MarcosMartinezSanchez/E+ via Getty Images

Thesis Summary

Ethereum (ETH-USD) is moving to PoS, which means ETH will now be staked to secure the network and rewards. Some are concerned that organizations and exchanges will hold too much power since they will centralize staking, but I disagree.

Furthermore, through the creation of synthetic assets, like sETH (staked Ethereum), the blockchain will become much more secure, though this could lead to systemic risk.

Fundamentals Getting Stronger, But Some Fear Centralization

Ethereum is gaining traction, and that has a lot to do with the transition to PoS and the latest update to the Ethereum network. As I explained in my last article, these measures are turning ETH into a deflationary token, making it scarcer and thus more valuable.

But there is one big problem with this, and that is that the move to PoS could turn ETH into a much more centralized system. The problem is not that lone whales will control too much of the validating process. Rather, the problem now seems to be that large liquidity protocols could become too powerful. This is already happening with Lido.

Lido is a liquidity pool that enables people to easily stake their Ether. Why would someone use Lido instead of staking it themselves or using an exchange? There are two main reasons.

First off, to stake ETH, you need to have 32 ETH, or in other words, at today’s price, close to $99,000. A large sum of money, especially to commit to staking ETH. This problem can be solved through pooling, which big exchanges like Coinbase (COIN) and Binance have done.

But Life goes one step further. The other big inconvenience to staking Ether is that it is locked in staking until the merge. Lido solves this problem by offering a synthetic asset, sETH, which screws interest, like actual staked Ethere, but can also be traded, and even used as collateral in other DeFi projects.

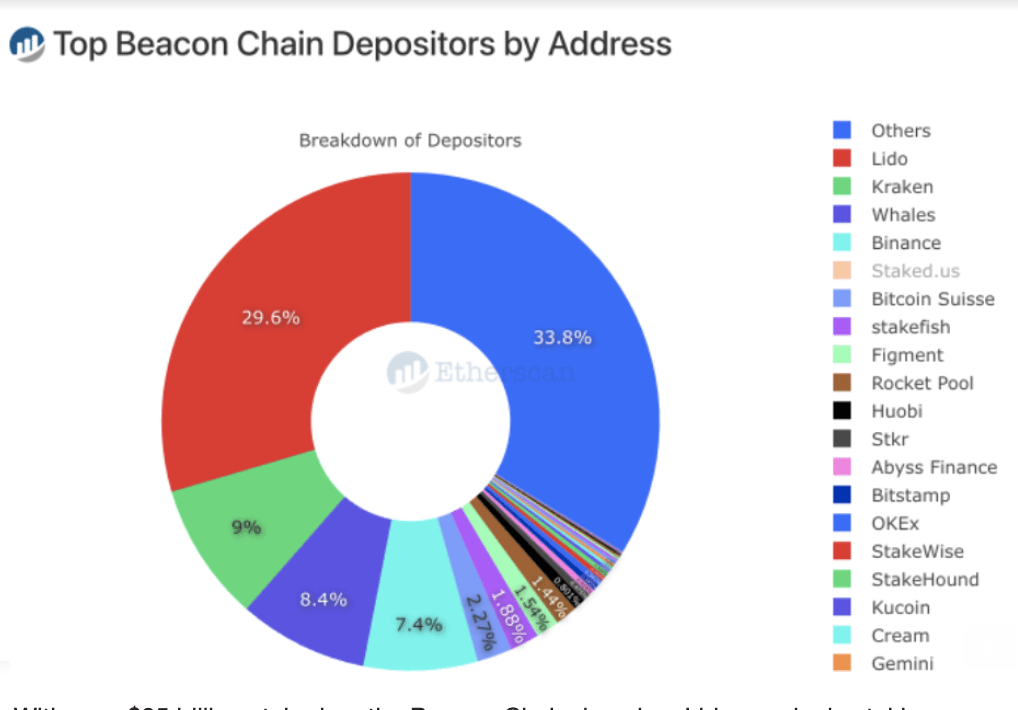

Staked ETH market share (Etherscan)

Lido’s innovative use of sETH has allowed it to capture nearly ⅓ of the staked ETH on the Beacon chain, which poses a challenge to the decentralization narrative.

What Is Being Done About This?

Having a highly centralized entity holding most of the staked Ether doesn’t sound great, and indeed, Lido is taking measures to address this problem. Two main issues arise here. First off, Lido has the power to decide which validators get the protocols stake. The second issue is security related. When someone stakes Ether, they receive a withdrawal key, which they need to use to redeem their There. In the case of Lido, all the Ether is held under one withdrawal key that the organization controls.

Having said that, Lido is trying to address both these problems. Regarding the keys, they are currently secured using a 6-11 multisig key. However, by the time ETH launches, Lido claims that it will be moved to an ETH smart contract so that 1 stETH will be trustlessly redeemable for 1 ETH.

Regarding choosing validators, Lido proposes using Distributed Validator Technology, so that validators can be grouped into independent committees that manage blocks together. In theory, this would reduce the risk of an individual validator misbehaving or even underperforming.

Is Staking Being Centralized?

So there are a couple of interesting issues here. When we think about the idea of staked Ether being centralized in the hands of Lido we have to answer the question: Is Lido itself centralized?

Lido is advertised as a DAO, but as we know there are different degrees of centralization. The changes that Lido means to implement are in fact examples of how Lido aims to be more decentralized. In truth, if Lido were a completely decentralized platform, then we couldn’t actually say that it is centralizing the ETH staking.

Ultimately, while most ETH could be governed under one organization, it could be fully decentralized. However, it would pose security risks. Any DAO or protocol is subject to attack due to human error like mistakes in the code or giving away keys.

How Do We Feel About sETH?

With that said, what is most fascinating to me, is the creation of sETH, which is a derivative product, and how it can affect the whole blockchain ecosystem.

First off, it does seem undeniable security will increase, to the extent that sETH can increase the amount of ETH being staked. With sETH, there are no “costs” to staking ETH, since you can use it and trade it as if it were ETH.

The more ETH is staked, the harder it is to attack the network:

If 20% of all ETH is staked, and an attacker wanted to acquire 66% of all stake (a critical threshold to corrupt the chain), they would have to buy 40% of all ETH in the open market.

If 60% of ETH were staked, but the stETH is liquid, then the attacker would have to buy 66% of all stETH, which also comes down to 40% of all ETH. Note that this has additional steps, where the attacker would first have to redeem the stETH to remove the honest validators and then re-stake their ETH.

Above 60% staked, the share of all ETH the attacker would have to buy is now higher than 40% and only increases from there.

If 100% of ETH are staked, then the attacker would need 66% of all stETH to get to the same threshold.

Source: research.paradigm.xyz

However, using derivatives can lead to systemic risks. sETH is being traded like ETH, and even being used as collateral in DeFi, providing more leverage to the market. But sETH is only liquid as long as everyone is happy to trade it and hold ETH. What happens when people want to redeem sETH for ETH, and put their money elsewhere? Collateral would be drained out of the financial system, which is using sETH as a base, and the market would collapse like a house of cards. Of course, this is always a possibility when you use debt and derivatives.

Takeaway

All in all, I do believe that Ethereum can thrive in the long-term. Though some are concerned with a centralization after they merge, it seems more likely that a DAO, like Lido, will control most staked ETH, and as long as this organization is in itself decentralized, that is not a problem.

I do think that sETH is a useful financial instrument, but I am worried that it could create systemic risk.

Be the first to comment