DKosig

Alteryx (NYSE:AYX) offers a data analytics platform that has traditionally been targeted at citizen data scientists. The stock has performed poorly over the past few years, driven by the combination of Alteryx’s slow shift to the cloud and the demise of the ETL paradigm. Alteryx’s recent product innovation and acquisitions better position the company for the future, and the company’s revamped sales strategy appears to be working. Relative to peers, the stock no longer appears as cheap as it once did due to the large pullback in software stocks.

Market

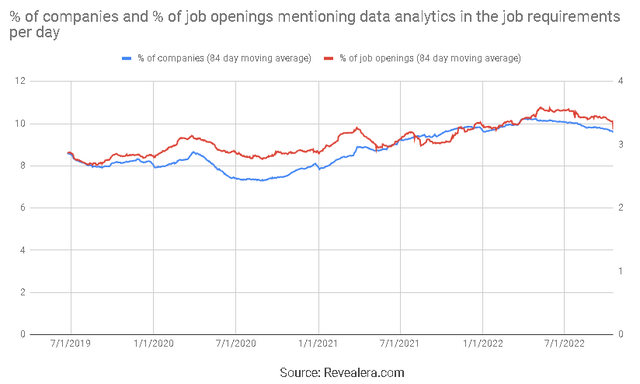

Data and analytics remain important strategic initiatives for most companies, despite the uncertain macroeconomic environment. For example, close to half of Alteryx’s customers are appointing Chief Data Officers whose focus is on combining business and analytics strategies. Despite this, it is likely that an economic slowdown will entail some reduction in spending on data analytics. Hiring data indicates that a modest reduction in growth has been underway since late 2021.

Figure 1: Job Openings Mentioning Data Analytics in the Requirements (Revealera.com)

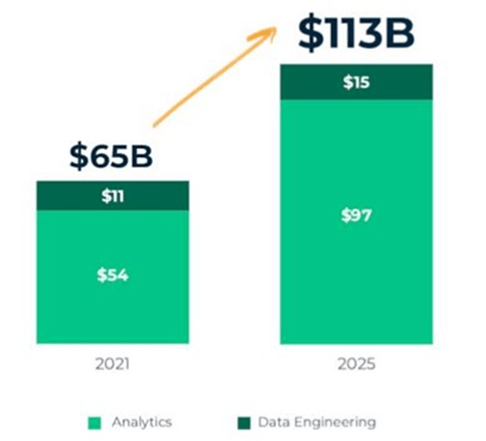

Even if a recession occurs in the near term, the long-term prospects for data analytics remain bright. Alteryx believes their current market opportunity is approximately 65 billion USD across the analytics and data engineering space. These markets are projected to exceed 110 billion USD by 2025.

Alteryx aims to democratize access to analytics and believes there are over 78 million advanced spreadsheet users who would benefit from their platforms. Alteryx believes their current user base is less than 1% penetrated into this population and that many of their customers are early in their journeys to data-centricity

Figure 2: Alteryx Total Addressable Market (Alteryx)

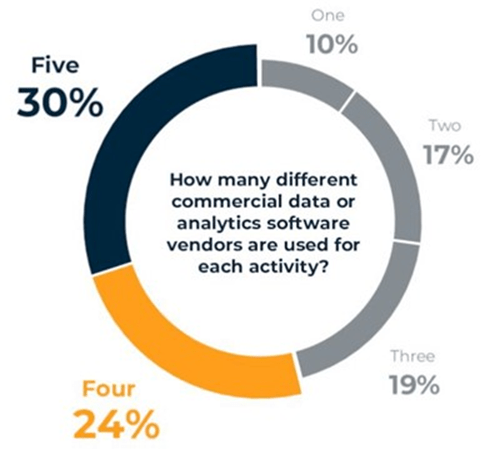

The current analytics landscape is extremely fragmented though, with the majority of spend directed towards disparate siloed legacy data engineering and analytic tools. Customers appear to be transitioning towards unified platforms though, and more customers are moving data into environments like cloud data warehouses. This trend should favor companies that offer end-to-end platforms and is likely to be even more important in the event of a recession.

