fcafotodigital

Sprouts Farmers Market (NASDAQ:SFM) has had to be very smart in how it differentiates itself given that it competes in an incredibly tough industry, against giants such as Albertsons (ACI), Kroger (KR), and to a certain degree even Walmart (WMT). Scale is really important in the grocery business, as spreading fixed costs over a massive revenue base is how low-cost operators manage to be profitable, while the rest barely survive.

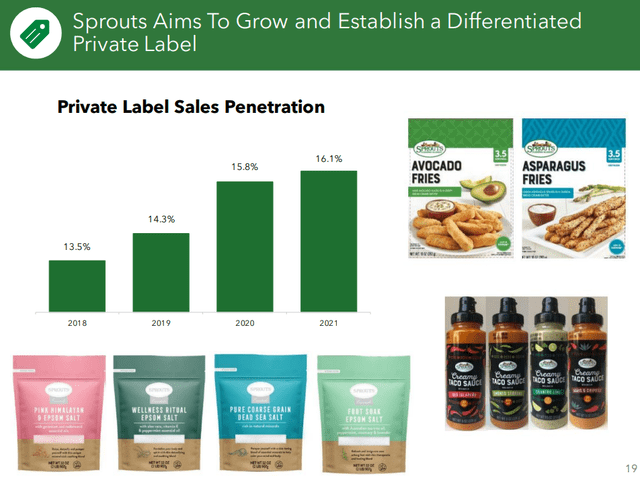

Sprouts, however, has followed a different differentiation strategy, where offering things others don’t is its key competitive advantage, and allows them to be not being limited to competing on price alone. That is why 70% of Products Sold in Sprouts are attribute driven: Organics, Paleo, Keto, Plant Based, Non-GMO, Gluten Free, Vegan, Dairy-free, Grass Fed, Raw, etc. Another way Sprouts differentiates itself is through its high-quality private labels. This too is becoming an increasingly important source of competitive advantage for Sprouts, as the percentage of private label sales increases. In 2021 its private label sales penetration reached 16.1%. This is great news for Sprouts, as private label products both increase customer loyalty and usually carry much higher gross margins for the company.

Sprouts Farmers Market Investor Presentation

Sprouts Q2 Earnings Results

Second quarter results for Sprouts showed that the company’s growth is back on track, that is likely why shares were reacting positively in after-market trading. For the quarter net sales totaled $1.6 billion, a 5% increase from the same period in 2021. Importantly, part of the growth came from comparable store sales, which grew 2.0%. Diluted earnings per share were $0.57, compared to diluted earnings per share of $0.52 in the same period of 2021.

The company also shared information on their full-year 2022 outlook, guiding to net sales growth of 4-5%, comparable store sales growth of 1-2%, and adjusted diluted earnings per share of between $2.18 to $2.26. The company is planning on opening 15 to 17 new stores during the year.

Industry

The grocery and food retail industry is one of the toughest to compete in when it comes to profit margins. Valuation expert Aswath Damodaran has compiled a list of operating and net margins for a number of different industries, and as can be seen below, the grocery and food retailers operate with an average net margin of only ~1%. This means a small increase in efficiency and/or scale can be the difference between a profitable operation and losing money.

| Industry Name | Number of firms | Gross Margin | Net Margin |

| Retail (Grocery and Food) | 15 | 25.68% | 1.11% |

Not everything is bad with the industry, those grocery and food retailers that manage to either operate with extreme efficiency, or to differentiate themselves enough, tend to earn attractive returns on equity, as such the ROE for the industry is relatively healthy at ~14%, with the lowest cost operators and most differentiated firms earning even higher returns.

