Thinkhubstudio/iStock via Getty Images

Unity (NYSE:U) is a software developer currently focused in the gaming space. However, as technology continues to evolve, Unity is exploring alternative applications for its technology. These alternative applications could provide extraordinary growth opportunities for Unity, which is already growing rather quickly. This article will examine the company’s current and future businesses, as well as its financial standing, to determine if it is worthy of your hard-earned money.

Operate Solutions

Before getting into Unity’s game engine and the metaverse, I’d like to discuss Operate Solutions. This is a less exciting component of Unity’s business but, given that it made up 65% of the company’s sales last quarter, it should be a primary focus for investors. As the name suggests, this segment is focused on assisting game developers and publishers with their game’s operations. Namely, Unity’s Operate Solutions division assists with monetization through Unity Ads and in-app purchases.

Because the majority of mobile games are free, monetization is a critical part of their success. There are over 2.2 billion active mobile gamers in the world, 56% of which play more than ten times per week. To put that in perspective, that’s .61x the amount of people that use social media around the world. That’s a huge market for developers to tap into and Unity aims to facilitate that.

The company’s ad program offers integration of all of the typical formats, such as banners, videos, and interstitials, that developers can integrate into their games. The company’s ad service also allows developers to introduce monetization across all app stores within the same process, which greatly simplifies the process for publishers. While there isn’t necessarily anything particularly noteworthy here, Unity simply does all of this very well to create a complete service for its customers.

Though, Unity doesn’t only provide its services to game developers. The company also offers its services to companies hoping to advertise on mobile games. Unity offers targeted advertising, which it claims is it is able to make more effective due to the swath of games at its disposal and, consequently, the incredible amount of data. Understanding that perhaps some players are more likely to pay for items within a game, maybe means that they can be best monetized by being advertised towards games that have a robust in-app purchasing system. Similarly, it may be a waste of money to advertise those games to players that aren’t going to buy anything, meaning they may receive ads from games that use ads to generate income.

Unity’s Audience Pinpointer is the main tool with which advertisers aim to maximize their revenue. Again, using the data from Unity’s more than 22 billion ad impressions every month and over 2 billion active monthly users, the world’s most popular ad service for mobile games has a vast data advantage in this specialized sector. Unity is able to provide advertisers with an expected return on their targeted ads, giving advertisers piece of mind and clear expectations. With real-time valuations of each player, Unity’s service breaks down ad spending to the individual. Unity has a clear advantage over peers in the mobile ad space, with more data available than anyone else and far greater utilization, making it one of the company’s stand out products.

It should be noted that Apple (AAPL) is now trying to severely limit how companies can gather data on users through their apps. This would be a decent blow to Unity’ offering, which essentially promises the best targeting in the mobile game sector. While the company’s lead in mobile gaming (to be discussed later) will aid in retaining customers, this is something for investors to be aware of. Though, it should also be noted that 78% of mobile gaming is done on Android devices, meaning this wouldn’t affect the vast majority of Unity’s data pool.

In the United States, the average amount spent on smartphone games is $137 while average revenue generated per user is $131.21. The global mobile gaming industry generated over $163 billion in revenue last year, demonstrating the efficacy with which these “free” games are able to monetize their play experiences. Unity, being the lead enabler of this marketplace, is an incredibly exciting opportunity.

Currently, the company is working on developing Unity Economy, a system for developers to create a more effective in-game economy. The goal of this service, among other things, is to create effective monetization tactics that the publishers can profit from. The creation of an effective economy is an important part of a game’s enjoyability, regardless of whether or not it is monetized, making this operating solution one that will likely see a lot of use upon its release. The service will also automatically keep track of players’ inventory, both currency and items, to reduce the overhead for the publishers.

Unity doesn’t only provide monetization services for its customers, however. There’s much more that’s needed to make a game run smoothly in operation once it’s gotten past the developmental stage, and Unity has the services to facilitate that. Multiplay is one of Unity’s core offerings and, as the name suggests, it enables a multiplayer experience.