Figure 3: Overlap in Analytics Software Vendors (Alteryx)

Alteryx

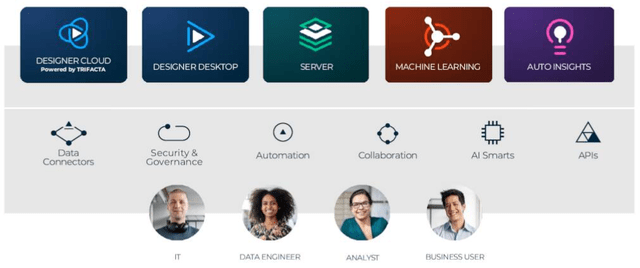

Alteryx is focused on providing customers with a unified platform so that they can consolidate vendors and reduce complexity. Customers also want more automation, and Alteryx is building out these capabilities. Alteryx’s product innovation is focused on cloud centricity, big data fluency and AI. Suresh Vittal was brought in to lead Alteryx’s product innovation initiatives. He has experience transitioning from on-premise to cloud products at Adobe (ADBE) which is relevant to Alteryx’s current situation.

Most of Alteryx’s innovation efforts have been aimed at developing a cloud-native solution, something that they were initially slow to do. Designer Cloud is built to support Alteryx’s existing products rather than replace them, as it addresses different personas and different use cases. Designer Cloud makes access to Designer ubiquitous, as it provides interoperability across on-prem and cloud and no-friction adoption. Designer Cloud went through beta testing in 2021 and was made generally available in 2022.

Alteryx has also been adding to their capabilities in Machine Learning, Intelligence Suite and Designer. Designer Cloud, Alteryx Machine Learning and Alteryx Auto Insights are now available in North America.

Figure 4: Alteryx Product Portfolio (Alteryx)

Alteryx has also made a number of acquisitions to build out the capabilities of its platform. Hyper Anna and Lore IO were acquired to enhance cloud functionality and improve data discovery capabilities.

Lore IO

Lore IO is a no-code data modeling platform that allows users to push workflows into an environment like Snowflake (SNOW) or Databricks. This acquisition provides capabilities in cloud-native analytic compute optimization and in-database processing, allowing Alteryx customers to extract value from large datasets.

Hyper Anna

Hyper Anna provides a cloud-based platform that allows anyone to generate insights from data, regardless of technical background. This acquisition allows Alteryx to automate the end-to-end analytic pipeline from data sources to AI-driven insights. Hyper Anna’s platform allows users to quickly scale insights and provide greater flexibility than traditional business intelligence dashboards. Hyper Anna has been rebranded as Alteryx Auto Insights.

Trifacta

Trifacta provides a leading data preparation solution that is used by over 10,000 companies for data wrangling and exploratory analysis. Their platform allows analysts to explore, transform, and enrich raw data into clean and structured formats by leveraging machine learning, data visualization, human-computer interaction, and parallel processing.

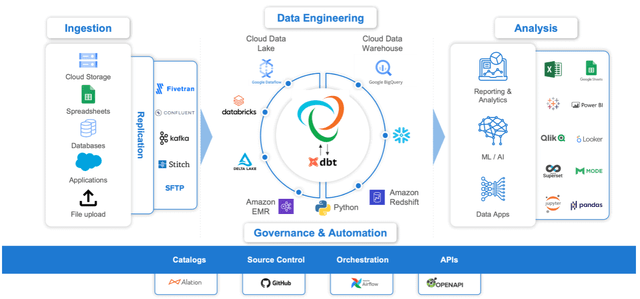

Figure 5: Trifacta’s Platform (Trifacta)

The acquisition of Trifacta accelerates Alteryx’s journey to the cloud by providing a data integration layer, that along with Alteryx’s Cloud Platform, constitutes an analytics platform. Trifacta will eventually become the cloud-based back-end for the combined Alteryx platform.

Trifacta is targeted more at the needs of IT and data engineers than Alteryx’s other solutions, helping to broaden their user base. The Trifacta team, prior to the acquisition, predominantly sold to whoever was making the Cloud Data Warehouse decision.

Much of Alteryx’s change in fortunes over the past 12 months appears to be related to their salesforce and go-to-market strategy. In the past, the sales organization targeted analysts and was not able to clearly articulate Alteryx’s value proposition around functional and digital transformation. Alteryx is now focused on larger enterprises and is targeting senior executives (CIO, CCO, CMO, CRO, CFO) with a top-down sales motion. To do this, Alteryx brought in experience from a range of companies (Adobe, Palo Alto (PANW), Cisco (CSCO), VMware (VMW)).