| Industry Name | Number of firms | ROE (unadjusted) | ROE (adjusted for R&D) |

| Retail (Grocery and Food) | 15 | 14.88% | 14.86% |

Sprouts Financials

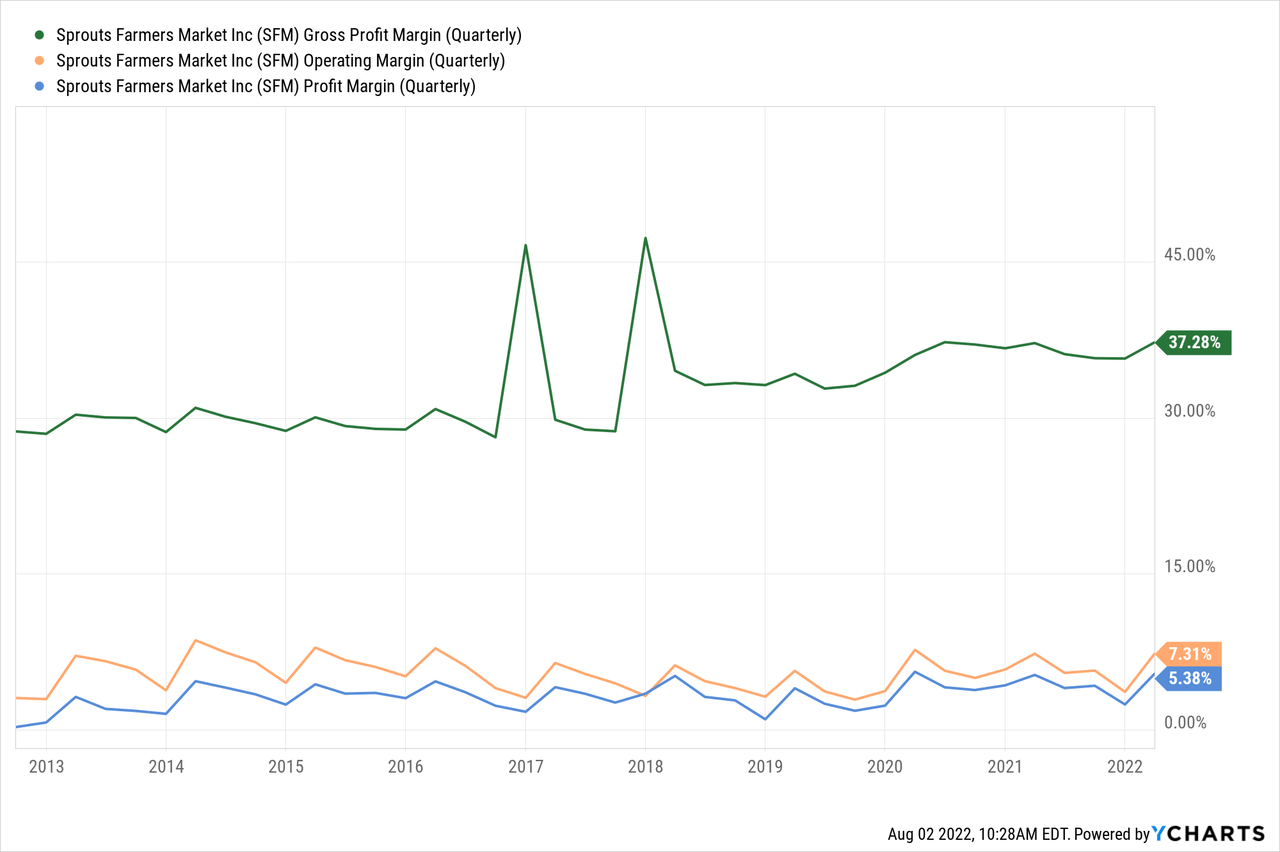

Despite its relatively smaller size, Sprouts has relatively healthy margins for its industry, largely thanks to its differentiation strategy. Gross margin has increased and structurally changed since 2019 due thanks to promotional strategy changes, more differentiated products , operational improvements, and the addition of two new distribution centers in FL & CO.

