NiseriN

What is going on in the stock market?

Yesterday, the Dow Jones Industrial Average was up 545 points. The S&P 500 Stock Index was up 94 points. And, the NASDAQ rose 355 points.

After such a winning day, the DJIA was up by 426 at 2:00 pm on Tuesday; the S&P was up 54, and the NASDAQ was up 144.

Analysts are having a hard time explaining such an exuberant stock market.

Well, earnings are coming in better than expected. Large banks are showing that the consumer has not totally left the market. And, so on.

But, the Dow is up almost 1,000 points in two days?

This is happening with the Federal Reserve sticking to its quantitative tightening policy.

And, the Fed is very intent on keeping to its original path of monthly reductions in its securities portfolio and continued increases in its policy rate of interest.

It looks like we will get another 75 basis point increase in the effective Federal Funds rate early in November at the next meeting of the Federal Open Market Committee.

The Fed is “tightening.” Investors do not seem fully concerned with what the Fed is doing.

Massive Liquidity

This is worrisome. For a couple of months now, I have raised the question of whether or not the Fed is really doing enough in its effort to tighten.

The Fed has put so much money into the banking system, a concern can be raised about whether or not the proposed reduction in the Fed’s securities portfolio is sufficient to really “tighten up” the banking system and the financial markets.

Over the past several years, I have stayed away from what is called “the monetary aggregates.” It seems that these data have fallen out of sight and are seldom referred to when discussing what the Federal Reserve is doing.

So, I took a look back at the monetary aggregates, and here is what I found.

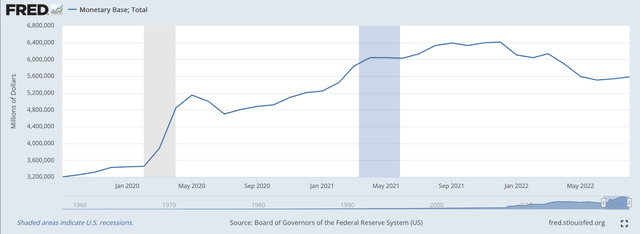

The Monetary Base, the foundation of the economy’s money stock, has grown since just before the appearance of the Covid-19 pandemic, from $3.454.5 billion to $6, 413.1 billion at its peak in December 2021.

Monetary Base (Federal Reserve)

As can be seen, the Monetary Base has fallen modestly since then to around $5,600.0 billion as the Fed has reduced the size of its securities portfolio, but it is still more than 1.6 times its size in December 2021.

This liquidity still floods the U.S. financial system.

And, this liquidity serves as the base for the money stock.

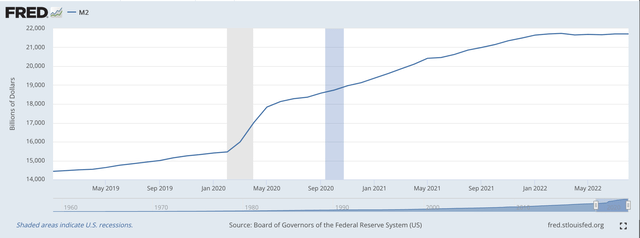

Here is what the M2 money stock has done over the same period of time.

M2 Money Stock (Federal Reserve)

The M2 money stock was at $15,458.7 billion in February 2019 and grew to $21, 490.0 billion in December 2021.

The question becomes, where did all this money go?

Well, it didn’t all go into real spending. We can see this by looking at the velocity of spending of the M2 money stock.

Velocity of M2 Money Stock (Federal Reserve)

The velocity of spending the M2 money stock dropped dramatically as the Federal Reserve pumped massive amounts of money into the financial system as the pandemic hit.

But, a large amount of the money was not spent on goods and services.

We see that in the second quarter of 2020 the turnover of the M2 money stock in spending on goods and services dropped to about 1.1 times per period. Note that even after the velocity moved up a bit, the turnover of the M2 money stock only rose to about 1.15 times per period.

So, a lot of money was jammed into the financial system, but the rate at which the money was used to buy goods and services declined substantially.

Where did the money go?

The money went into the financial circuit of the economy.

The money was used, but the money was used to buy assets. In particular, the money was used to buy stocks.

The stock market boomed during this time period, hitting one new historical high after another.

S&P 500 Stock Index (Federal Reserve)

The last historical high for the S&P 500 stock index came on January 3, 2022.

But, this is what investors had been doing for years. As the federal government and the Federal Reserve stimulated the economy over the past 40 years or so, more and more of the stimulus money went into asset prices rather than real capital investment or other real expenditures.

This “credit inflation” generated asset price bubbles in housing, commodities, as well as stock prices.

This is where the money went.

And, one can draw from the data just presented that the money the Federal Reserve pumped into the economy went someplace, it went into assets and did not go into the purchase of real goods and services.

Hence, this accounts for the major decline in the velocity of circulation of the M2 money stock. The stimulus money did not go into real output.

So What Happens Now?

The Federal Reserve is now trying to remove reserves from the banking system, from the Monetary Base, and in doing so it hopes to remove money from the financial system, which will result in a reduction in spending on real goods and services. That is, real GDP will decline and this will take pressure off of consumer prices.

The problem is that a lot of the money the Fed wants to remove is in the financial circuit of the economy.

And, there are trillions of dollars in the financial circuit of the economy.

These monies the Federal Reserve cannot control while they still exist.

Thus, the question is whether or not the Fed is removing a sufficient amount of reserves in its program to reduce the size of its securities portfolio.

The Federal Reserve has injected a massive amount of reserves into the banking system.

As a consequence, the M2 money stock has grown to an enormous size. And, the M2 money stock has not been turned over to buy goods and services. It has been turning over in making financial transactions.

This may be the reason why investors are not responding the way that the Fed would like. The investors have all this money created by the Fed, and the Fed cannot control how these funds are used as long as they are so plentiful.

So, my question remains: is the quantitative tightening program of the Federal Reserve sufficient to reduce all the “largesse” the Fed pumped into the economy at an earlier time?

If the Fed does not fully reverse itself from its earlier generosity, will the inflationary presence in the economy remain and distort economic activity?

Here is the painful part of pumping too much money into the economy at some earlier stage. In such cases, the money must be removed to return to “more normal times.”

Be the first to comment