VanderWolf-Images/iStock Editorial via Getty Images

In the airline industry, we are currently seeing a bullish layer that could propel the financial performance of airlines higher. Those are the continued strength in air travel, international markets reopening, and supply chain challenges and staff shortages keeping supply limited. At the same time, we are seeing caution due to expected economic cooldown as a result of high inflation and energy prices as well as labor shortages, which are also putting a damper on financial performance already. In China, we are seeing something entirely different in terms of financial performance, as I will discuss in this report about China Eastern Airlines Corporation Limited (NYSE:CEA).

Green Light, Red Light Recovery in China

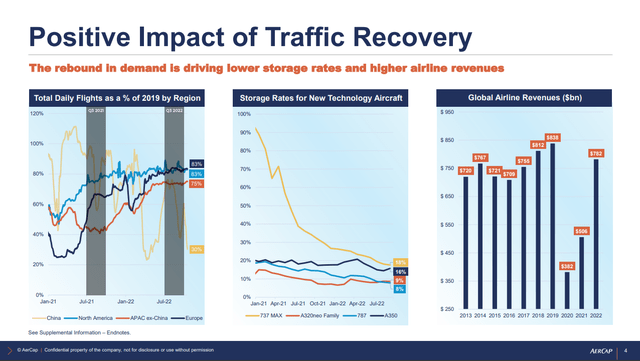

Recovery profile air travel (AerCap/The Aerospace Forum)

The reason for the performance in China to diverge from the rest of the world is visible in the slides that AerCap provided during its earnings presentation, which I previously have analyzed. In general, we see that the recovery in China is much more volatile. Whereas the trend in other key markets has a clear direction, in China the recovery is much more volatile and choppy driven by rapid openings and closings due to the zero-COVID policy. In Q3 2021, we saw that flight activity was almost fully recovered to 2019 levels, but dipped to the slightly below the 60% level, and in Q3 2022, flight activity was lower than a year earlier, with 75% of the flight activity recovered at some point before dipping to slightly below 40%. That is hurting the airlines in China, setting them up with steeper losses and year-over-year declines contrasting strongly with other key markets.

International travel to and from China has largely been subject to strict rules holding back international recovery, making Chinese airlines more dependent on strength in the domestic market. Due to the rapid closings and openings in the domestic market, that strength was simply lacking.

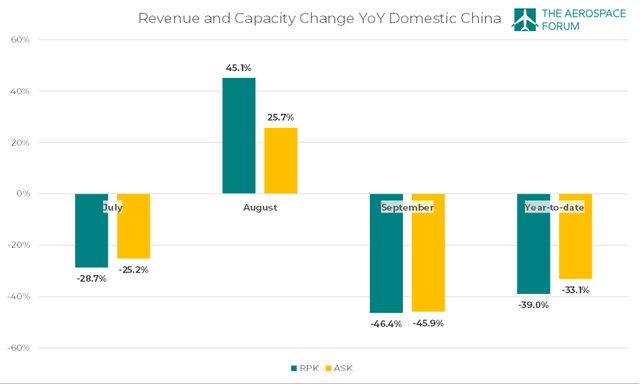

Capacity and RPK in domestic China (The Aerospace Forum)

Monthly IATA data also shows that, year-over-year, there has been significant pressure. In July, capacity was down 25%, and revenue-passenger-kilometers were down 29%. This shows that there was no particular strength in unit revenue, either, and in September the drop was even higher, with a 46% decline in capacity and roughly the same decline in revenue-passenger-kilometers (“RPKs”). August was the positive outlier, with a 26% capacity increase year-over-year and strength in unit revenues, but this increase was mostly driven by timing of a closure last year. Year-to-date, we see that the Chinese market is suffering with a 33% capacity cut and a higher reduction in RPKs, indicating softer unit revenues.

