Arnoldo Robert/iStock Editorial via Getty Images

As the U.S. economy teeters more into the possibility of a recession, airlines provide an interesting case study in stock performance vs. the larger market. Because of Covid, most airline stocks were significantly depressed for two years and began to recover only when signs of stronger demand were confirmed. Because of the fits and starts of Covid, recovery was expected multiple times, only to be dashed by another wave of the virus. Over the past four months, however, airline stocks have been strong due to repeated strong reports of the return of demand, first on domestic routes and later on international routes to Europe and Latin America. Over the past month of significant overall stock market decreases, airline stocks have performed as well as, if not better than the general market. While airlines are traditionally leading indicators of impending economic weakness, the current environment of Covid demand return for airlines on top of covid-weakened stock prices has put U.S. airlines in a noticeably privileged position on the stock market. Investors can and should look at airline stocks carefully.

American (NASDAQ:AAL) and JetBlue (NASDAQ:JBLU) are two airlines that require direct comparison. As a global legacy carrier, American has long held the position of being the least profitable U.S. airline, due to both its inability to profitably operate its longhaul international networks to Europe and Asia as well as its high labor costs and its poor decisions regarding capital management. After 20 years as CEO of AAL, Doug Parker stepped down from a tenure that spanned USAirways (which orchestrated a merger with American while the latter was in bankruptcy as AMR Corp.) and, before that, an acquisition of USAirways by low cost airline America West where Doug Parker was also CEO. While an industry veteran, AAL’s new CEO, Robert Isom, appears to be committed to fixing a number of AAL’s structural and endemic problems including those that have harmed its preference with coveted business passengers.

JetBlue, in contrast, is just over 20 years old, and was conceived as a high-quality low-cost airline based in New York City that offered low fares and amenities such as seatback entertainment systems that were only common on longhaul international flights. JBLU grew rapidly during its first 15 years, in part because slot controls at NYC’s largest airports limited competition and because legacy carriers had still not figured out how to compete effectively post 9/11. JBLU’s margins began to erode in the late 2010s as Delta, JBLU’s most direct competitor strengthened its operations at New York’s LaGuardia and JFK airports where Delta (DAL) is the largest airline and also because Delta designated Boston as a hub due to growth at JetBlue’s second largest operation. The U.S. DOJ also furthered efforts to increase access for other low cost carriers to NYC’s airports while the FAA removed slot controls at Newark airport, United’s (UAL) primary NYC hub, allowing a string of low cost carriers to add service to the New Jersey airport.

Increased competition in NYC harmed American which, over the past 20 years, has been displaced as the largest airline at both LaGuardia and JFK airports by Delta. American found it increasingly difficult to compete against Delta on the New York state side of the NYC metro and United at Newark, causing American to shrink its NYC network both domestically and internationally pre-covid. Even during the booming heydays of the pre-covid airline industry, American underutilized its slots at both LGA and JFK airports, leading the DOT to increasingly pressure the airline to either come up with a plan to fully use those slots or return them to the FAA for redistribution to other airlines; part of the reason that Newark aircraft lost its slot controls was because United, the largest airline at that airport, underutilized its slots while holding onto those slots, preventing other carriers from adding competition. American and JetBlue formed an alliance which included a number of features, but is driven heavily around the idea of the two working together in New York City and Boston to use JBLU’s domestic strengths to help American add longhaul international flights using JBLU to provide domestic connecting passengers for those flights and for allowing American to sell JBLU domestic flights including to the center part of the U.S. where JBLU is relatively weak. It is against that overall general summary of the two companies that an appropriate analysis of the two companies is done to help investors determine which airline is a better choice as an investment and whether either of those two are the best choices should an investor be inclined to invest in the U.S. airline industry.