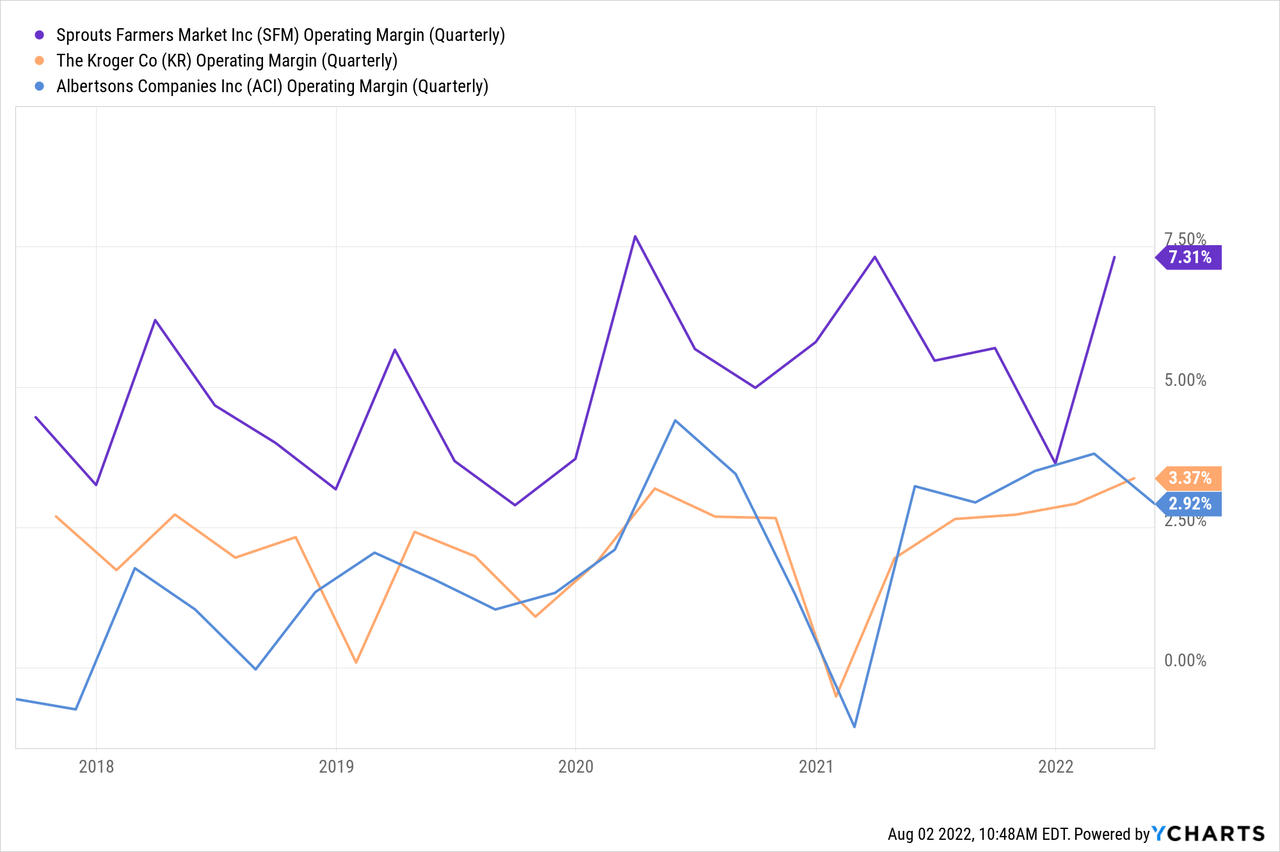

Sprouts business strategy based on differentiation is working so well that it even has better operating margins than Kroger and Albertson’s.

