David Baileys/iStock via Getty Images

As most of my followers know, I began writing on the Seeking Alpha platform in 2010, just as investors were thawing out of the Great Recession.

Prior to the recession I was working with a regional homebuilder in South Carolina, and although I wasn’t investing in many stocks back then, I was deeply involved in commercial real estate.

Like anything in life, some of the best ways to improve your chances of success is by learning from your mistakes.

I enjoy writing “lessons learned” articles because readers can gain valuable insight into my mistakes – some caused by me, and some caused by others.

First, let me recap the cause of the Great Recession, as explained by Jeremy Siegel (Stocks for the Long Run),

“The financial crisis that led to the severe 2008-2009 recession was caused by the overleveraging of real-estate related securities in the portfolios of key financial institutions.

This overleveraging was motivated by several factors: The decline in risk that took place during the unusually long period of financial stability that preceded the financial crisis, the mis-rating of mortgage-related securities by the rating agencies, the approval by the political establishment of the expansion of homeownership, and the lack of oversight by critical regulatory organizations.”

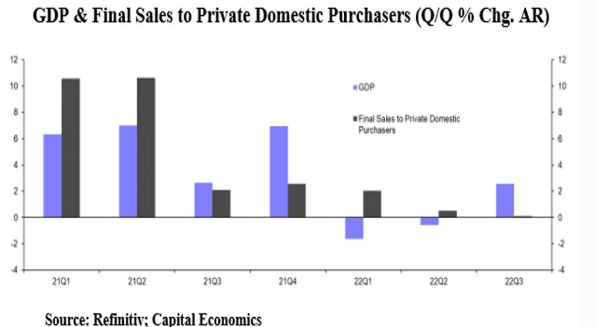

Many experts believe that we’re already in a recession, as the US already experienced two consecutive quarters of negative GDP growth, a common definition of recession.

However, the headline Q3 GDP report was +2.6%, driven by +2.8% in Net Exports, the domestic economy’s GDP growth was -0.2%.

I’ll let you decide if we’re in a recession right now…

Refinitiv

The chart above tells the real story about a weakening U.S. consumer (the black bars – note the lack of such on the right-hand side).

Services held up the best with vacations rising +6.3% (appears to be due to pent-up demand after two summers of COVID-related issues).

On the other hand, the purchase of goods was weak with durable goods falling at a -0.8% annual rate (-2.8% AR -0.7% in Q2) and non-durables down -1.4% (AR) (down three quarters in a row).

Alternatively, in 2008’s Great Recession, the following was the sequence of the quarterly GDP prints:

- Q1’08: -1.6%

- Q2’08: +2.3%

- Q3’08: -2.1%

- Q4: ’08: -8.7%

In the dot.com bubble bust:

- Q1’01: -1.3%

- Q2’01: +2.5%

- Q3’01: -1.6%

We find a similar pattern in the recessions of the ‘70s and ‘80s, which augments my reasoning that the recession is real, and investors should begin to prepare accordingly.

As I have said, I’m not fearful of a recession, and in fact, I’m actually rooting for one.

Why?

Because I’ve learned from my past failures, and I’m committed to not making the same mistakes again. While I know a recession is imminent, I’ve been preparing for the downturn by always reminding myself of the lessons that I learned in 2008, and of course, now I can share these with you…

Lesson 1: Don’t Use Too Much Leverage

Leverage is a necessary evil, especially if you’re a real estate investor.

When I started out as a young scrappy developer, most of my projects were financed with debt. In fact, I rarely put cash in a deal, always relying on banks or OPM (other people’s money).

Of course, this also means that I signed many personal guarantees, racking up close to $70 million in recourse debt to finance my dream of being a rich landlord.

The good news is that most of my deals were income-producing properties, so my guarantee was considered a secondary form of repayment.

I never considered a “black swan” type of event, especially in my younger years. I had no wife or kids, so I had very little life insurance and I traveled to job flights frequently via single engine airplanes.

(I’m not a pilot, but I used to date one.)

