Cindy Ord/Getty Images Entertainment

Investment Thesis

Spotify Technology S.A. (NYSE:SPOT) stock has been hammered since its all-time highs in 2021. The stock has lost more than 70% of its value from its February 2021 highs. In addition, it took another beating recently as Netflix (NFLX) stunned investors with its Q1 shocker. Consequently, SPOT stock last traded near its March 2020 COVID bottom. Therefore, we think its pandemic bubble has indeed been burst.

As a result, we think now might not be the right time to sell SPOT stock. However, despite the massive sell-off, it doesn’t mean investors should go into dip-buying mode. We don’t think SPOT stock has proven itself over the last three years that it can build robust profitability over time. Notably, we also couldn’t reconcile how Spotify can defend its moat against its key competitors with massive ecosystems.

Furthermore, the Obamas have been reported to be nearing the end of their exclusive podcast partnership with Spotify. Therefore, it validated our concern that the platform doesn’t have a defensible moat. As such, we encourage investors to look away. Moreover, given the recent bottom, plenty of growth and tech stocks are available.

Podcast Is Not A Defensible Moat

Bloomberg reported that Former President Barack Obama and his wife Michelle Obama are set to end their exclusive Podcast partnership with Spotify. Spotify was also reported to have declined to make an offer to renew the partnership. In addition, the Obamas also seemed to be keen to move on, as Insider reported that they have been searching for a new partner. It also noted that the Obamas and Spotify had a series of disagreements, including over the exclusivity of their podcasts. The Obamas were reportedly keen to increase the reach of their platform across several services. Insider added (edited):

Higher Ground’s (The Obamas’ production company) departure follows a number of disagreements with Spotify, such as how frequently the Obamas would feature in output, and over the exclusivity of shows.

It’s still possible, one of the sources noted, that the Obamas could renew their deal with Spotify. But the Daniel Ek-led service might have more competition than it did three years ago as other deep-pocketed platforms, including Amazon (AMZN) and Apple (AAPL), up their investment in podcasts. – Bloomberg, Insider

Isn’t it clear that Podcast isn’t a defensible moat? The Obamas were interested in extending their reach. So, we think it’s clear that Spotify couldn’t provide the reach that the Obamas wanted. Notably, eMarketer reported that Spotify had 28.3M podcast listeners in 2021, 200K more than Apple’s 28.1M.

Moreover, eMarketer estimates Spotify could extend that lead further, reaching 42.4M by 2025, against Apple’s 29.2M. But compared to the 330M US population, Spotify’s reach seems more niche than mainstream. So, we think it makes sense that the Obamas wanted to expand their reach in a highly fragmented market. Furthermore, the inability of Spotify to “lock in” the Obamas also added to our conviction in its lack of a defensible moat.

Therefore, we think it’s a risky proposition that Spotify is trying to expand and invest aggressively through its Podcasting strategy. CFO Paul Vogel also emphasized Spotify’s podcasting ambitions in a March conference, as he added (edited):

We’re investing a lot in podcasting. With podcasting where there’s a huge opportunity to completely modernize how people advertise in podcasting.

We’ve talked about this publicly that podcasting will be a drag on gross margins. But, it was less of a drag because the advertising far exceeded our expectations on the podcasting side. So we continue to see those trends.

It will still be a drag in 2022, but we see the inflection point is not too far away in terms of when we cross that. And when we look out sort of in our 5-year model, the steady-state gross margins on the podcasting business should be really nice and will definitely be additive to kind of where we are from a consolidated basis right now. – (Morgan Stanley TMT Conference 2022)

Weak Moat And Weak Profitability

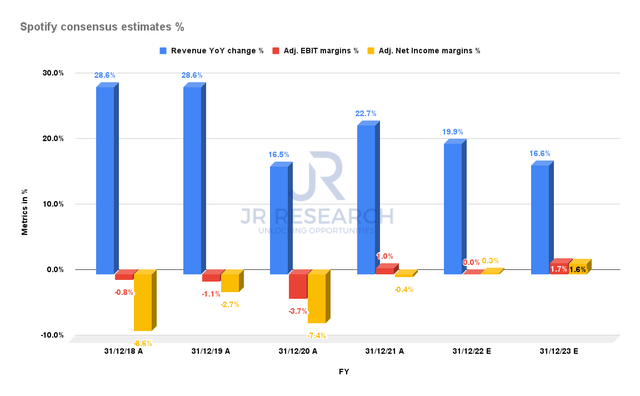

Spotify consensus estimates % (S&P Capital IQ)

A glance over Spotify’s PNL reveals the uninspiring profitability of Spotify’s business model. Notably, the company’s growth is expected to slow over the next couple of years, as seen above. But, given its investments, we don’t expect the company to report meaningful profitability in the near term. Note that Spotify is a critical player in the streaming business. But, it’s still unable to deliver sustainable and consistent profitability. Furthermore, it has to contend with well-funded rivals such as TikTok (BDNCE), Amazon, and Apple, who are inclined to encroach further into Spotify’s space.

We believe Netflix’s experience should have informed investors that investment for growth could only work if the ecosystem were defensible. After ten years, we realized that NFLX stock could have been overvalued given its weak FCF yields. Once that growth levels off, investors would inevitably turn to profitability metrics.

Is SPOT Stock A Buy, Sell, Or Hold?

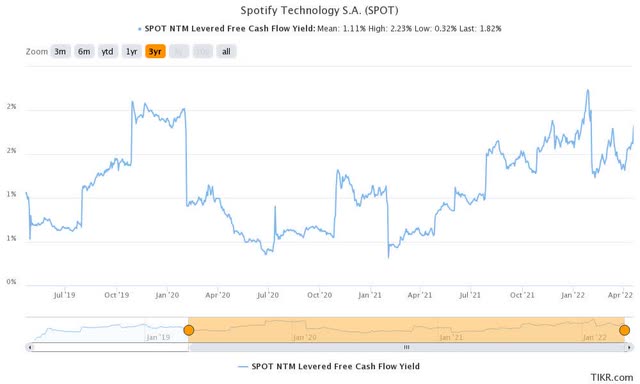

SPOT Stock NTM FCF yields % (TIKR)

SPOT stock NTM FCF yield has improved substantially given its significant value compression. It last traded at an FCF yield of 1.82%, below its 3Y high of 2.23%. Therefore, we think it’s no longer an outright sell now. However, the lack of a defensible moat and weak profitability means it’s hard for us to justify its fundamental thesis.

As such, we rate SPOT stock a Hold.

Be the first to comment