China Eastern Airlines Results Reflect Closures And Higher Costs

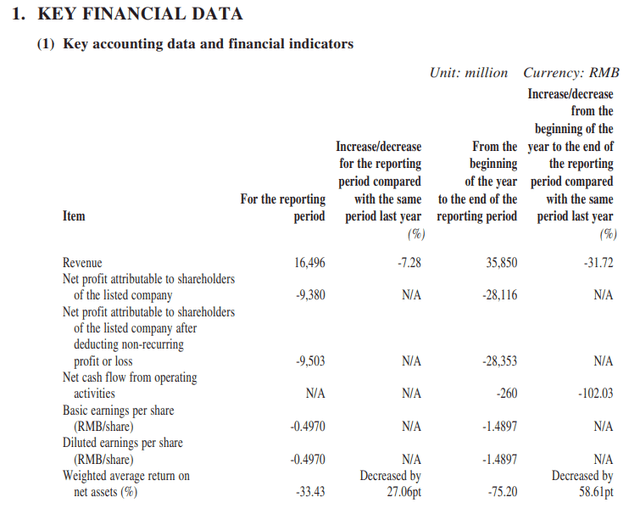

China Eastern Airlines Q3 2022 results (China Eastern Airlines)

A detailed report for the third quarter of 2022 has not been filed yet, but revenue declined by 7.3% driven by the reduced demand for air travel during the quarter. Year-to-date, the reduction was 31.7%, which is better than the reduction in RPKs for the domestic air travel market. Adjusted loss was 9.5 RMB billion compared to a 3 RMB billion loss a year earlier, and year-to-date figures show a loss of 28.4 RMB billion loss compared to a 8.7 RMB billion loss a year earlier. The increase in losses was higher than the drop in revenues, indicating that costs rose significantly as well. Just like with other airlines, the obvious reason for that cost increase was higher fuel prices.

Risks and Opportunities for China Eastern Airlines

China Eastern Airlines faces two prime risks. The first one is the risk of lower demand for air travel due to reduced economic growth, both globally as well as within China. That is a risk that other airlines face as well. The risk particular to Chinese carriers is the way rapid closures due to COVID-19 infections result in significant airline service disruptions. In particular, closures for Shanghai can hurt China Eastern Airlines the most.

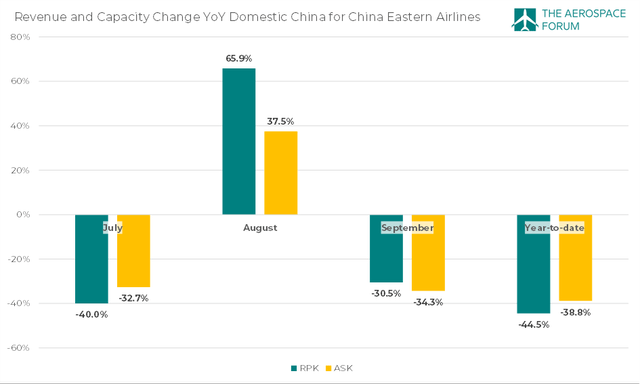

Capacity and RPK for China Eastern Airlines (The Aerospace Forum)

This is also demonstrated in the cuts in capacity and the RPK, which have been steeper during the closures for China Eastern Airlines. However, from the graph we see one of the two opportunities as well. When the markets do reopen, China Eastern Airlines shows stronger capacity increases, with even stronger improvement in the RPK. That, without doubt, is related to the hub they have in Shanghai. Additionally, China is looking to facilitate more international flights, doubling from the same period a year ago due to the social and economic importance of international traffic. This should provide a big boost for China Eastern Airlines.

Conclusion: Risks Make China Eastern Airlines Stock A Hold

The results that China Eastern Airlines booked largely display top line decline due to rapid closures to battle COVID-19 in China without much regard for the impact it has ha on businesses as well as cost pressures from higher fuel prices.

At the same time, with international flights expected to double, there is a huge opportunity for China Eastern Airlines to benefit from this with Shanghai as an important hub. As a result, I do believe that shares of China Eastern Airlines are at least a hold and at most a speculative buy with the main identified key risk for a sustained recovery of airlines being the zero-COVID-19 policy that hasn’t shown to be the most effective.

Be the first to comment