This shift in strategy, coupled with a tight labor market, caused a significant amount of attrition amongst Alteryx’s salesforce in 2021 and subsequent concern amongst investors. In hindsight, these concerns were overblown as Alteryx has managed to expand its salesforce and increase its productivity, while attrition has normalized. Employee attrition has halved since the peak in Q2 2021 and Alteryx has seen double-digit improvements in sales rep productivity in Q2 2022.

This shift in strategy appears to have been successful, with Alteryx closing nearly twice as many million USD plus deals in Q4 2021 than they did a year earlier. Alteryx also achieved 45% growth in the number of customers with over one million USD in ARR over the same period. Approximately 39% of the Global 2000 are now Alteryx customers, and the company is targeting much greater penetration. Sales productivity and renewal rates have also been increasing. This has not come without cost though, as Alteryx’s salesforce has increased significantly and consequently so have sales and marketing expenses.

Alteryx is also having success with enterprise license agreements that allow them to sell higher in a customer’s organization and enable customers to scale faster. ELAs provide companies with a frictionless path to more broadly leveraged cloud opportunities within the Alteryx analytics platform.

Partnerships, both technology and channel, are becoming increasingly important for Alteryx as they focus on the cloud and larger customers. Partner-influenced business constituted approximately 50% of new ACV bookings in Q2 2022.

Alteryx has a strategic alliance with KPMG that is designed to help organizations accelerate data-driven business transformation around tax operations. Tier 1 accounting and consulting firms are among Alteryx’s largest customers, with PwC alone having more than 150,000 Alteryx licenses. Most of these firms use Alteryx in their transformation, functional, department or digital projects. Alteryx has also expanded their partnership with Thomson Reuters, allowing them to sell Alteryx across three of their key business units.

Alteryx’s strategy with technology partners is to deliver seamless integrations for customers and encourage deep-field collaboration. Alteryx is in the top tier of Snowflake’s tech partner program. The two companies have over 500 customers in common and growing. Alteryx Designer and Server became available in the AWS Marketplace in Q4 2021. This means that customers with enterprise discount programs in place can now have Alteryx product purchases count towards their annual consumption commitment.

Figure 6: Alteryx Partners (Alteryx)

Alteryx recently achieved FIPS compliance, which applies to on-premise technologies and helps to unlock the federal and public sector markets. Alteryx is also working on FedRAMP for their cloud technologies.

Driving end user adoption also remains an important part of Alteryx’s strategy. Alteryx has a strong community, with over 290,000 users. Alteryx is also building their user base with their SparkED program, an education and upskilling initiative that provides users with data analytics knowledge and skills. There are now more than 130,000 students representing over 700 universities in the program. These students have the potential to become Alteryx advocates throughout their careers.

The market for analytics software is highly fragmented, with over 400 companies competing for various segments of the market. The current market downturn could make funding difficult going forward and result in consolidation the space, which may ultimately be beneficial for larger companies.

Alteryx believes they are well positioned due to their large user base and the comprehensiveness of their platform. They believe this is validated by their success with partners like Snowflake and UiPath (PATH) as well as their strong win rates. Management has also stated that they don’t see a lot of competition as they are more focused on expanding sales within their large user base.

Financial Analysis

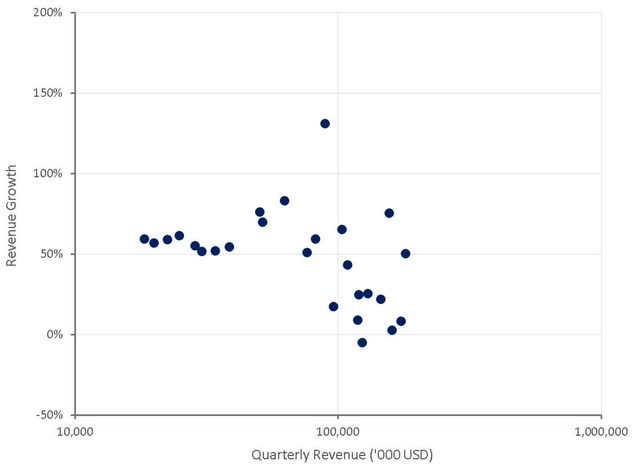

Alteryx’s revenue growth stagnated in 2021, which was in part due to a shift in their business model. Average contract duration declined due to a focus on ACV and Alteryx suggested that every tenth in annual duration compression impacted revenue by 10 million USD. ARR is unaffected by contract duration and hence has been a better indicator of business performance over this period.