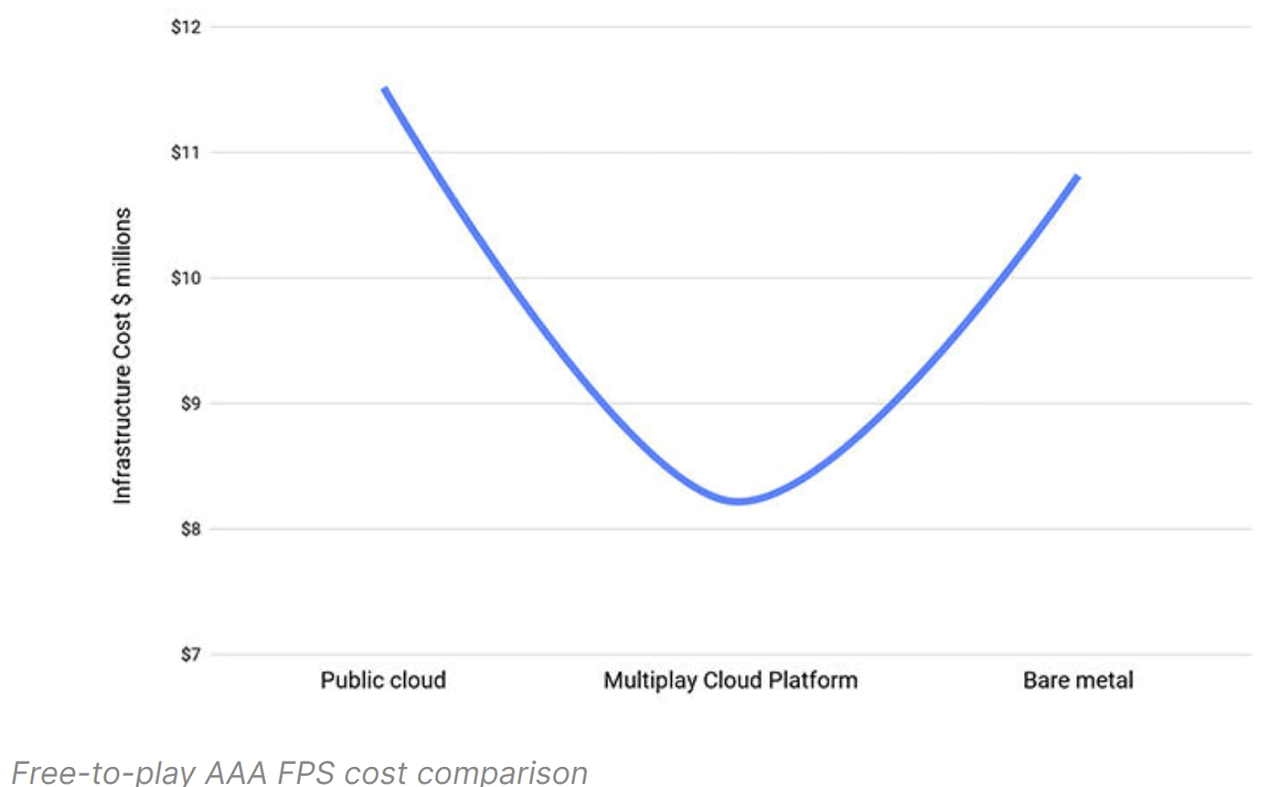

Multiplayer, especially when looking at console or PC games, is one of the most common ways for people to enjoy games. This is especially true for more casual players, who may simply enjoy the game for the company of their friends rather than the actual content. Multiplay claims to be a cheaper alternative to public clouds, with the performance required of a truly global game. The company cites Electronic Arts’ (EA) immensely popular Apex Legends, which went from 0 users to 50 million users in 24 days, as a prime example of the service’s capabilities. With servers across the globe, Multiplay aims to provide a quality experience for all of a game’s users, no matter their location.

Unity

To bolster its multiplayer experience, Unity also offers Vivox, an in-game voice and text communication service. This service is used by many of the world’s premiere multiplayer games, such as Valorant, League of Legends, and PUBG. Just for a bit of context, League of Legends averages 117 million unique monthly users. Unity is also currently in beta testing of its Lobby service, which will enable players to join multiplayer servers in a smaller group. These can be invite-only, or open-ended. Lobbies are a major component of most multiplayer shooting games, such as Apex Legends, and Unity’s service aims to reduce development overhead and costs associated with enabling them.

More backend capabilities build upon the Economy service’s ability to maintain accurate records of player inventories. For example, Unity’s Cloud Save allows game publishers to offload the storage of players’ game progression and statuses. While it would be a bit redundant to highlight every one of Unity’s different services, the point I am aiming to make should be clear at this point. Unity’s Operate Solutions cover a wide range of products that aim to improve upon, or lower the cost of, necessary operating overhead for game publishers. The company also doesn’t limit its client base for any of its services to those that developed their games using the Unity game engine.

