Marina_Skoropadskaya/iStock via Getty Images

Sportsman’s Warehouse Holdings, Inc. (NASDAQ:SPWH) is an American outdoor retailer that specializes in hunting, shooting and fishing products. Since going public in 2014, the company has almost tripled its stores, mostly located in the West.

During 2020 and 2021, outdoor activities became more popular and demand for guns increased. In that period, SPWH almost doubled its revenues.

SPWH almost got acquired by Great Outdoors Group for $18 a share, but the deal did not go through on the basis of FTC complaints. From the failed merger, SPWH netted $55 million in compensations, which were used to repurchase more than 10% of its outstanding stock.

Although the company is trading close to an expected 10% earnings yield in FY22, I am concerned with the operational leverage embedded in its retail operations. The company has shown difficulties to grow profits despite significant growth in stores. These could signal a significant efficiency problem at the corporate level or with store allocation strategy.

Note: Unless otherwise stated, all information has been obtained from SPWH’s filings with the SEC.

Competitive strategy, cyclicality and moral concerns

SPWH is a pure retailing operation. The company has no manufacturing capabilities and 95% of the company’s revenues are generated by third-party brands. In my opinion, this means SPWH has to compete with four groups: other retailers, suppliers, lessors and employees.

On the retailing side, SPWH has to compete on the basis of location and price, mostly with mom and pop competitors. It also has to compete purely on price with e-commerce operations, given that it does not carry its own product assortment. On the supplier side, the company fights for margin. It can obtain more bargaining power against suppliers the more customer traffic and volume it can generate. Finally, the company does not have a lot of bargaining power with lessors and employees. It has to accept the conditions of the locations where it wants to do business.

SPWH’s competitive strategy seems to be focused on increasing its footprint while avoiding competition with national retailers. The company mentions on its 10-K for FY21 that it has tried to open stores in small cities, and that 61% of its stores do not compete with nationally recognized outdoor retailers.

This strategy provides the company with two competitive advantages. First, it can function as an entry point to underserved customer pockets for brands, therefore increasing its bargaining power with suppliers. The more stores the better in this aspect. Second, with higher volumes, better pricing, and therefore more room to compete with other retailers.

SPWH has to balance these advantages of increasing its store count with the costs generated by each store, particularly those of a fixed nature like rent and payroll. It also has to finance inventories and corporate overhead.

On the cyclicality side, SPWH only provides information going back to 2014, when it went public. The company has been opening stores, so same store sales figures are difficult to compile. This provides little information on how much SPWH could be affected under a recessionary context.

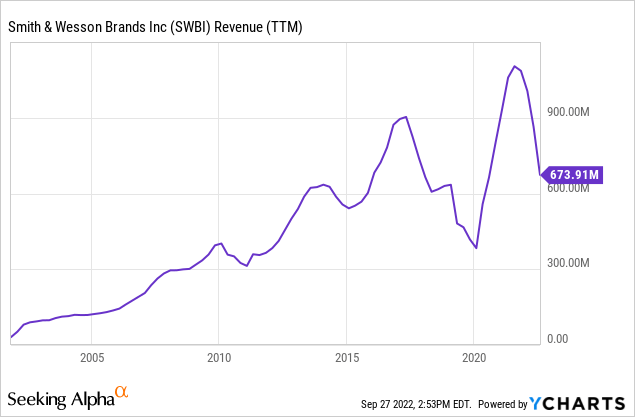

I speculate that being specialty retailing, SPWH’s sales are probably negatively affected by falling income. However, more than 50% of SPWH’s revenues are guns and hunting equipment, and these may actually go up in turbulent times. The company mentions social unrest (probably related to the Black Lives Matter riots) and the 2020 presidential elections as factors in the tremendous increase in revenues between 2020 and 2021. In the same vein, below is the revenue chart for Smith & Wesson (SWBI), showing that sales actually went up during the Great Financial Crisis, and down during the Trump administration.

Finally, selling weapons affects SPWH as an investment vehicle. Some funds or individual investors may avoid investing in companies that promote weapon ownership, on moral grounds. This may provide value to the investor that does not find weapon selling to be a moral impediment.

SPWH’s operating history

Since going public in 2014, SPWH’s operating history has been marked by its strategy of opening more stores. While the company had 56 stores in January 2015, the number had grown to 92 stores by January 2019 and finally 129 stores as of July 2022. In terms of square footage, the company has almost doubled it, from 2.6 million at the end of 2014 to 4.6 million by the end of 2021.