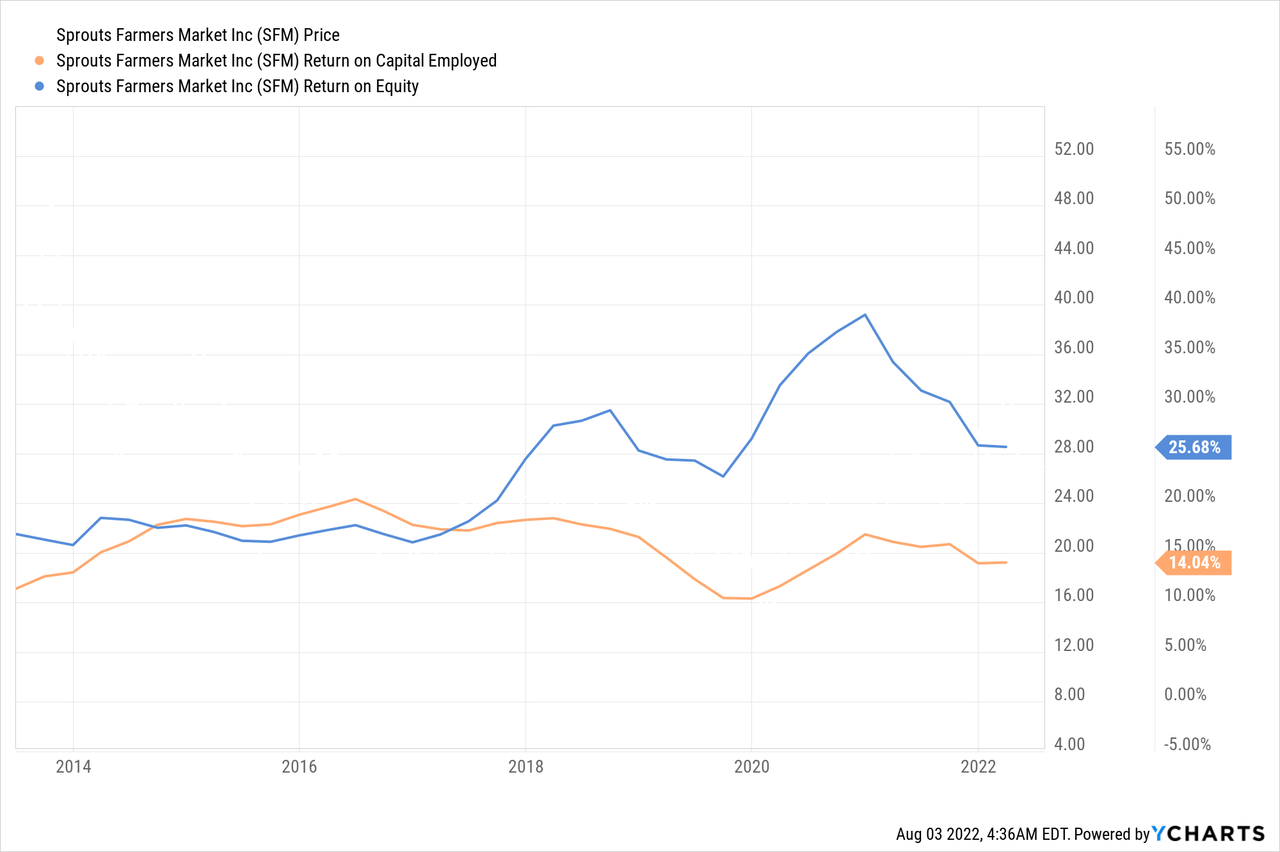

It has also allowed the company to earn a ROE above its industry average, and a very healthy return on capital employed, currently around 14%.

Sprouts is not standing still, however, and is looking to improve its financial results further. Its financial objectives include improving store economics, 10%+ unit growth, and low single digit comps, with stable to expanding EBIT margins. These financial targets, if reached, should translate to low double digits earnings growth, and an expansion of the return on invested capital.

