Editor’s note: Seeking Alpha is proud to welcome Marco Luzi as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Photon-Photos/iStock via Getty Images

Nickel 28 (OTCPK:CONXF) is a Toronto-based company with a small market capitalization, hovering around $85 million at the current price of ~$1. Nickel 28 is one of a handful of stocks that allow an almost direct investment in nickel and especially cobalt. The company holds stakes in several nickel and cobalt mines. Among these, the Ramu mine in Papua New Guinea is operating, Dumont (Canada) and Nyngan (Australia) are in the development phase, and an additional nine projects are undergoing exploration. Nickel and especially cobalt are critical for lithium batteries, such as those used in electronic devices and electric vehicles (EVs).

Even though its share price has more than doubled over the last 12 months, I believe that Nickel 28 is still undervalued, especially in light of current cobalt and nickel prices. Either the market is overrepresenting risk or the increases in nickel and cobalt prices do not reflect in the company evaluation.

Cobalt demand hits record high in 2021, outstrips production

Lithium batteries require three rare metals: cobalt, nickel, and lithium. These batteries are the current standards for most applications, from electronics to electric vehicles. Cobalt is the biggest bottleneck of the three, since it is rare to find and hard to mine. In particular, its exploitation is linked to allegations of child labor, evidence of negative social impact, and sometimes environmental concerns, as is the case for the Ramu mine (partially owned by Nickel 28).

According to a May 2022 report by the Cobalt Institute, cobalt demand hit 175 kt (thousands of metric tonnes) in 2021, and 34% of that amount went into EV batteries. Demand increased by 22% YoY and is expected to hit 317 kt by 2026.

According to the U.S Geological Survey, global cobalt production hit 170kT, lower than the amount used. And while that might be a rounding error, it is a fact that current production has a hard time keeping up with the rapid increase in cobalt demand. It has been this way for years.

Two thirds of global cobalt reserves are in Congo, and most of the rest in Asian countries. An additional 7kt (4% of the total) produced in Russia, and this percentage might have a hard time hitting the global markets due to the Ukraine war.

All these facts seem to suggest that upward pressure on cobalt prices will not decrease in the next few years.

Electric Vehicles sales doubled last year, increasing pressure on cobalt (and nickel)

A report by Jato shows the change in BEVs (battery electric vehicles) in 2021. In 2021, 4.2 million BEVs were sold, up from 2.01 in 2020. This marks an increase of 109%, and BEVs now make up around 6% of the total sold.

BEVs generally only include full electric vehicles – those without an internal combustion engine. Hybrid vehicles (especially plug-in hybrids) are not included, even though they need (smaller) batteries as well.

The increase in BEV sales has been putting pressure on the cobalt market. And this pressure has been evident for some years now. In 2017, Volkswagen (OTCPK:VWAGY) attempted to buy over a third of the available production, without succeeding. The average BEV battery contains 10 Kg of cobalt as mentioned in the Reuters article quoted above, while a smartphone includes less than 10 grams.

Given the global increase in oil prices and environmental awareness, it is not unlikely that BEVs will continue to increase their market share. And while alternative batteries without cobalt are starting to appear, with Tesla (TSLA) working on them, they do not have similar energy density. Cobalt remains therefore necessary in the electrification of trucks, buses, and taxi cabs at the very least.

Nickel 28 owns a 8.56% stake of the Ramu mine, which will grow to 11.3%

Nickel 28 owns stakes in several nickel and cobalt mines across the world. The most important one is an 8.56% in the Ramu mine in Papua New Guinea. This mine produces 8,756 tonnes of Nickel and 830 tonnes of cobalt every year, as shown in the 2020 financial statement, and is the only one currently operating among those in the company portfolio. Nickel 28 is using the cash flow from Ramu to pay back the non-recourse debt used to buy the stake, standing at $107 million as of December 2020. According to company forecasts, they will repay the debt fully in 2023. The unaudited Q3 2021 financial statement put the outstanding value of the non-recourse debt at $79 million.

