Lemon_tm

I would like to acknowledge my fellow Seeking Alpha contributor and coauthor of this analysis Badsha Chowdhury for contributing his time, perspective and expertise. I believe this analysis is both more complete and more finely nuanced than it would otherwise be without Badsha’s efforts.

Overview

Newtek Business Services Corp (NASDAQ:NEWT) is a business development company that is currently reorganizing to become a bank. In August of 2021, NEWT announced plans to acquire National Bank of New York City as part of its plan to reposition itself as a bank holding company.

NEWT is currently trading near its 52 week low of $15.70 after falling almost 27% in the last month. Based on its most recent quarterly dividend ($0.65) and current share price ($15.79), forward yield is tempting at over 16%. We think NEWT is a dangerous value trap with a dividend that is likely to be cut. This analysis will focus on NEWT’s valuation with relation to peers, balance sheet & recent quarterly results; shareholder value creation & dividend history; dividend safety & payout ratio; and ratings & performance outlook.

Matrix Evaluation – NEWT & Peers

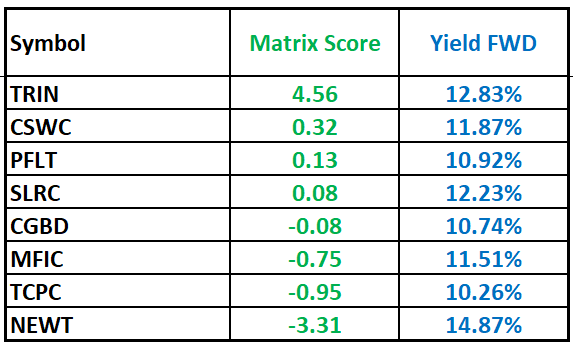

NEWT and seven peers with forward dividend yields over 10% were evaluated using a multifactor matrix. A higher matrix score indicates a superior investment relative to peers; NEWT scored lowest amongst its peers.

Matrix Scores

Authors

The matrix was designed and calculated by the authors with Seeking Alpha data and is available to download as an Excel file.

The matrix score is the sum of normalized factors for dividend yield, dividend payout ratio, EV/Sales, Price/Book, growth, and debt.

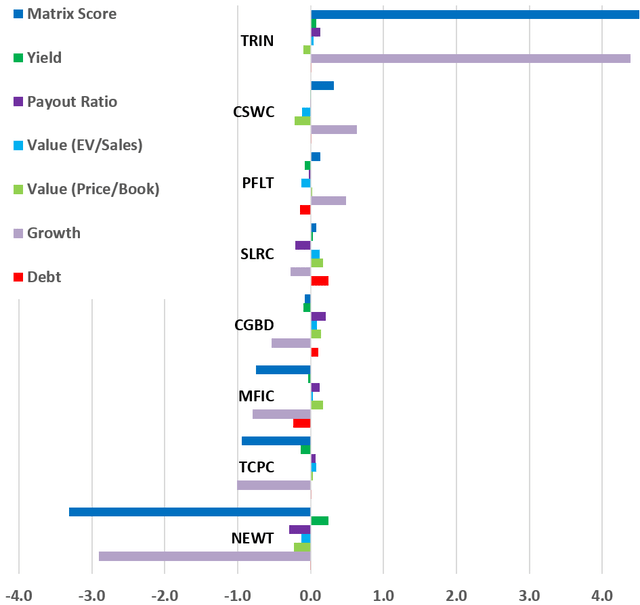

Matrix Bar Chart

NEWT matrix score of -3.31 was lowest with only one factor, dividend yield, comparing favorably with that of its peers. NEWT payout ratio, EV/Sales, and Price/Book were slightly less than the averages of its peers. NEWT growth was substantially less than the average of its peers.