Game Engine

While the company doesn’t limit its users to only those that have used its game platform, it could still find moderate success if it did. 61% of mobile games are developed using Unity’s game engine, making it the most popular mobile game engine in the world. By a wide margin. Over half of the world’s games, across mobile, PC, console, and VR also use Unity’s engine. Now, before getting too far ahead of ourselves, it’s important to understand what exactly a game engine is.

A game engine is essentially the framework for a game that developers can piece together to create a final product. Within a game engine, there is a detailed physics simulation, animation system, shading and coloring detail, sound systems, rendering – essentially anything you need to make a game “run” (hence, engine). While it’s up to the game developers to take these multiple systems and simulations and turn it into a game. The engine is also responsible for communicating with the platform with which it is being played on, be that iOS, Windows, or PlayStation. Without a universal engine, like Unity, game developers would need to make new engines for different platforms and for new games. Creating an engine, as you may imagine, is a lot of work and, small developers especially, don’t really have the resources to do it. That’s where Unity comes in, with a game engine that anyone can use to create a game.

Triple-A, or AAA, studios don’t always use a premade engine, like Unity, however. AAA studios have the resources to develop their own engines, though they sometimes opt for a hybrid system. Say you’re looking to develop a racing game. You may be happy with how the coloring and shading of a given engine look, but you need a more tuned physics engine and more immersive sound. In this instance, it’s not uncommon to develop a hybrid system of sorts, where a studio uses some aspects of a standard game engine, while also developing some aspects that fit their needs.

In the game engine market, however, there are really only two products to be aware of. Unity, of course, is one. The other is Epic Games’ (OTCPK:TCEHY) Unreal Engine. Between the two of them, they are responsible for the vast majority of games on the market. When it comes to AAA games using a pre-built game engine, however, Unreal is typically the engine of choice.

Regardless, it’s clear that Unity has a stronghold on the game engine space with its closest competitor, Unreal Engine, only surpassing it in the console and PC game space. The games made on Unity have 2 billion monthly active users, as of late 2020, supported by 1.5 million monthly active creators. The company’s business model, for the game engine, follows a subscription model, with developers paying per seat. So, why is the success of games developed on Unity important? Well, while the company’s Operate Solutions aren’t exclusive to games developed on Unity, the game engine certainly provides a great feedstock to Operate Solutions. Around 65% of Unity’s Operate Solutions customers also utilize the company’s Create Solutions, demonstrating fairly high efficacy of this feedstock. Thus, Unity is able to profit from the creation, and then operation, of the games it helps create.

Separate from its game engine, Unity also maintains tens of thousands of assets for developers to use, a significant asset for the engine. For those unfamiliar with the term, or at least how it applies to game development, assets cover a wide range of different applications centered around building a virtual environment. Physical, or graphical, assets could be anything from a detailed model of a tree, with independent branches and leaves that interact with virtual wind (another asset), to a small rock. Assets also include sound effects, like damage indicators or perhaps the sound of footsteps. You get the idea. Even AAA studios will use some third-party assets in their games, instead of making all of their own, as it’s far more efficient for them to focus on creating proprietary assets that players will constantly interact with, not so much when it’s something small like a fence post.

On the Unity Asset Store, assets can be listed for free but, if not, the minimum price creators can set for these assets is $4.99. Yet, of the 75,372 assets listed on the Unity store, only 7,343, or 9.74%, are listed for free. There is also often a significant quality disparity between free and paid-for assets, meaning developers typically opt for paid assets. Some of these assets are created by Unity, though most are not. However, Unity charges a 30% revenue share for assets listed on its store and, with some priced in the hundreds of dollars range, it offers a fairly solid source of revenue. Exact figures are unknown and Unity hasn’t disclosed much, beyond when it disclosed, all the way back in 2014, that top creators were earning $30,000 per month.

Weta Acquisition

For some self-proclaimed cinephiles, Weta is a name that should carry some weight. Founded by Peter Jackson, Richard Taylor, and Jamie Selkirk in 1993 to produce the visual effects (“VFX”) in Heavenly Creatures, the VFX studio has been heavily involved in major blockbuster hits, including most Marvel titles, Avatar, and the Lord of the Rings. Popularizing the use of motion capture with Golem’s character, the studio is now the go-to house for the technology, earning critical acclaim in The Planet of the Apes series, though its involvement in Avatar was likely its most impactful. Responsible for the visual effects in the top two most successful films of all time, it’s clear that the studio is one of the best in the world. But what’s Unity’s interest in it?