Sprouts Farmers Market Investor Presentation

Growth

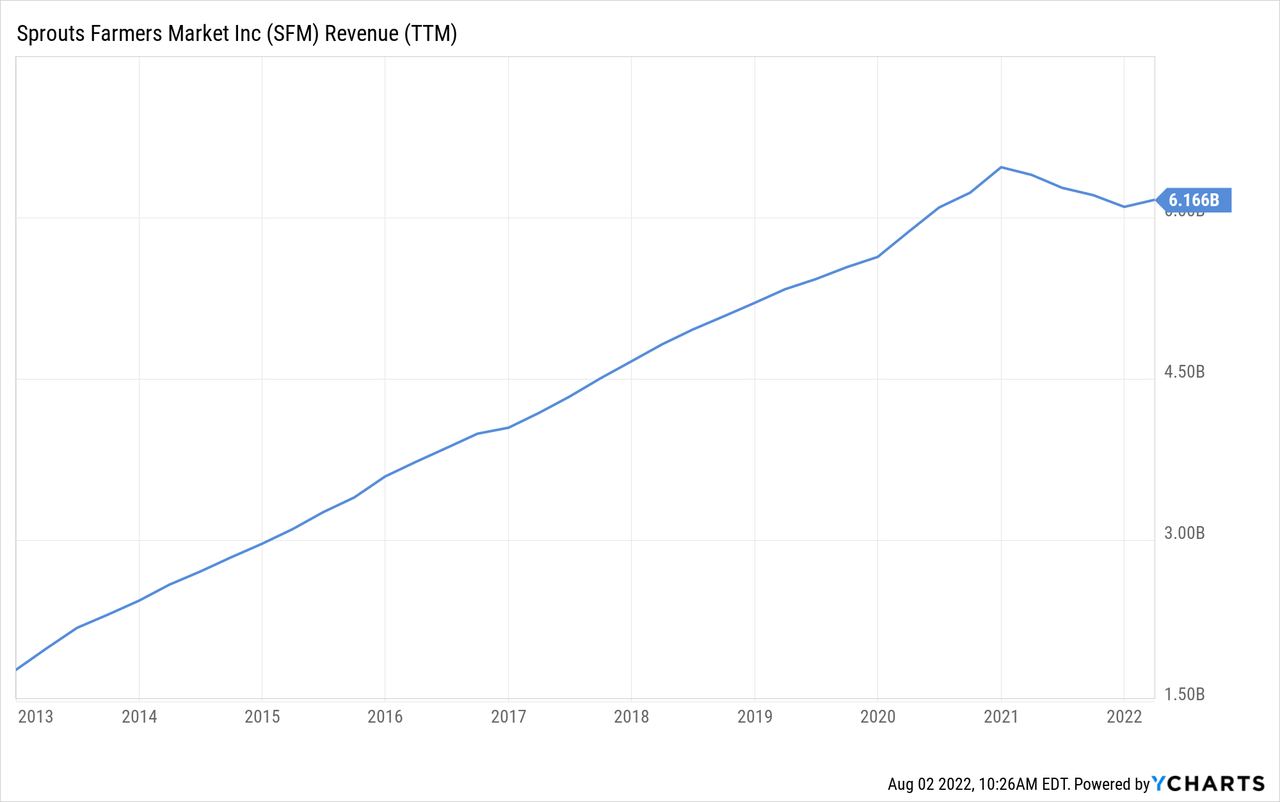

Sprouts had been growing very consistently until about 2021, when growth turned negative. Since then growth has turned back positive, with +4.1% growth y/y in Q1 and +5% y/y in Q2, and according to company guidance growth should re-accelerate going forward.

Balance Sheet

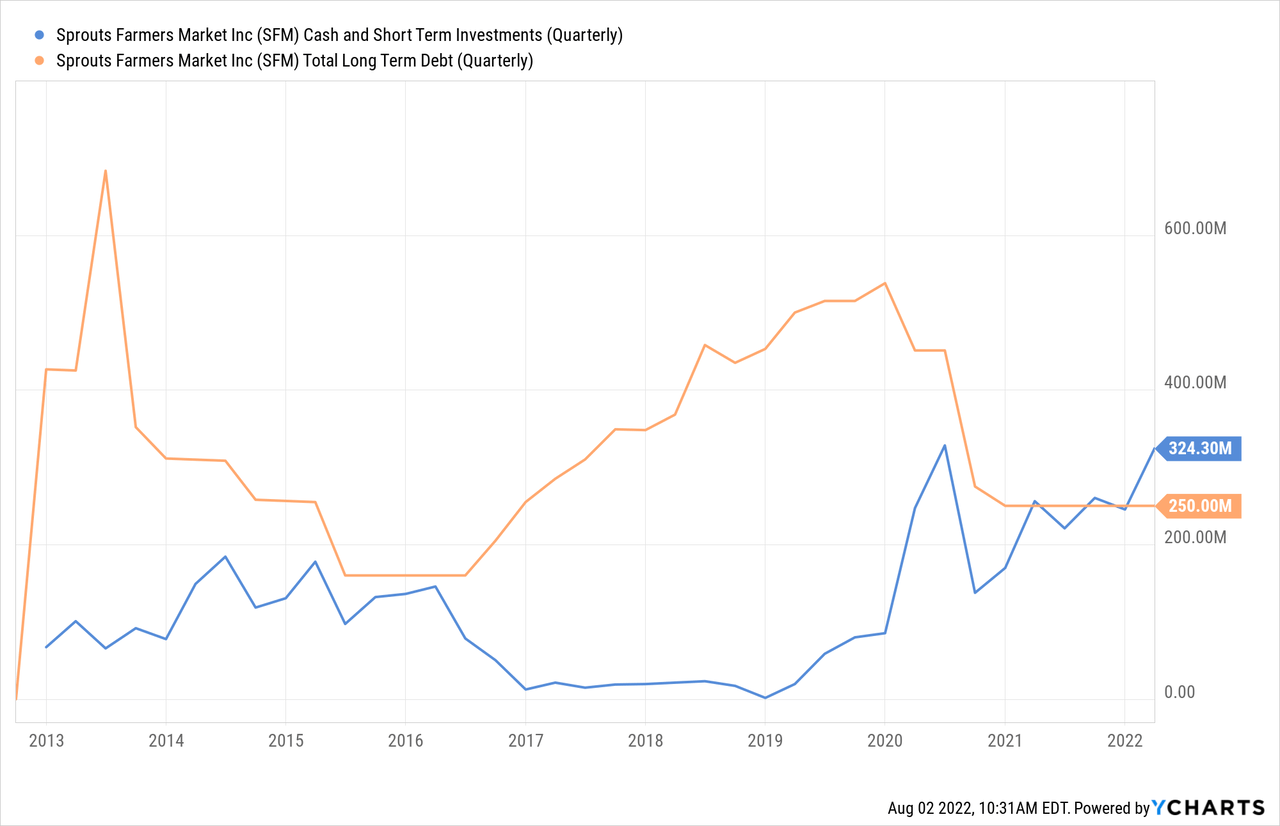

Sprouts Farmers Market has a very healthy balance sheet, with cash and short-term investments exceeding long-term debt. Financial debt to EBITDA is also very modest, at only ~0.4x.