Balance Sheet

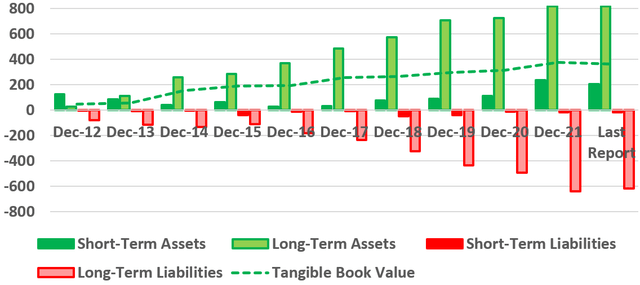

Balance Sheet: 2012 – Present

At first glance, NEWT balance sheet is not alarming with asset growth approximately matched by increasing liabilities over the last 10 years. However, recently, long term assets and tangible book value have stagnated while debt has expanded quickly.

2nd Quarter Revenues

NEWT’s most recent quarterly results are also worrisome with several alarming decreases from 2Q21 to 2Q22.

- Total investment income decreased 47.5% from $36.6M in 2Q21 to $19.2M in 2Q22.Total investment income decreased 47.5% from $36.6M in 2Q21 to $19.2M in 2Q22.

- Net investment income decreased 113% from $15.5M in 2Q21 to a loss of $2.3M in 2Q22.

- Adjusted net investment income decreased 37.5% from $27.0M in 2Q21 to $18.1M in 2Q22.

- Net asset value decreased $0.07/share from $16.38/share in 2Q21 to 16.31/share in 2Q22.

And finally a little good news, NEWT’s total investment portfolio increased 8.8% from $696.1 in 2Q21 to $757.1M in 2Q22.

Shareholder Value Creation & Dividend History

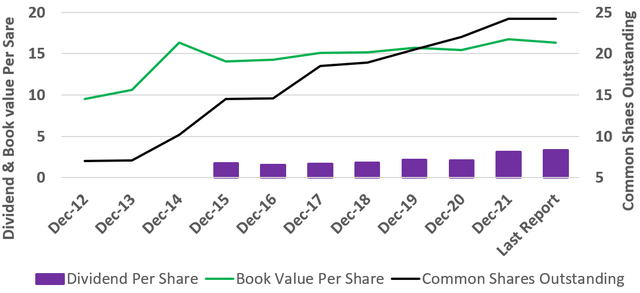

Dividend/Share, Book Value/Share, and Share Count

Over the last ten years, NEWT has increased book value per share over 70% from $9.50 to $16.31 per share while paying total dividends of $17.43 per share. More recently, book value per share has stagnated while shareholder dilution has increased.

10-Yr Price Return

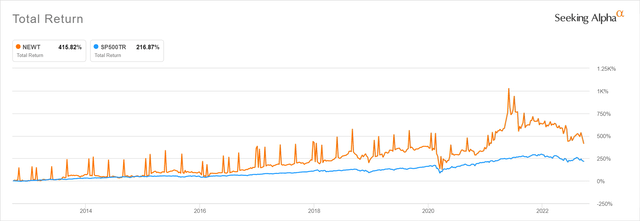

Over the last 10 years NEWT was a very good investment with total return of over 400% vs about 217% for S&P500. More recently, NEWT has underperformed even a falling S&P500.

1-Yr Price Return

Over the last year, NEWT total return of -27.64% has lagged the falling S&P500 by over 13%. The largest slide coincides with a broader slide in early June on inflation and jobs data news. NEWT also declined on August 9th following a second quarter revenue miss of $514K and 47% revenue decrease YoY. Recently, NEWT has declined more sharply than S&P500 on the latest Federal Reserve rate hike.

Dividend Safety

We think NEWT’s 15% forward yield, although tempting, makes NEWT a particularly dangerous stock to buy or even hold right now.

