georgeclerk

Thesis

United Bancorp, Inc. (NASDAQ:UBCP) is growing its topline, but the bottom line is suffering. The group have recently rebalanced their portfolio to benefit from the coming high inflation high-rate environment, which is expected to bring significant benefits to the company in the near future. Still, at the moment, income tax has fallen slightly, and the company is marginally overpriced. Despite this, future prospects are positive, so we recommend holding.

Intro

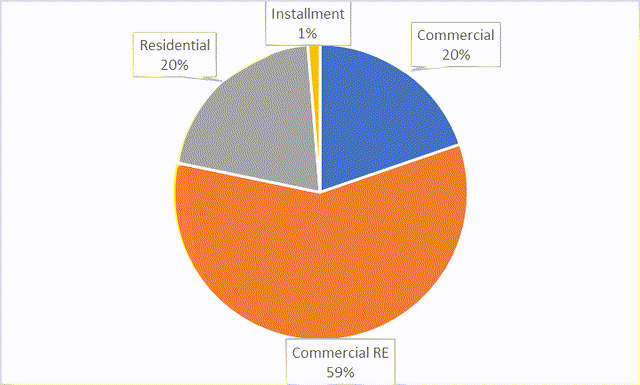

UBCP is a community bank that provides commercial and retail banking services in Ohio with a strong presence in commercial, commercial real estate, and residential loans (see portfolio split displayed below)

SEC

(Source: SEC Filings)

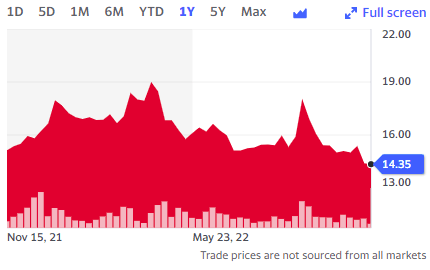

Despite a strong environment for the banking industry (higher interest rates), UBCP’s share price has dropped around 6% in the past year, currently sitting at around $14 USD

Yahoo Finance

(Source: Yahoo Finance)

Financial Analysis

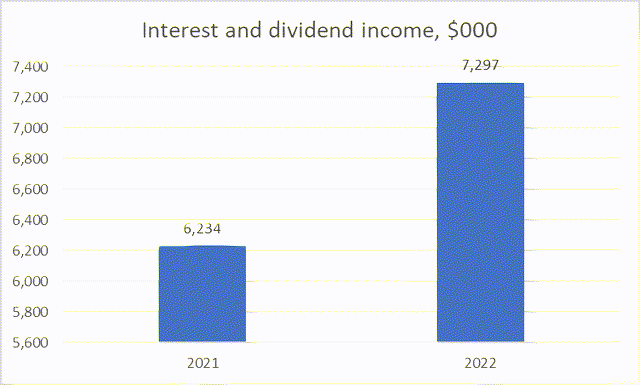

Despite the poor market performance, UBCP has a strong P&L and Balance Sheet. Interest income for the past 3 months ending September grew to almost $7.3m, up 17% over the past year, which has been driven by higher-yielding investments thanks to a balance sheet rebalancing earlier this year.

SEC

(Source: SEC)

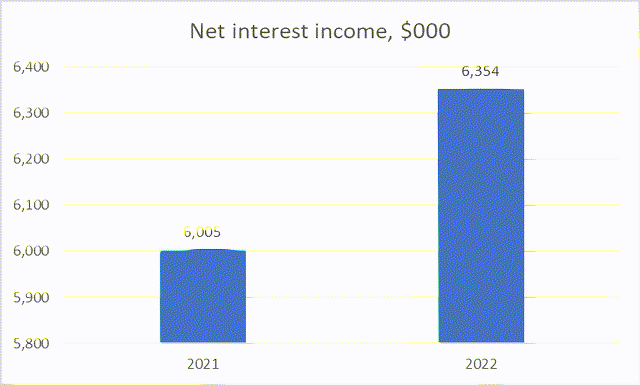

While top-line interest income grew by 17%, net interest income only grew by 6% due to an increase in both interest expense and provisions. Net interest income reached $6.3m in the quarter.