Simply put, I had a high-risk tolerance level.

However, the older I got, the more risk averse I became.

Over the years, I continued to rack up leverage and purchase several vacant properties (with no income). At some point, the banks were lending me large sums unsecured, and while I knew that was risky, I never imagined a black swan moment.

I can only imagine what my life would have been like had I maintained modest leverage prior to the Great Recession. I would have been worth at least $50 million right now, based on the equity value of my former real estate portfolio.

It took me over a decade to unwind the tangled partnerships (mostly LLCs) and to resolve my personal guarantees with lenders. I fought hard to avoid bankruptcy, and in hindsight, perhaps that would have been a quicker outcome.

The silver lining is that I have become extremely risk averse, and I will now always maintain low leverage. I have worked hard to build back a credit profile that’s now considered above average.

A large majority of my REIT investments are in blue-chip names like Realty Income (O), Simon Property (SPG), and Mid-America (MAA) – all A-rated REITs with fortress balance sheets.

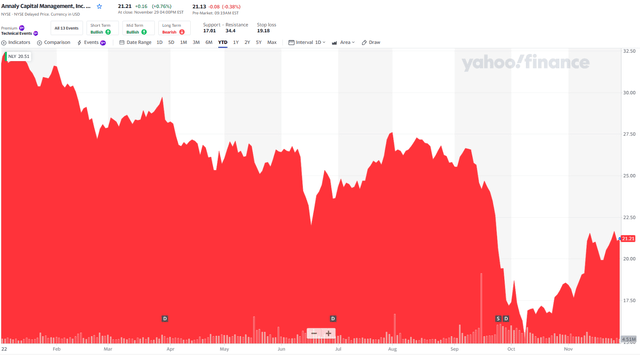

Alternatively, I have no interest in being a “hero” market timer and owning shares in mortgage REITs like Annaly (NLY) or AGNC (AGNC). These highly-levered alternatives are toxic and a first class ticket to the poor house.

Lesson 2: Don’t Put All Of Your Eggs In One Basket

Prior to the Great Recession my real estate portfolio consisted of around a dozen shopping centers and around 10 net lease properties, sprinkled in with a vacant shopping center (former K-Mart) and around 100 acres of land (and a 75 acre farm).

Most of the investments were retail and my former partner and I had one LLC in which he was the managing member.

When times got tough, I was not successful in leaving him (from the business), and in fact, he never provided me with K1s (he was the managing member) after 2004.

So, there I was, with a boatload of debt, and no way to get out of the partnership.

Simply put, I was strapped onto a sinking ship.

Most everything I owned was in one LLC with one business partner, who controlled everything.

This was my Black Swan.

These days, I stress diversification across:

- Investment Classes

- Property Types

- Geographies

- Business Partnerships

This has saved me hundreds of thousands of dollars…

For example, I avoided EPR Properties (EPR).

Prior to COVID-19 we downgraded to a SELL based in large part on tenant concentration and dividend safety. That wasn’t luck at all, it was intuition, recognizing that I lost millions of dollars by putting all of my eggs in one basket.

Likewise, I avoided getting burned with Washington Prime because I adhered to sound diversification. I recognized that the mall sector was challenged (long before COVID) and I didn’t want to have many chips on that speculative bet.

Today, my REIT portfolio consists of around 40 stocks, and I have continued to round out my pre-retirement portfolio with other high-quality dividend-paying stocks like Agree Realty (ADC), Digital Realty (DLR), American Tower (AMT), Prologis (PLD), STAG Industrial (STAG), Mid-America (MAA), and others.

Lesson 3: Don’t Chase Yield (Shiny New Toy Syndrome)

I know you’ve heard the saying, “what seems too good to be true, usually is.”

In my younger days, I wasn’t much of a skeptic, so whenever I saw something that was cheap, I never questioned why it was cheap.

If a good deal came my way, like the time I bought a portfolio of Alltel buildings (worth around $100 million).