Alteryx has had fundamental issues as well though, such as slower customer growth and elevated churn, particularly amongst smaller customers. Alteryx’s gross customer retention rate is typically in the 90s, with churn concentrated amongst smaller and newer customers. On the most recent earnings call, management seemed quite positive, suggesting that demand was healthy as evidenced by multiyear high renewal rates and solid year-over-year growth in pipeline generation.

Alteryx’s net expansion rate has been fairly consistent at around 120%, and a stronger 127% within global 2000 customers. Customer additions have been modest in recent quarters though, which may just be a reflection of Alteryx’s focus on larger customers.

Alteryx’s acquisition of Trifacta closed on February 7, 2022 and Alteryx anticipates that this acquisition will contribute approximately 20 million USD in ARR in 2022. The revenue contribution is expected to be limited due to purchase accounting treatment of deferred revenue.

Figure 7: Alteryx Revenue Growth (Created by author using data from Alteryx)

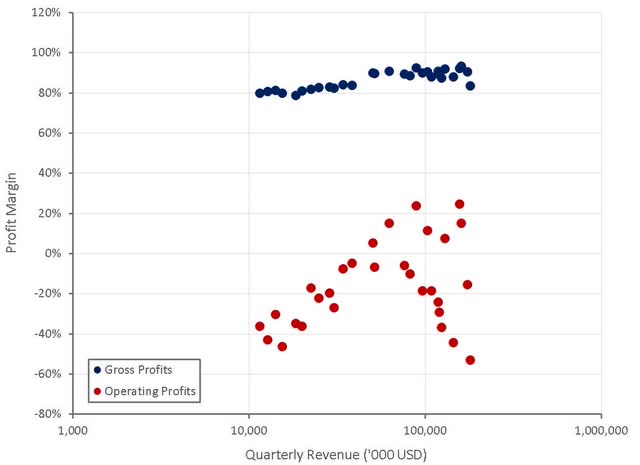

Alteryx’s gross profit margins have generally been around 90% in the past, although they are likely to decline somewhat as the cloud business grows in relative importance. Operating profit margins have declined significantly in recent quarters as Alteryx has been investing aggressively, and is only now beginning to realize the benefits.

Figure 8: Alteryx Profit Margins (Created by author using data from Alteryx)

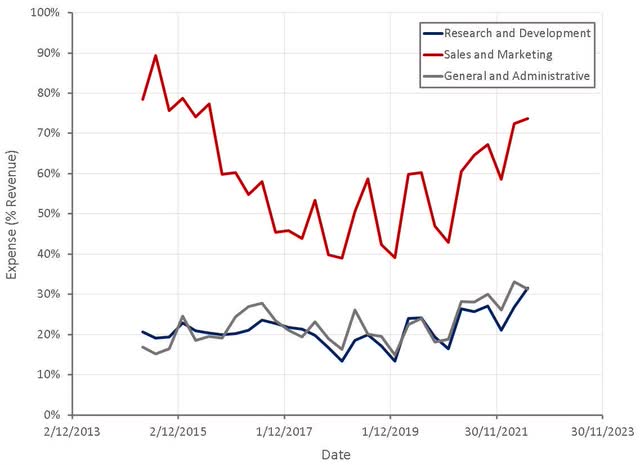

Alteryx’s operating expenses have increased dramatically over the past two years, which has primarily been attributed to an increase in headcount and payroll-related expenses. To support their rapid growth, Alteryx more than doubled the size of their recruiting team in 2021 and has almost tripled the size of their customer success team.

Figure 9: Alteryx Operating Expenses (Created by author using data from Alteryx)

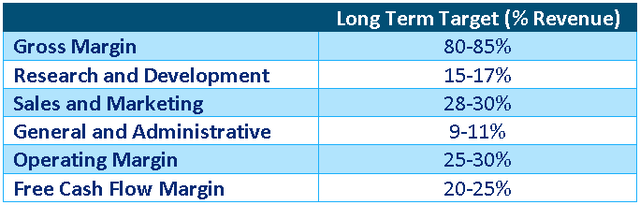

Alteryx is targeting operating profit margins of 25-30% in the long term, which seems reasonable given the nature of the business. This is currently a long way off though, and it will likely take Alteryx several years to grow into their current cost base.

