jetcityimage

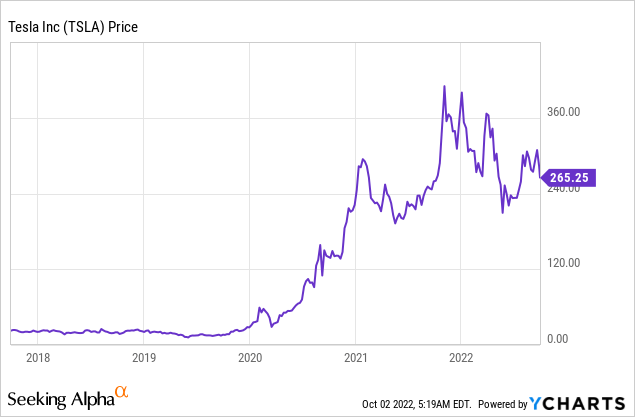

Tesla (NASDAQ:NASDAQ:TSLA) is one of the world’s largest electric vehicle makers, and a pioneer in self-driving technology. The company recently announced a spectacular AI Day with robots and supercomputers galore. The introduction of a robot for mass production has expanded Tesla’s total addressable market. The company is already poised to spearhead trends across Electric Vehicles, Solar Energy, Battery Storage, and more. In this post, I’m going to break down Tesla AI Day and input the financials into my valuation model. Let’s dive in.

AI Day Unpacked

Elon Musk is one of the greatest entrepreneurs of our time and a true showman. Although, he isn’t as elegant in his speech as someone like Steve Jobs, his humor, humbleness, and large vision make up for this by captivating customers and investors alike.

Optimus the Robot

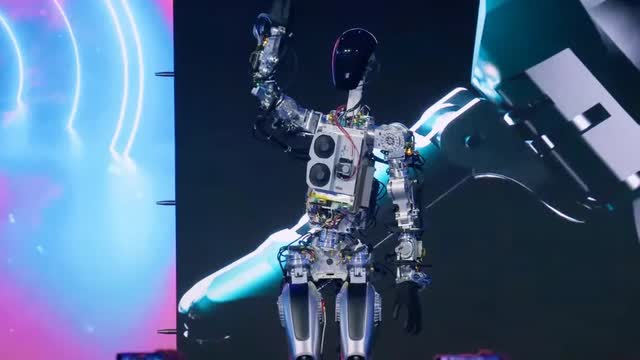

Tesla AI Day is the perfect platform for Elon Musk and Tesla to showcase its latest and greatest new technology. This AI Day had been particularly interesting as Musk announced they were building a “useful robot” called Optimus at the last AI Day in 2021. Musk followed through with his word and revealed a “humanoid” style robot that slowly walked about before waving to the crowd.

Musk was careful not to make the robot do any challenging tasks, as it is still a prototype and he didn’t want to embarrass Tesla if the robot fell “flat on its face”. However, Musk did show videos of the robot actively helping in Tesla offices, picking up parcels, and doing small tasks.

Tesla Robot Optimus (Tesla AI Day)

Robotics may seem like a major leap for a “car maker” but the robot actually uses the same full self-driving computer as the Tesla vehicle. In addition, Musk says that we as humans have just “two cameras”, our eyes, which are connected on a “slow gimbal”, which is our head. Then this sensory information is fed back to a biological neural net, which is our brains. Thus, Musk reasons that a robot with eight eyes, or cameras, 360′ vision, a powerful neural net, and a more powerful processor could do many tasks we humans do “better”.

Elon Musk envisages the robot to be able to do many “useful tasks” from helping out in a manufacturing plant, to home tasks, and even being able to drive a truck, although I am guessing the self-driving technology will take care of that. Elon also made a humorous joke that people will find all sorts of “creative uses” for the robot longer term and even hinted at “cat girl” version next.

Tesla Optimus Parcel (Tesla AI Day 2022)

