Ramabhadran Thirupattur/iStock via Getty Images

Some investors prefer a quality stock to remain cheap, as it gives them more opportunities for dividend reinvestment at low prices. However, it simply feels good to be validated by the market, after picking up on a number of shares of a value stock when it was cheap.

Such I find the case to be with Spirit Realty Capital (NYSE:SRC), which has returned 21% since hitting its 52-week low of $34.31 in October. In this article, I highlight why SRC remains a bargain at the current price for its high yield and low valuation, so let’s get started.

Why SRC?

Spirit Realty Capital is a self-managed net lease REIT that owns a large number of properties across the U.S. It’s made great strides in improving its risk profile since its current CEO, Jackson Hsieh, came on board in 2017, spinning off its lower quality properties and improving its balance sheet profile.

At present, SRC enjoys a high occupancy rate of 99.8%, and carries a diverse portfolio of 2,118 retail, industrial, and other properties across 49 states, and leased to 346 tenants in 34 diverse industries. SRC earns a solid reputation with its tenant base, as 77% of its recent deals were relationship sourced.

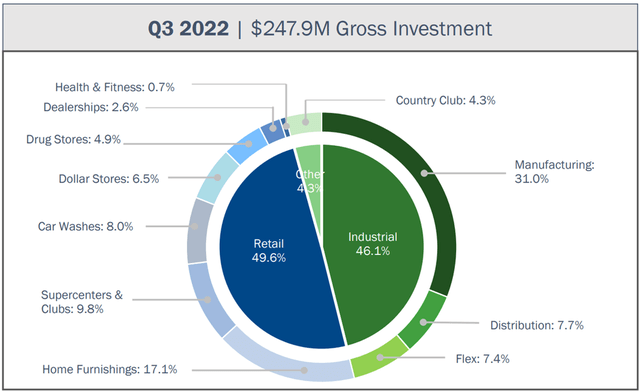

Also, while SRC generates the majority of its annual base rent from retail tenants, they mostly fit into e-commerce resistant categories. SRC’s recent quarter acquisition activity was focused primarily around the favorable demand vs. supply industrial segment, and essential / e-commerce resistant retail property types such as dollar stores, drug stores, car washes, supercenters, and home furnishings.

SRC Acquisition Profile (Investor Presentation)

Spirit Realty was able to source the 51 properties during the third quarter at an attractive 6.9% average cap rate and they carry a long weighted average lease term of 14.8 years. A part of the funding came from active portfolio pruning, in which 11 properties were disposed of at a cap rate of 5.7%, enabling SRC to take advantage of the investment spread between dispositions and acquired properties.

This, combined with annual rent escalators and lease spreads on the existing portfolio enabled SRC to achieve a respectable 7.1% YoY AFFO per share growth to $0.90. This apparently gave management the confidence to raise its quarterly dividend by 3.9% to $0.663. Importantly, SRC’s dividend payout ratio has improved from 78% last year to 74% at present, due to faster AFFO per share growth than dividend growth.

What this means for Spirit Realty is that it now has more retained capital with which it can use as an internal source of funding for acquisitions. That is perhaps a key reason for why management prefers to have a lower payout ratio in the current era of high interest rates, so that it’s not as reliant on external capital sources to fund its deal pipeline. Meanwhile, SRC maintains a strong BBB rated balance sheet with a reasonably low net debt to EBITDAre ratio of 5.2x (5.4x including preferred shares).

Looking forward, SRC continues to evolve, as management targets the industrial space with attractive deal profiles, as noted during the recent conference call:

As you will notice, the percentage of industrial acquisitions rose meaningfully since last quarter from 18% to 46%. And I anticipate that percentage to rise materially higher in the fourth quarter as the industrial segment is where we are seeing attractive sale leaseback opportunities. Many of our customers that operate light manufacturing, distribution and iOS facilities, need funding to meet their growth objectives.

Despite this favorable dynamic, we are being highly disciplined and selective in our pursuit of opportunities. And we believe pricing for these assets could become more attractive in the near to medium-term. To help fund these opportunities, we continue to pursue prudent asset recycling by disposing of smaller retail assets, where cap rates have proven stickier.

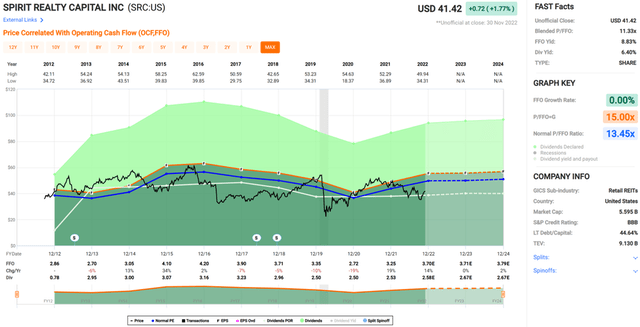

Turning to valuation, SRC remains undervalued at the current price of $41.42 with forward P/FFO of 11.2, sitting below its normal P/FFO of 13.5. Comparatively speaking, peer Realty Income Corp. (O) currently trades at a much higher forward P/FFO of 15.7. While Realty Income Corp. is undoubtedly a higher quality enterprise, I see the valuation gap as being too large. As such, I see potential for SRC to trade at least in the 13x P/FFO range, considering its strong balance sheet, quality and evolving portfolio, and steady growth.

Investor Takeaway

Spirit Realty has made smart strategic decisions to transition towards higher quality and e-commerce resistant property types, and has an increasing exposure to the industrial segment. It carries strong portfolio fundamentals and is well positioned to fund growth with its lower payout ratio and strong balance sheet. SRC remains undervalued while paying a well-protected and growing 6.4% yield.

Be the first to comment