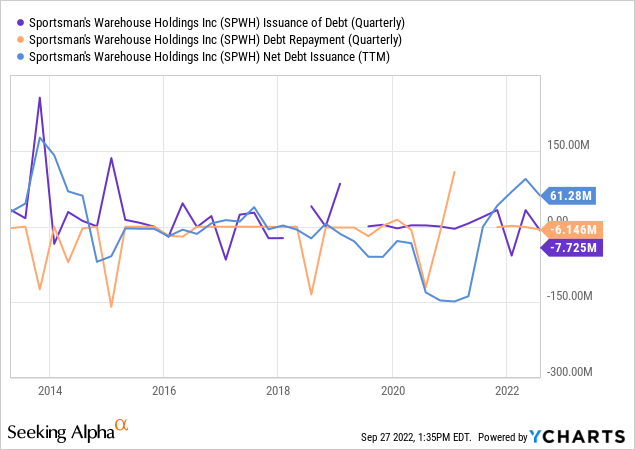

These stores do not require a lot of capital, given that the space is leased. According to SPWH, the average store requires $2.5 million in capital investments plus another $2.5 million in starting inventories. This has allowed SPWH to self-finance its growth, for the most part, actually repaying debts while growing, on a net basis.

According to SPWH, after 18 to 24 months, stores should generate a 17% EBITDA margin. The company does not comment if that EBITDA margin already includes rent costs (considering that leases are expensed as depreciation of ROU assets).

The strategy seems very interesting. Open stores that require little capital, can become self-funded, have high margins and increase bargaining power with suppliers. However, the data does not support that theoretical strategy.

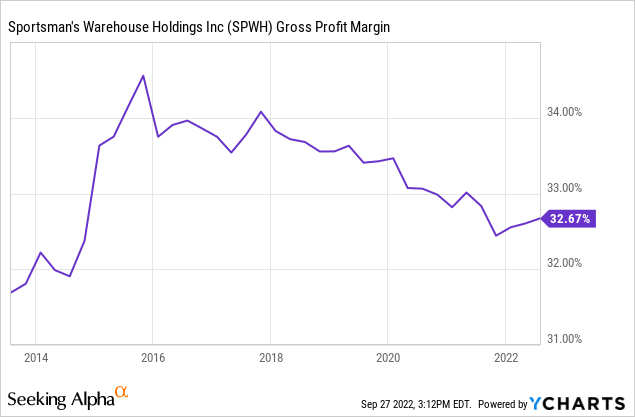

Starting with bargaining power, SPWH does not seem to have improved it, given the constant gross margins. The company’s product mix has not changed since 2015, to account for this reality.

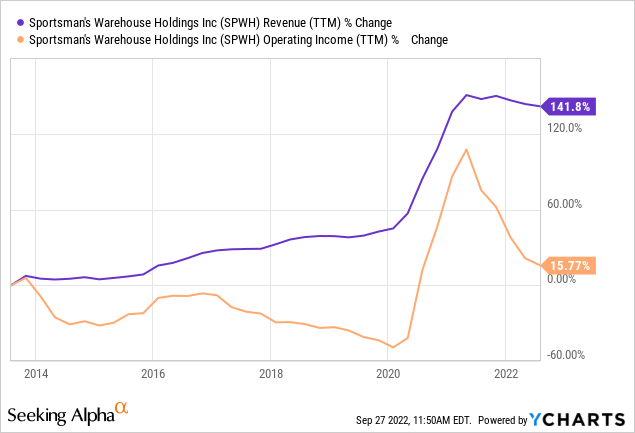

Revenues were also disappointing. Between 2014 and 2019, SPWH almost doubled the number of stores it has, but revenues only grew by 50%. The growth shown after 2020 seems to have been caused by external factors like COVID and social unrest. Even taking that into account, by the end of 2021, with 129 stores (250% growth since 2014), revenues were up only by 140%.

It is true however that the story is different on a square foot basis, given that SPWH has opened smaller stores. Square footage grew 76% between FY14 and FY21.

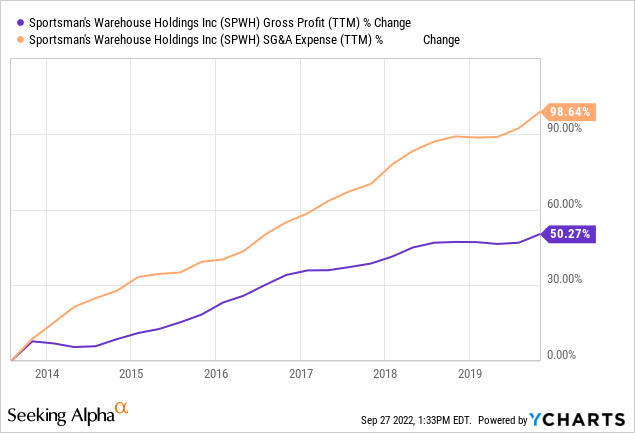

Finally, as the chart above shows, operating income actually decreased, almost 50% between 2014 and 2020. After the pandemic boom, operating income is only marginally higher that when the company went public. This has been caused by SG&A expenses, as the chart below shows.