Strategic Assessment

Having exited its chapter 11 reorganization over 10 years ago, American spent much of the last decade trying to figure out how to be profitable – and didn’t do a very good job. Unlike Delta, which engaged in the first U.S. global airline megamerger with Northwest, or United which followed with its merger of Continental, American did not shutdown any of the hubs it inherited as part of its merger with USAirways. Part of American’s financial challenges included the financial underperformance of several of its hubs; while the company specified by the end of the decade that its Dallas/Ft. Worth megahub, Charlotte and Washington National hubs were its most profitable, it did not specify which hubs were least profitable. Based on its flight cuts in New York City, it is certain that its JFK and LGA flights were not profitable, given that its system profitability for much of the decade was in the low single digits. While the decade was challenging for American, by the time Covid hit, AAL had a pretty good sense of what needed to be cut and aggressively retired older widebody international aircraft with the expectation that it would be much more judicious in adding new markets when international travel recovery returned as it is doing now.

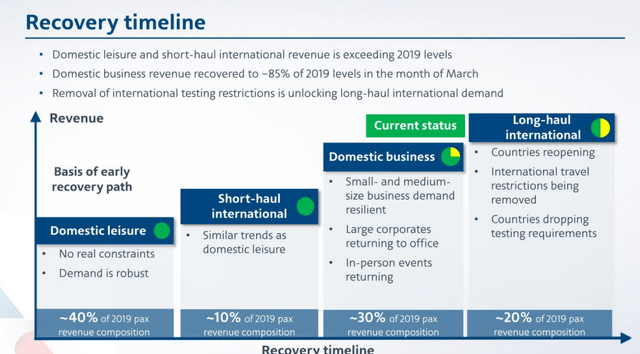

AAL recovery timeline (AAL recovery timeline)

JetBlue has expanded its network from its initial base at New York JFK airport to include major bases/hubs at Boston and Ft. Lauderdale with the latter instrumental in penetrating the Caribbean and Latin America including into the northern tier of S. America. DOT data shows that its average fares from JFK were on par with or comparable with the industry average but fares from LaGuardia or Newark airports to the same destinations were below average, in part because Delta and United have premium cabins on all of their mainline flights and many regional jet flights. JBLU had attempted to build its presence primarily up and down the east coast and on transcontinental routes from Boston, Ft. Lauderdale, and New York City. JetBlue has never been able to develop a significant presence in the middle of the U.S., making its partnership with American valuable in connecting its customers to American’s vast network in the Midwest and South outside of Florida.

JBLU’s network is highly competitive; unlike any of the legacy/global carriers or Southwest (LUV), JBLU has no moats across its network and it is now being undercut on costs by ultra low fare carriers including Spirit (SAVE) and Frontier (ULCC) with which SAVE has chosen to merge. It is not a surprise that JBLU is fighting to win a bidding contest for SAVE since a combination of Frontier and Spirit will further isolate JBLU as a niche airline predominantly focused on the Northeast and Florida with little presence in the middle of the country or the west coast. SAVE’s growth in S. Florida has certainly put pressure on JBLU’s margins. Given that JBLU and SAVE are the two largest airlines at Ft. Lauderdale and JBLU has an alliance with AAL which is the largest airline at Miami, there will be significant advantages to JBLU if it can successfully acquire SAVE, but it is also certain that the DOJ’s interest in the transaction will involve far more than just NYC and the Northeast.

Updated Cost and Revenue Guidance

As with all airlines, the Covid era decimated cost control for JBLU. While the federal government provided aid to cover the majority of direct labor costs as an incentive to ensure that airlines were ready to resume service when the pandemic waned, revenue was depressed for a significant enough period that revenues including federal government aid was not sufficient to cover costs. JBLU has not shown a profit since the pandemic began and is not expected to do so in the second quarter of 2022.

While American has consistently been one of the least profitable U.S. airlines for more than a decade, it will shake that reputation during the second quarter when, ironically, its low cost carrier partner JBLU is expected to post a loss while AAL could become profitable even at low margins. American has long struggled with cost control and especially with labor costs; AAL’s new CEO appears committed to addressing the structural reasons for AAL’s cost inefficiencies.

