malerapaso/E+ via Getty Images

Stocks may be able to fake their profits for a period. However, they can’t fake increasing cash payouts to shareholders for 50-plus years. This makes Dividend Kings great investments to buy and hold for the long run.

The water utility American States Water Company (NYSE:AWR) is undoubtedly one of the highest-quality stocks in the world. For the first time since I initiated coverage in December 2019, I’ll dig into the reasons why American States Water is worth considering for your portfolio. I will also provide the valuation that I believe would make it a buy.

The Longest Dividend Growth Streak On The Planet

AWR’s 67 straight years of payout raises is the longest stretch among all publicly traded stocks. And with a 10-year annual dividend growth rate of 9.8%, AWR has more than doubled the 4.5% median growth rate of its sector during that time.

Better yet, I believe AWR has many more years of robust dividend growth left in its future. This is because the stock maintains sustainable adjusted diluted EPS payout ratios.

AWR produced $2.47 in adjusted diluted EPS in 2021 (according to page 1 of AWR’s Q4 2021 earnings press release). Against the $1.40 in dividends per share that were paid during the year (per page 6 of AWR’s Q4 2021 earnings press release), this equates to a 56.7% adjusted diluted EPS payout ratio.

AWR didn’t provide adjusted diluted EPS guidance for 2022. But, I will assume an 8.1% growth rate to $2.67 for the year. Compared to my assumption of $1.52 in dividends per share that will be paid in 2022, this would be a 56.9% adjusted diluted EPS payout ratio.

These payout ratios give AWR some flexibility to grow its dividend slightly ahead of its earnings. And because I anticipate 7% to 8% annual earnings growth from AWR, I will assume an annual dividend growth rate of 8%.

A Strong Showing In 2021

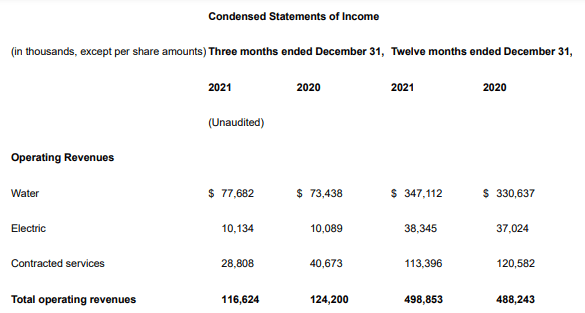

AWR Q4 2021 Earnings Press Release

AWR reported $498.9 million in total operating revenue in 2021. This works out to a 2.2% growth rate over the year-ago period (all details from page 5 of AWR’s Q4 2021 earnings press release). How did AWR pull off this growth?

First, AWR’s total customer base grew 0.4% year-over-year to 287,426 at the end of 2021 (data sourced from page 4 of 134 of AWR’s recent 10-K). Second, AWR benefited from new rates authorized by the California Public Utilities Commission (according to page 2 of AWR’s Q4 2021 earnings press release).

AWR recorded $2.47 in adjusted diluted EPS in 2021, which is equivalent to an 8.8% growth rate over the year-ago period (per page 1 of AWR’s Q4 2021 earnings press release). AWR’s higher revenue base and a 120-basis point increase in net margin to 18.9% were the factors that contributed to this impressive earnings growth (calculations sourced from data on pages 5-6 of AWR’s Q4 2021 earnings press release).

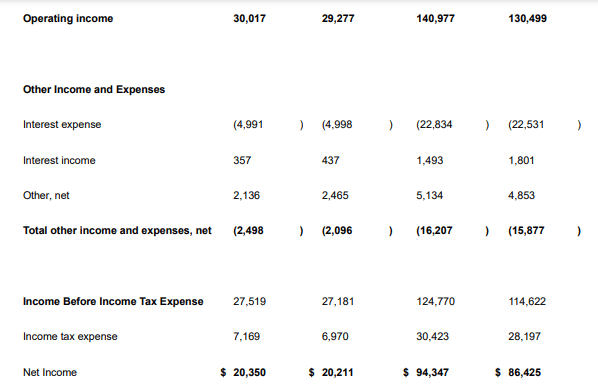

AWR Q4 2021 Earnings Press Release

Besides AWR’s respectable growth in 2021, the stock also possesses rock-solid financial conditioning.

AWR’s interest coverage ratio strengthened from an already impressive 6.5 in 2020 ($135.3 million in earnings before interest and taxes/$20.7 million in interest costs) to 6.8 in 2021 ($146.1 million in EBIT/$21.3 million in interest expenses) (details according to page 6 of AWR’s Q4 2021 earnings press release).

Simply put, AWR could be an excellent dividend growth stock if purchased at or below fair valuation.

Risks To Consider

AWR is one of the best-run publicly traded companies out there. However, it’s important to realize the risks that go along with a stock as a prospective or current shareholder.

The first risk to AWR is one that all utilities have especially been exposed to in recent quarters, which is accelerating inflation. The March 2022 CPI reading of 8.5% came in a notch above the average analyst prediction of 8.4%.

This could lead to elevated expenses soon for AWR, which could harm the stock’s profitability and earnings growth. This would also likely result on downward pressure in the stock price.