Leases do not explain the margin contraction. In 2014, the company paid $33 million in operating lease expenses for 2.6 million square feet of stores. By the end of 2021, the company was paying $64 million for 4.6 million square feet, or only 10% higher on a square foot basis.

SPWH does not have a gigantic corporate structure. From 7.7 thousand workers, only 320 work at corporate, and another 520 in their central deposit, the rest work at the stores. SG&A is not affected by logistic costs either, given that freight-in and shipping costs are included in CoGS. If we divide the $310 million in SG&A expenses that are not lease costs or marketing, by the 5.5 thousand full-time equivalent workers at SPWH (3.3 thousand full-time, 4.4 thousand part-time), it results in a $56 thousand yearly salary, which is significantly above the national average for a retail salesman. From the data I have, I cannot explain what is driving this SG&A inefficiency, but it is there.

On the financing side, I showed that the company has not financed growth with debt. SPWH has an open credit facility for $350 million paying LIBOR + 1%. Its maturity has been extended to May 2027. As of July 2022, the company had drawn $90 million, but these will probably be repaid as inventory is sold in 2H22.

Going forward

According to the company’s 2Q22 report, same store sales have gone down 12%, meaning 20% in real terms, considering 8% inflation. Although that is not a positive sign, the reader has to recall that SPWH comes from record revenues in 2020 and 2021. Some revenue decrease was expected. Compared to 2019, sales are still more than 60% higher.

The company has also used the proceeds from the failed merger with Great Outdoors Group ($55 million) to repurchase shares, reducing outstanding shares by 10%, to 38 million.

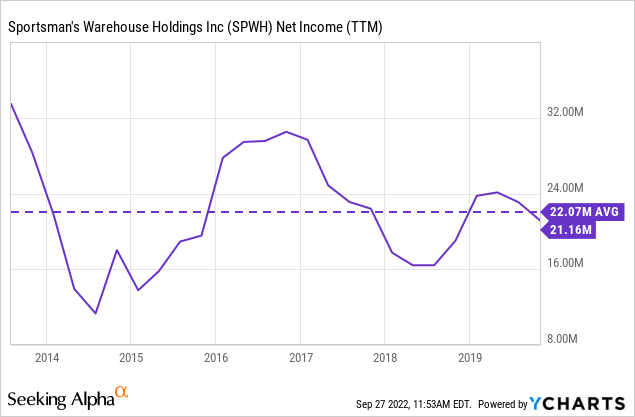

We can calculate the revenue implied on the current share price. With a share price close to $9, and requiring $.9 in earnings (a 10% yield), the company has to generate $34 million in net income. That number is significantly above the historic average, as the chart below shows, but not so far away from other peak sale periods, like the 2016 presidential election.

$34 million in net income translates to $45 million in pretax income considering a 25% income tax rate. Interest expenses are low given that the company is constantly repaying its credit facility. If we consider the $90 million outstanding and an effective interest rate of 5%, it adds $4.5 million in interest expenses. SG&A expenses add another $400 million.

That means SPWH has to generate almost $450 million in gross profits to generate $.9 per share in net income. Using the historic 33% gross margin, that translates into $1.35 billion in revenue. With $660 million in revenues as of 2Q22, and the second half of the year usually presenting more sales, SPWH seems able to reach that revenue target this year.

As I commented on the competitive position section, SPWH’s business might even benefit from a recessionary context, because people tend to purchase more guns in negative scenarios. Therefore the company is somehow protected from negative economic perspectives.

However, the problem as usual with brick and mortar retailers is operational leverage. With $1.3 billion in revenue, 5% lower than the revenue target, SPWH can generate only $18 million in net income, or $.47 per share. A 5% fall in revenue generates a 50% fall in net income per share. Other aspects of leverage compound over time if the company is not doing great. In particular, the company can face losses if it decides to close stores, because it has to pay severance and lease termination fees.

If SPWH had a compelling growth story behind it, I would consider the risk of lower earnings less problematic. However, SPWH’s growth story is incomplete, because store and revenue growth did not translate into profits growth. Without growth in the future, the risk of significant earnings decrease has no counterbalancing benefit.

Conclusion

SPWH has shown that it can grow stores fast and that it can increase its revenue per square foot. However, SG&A costs have risen faster than gross profits, decreasing the company’s operating margin, and preempting bottom-line growth.

Although SPWH sells products that can benefit in a recession, its operating leverage loads a lot of risk in even small variations of revenue targets. Without growth to balance that risk, SPWH does not seem like an interesting opportunity at these prices.

In the future, the most important positive factor would be the improvement or at least maintenance of operating margins, in order to translate revenue growth into net income growth. In terms of price, I would reconsider my evaluation of SPWH as an investment below $6 a share.

Be the first to comment