Looking at Unity’s press release, in which it announced its intention to acquire Weta, the company states: “Ultimately, this acquisition is designed to put Weta’s incredibly exclusive and sophisticated visual effects (“VFX”) tools into the hands of millions of creators and artists around the world, and once integrated onto the Unity platform, enable the next generation of RT3D [real-time 3D] creativity and shape the future of the metaverse.” So, I’d say the intentions are pretty clear. While the company’s VFX business is rather strong, Unity’s main interest here is in acquiring IP and talent.

Further Potential

This is where things begin to get exciting. Unity describes itself as “the world’s leading platform for creating and operating interactive, real-time 3D content.” I think that this phrasing, specifically the absence of anything to do with games, indicates where Unity sees itself progressing. Now, mobile gaming doesn’t translate too well to a metaverse-like application, with the engine behind console or PC games being far more relevant. Unreal’s fairly massive lead in that space may be a bit concerning for investors, but Unity has been building a lead in XR. In fact, according to Unity’s CEO John Riccitiello, the company’s lead in XR is even greater than its lead in the mobile game sector. With the company holding more than 60% to 70% of the XR development market, I think it’s safe to say that Unity currently dominates the space.

XR, or extended reality, is an umbrella term that covers virtual reality (“VR”) and augmented reality (“AR”), which is the space that many expect the metaverse to occupy. For those that don’t know, VR is a computer-generated experience that aims to completely immerse the user in an alternative environment, thus creating a “virtual reality”. AR allows the user to remain fully cognizant of their real-world surroundings and aims merely to enhance a user’s perception of their environment, often by providing supplementary information. Heads-up displays, which are becoming increasingly more popular in high-end vehicles, are a great example of this, as are Apple’s Animojis.

So, clearly, XR extends well beyond video games and Unity is taking full advantage of that. A case study of the company’s work with Audi (OTCPK:AUDVF) to develop the first VR car configurator and a packing training course details one of many potential applications. The virtual training course allows the company to allocate more time to train its employees on proper technique, without needing to deploy more capital. The company also partnered with PiXYZ back in 2018 to develop a platform to utilize CAD files in real-time. These, among others, are steps the company has taken over the past several years to develop its XR capabilities beyond those offered by its peers. The lead Unity has built is clear and looks to be a lasting one.

A recent report from Research and Markets, estimates that the XR market will be worth $397.81 billion by 2026, up from $25.84 billion in 2020. While most of that value will go towards those that are developing the various applications of the space, Unity does stand to benefit tremendously from that growth as it positions itself as the leading platform on which these applications are being developed. 60% of the global XR engine market, the low end of the estimate for the company’s current market share, could be worth $6.7 billion in sales by 2026 based on industry multiples.

At that point, 2026, I don’t think the metaverse will be a widely-utilized platform yet. Instead, I expect most of the company’s XR business to come from a combination of gaming and niche commercial applications. Transitioning towards the metaverse, however, Unity has room for even more explosive growth. Because XR is the platform upon which the metaverse looks to be built upon, Unity’s foothold as the leading provider of development solutions for XR development offers outstanding growth opportunities through the mid- to long-term horizon.

Unity Simulation Pro and Unity SystemGraph are perhaps the most significant steps Unity has taken towards the development of mass-market applications that build off of its 3D content development. Simulation Pro is a high-performance simulation platform that produces “faster than real time simulation speeds and empowers developers to iterate and test more, accelerating their time to insights at a fraction of current operating costs.” According to tests from Carnegie Mellon, the platform enables simulation processing 2,400% faster than standard processes. This heightened processing efficiency has enabled the University to reduce training programs from weeks to days. These simulations can be used for a variety of applications, including robotic automation and self-driving vehicle training. The speed and accuracy with which Simulation Pro can generate various environments may also hold some fidelity for the creation of virtual environments, such as those that the metaverse seeks to occupy.

Within its XR and real-time 3D capabilities, Unity is now also attempting to make a bridge to live sports. Using volumetric capture technology, Unity has partnered with the UFC to offer viewers unrivaled experiences. By creating digital twins of the live action, Unity aims to provide viewers the ability to watch the action from any perspective they choose, even the perspective of the fighters themselves. The UFC offers a solid testing ground for Unity, as the confined environment and limited participants reduce the number of variables that the company has to account for. It’s unclear how long it would take for such a technology to be commercialized, but it’s goals like these that start to give context to the type of impact Unity can have outside of just video games. Morgan Stanley analyst, Matthew Cost, estimates that the TAM for non-gaming applications could be worth $25 billion for Unity within five years.