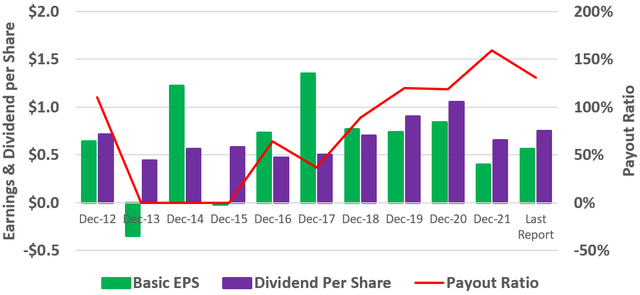

Dividend Payout Ratio

Over the last four quarters shown, NEWT has paid shareholders more in dividends than it has earned per share. Payout ratio was 159% and 130% in 4Q21 and 1Q22 respectively. Business development companies are allowed to avoid corporate taxes if they pay at least 90% of their annual taxable income to shareholders, but payout ratios above 100% are neither safe nor sustainable. In fact, NEWT recently cut its quarterly dividend by 13% from $0.75 to $0.65/share.

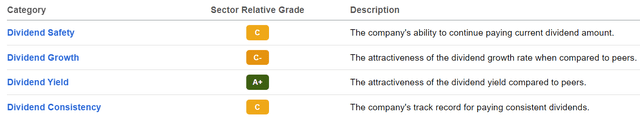

Seeking Alpha Dividend Grades – Relative to Financials Sector

Seeking Alpha dividend score card reflects the dangerous payout ratio. Although NEWT receives an A+ for yield, it receives relatively low scores for safety, growth, and consistency.

Ratings and Outlook

NEWT ratings by Seeking Alpha and by Wall Street analysts reflect recent poor performance and a less-than-encouraging outlook.

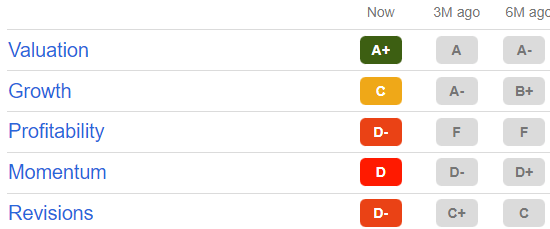

Seeking Alpha Factor Grades

Seeking Alpha

Currently, Seeking Alpha rates NEWT at hold with an A+ grade for valuation but poor grades on growth, profitability, momentum, and earnings revision. Most scores have decreased over 3 months and over six months.

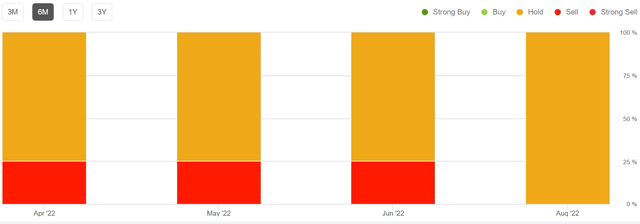

Wall Street Ratings

NEWT is currently covered by 4 Wall Street analysts with generally poor outlook for the stock. Recently, one analyst upgraded NEWT from sell to hold. Perhaps that analyst has concluded that NEWT is cheap enough. We disagree.

Conclusion and Recommendations

Based on a multifactor matrix, NEWT is an inferior investment compared to its peers. Although NEWT is near its 52 week low, we think it is still overpriced. The 15% dividend is unsupported by earnings with a recent payout ratio of 130% and a poor dividend safety rating from seeking alpha. NEWT’s most recent quarterly report was bad news on almost every front and recent stock performance has lagged even the falling S&P500.

Seeking Alpha and Wall Street analysts rate NEWT a hold; we feel like both are overly optimistic. We are convinced that NEWT’s dividend is precarious and in danger of being cut again with a resulting sell off and declining share price. Although NEWT has been an excellent investment over the previous 10 years, we feel like investors have suffered enough this year. We recommend that those investors who hold NEWT sell at current market price.

Do not seek to bring things to pass in accordance with your wishes, but wish for them as they are, and you will find them. – Epictetus

Be the first to comment