Table 1: Alteryx Long Term Target Margins (Created by author using data from Alteryx)

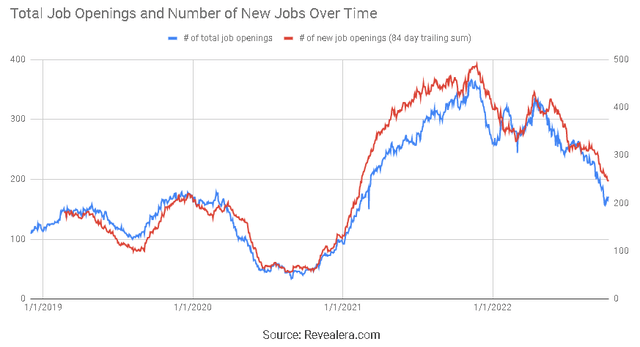

Alteryx’s hiring has slowed substantially this year, which could be viewed as a negative indicator of growth prospects or a normalization of hiring after building out their sales organization in 2021.

Figure 10: Alteryx Hiring Trend (Revealera.com)

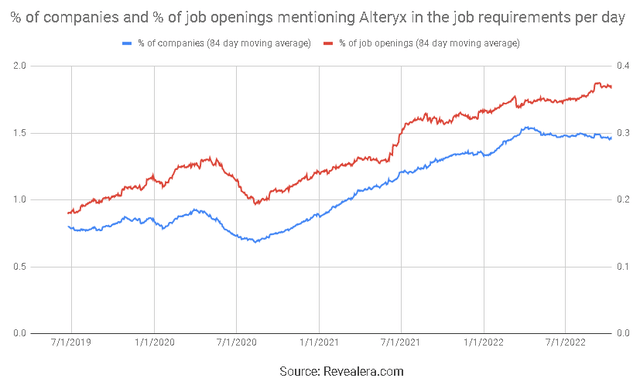

The number of job openings mentioning Alteryx in the requirements has steadily increased since the COVID lows, which may be indicative of continued demand for Alteryx’s platform.

Figure 11: Job Openings Mentioning Alteryx in the Requirements (Revealera.com)

Valuation

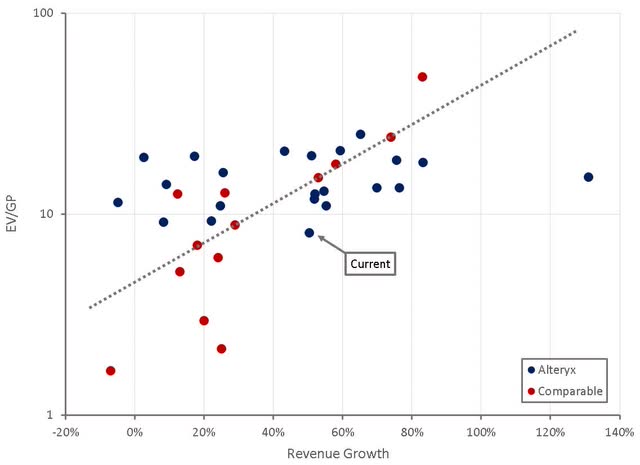

Alteryx’s stock has been relatively inexpensive for the past 18 months, but over this period software valuations have pulled back significantly. Providing Alteryx’s product innovation and sales initiatives remain successful, the stock should do quite well from current levels, but in the current environment improvements in profit margins will be needed before the stock moves higher. Based on a discounted cash flow analysis I estimate that Alteryx’s stock is worth approximately 90 USD per share.

Figure 12: Alteryx Relative Valuation (Created by author using data from Seeking Alpha)

Conclusion

The strength of Alteryx’s business has been vastly underestimated over the past few years and it is no surprise to see their product and sales initiatives result in a return to strong growth. While there remain valid concerns about Alteryx’s positioning as data architectures evolve, the company is positioning itself to remain relevant. The stock is still relatively cheap, although with most software stocks pulling back significantly, the relative discount is now much less. Alteryx will likely need to show sustained growth and an improvement in profitability before the stock moves higher.

Be the first to comment