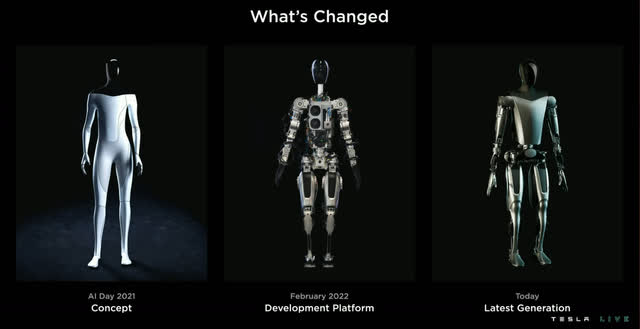

Critics have cited that there are many long-established competitors in the robot arena, from the high-tech Boston Dynamics, which has a robot that can do backflips, to ASIMO by Honda, and even a humanoid robot by Agility Robotics which looks very similar to Tesla’s AI humanoid robot. Although these are all more advanced robots than Tesla’s right now, Musk has designed his robot for “mass production”. Thus, this isn’t just “prototype/concept” robot which has no connection to the real world, Musk believes this robot could be available to purchase for “less than a car”. He thinks it could cost the average person or company approximately $20,000 and be available to order and receive within “3 to 5 years”. Although we do know Musk has been optimistic on timescales in the past, given Tesla’s substantial market capitalization of over $830 billion and strong balance sheet, I think it would have made sense for Tesla to try to acquire a competitor such as Agility Robotics in order to speed up its technology development process. For example, Amazon (AMZN), which is also building a home robot, recently announced a $1.7 billion acquisition of iRobot, which is a robot vacuum cleaner company. However, I do understand why Tesla has built everything in-house as they have leveraged similar components to its vehicle.

Optimus Models (Tesla AI Day 2022)

Elon Musk also has the uncanny ability to generate excitement both from customers, investors, and partners. Many companies have been developing robots for years and it wasn’t really mainstream news. But when Musk announces a technology, the world listens, and given his financial firepower, he can make it happen.

Full Self-Driving Updates

Full self-driving technology could change the world as we know it. This technology could create a “third space” for people to work from or enjoy leisure time. In addition, the technology could disrupt the entire automotive industry, in addition to ridesharing, delivery, and even the railroad. Currently, Tesla vehicles are equipped with a driver assistance feature which they call “Autopilot”. Customers are then encouraged to pay $15,000 extra to purchase “Full self-driving” which Musk promises will one day be fully autonomous, after which the price would likely increase, and thus Musk has created a stark value proposition for customers. Buy the full self-driving software now and lock in the lower prices. Currently, most Teslas have “level 2” self-driving which means drivers must be engaged.

Tesla full self-driving (Tesla/Teslamania)

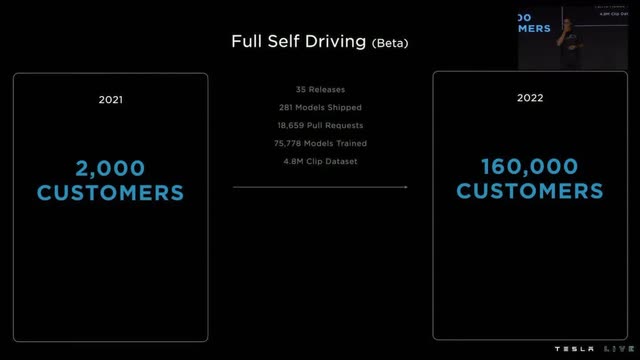

To win the self-driving battle, big data is king and Tesla has one of the largest self-driving data sets of any company on the planet. With over 2.3 million cars sold by the end of 2021 and a further half a million units sold in 2022 as of the second quarter, Tesla leverages its fleet of vehicles to continually gather data with its cameras and allow users to opt into “beta” versions of its self-driving software, which many do. For example, in 2021, Tesla’s full self-driving had just 2,000 users on its beta program, whereas it now has over 160,000 drivers online. This technology is only active in the US and Canada currently due to regulatory issues, but he does expect to expand this globally by the end of the year. The beauty of Tesla’s system is once they do crack fully autonomous driving, it can be rolled out instantly with a software update. This means Tesla will not need to again sell “self-driving” vehicles as there is already a fleet ready to turn into robots on the road.

Tesla Self Driving (Tesla AI Day)

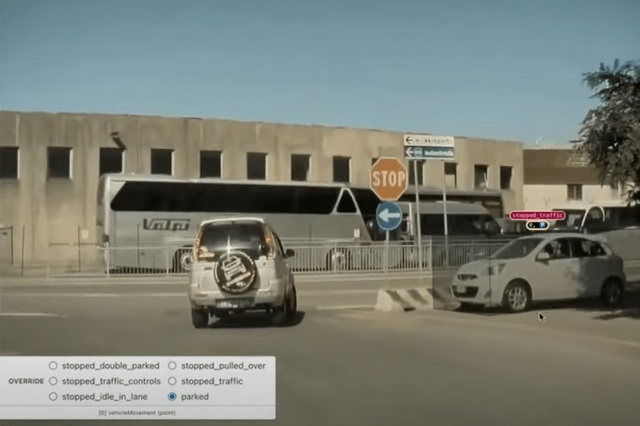

On Tesla AI Day 2022, Tesla engineers presented how the full self-driving technology is now dealing with challenging edge cases when driving. For example, if you pull up to a crossroad and there is a parked vehicle on the corner. This edge case would even cause initial confusion for many human drivers, as the car looks as if it is about to pull out, but on closer inspection, it is clear there is no driver. In order to improve the self-driving system, the engineers search for many similar cases and then tag them with the correct label using computer vision technology.