Once the debt is repaid, Nickel 28’s stake in the Ramu mine will increase to 11.3% without additional payments. Estimations say that the mine will continue producing at current rates until 2033. Nickel 28 would receive 8.72 million pounds of nickel and 0.83 million pounds of cobalt per year.

Nickel 28 2020 income statement

Here is a screenshot of the 2020 income statement:

Source: Nickel 28 2020 consolidated financial statement, Page 5

The revenues come from the Ramu mine, and amounted to $7.7 million in 2020. The biggest expense is the interest paid on the non-recourse debt. The same statement provides a breakdown for the Ramu mine.

Source: Nickel 28 2020 consolidated financial statement, Page 19

The revenues, with 2020 prices, amounted to $35 million. The costs were around $18.5 million, for a profit margin of $16.5 million. As the Q3 2021 report mentions, there were both a cost reduction due to greater efficiency and a revenue increase for the jump in nickel and cobalt prices. These improvements will probably show in the 2021 financial statement, when released.

Evaluation of Ramu mine: company calculation

Considering recent nickel and cobalt prices, hovering around $11.97 and $36.34 per pound in Q1 2022, the Ramu mine could bring revenues of $92 million per year to Nickel 28. The company valued the stake at $128 million in 2020, under the following assumptions:

Source: Nickel 28 2020 consolidated financial statement, Page 20

The company does not detail the calculation behind this evaluation. Their 2020 financial report (linked above) clarifies that the “calculations use cash flow projections based on financial budgets covering the period from 2021 to 2033.” Also, “a positive 10% movement in the price assumptions range for nickel results in an increase in the present value of future cash flows of approximately $18.5.”

Under the same assumptions and updated cobalt (+90%) and nickel (+66%) prices, the carrying value of the Ramu mine should have increased by around $129.5 million, for a current amount of $257.5 million. Split across the 85 million shares, that works out to $3.02 per share. Taking out the $79 million of non-recourse debt left, we stand at around $2.09.

This $2.09 figure represents a Q1 2022 evaluation of Nickel 28’s stake in the Ramu mine alone, with current prices and cost structure.

Evaluation of Ramu mine: author’s calculation

I believe that the $257.5 million carrying value is conservative, since the increase in revenues because of the higher prices will probably mean better margins. Sensitivity analysis works for numbers close to the mean. In this case nickel and cobalt prices have increased significantly. For this reason, the $18.5 million increase in the evaluation predicted by the company for each 10% nickel price movement seems an understatement at current price levels.

A more optimistic perspective would bring the actual NPV of the Ramu stake quite a bit higher, at almost $488 million, with a value per share of almost $6 coming from this revenue stream. Here is an example of a cash flow model:

Created by author using data from the 2020 financial statement and Q1 2022 cobalt and nickel prices

This model assumes stable cobalt and nickel prices at the Q1 2022 level of $36.24 and $11.97 and steady production. It also considers that the non-recourse debt is paid in full by 2023, meaning that the full profit stream starts in 2024. All this while considering a very high 14% discount rate for future cash flows.

It is clear that the model is optimistic. It considers stable production costs, and prices sitting at current levels over the next decade. This calculation is not a target price; it uniquely aims at providing an upper ceiling for the evaluation of the Ramu stake.