Financial Health

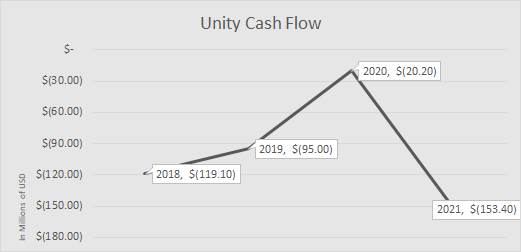

The first thing I’m interested in determining here is the company’s current capital burn rate and, subsequently, how long its current cash can last. The figure below examines the company’s cash flows since 2018, demonstrating that there hasn’t exactly been any outstanding consistency. Though, this is largely due to a few anomalous events since Unity has gone public. This includes the company’s IPO, which netted the company $1.418 billion, the acquisition of Weta, which cost the company $1.58 billion, and the issuance of convertible notes, which netted the company $1.725 billion.

Long Term Tips

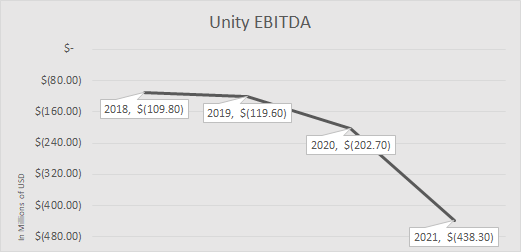

Regardless of anomalous events, a company cannot expect to sustain any sort of cash flow if it cannot generate stable profits. The figure below depicts Unity’s EBITDA since 2018. You may notice that, unlike the company’s cash flows, there does appear to be an identifiable pattern here. The trend here is clearly negative as, despite rising revenues, Unity’s operating expenses continue to balloon.

Long Term Tips

Yet, despite all of this, the company’s current assets sat at $2.151 billion at the end of 2021. Investors may be concerned about the interest payments that come with taking on $1.725 billion in debt, yet the 2026 convertible notes do not pay interest. At a conversion price of $308.72 per share, these notes also assume rather significant appreciation from Unity’s current share price. Issued just one day before Unity hit its all-time high, I’d say management was rather opportunistic in its issuing of these convertible notes, which provided ample liquidity for the company without contributing to significant dilution or burdening it with high interest payments. Down over 50% from that all-time high, the original 57.5% premium that the convertible notes priced in is now almost 250%.

So, with $2.151 billion in current assets and a burn rate of a few hundred million dollars per year, Unity is in a strong funding position at the moment. Quite honestly, the company’s market debt ratio of just .06 also implies that it has significant room to raise more funds through even more debt if needed, which can be covered by equity should struggles persist. Don’t get me wrong, profitability would be far more ideal, though there aren’t any near-term, or even medium-term, concerns regarding Unity if it continues down its aggressive path. However, just because the company isn’t on the verge of financial ruin doesn’t mean profitability isn’t important. To be a valuable growth company, there has to be evidence that this growth can be converted to profitability at some point.

Valuation Discussion

In response to a Quora post nine years ago inquiring about Unity’s business model and how it makes money, David Helgason, the company’s founder, stated “Pretty old fashionedly I must admit. We make money primarily by selling Unity software to small and big customers (in that order), and a tiny bit from our 30% cut in the Asset Store. After that it’s just tiny bits and pieces. We don’t publish our revenue numbers, but we are nicely profitable from this all and growing very robustly.” It’s that last bit that I’d like to focus on.

Unity, at its early stages, was profitable. Yet, now generating hundreds of millions in sales, the company is unable to turn a profit. What went wrong? The simple answer is: nothing. In today’s energized market, we consistently see unprofitable companies with incredible growth, gaining favor over those which are merely churning out static profits. Whether or not this is right is a completely different issue, the question this article is concerned with is to what extent investors should value this growth.

Though, Unity is a far different company now than it was nine years ago. Its profitability then doesn’t really mean squat as far as its profitability today, or in the next few years, is concerned. It seems that one of the company’s biggest expenses, as it currently stands, is stock-based compensation. The company’s total stock-based compensation in the most recent quarter was $97.8 million, 30.9% of the company’s total revenue. As the company continues to rapidly add more employees, growing its headcount by 31% last year, employee-related expenses, such as stock-based compensation, will only continue to grow. However, Unity’s revenue is growing faster.