SEC

(Source: SEC)

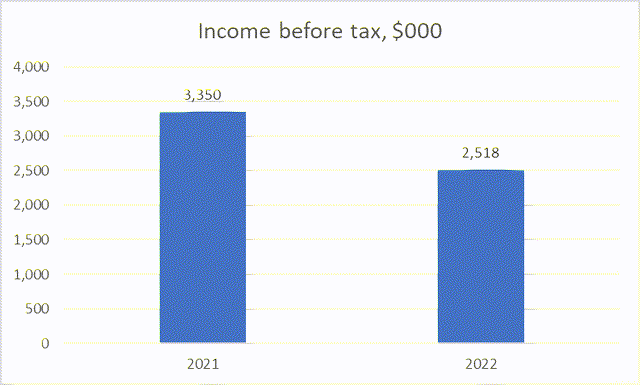

Unfortunately, this growth didn’t trickle down to the bottom line. Non-Interest income dropped -54% in the period (due to lower bank-related fees, such as mortgage origination income) and non-interest expense remained stable (due to higher inflation that led to higher levels of staff-related expenses from high wages, tight labour market, and incentive pay-outs), which led to a decline in income before tax of -25%, reaching $2.5m at the end of the quarter.

SEC

(Source: SEC)

Overall, it resulted in a decline in EPS from $0.50 to $0.40. Despite this, we believe the future looks bright for UBCP.

Balance Sheet Improvements

The company previously had a very cash-intensive balance sheet and could not put it to good use and earn reasonable yields. The current high inflation high-rate environment is changing this. More recently, the company managed to adjust their balance sheet by changing the mix from low-yield cash investments to high-yield long-term loans and securities, especially within municipal and agency securities as long-term yields have risen to much higher levels compared to the past several years, compared to a previously cash-intensive balance sheet. They have successfully managed to put cash to good use. Therefore, the balance sheet has grown to $761m, a 4.2% increase over the previous year, driven primarily by growth in gross loans. These changes have led to an improvement in the net interest margin by 6 bps to 3.6%, equity assets to 7%, and shareholders’ equity to $52m.

By rebalancing the balance sheet, the company should benefit in the near future, now generating higher levels of the net interest income (after a brief slowdown recently). As assets are rebalanced into higher-yielding items, the net interest margin should continue to improve. Furthermore, the benefit of these higher-yielding assets is that they are tax-except investments, so the company should see greater tax efficiency going forward

Valuation

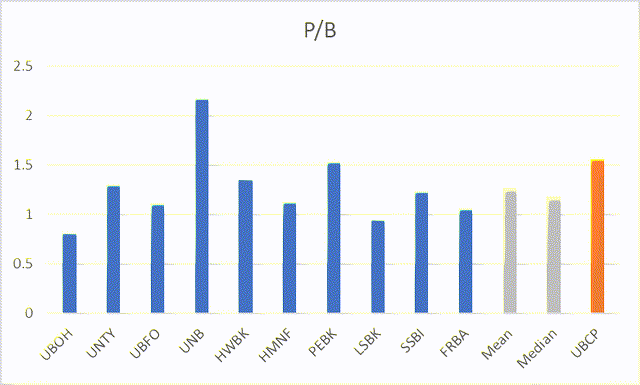

If we collate a peer group of comparable regional and community banks, we can compare valuations on a P/B methodology.

Yahoo Finance

(Source: Yahoo Finance)

Peers on average have a P/B ratio of around 1.25x, whereas UBCP is priced at just over 1.55x. Given that there aren’t many factors that give UBCP a premium compared to peers, especially as profit margins are roughly in line, one could argue that UBCP is slightly overvalued, and can expect a potential downside of around 20% or more from current prices.

On the other hand, taking into account the discussion above, UBCP could see share price increases if their portfolio rebalancing is a significant success and the higher yield investments bring a substantial increase in interest income, especially if operating expenses remain stable. An improvement in the top line from interest income is likely to trickle down and improve overall profit.

Risks

- One risk is if the higher yield assets that the balance sheet has now shifted towards are not as good quality as we expect, and the increase in return is as not as great as expected. This would be the case if rate rises were to stop happening, but this risk is low given that inflation is substantially high at this moment and rate rises are expected to continue through 2023.

- A second risk is if non-interest income could continue falling and non-interest expense could continue rising. Given that non-interest income is bank-related fees such as mortgage origination in a high inflation high-rate environment where mortgage demand is low, and non-interest expense is operating expenses, such as staff costs in a wage inflation environment, these risks are more likely, and could potentially wipe off a large portion of the margin.

Conclusion

Overall, it very much depends on the performance of the new rebalanced balance sheet if the new investments made come to fruition and lead to an improvement in interest income. Based on current pricing, UBCP is slightly overvalued compared to peers on a P/B basis. But on the other hand, the balance sheet and investments have improved over the past several months which will lead to improvements in income in the near future. It is whether this is priced in or not, and the performance of these securities will decide if UBCP are at a fair valuation or not. Right now, we could argue that they may be fair valued or maybe slightly overvalued, so we do not necessarily recommend a buy, a better idea would be to hold until we see some material gains from the rebalancing.

Be the first to comment