SFM Stock Valuation

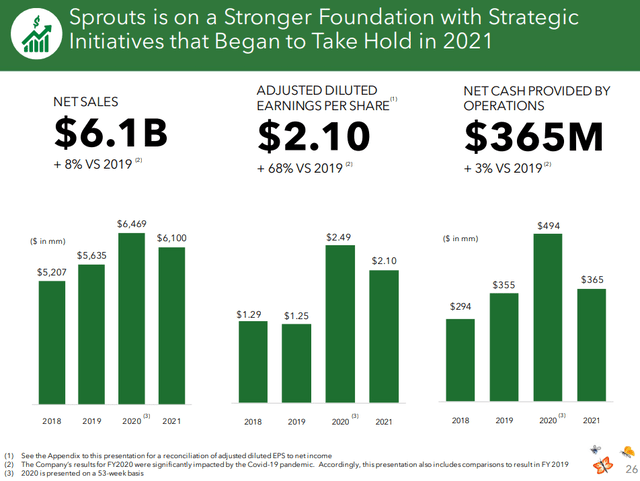

Sprouts is trading with a market cap of only ~$3 billion, which we find very attractive given that in 2021 it had sales of ~$6.1 billion, and net cash provided by operations of ~$365 million.

Sprouts Farmers Market Investor Presentation

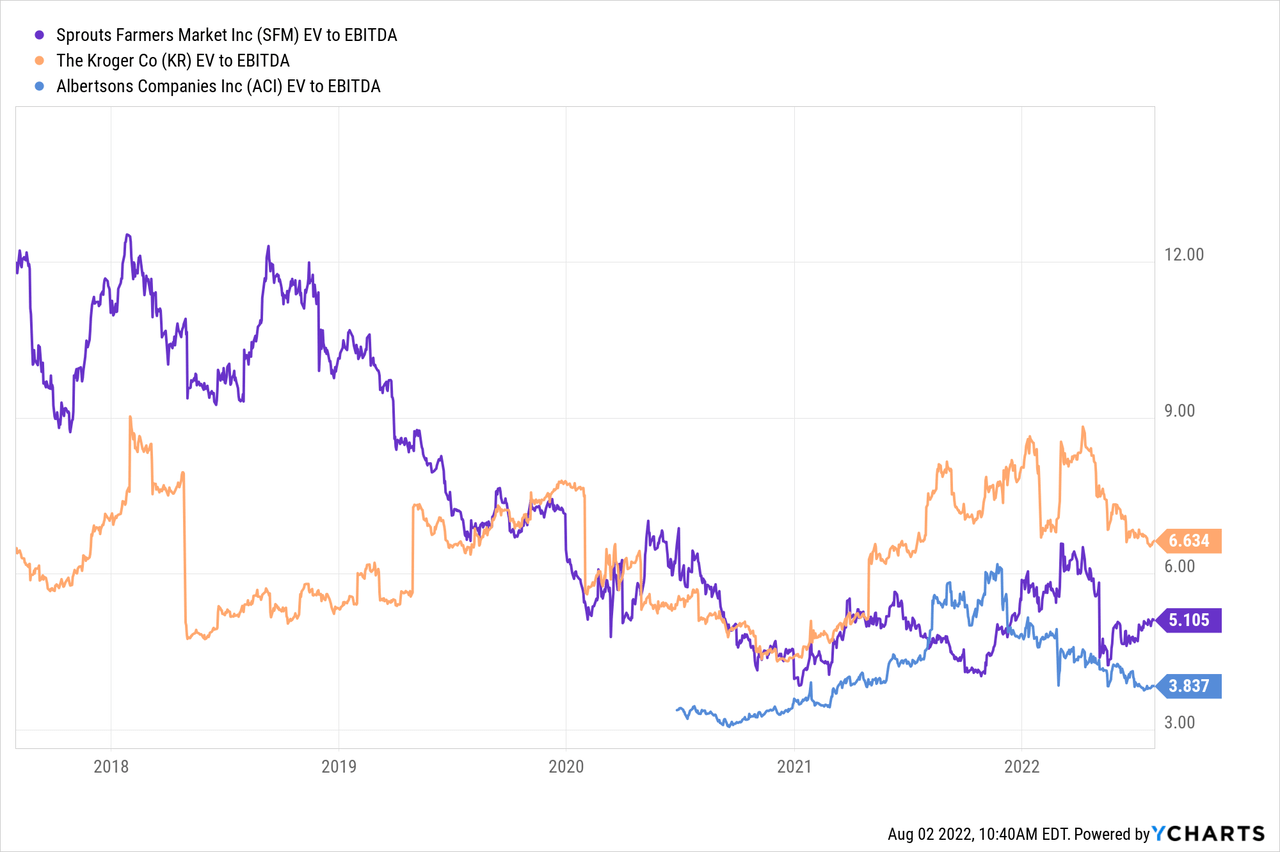

Compared to Albertson’s and Kroger, Sprouts is trading at an EV/EBITDA of ~5.1x, which is cheaper