Back in the good old days, Lehman Brothers was lending money like there was no tomorrow. My partners and I had a massive credit facility in which we were gobbling up net lease properties nationwide.

I was so excited to be a landlord to more than 20 Alltel-leased properties, but most of the acquisition was capitalized with non-recourse debt. This simply means, there was very little cash flow and I ended up with peanuts.

So, whenever I see high-yielding, highly levered REITs, I run.

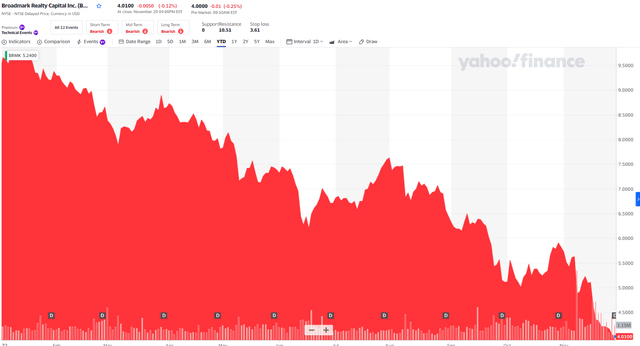

Members at iREIT on Alpha know that I ran from Broadmark Realty (BRMK) a few weeks ago. We downgraded from a Buy to a Sell based upon an unstable management team and dangerous payout ratio.

Yahoo Finance

Another good example is Annaly Capital. You may recall an article I wrote a few months ago in which I explained

“…whenever I see a dividend cut – even during a pandemic – I question whether management is allocating capital wisely. One mulligan isn’t necessarily the end of the world. However, when I see a chronic cutter,” I don’t walk away… I run!”

Yahoo Finance

Lesson 4: Cash Is King

One of the biggest mistakes in my investing career (that spans three decades) is not having enough cash.

Prior to the Great Recession, I was living on leverage, and I never needed much cash. The banks were feeding my development appetite and giving me practically anything I wanted.

However, when the music stopped playing, it got ugly…

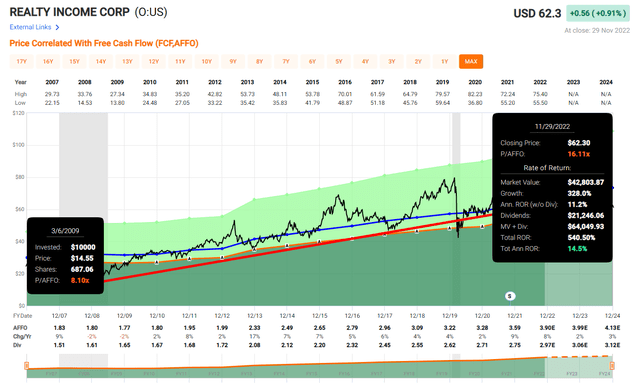

If I had $1 million in cash back in 2009, I could’ve built a fortress of dividend-paying stocks that would be worth well over $6.5 million today.

FAST Graphs

I used this example of Realty Income (O) to demonstrate that had I bought $1 million in Realty Income stock, I would be sitting on annual returns of 14.5%.

Folks listen to me…

I provided you with my playbook, which means you’re getting decades of experience, and trust me when I tell you that 2023 is going to be my version of 2009, with one major difference…

I understand the meaning of cash is king!

In case you didn’t know, I’m scooping up REITs and other dividend-growth stocks in record numbers. And I plan to retire wealthier than I ever imagined, simply because I now know the rules of the game.

It took some serious adversity for me to come out of this with a newly-trained brain that understands the laws of discipline. As I tell my friends back home, I’m not the old Brad Thomas…

I’m a new version of me – aka Brad Thomas 2.0 – “better, stronger, faster”…and my entire financial blueprint can be summed up on one simply word:

discipline.

So, I hope you enjoyed my article, and while I’m not rooting for job losses, foreclosures, or financial stress, I’m rooting for a recession, because I’m prepared for it…

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end we could count great compensations.” Benjamin Graham

Be the first to comment