Tesla self-driving edge cases parked car (AI Day)

Other challenging conditions for self-driving vehicles are the ability to operate at night, in fog, and during torrential rain. Google’s (GOOG) (GOOGL) Waymo has historically struggled with rainfall which is why its vehicles have been initially rolled out in Arizona.

Tesla has also increased the speed its cars can make decisions from milliseconds to 100 microseconds, which is 10 times faster than previously. In theory, a computer should be able to make decisions faster than a human, and it doesn’t get tired or emotional like us.

Dojo Supercomputer

Tesla trains its full self-driving technology with its Dojo supercomputer platform which is three supercomputers tied together. This platform is so powerful that it even tripped the power grid in Palo Alto during a test.

Dojo has a staggering 14,000 Graphical Processing Units [GPUs], with 10,000 of these for training data processing and another 4,000 for labeling. It is believed these GPUs are NVIDIA-based, which is a nice data point if you are an investor in NVIDIA (NVDA) stock; I have previously written an analysis here.

The company also announced that it may sell “compute time” on its Dojo supercomputer similar to Amazon Web Services. This offers more upside for the company given the global Artificial Intelligence [AI] market was worth ~$60 billion in 2021 and is forecasted to grow at a blistering 39.4% CAGR, reaching a value of $422 billion by 2028.

Tesla has built out a “neural network” which is a computer system modeled on the human brain in order to identify lanes of traffic. However, the company wishes to take things much further, but expanded it to more complex use cases when driving, such as multiple lane crossing.

Metaverse?

The fleet of Tesla vehicles on the road feed their camera video feeds back to a Tesla data center which has approximately 30 petabytes of stored footage, which is astonishing. Tesla has even created a realistic-looking simulator of roads in San Francisco with the Unreal gaming engine. This enables autopilot software to train in the video game, before being rolled out via a software update. This simulation could also be leveraged in other ways and as really this is the “Metaverse”.

Tesla Unreal Simulation of SF (Tesla)

Advanced Valuation

Tesla is an incredible company with many competitive advantages from brand to technology and even its culture/talent. However, the stock has notoriously been “overvalued” and criticized by many. The interesting thing is many critics have not actually valued the company or have just used a very simple metric like a price-to-earnings ratio. Thus, in order to value Tesla more accurately, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation.

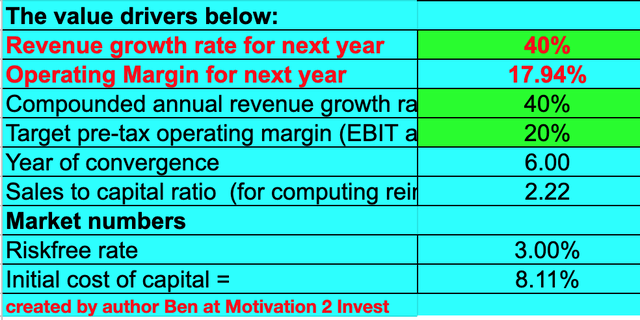

Tesla generated strong second quarter revenue with $16.93 billion generated which beat analyst estimates by ~$2 million and popped by 42% year over year. Given these previous growth rates and factoring in analyst estimates of a 55% CAGR for revenue, I have forecasted 40% revenue growth per year for the next 1 to 5 years.

Tesla has now finished the construction of its Shanghai factory and is now expected to spearhead with world’s largest EV market, China, with 22,000 vehicles per week in production by the end of 2022. If we combine this with the Fremont factory production of 600,000 cars per year and with Berlin and Austin ramping up, management expects a record 1.5 million units by the end of the year.

Tesla stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted Tesla’s operating margin to increase by a couple of percentage points to 20% over the next 6 years. I expect this to be driven by the increase of Tesla’s higher-margin software capabilities and upsells from other products from Solar Roofs to energy storage equipment. Note, this margin also includes an adjustment for R&D expenses which I have capitalized.

