geopolitical tensions including China-Taiwan and Russia-Ukraine. Therefore, our readers should be aware of heightened stock market volatility and potential sharp technical correction of this ETF. But we still believe that as long as key companies in this ETF are capable of growing and making money, maybe such sell-offs provide a buy-the-dip opportunity with a view to the long-term horizon.

Be the first to comment