than Kroger’s ~6.6x, but more expensive than Albertson’s 3.8x. Even though Albertson’s is cheaper, we still find Sprouts ,with its healthier margins and differentiated strategy, more attractive.

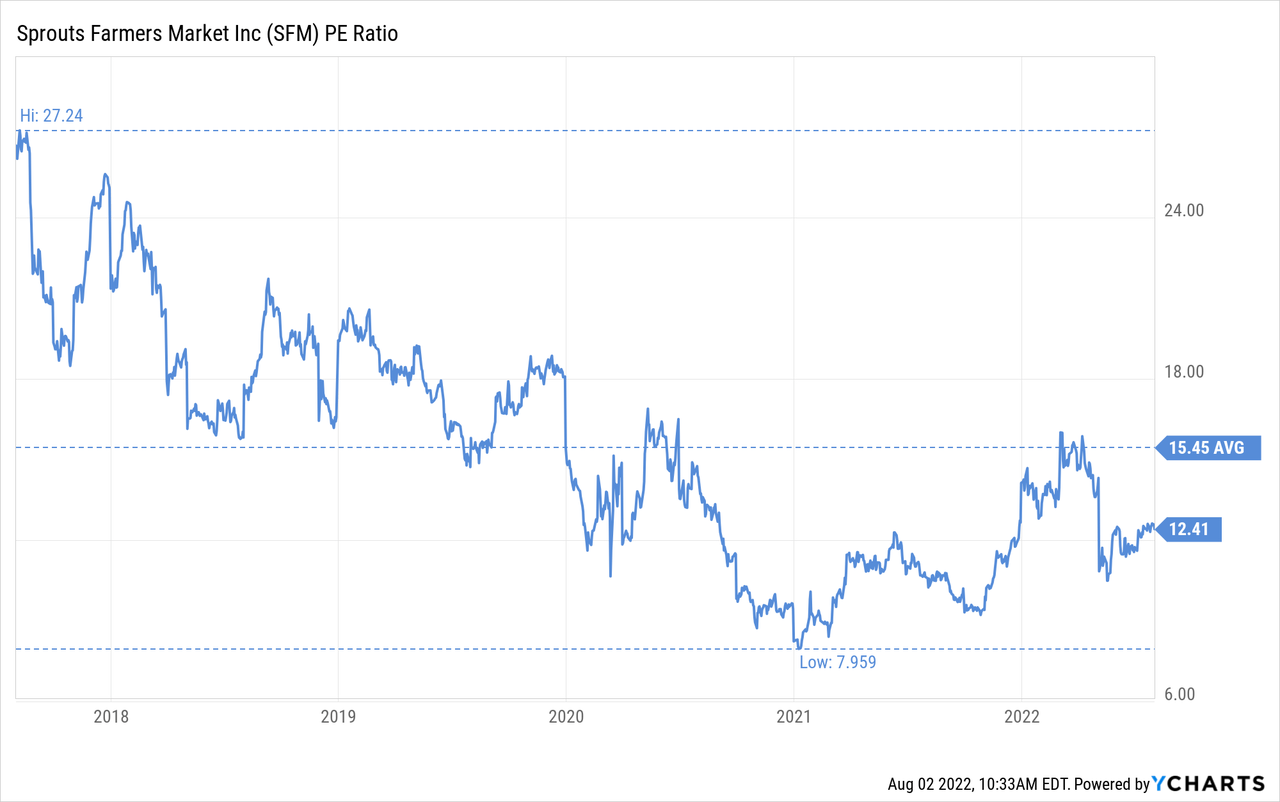

In the last five years Sprouts has traded with an average price/earnings ratio of 15x, and it is currently cheaper than that at only ~12x. We therefore believe shares are currently attractively priced.