American Airlines updated 2Q2022 guidance (Seeking Alpha)

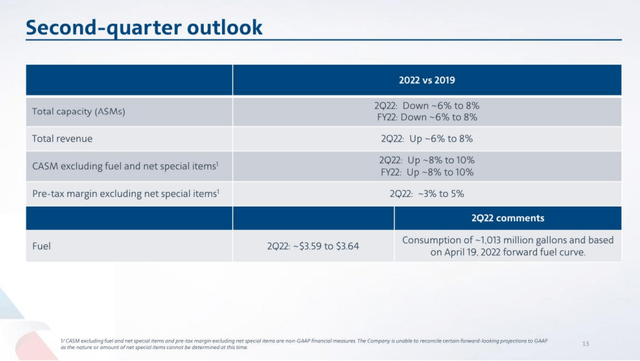

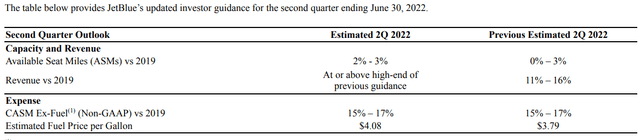

JBLU has also improved its revenue guidance as have nearly every other airline, in part due to the necessity to reduce capacity which has in turn pushed up fare yields in the face of very strong domestic demand.

Part of the reason for reduced capacity across the industry and at JBLU is due to labor shortages including of pilots. The pilot shortage is driven by several factors including the large numbers of pilots that were expected to retire even before the pandemic. The economics of regional jet flying is deteriorating because of the greater efficiency of larger aircraft and because of higher labor costs. Airlines like American which have extensive regional jet operations are shifting flying to their mainline (large jet) flights.

JetBlue does not have affiliated regional carriers like American, but JBLU does operate the E190, the largest regional jet that operates in the U.S. One phenomenon that is shaping up as the pilot shortage develops is that, anecdotally, young pilots are indicating greater career preference for the global airlines which have widebody aircraft and longhaul international routes, providing higher potential career earnings. United Airlines is the first U.S. airline to come to an agreement in principle for its pilot union post-pandemic; while terms have not been released publicly, pay rate increases are reportedly muted given the current inflationary environment. The pilot contract improvement cycle is just beginning so it is hard to know how much will change and when for either American or JetBlue’s pilot contracts – but it is certain that labor costs will increase in line with general inflation in the economy. Because low cost carriers such as JBLU are more susceptible to increases in costs that impact all airlines, labor cost and fuel increases will more negatively impact JBLU than AAL.

JBLU revised 2Q2022 guidance (Seeking Alpha)

Balance Sheet

For years, American has been negatively perceived by investors because of its heavily indebted balance sheet which is the result of an aggressive fleet replacement strategy that spanned more than 10 years while JetBlue has had one of the better balance sheets in the industry not unlike other low cost carriers. Several factors might be converging to shift the pendulum in American’s favor compared to JetBlue with respect to balance sheet strength. First, American is slowing its fleet capex from highs that exceeded $5 billion/year; its low profit margins for much of the past ten years did not support the level of capex which resulted in escalating debt levels. The primary remaining negative in AAL’s fleet plan is its fleet of more than 60 B777s, two-thirds of which are 777-200ERs with the remainder 777-300ERs. The 777-200ER is now the least fuel efficient aircraft per seat in the U.S. carrier fleet while American’s 777-300ERs have a low number of seats compared to other U.S. airlines making it even less cost efficient. The 777-200ERs are older and have low ownership costs but they burn up to 30% more fuel per seat than American’s 787-9s or other new generation aircraft. While American is making adjustments to its international fleet strategy including delaying delivery of its remaining 787-9 aircraft to incorporate new performance enhancements, the 777 fleet at American results in more than $400 million in higher fuel costs compared to Delta which retired its much smaller fleet of 777s during the pandemic. United also has a large 777 fleet and suffers an even higher cost penalty. American is trading some fuel inefficiency for lower capex and the result should be an improving balance sheet. Thus, AAL is trading lower capex and the ability to pay down its debt for higher operating costs, especially on its longhaul international operation.