Growing 43.77% last year, the company’s revenue is outpacing the addition of new employees, which is its greatest expense. Additionally, the company is expected to grow its revenue by another 34.8% next year, according to consensus estimates. As sales grow, so too will profitability as expenses begin to become less significant relative to earnings. Analysts currently expect that Unity will ultimately become profitable in the second quarter of 2023 as its growth persists.

The critical question now shifts from whether or not Unity can become profitable, to how much growth Unity can really sustain. This was already discussed briefly, when discussing the impact of stock-based compensation, but I’ll be taking a deeper dive here. As of Q4 2020, the last time Unity provided an update, 94 of the top 100 game development studios, ranked by revenue, were Unity customers. Furthermore, 71% of the top 1,000 mobile games were developed using Unity. This second metric is up significantly from 2019, when the software company was responsible for the development of 53% of the top 1,000 mobile games. In 2019, the company also maintained 93 of the top 100 game development studios as customers. While no specifics were provided this time around, Unity claims that its market share has continued to rise in its most recent filing.

Top game developers aren’t the only ones making money for Unity, however. The company focuses on customers that generate over $100,000 of revenue as one of its key growth metrics. In 2021, this customer base grew from 739 in 2020 to 973 in 2021, 31.7% growth. Furthermore, within its existing customer base, Unity is also seeing sharp growth in expenditures. The company’s dollar-based net expansion rate was 133% in 2019, 138% in 2020, and 140% in 2021. This consistent, and extreme, growth demonstrates the efficacy with which Unity is not only maintaining existing customers, but growing their value as well. The game engine market is expected to grow at a CAGR of 13.63% from 2020 to 2027, providing strong growth for Unity’s core business.

However, let’s look beyond the company’s established business segments. While that growth is fairly significant, what interests me more is the revenue coming from non-gaming applications. Still in the early stages of adoption, only 25% of the company’s sales currently come from non-gaming applications. Yet, those $1.1 billion in sales last year represent 70% growth from 2020. $1.1 billion is also far below $6.7 billion that Unity could conceivably generate by 2026.

While it may have started with modest ambitions to build accessible and high-quality game engines, Unity has evolved to become much more than just a games company. That’s something that I’m not sure many people on the sidelines have come to realize just yet. Just as GPUs have made the transition away from being considered, primarily, a gaming product, so too will these engines. As far as what this could mean for a company like Unity, consider NVIDIA (NVDA). The king of GPUs, originally a niche product, looks set to be the first semiconductor company to hit a $1 trillion market cap.

Currently, the average price target for Unity is $150.38 and, of the 18 analysts covering the company, only one has a rating below ‘hold.’ This surprised me, given the company’s struggles to generate a profit, though I do agree with the ‘expert’ sentiment. The software company is incredibly well-positioned to capitalize on an exploding industry.

Thesis Risks

Whenever there’s an investment thesis that hinges heavily upon significant growth, there is significant risk. There is potential for some, or many, of these opportunities to simply never materialize as expected. If that is indeed the case, it is likely that Unity will continue to struggle with profitability and the company will need to make significant changes to its business and operations. Massive layoffs can often be terminal for a company’s growth, as current employees flee a toxic and uncertain environment.

Furthermore, as with any sector of extreme growth, Unity will likely come to face some competition. Now, Unity does have a strong product and talent moat, which makes the barrier to entry quite high, but it is still breachable. While Microsoft (MSFT) and Meta (FB) could be huge customers, given their desire to develop virtual environments, they could also arise as competitors. Both companies have vast resources, including talent, that they could leverage to simply cut Unity out of the picture. Though, I feel confident that Unity’s service will offer greater quality at a lower cost. The multi-year lead is something that can’t really be bought, unless, of course, it becomes an acquisition target. With Microsoft looking to bolster its gaming business, Unity could certainly be an interesting target for them.

Investor Takeaway

I like Unity, I really do. But it’s expensive. To an extent, I can’t help but be reminded of the original dotcom bubble. While there was a lot of trash there, there were also a few good companies that just got too hot too soon. Yet, even those companies took years to provide returns to investors as they had been hyped up far beyond their fair values. You could have the right idea, but simply be too early. Being too early is just as bad, if not worse, than being too late. Virtual environments have tremendous potential, certainly, but that future is still a very long way out.

All that being said, I don’t think it’s too early for Unity. The company already has a very strong business in the gaming industry and is making the right investments to grow the application of its industry-leading products. Going back to the GPU comparison, those within the space foresaw the industry expanding dramatically as new technological advancements required the products. To me, Unity offers the equivalent opportunity in which investors can take part in a major industry evolution.

Be the first to comment