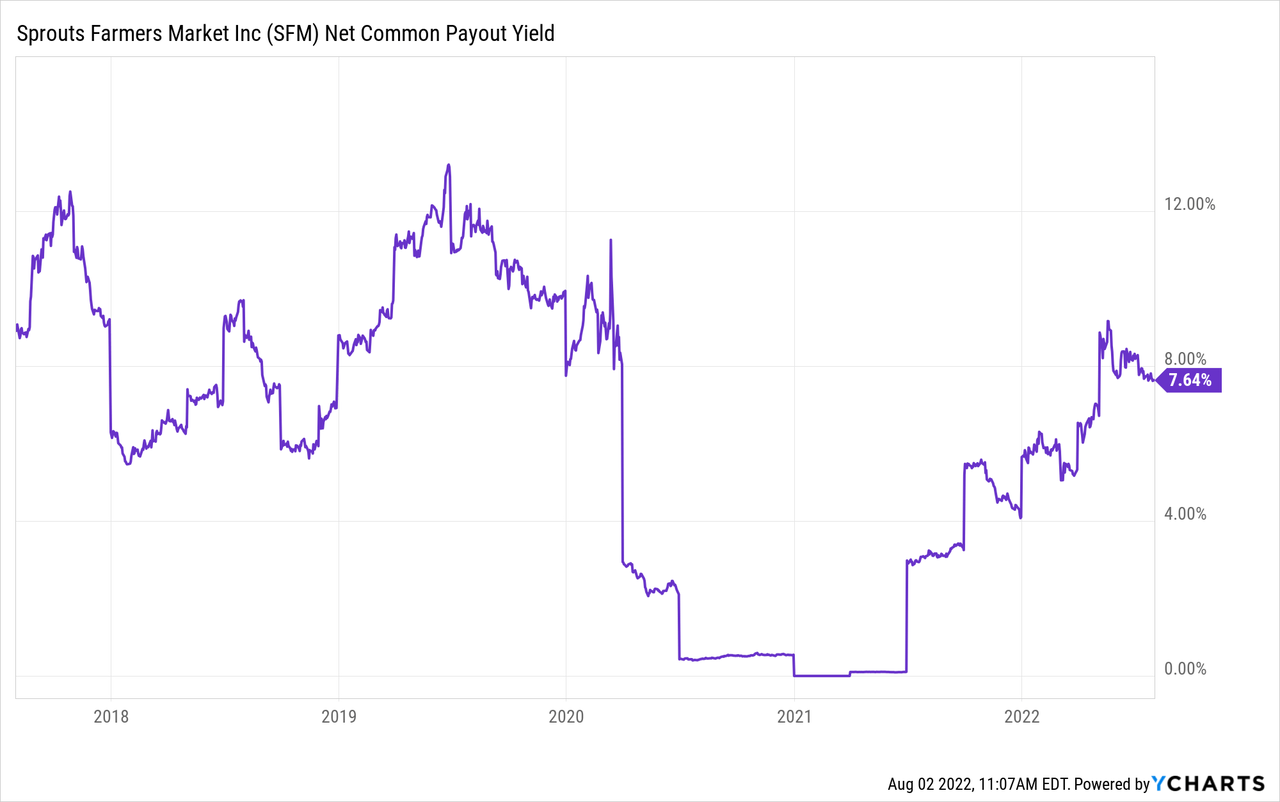

Unfortunately Sprouts does not pay a dividend, but it does repurchase shares. The net common payout yield, which is the sum of the two, is currently around 7.6%. The fact that the company is aggressively buying back shares shows that the company also believes shares are currently undervalued.

Risks

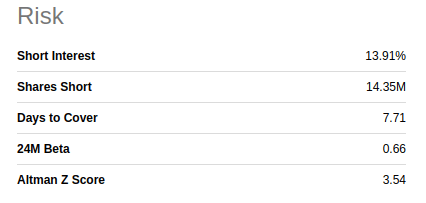

While we see potential in the shares at the current low valuation, we do believe this is an above average risk investment. Sprouts will have to keep working hard to differentiate itself and provide excellent service, in order to be able to compete with much larger companies that have the cost advantage of spreading their fixed costs over a much larger revenue base. The short interest in the shares is also relatively high at ~13.9% of shares outstanding, and the Altman Z-score is only slightly above the 3.0 threshold.

Seeking Alpha

Conclusion

We see Sprout shares as meaningfully undervalued at current prices, and we believe that it can successfully compete in the tough grocery business thanks to its differentiation strategy. It has healthy profit margins for its industry, showing that its business strategy is working. Growth disappointed recently, but based on the most recent quarter it seems to be improving. All in all, we see a decent risk/reward for the shares at the current valuation.

Be the first to comment