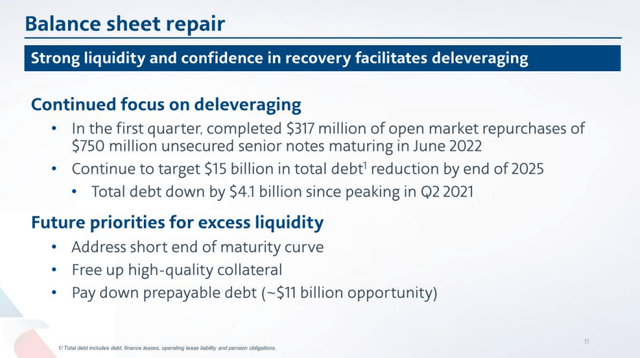

AAL balance sheet repair (AAL)

In contrast, JetBlue has a fairly efficient fleet composed of A320 family aircraft including the fuel efficient A321NEO, new generation A220-300s, and a fleet of E190 regional jets which JBLU intended to begin to retire pre-pandemic but may maintain some of them for a longer period of time. JBLU’s fleet of A320s is beginning to age which is resulting in higher maintenance expense but the A320 is capable of flying for longer than most of JBLU’s current A320s. Thus, JBLU’s capex has been heavily devoted to growth rather than fleet replacement and that should remain the case for at least three to five more years.

However, JBLU’s balance sheet could face erosion because of decreasing profits and because of its current attempt to acquire Spirit Airlines in a hostile, all cash transaction. While JBLU was one of the financial darlings of the airline industry in the mid 2010s because of its high profit margins, the last five years have seen continued erosion of JBLU’s profits. JBLU’s decision to aggressively pursue a merger with SAVE is, in part, a recognition that JBLU’s strategic growth options are limited. Delta is now operating its largest schedule ever at Boston and has reached local market revenue parity while JBLU’s attempts to expand at Newark airport have been scaled back because of airport facility and air traffic control limitations. SAVE and other ultra low cost airlines including Frontier (ULCC) do well in heavily leisure and price sensitive markets such as Ft. Lauderdale. SAVE and ULCC also fly from the NE to Florida but also serve dozens more cities across the U.S. and into the Caribbean than JBLU. Thus, not only are JBLU’s profit margins not likely to return to previously high levels compared to the industry, the company’s answer is to attempt to acquire a lower cost competitor in a transaction that will add significant debt to the balance sheet. Alaska Airlines used a similar strategy to acquire another airline via debt in the last decade and took years to undo the financial damage, both in terms of higher costs and increased debt on the balance sheet as I noted in this Seeking Alpha article. A JBLU-SAVE transaction would be much more complex operationally and also add more debt. Fitch’s decision to downgrade JBLU debt in early April is directly related to the risk associated with its potential SAVE acquisition.

In comparing AAL and JBLU’s balance sheet as well as its overall finances, American is very likely to be better positioned for the next few years. AAL is committed to reducing debt and will likely see higher margins than JBLU, while JBLU will increase debt and push its margins down as a result of a merger with SAVE which will require a costly transition of SAVE’s business plan while loading up JBLU’s balance sheet with debt. JBLU will lose competitive momentum including in its most significant markets. The possibility remains that the DOJ could impose a lengthy review which would negatively impact the ability of both SAVE and JBLU to plan for even medium term opportunities. Finally, SAVE and JBLU are both paying near the top end of the industry’s price for jet fuel, a very uncomfortable position for low cost carriers. Legacy carriers with their ability to obtain higher fare business revenue including from premium cabins are better positioned in a high fuel cost environment.

AAL, JBLU, or someone else?

AAL and several other airline industry stocks, esp. legacy carriers plus ALK and LUV, are buys right now because of pandemic depressed prices while JBLU is not attractive given its expected losses through the second quarter as well as the possibility that it could win the SAVE acquisition contest which would trigger a costly acquisition process which will depress JBLU’s financial position for years.

Guided margins for the second quarter favor ALK, DAL and LUV – not necessarily in that order. The global/legacy carriers (AAL DAL and UAL) are guiding to margins for the second quarter not far from their pre-covid levels due in part to the return of international demand. DAL is positioning itself to once again become the most profitable legacy carrier in the world while LUV and ALK are both expected to return to healthy margins, with all three carriers guiding to have pre-tax margins in the mid-teens. AAL’s margins are expected to, once again, be less than half of DAL’s while UAL will be about two-thirds of DAL’s.