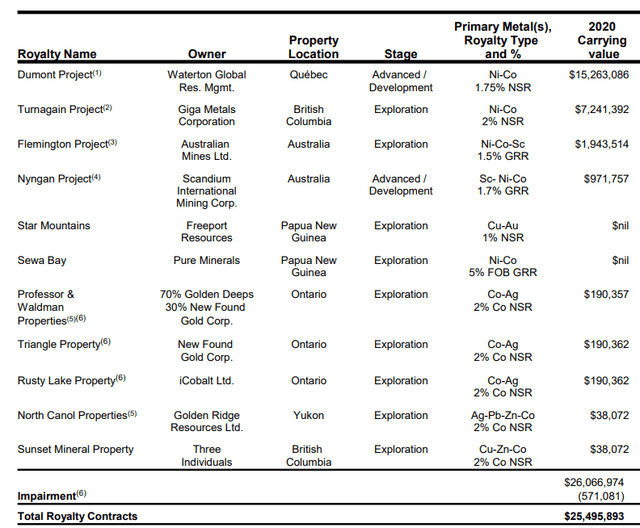

Evaluation of other royalty contracts

Besides the currently operating Ramu mine, Nickel 28 has a stake in several other projects under exploration and development.

Source: Nickel 28 2020 consolidated financial statement, Page 21

The Dumont project, located in Quebec (Canada), is the most advanced and relevant contract in the portfolio, with the possibility of yielding up to 1.7 million pounds of nickel to Nickel 28 over its life.

Since the carrying values are calculated based on the same assumptions used for the Ramu mine (cobalt at $20 and nickel at $8 per pound), the current ones are realistically closer to the $40 million mark. The company in 2020 estimated $25 million based on prices at the time. The updated evaluation would mean a potential impact of $0.47 per share.

Since these projects are under development and not currently running, a cautious evaluation would not include this additional amount. These revenue streams might or might not happen in the future.

The current price of Nickel 28

Nickel 28’s 2020 financial statement states that “at the date there were no derivative commodity contracts being used.” Price changes will impact margins with a strong correlation.

Company evaluation

The current share price is sitting around the $1 mark, well below the combined $3.47 derived from summing the Ramu and the other streams ($257.7 million and $40 million, using the company evaluation and Q1 2022 prices). The $257.7 and $40 million evaluation are probably on the lower end of the actual evaluation, since they fail to factor in the increase of margins coming from both higher prices and lower costs. Even if we discount the $79 million outstanding debt, we stand at a $2.56 per share.

Author evaluation

Since the company is not hedging against price volatility, it is not simple to pinpoint the evaluation: nickel and cobalt prices substantially affect this amount. If prices remain stable, I believe a price target can realistically be $4.22. This number moves from my previously shared calculation, with the following assumptions:

- Only the Ramu mine is included, since it is the only one currently producing.

- The non-recourse debt is paid in 2024, instead of 2023 as stated by the company. Therefore, the cash flow begins to count as profit starting 2025 instead of 2024.

- There’s a 16% discount rate on future cash flow.

Risks of Nickel 28

Several risk factors exist.

- Production risks: While the Ramu mine is working, all other projects are still under construction. Exploration of new mines has high likelihood of failure, and it is possible that not one of these projects will yield revenues.

- Environmental risks: The Ramu mine has had some environmental problems due to spilling of potentially toxic waste into the sea. The government shut down the mine in 2017 and several protests took place in the following years.

- Strong portfolio centralization: As analyzed, the vast majority of the company’s value stands in one revenue stream. Any disruption would have dire consequences.

- Price volatility: The company, as per its financial disclosures, has (as of December 2020) not entered into any derivatives position to hedge against price swings.

- Global Economy: Commodities can suffer during a bear market, and non-necessary items even more.

All these risks add uncertainty to the stock. I believe that this uncertainty is the biggest reason for its cheap evaluation.

Conclusion: Nickel 28 should be trading above $4

The current share price, hovering around $1, is attractive – I believe that Nickel 28 is undervalued. The actual price range is, in my opinion, somewhere between $3 and $6, with $4.22 being the figure that conservatively represents the value of its stakes with current nickel and cobalt prices.

CONXF is one of the best options available to investors seeking exposure to nickel and cobalt. Both metals are in high demand due to electric vehicles. At the same time, given the nature of its operations, its portfolio, and the risks connected to Nickel 28, this stock is a highly risky investment.

Be the first to comment