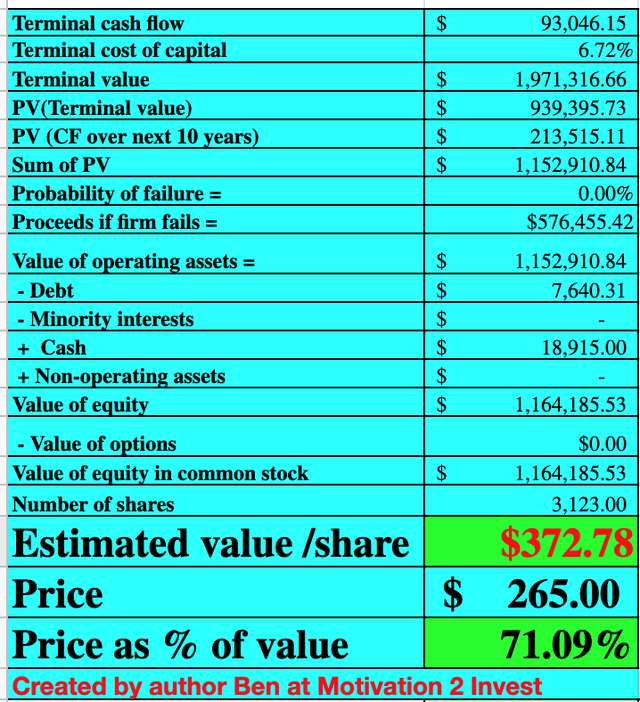

Tesla stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $372 per share. The stock is currently trading at $265 per share and thus is ~29% undervalued. Keep in mind, this doesn’t include the huge upside, of Robotics or even global autonomous driving and its many use cases. I consider those technologies to be optionality in the stock and help to mitigate the potential risk of a competitive EV market.

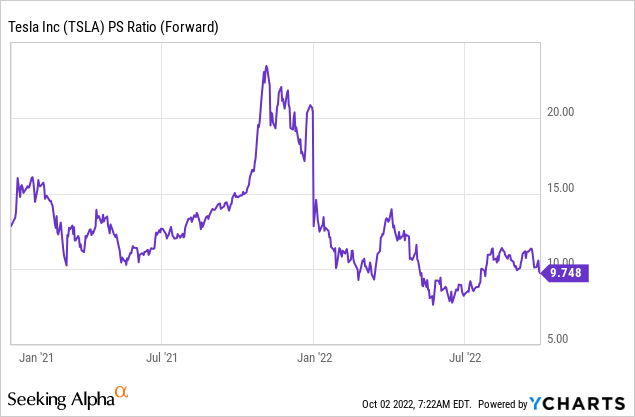

As an extra data point, Tesla is trading at a Price to Sales Ratio = 9.75, which is 23% higher than its 5-year average, but I believe this metric is skewed by pre-2020 multiples. Tesla is in a much stronger position today with its extensive manufacturing built out. In addition, Tesla is now profitable with $2.5 billion in operating income generated in the second quarter and over $10 billion in the trailing 12 months. The company is also part of the S&P 500 and has a solid balance sheet with $18.9 billion in cash and cash equivalents in addition to $6.6 billion in total debt.

Risks

Elon Musk Distractions

Elon Musk is an incredible entrepreneur and arguably the greatest inventor of our generation. However, like many people with an active mind, Elon Musk seems to get himself caught up in many unnecessary battles and projects. From the botched acquisition of Twitter (TWTR) to Bitcoin (BTC-USD) and even Dogecoin (DOGE-USD). Musk is already running rocket company SpaceX (SPACE), Neuralink, the Boring Company, and Tesla. He also finds time to share memes on Twitter regularly. Now I’m not knocking Musk as so far, his juggling act is working well, but he is only human. I believe investors would sleep better at night if Musk focused purely on a single company. Solving the world’s transition towards renewable energy through EVs would be a tremendous feat in itself. If Musk also cracked fully autonomous driving, that would be another global achievement for humanity. Does he really have time to reinvent social media with Twitter or even solve the financial system with crypto?

EV Competition

Tesla was a true pioneer in electric vehicles and they sparked the imagination of millions of customers and competitors. In China, we have some very similar “Tesla-style” vehicles such as NIO (NIO) and even XPeng (XPEV). Salespeople in China even run live events with an XPeng vehicle and Tesla side by side, where they point out the advantages of XPeng over Tesla. We also have Buffett-backed BYD (OTCPK:BYDDF), which recently overtook Tesla as the world’s largest EV maker after record orders. Then we have Amazon-backed Rivian (RIVN) and even Lucid Motors (LCID). This is not to mention incumbents such as global automakers such as Toyota (TM), Volkswagen (OTCPK:VWAGY), and even GM (GM), which are investing heavily into EVs. For example, Ford (F) is planning to spend $50 billion on its EV models up until 2026 and plans to produce 2 million EVs annually by the end of the period. Ford manufactures the F-150 pickup truck which was the most popular vehicle sold in the US in 2021 and has recently announced an electric vehicle version.

Final Thoughts

Tesla is a tremendous company and a true technological powerhouse. Many companies say they are “building the future” but Tesla actually is. I am continuously amazed by Elon Musk’s ability to execute at speed, whether it be building a humanoid robot within a year or building out a plethora of gigafactories globally. This is a strong positive of Tesla being a founder-led company, decisions don’t get stuck and slow down by laborious committees and unnecessary friction. Tesla is going from strength to strength and the recent AI Day announcements have only heightened the upside potential for the future.

Be the first to comment