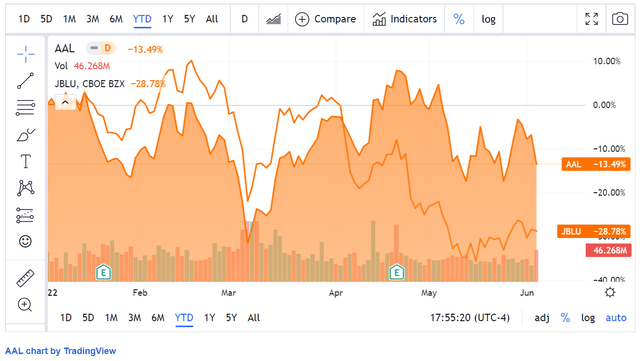

AAL JBLU YTD chart (Seeking Alpha)

Fuel cost management matters more than ever

Jet fuel right now is the most volatile cost item for airlines, more than doubling from pandemic weakened prices. Several airlines have updated their guidance including JBLU which is now guiding to a second quarter fuel price of $4.08 in line with airlines that have updated their second quarter fuel guidance but which do not have fuel cost control strategies, close to UAL’s level. AAL is guiding to $3.95/gal. ALK and LUV hedge fuel while DAL’s refinery strategy is producing a 35 cent/gallon fuel cost advantage compared to other airlines and esp. those that have large operations in the NE U.S.

The key distinctive that ALK, DAL and LUV have in the industry is that all three carriers have active fuel price strategies. ALK and LUV hedge fuel while DAL has a refinery in the NE. LUV has long hedged fuel primarily as a cost predictive tool more than to have the lowest jet fuel prices; LUV financial statements show that it recorded “premium fuel expenses” for many years pre-covid when jet fuel was a fraction of the price it is now. However, in the years after 9/11 when the legacy airlines had to liquidate their fuel hedges, Southwest had a significant fuel cost advantage and it used it to aggressively expand its network. ALK has hedged for years but the size of the hedges was relatively small and the systemwide advantage was not as great as it is now; fuel prices in the Pacific Northwest and Alaska, major markets for ALK, are consistently higher than elsewhere in the U.S.

Delta hedged crude oil but realized like all of the global carriers that hedging was a costly attempt that airlines could not win so Delta pursued its refinery strategy. As I noted on Seeking Alpha as recently as a year ago, Delta’s refinery strategy reduced its fuel costs by pennies on the gallon compared to its most direct peers for years while produced over a billion dollars in savings to the airline even though the refinery itself lost money when accounted for as a subsidiary. The refinery strategy was specifically designed to address high jet fuel crack spreads in the NE as well as the potential for refined product supply shortages in the NE, exactly the scenario that is occurring now for jet fuel. Delta’s system fuel cost advantage vs. United for this quarter is 37 cents/gallon; both carriers have major operations in the NYC area as well as elsewhere in the NE.

American and JetBlue do not have significant hedging strategies or the benefit of the refinery although both also have large operations in the NE. AAL is expected to have second quarter margins in the mid-single digits while JBLU is not expected to be profitable at all. Neither ALK or LUV have major operations in the NE compared to other airlines.

With predictions that refinery capacity in the NE will remain tight for years to come, a very low likelihood of new pipelines being built in the NE, and tight refinery capacity elsewhere in the world meaning that imports of jet fuel will be insufficient to reduce jet fuel costs especially in the NE, airlines that have active fuel cost reduction strategies will have an advantage not just this year but potentially for years to come.

While neither JetBlue or American have active fuel cost reduction strategies, American has a lot more that will help its margins compared to JetBlue. American is the better choice as an investment in the AAL-JBLU alliance. However, other airlines including ALK, DAL and LUV will be better investment choices not just for their effective commercial strategies but also because of their fuel cost reduction strategies.

Be the first to comment