Paul Campbell

Thesis

In mid-June, when the stock market was trading at a similar valuation level as of now, the S&P 500 (SPY, SPX) surged by almost 19%. Reflecting on elevated levels of fear (1), rich implied volatility (2), and attractive valuations (3), I argue that an attractive set-up for a sharp bear market rally is forming.

A few weeks ago, I argued that investors should take advantage of the imminent sell-off by buying 95/85 percent moneyness put spreads. And since my pitch, the strategy has returned about 200%. Expecting once more a sharp move – but this time top the upside – I again advise to play the move through options spreads. In my opinion, the 105/115 percent moneyness CALL spread should provide investors with an attractive risk-reward.

Sentiment In Panic Territory

This weak, Citigroup’s Levkovich Index (formerly Panic and Greed Index) fell to negative 0.21. Readings below negative 0.19 are defined as panic territory and indicate a greater than 90% probability that the stock market will deliver a positive 12-month forward return. The Levkovich index is one of my personal favorite analysis tools and a highly reliable contra-indicator. The index reflects data including (Source: Citi Pulse Monitor)

NYSE short interest as a percentage of float, margin debt, TRF volume % of US tape, Market Vane and AAII bullishness, National Financial Conditions Nonfinancial Leverage, put/call ratio, CRB futures, gasoline prices, and 25 delta put/call skew.

Citi’s recording of panic sentiment reading is in line with Bank of America’s (BAC) investor survey, where 52% of respondents cited being underweight stocks and hording cash. According to BofA strategist Michael Harnett, investor sentiment is ‘unquestionably’ the worst since the financial crisis in 2008/2009.

Rich Implied Volatility/PUT Buying

In September 2022, the Financial Times reported that investors are buying record amounts of insurance against a market sell-off. As another reliable contra-indicators, such activity (frenzied buying of PUT options) has historically coincided with a bear market low, or at least a short-term bottom. As traders and investors bought about $34.4 billion worth of PUT contracts within only 4 weeks, options markets experienced the largest bear market insurance accumulation since the financial crisis.

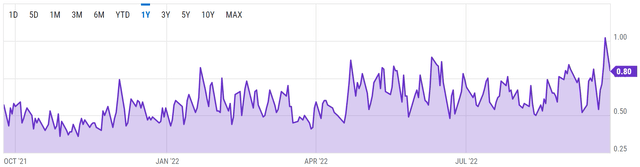

Accordingly, it should be no surprise that on September 23 the Chicago Board Options Exchange PUT/CALL ratio jumped to a fresh YTD high.

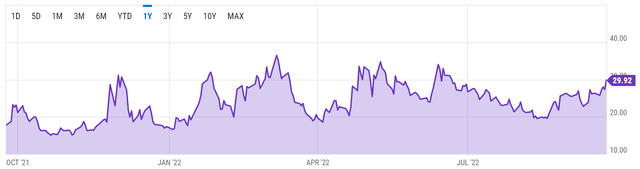

Similarly, the VIX index remains at elevated levels, reading 29.92 as of September 27.

Attractive Valuations

The sharp market sell-off has created a highly attractive environment for selective stock-picking. Bloomberg Intelligence reported that the number of stocks that are making new four-week lows now stands at 85.5%. This is highly notable and, if 2018 and 2020 can be taken as a reasonable reference, could precede a sharp rebound for the stock market. (Source: Bloomberg Intelligence Primer, S&P 500 as of September 2022)

Bloomberg also reported that more than half of the S&P 500 constituents have lost more than 20% of market capitalization as compared to their all-time-high valuations. And as a consequence, the number of stocks that now trade at a P/E below 10 has reached 21% (Source: Bloomberg Intelligence Primer, S&P 500 as of September 2022)

Reflecting on such a drawdown, I argue it is highly likely that bargain hunters will start to engage with the market – despite the macroeconomic headwinds – because valuations are seemingly too attractive to ignore. Investors should note that as of September 25, it is estimated that about $5 trillion of cash and money-market holdings is waiting on the sidelines, ready to rush into the market and buy the dip on improving investor sentiment.

Conclusion

Investor Takeaway

Betting on a sharp rebound during a structural bear market can be dangerous, because the line of least resistance for prices is undoubtedly lower. And given multiple macroeconomic challenges including a tightening monetary policy environment, there are good reasons why the market is selling-off. However, as outlined in this article, I believe there are also arguments to be made why the market might have found an intermittent bear-market low and could be vulnerable to a sharp upside move.

Trade Recommendation

Given the speculative nature of the thesis, I believe buying call spreads provides the best risk/reward for investors interested to trade the prospects of a bear market rally – given that the loss for call spread is limited to the options premium outlay. Personally, I advise to buy the 115/105 percent moneyness call spreads with about 3 weeks to expiration. The trade would offer a pay-off of approximately 4:1, if the S&P 500 closes above the long strike on expiration.

Be the first to comment