The Federal Reserve also has to thread a fine needle with interest rate hikes to avoid plunging the U.S. economy into a recession. A recession could lead to slightly reduced customer consumption of water and reduced revenue for AWR. A weak economy could also make it more difficult to convince regulatory authorities to approve rate cases.

The Stock Is Wonderful, But The Valuation Is Not

AWR’s stock has lost 1% since my previous article while the S&P 500 has gained 40% during that time. This reiterates the correlation between significantly overpaying for a stock and poor returns. Despite this significant underperformance, it appears that AWR is still moderately overpriced.

This is based on my inputs into two valuation models.

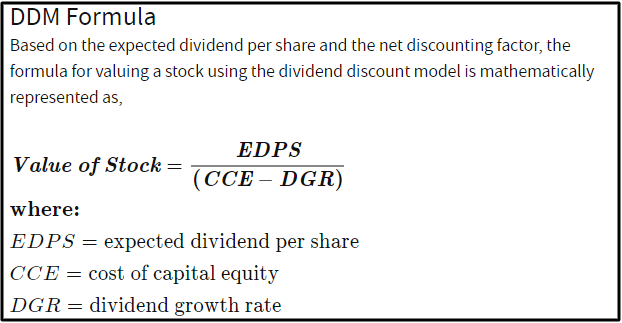

Investopedia

The first valuation model that I’ll use to value shares of AWR is the dividend discount model (“DDM”). This consists of three inputs.

The first input into the DDM is the expected dividend per share, which is the annualized dividend per share. AWR will be increasing its dividend in July. However, I will use its current annualized dividend per share of $1.46.

The second input for the DDM is the cost of capital equity, which is another term for the annual total return rate that an investor requires from their investments. My personal preference is 10% annual total returns, so that’s what I’ll be using for this input.

The third input for the DDM is the DGR, or annual dividend growth rate for the long haul.

The first two inputs into the DDM require minimal consideration. But correctly predicting the annual dividend growth rate for the long term requires an investor to think about several elements: These include a stock’s payout ratios (and whether those payout ratios are positioned to expand, contract, or remain unchanged), annual earnings growth potential, the health of a stock’s balance sheet, and industry fundamentals.

I will be using an 8% annual dividend growth rate for AWR.

Plugging these inputs into the dividend discount model, I am left with a fair value of $73.00 a share. This implies that AWR’s shares are trading at an 18.9% premium to fair value and pose a 15.9% downside from the current price of $86.78 a share (as of April 21, 2022).

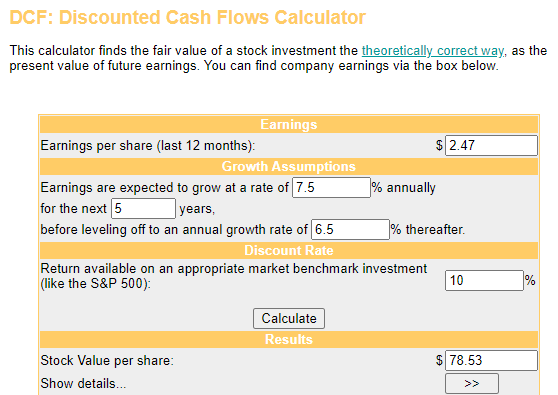

Money Chimp

The second valuation model that I will employ to approximate the fair value of shares of AWR is the discounted cash flows model. This also is comprised of three inputs.

The first input for the DCF model is a stock’s trailing-twelve-month earnings. This amount is $2.47 in adjusted diluted EPS for AWR.

The next input into the DCF model is growth assumptions. I am forecasting 7.5% annual earnings growth in the next five years for AWR and a subsequent drop to 6.5% in the years that follow.

The final input into the DCF model is the discount rate, which is the annual total return rate that an investor requires. I will again use 10% for this input.

Using these inputs for the DCF model, I arrive at a fair value of $78.53 a share. This signals that AWR’s shares are priced at a 10.5% premium to fair value and pose a 9.5% capital depreciation from the current share price.

Upon averaging out these two fair values, I compute a fair value of $75.77 a share. This means that shares of AWR are trading at a 14.5% premium to fair value and pose a 12.7% downside from the current share price.

Summary: A Dividend Growth Stock Worth Your Attention

AWR has raised its dividend paid to shareholders longer than most people reading this article have been alive. And with the adjusted diluted EPS payout ratio set to be 56.9% in 2022, there’s reason to believe AWR will be hiking its dividend for many more decades.

This is supported by the fact that AWR delivered high-single-digit adjusted diluted EPS growth in 2021. Not to mention that the stock’s interest coverage ratio is the highest that I have ever seen from a utility.

The stock’s 1.7% yield is almost entirely offset by my prediction of a 1.3% annual valuation multiple contraction over the next decade. And even with 7% to 8% annual earnings growth, the annual total returns are too far away from my 10% annual total return target to rate the stock a buy. That’s why until AWR’s stock price comes down to the mid-$70 range or its fair value meaningfully increases over time, I will rate the stock a hold.

Be the first to comment