Spencer Platt/Getty Images News

Investment Thesis

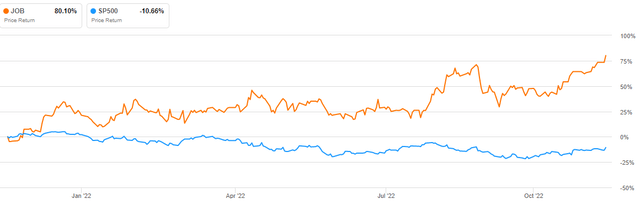

GEE Group, Inc. (NYSE:JOB) is a U.S.-based permanent and temporary placement service provider for the professional and industrial sectors. Human Resources being one of the adversely affected sectors by Covid 19, the company seems to be flourishing post-pandemic. It has been on an upward trajectory since December 2021, outperforming the market with a margin of over 90%. The stock is currently trading at $0.80 per share, which is its 52-week high.

Increasing demand for human resources in the post-pandemic revival of the U.S. economy bodes well for the company’s future growth and profitability. Alongside the growing demand, the firm enjoys a diverse client base ranging from SMEs to fortune 500 clients.

According to the relative valuation metrics, the company is significantly undervalued, offering a cheap entry point to potential investors. I am bullish on the stock given its growth potential and diverse client base, but investors should be wary of the potential risks of venturing into this investment. Inflation affecting the labor market and the company’s potential liability in contractual breakdowns are among the risks.

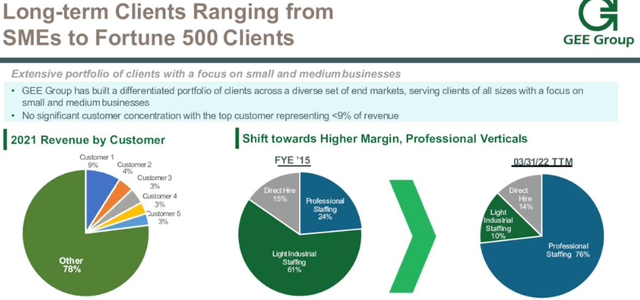

Diverse Client Base

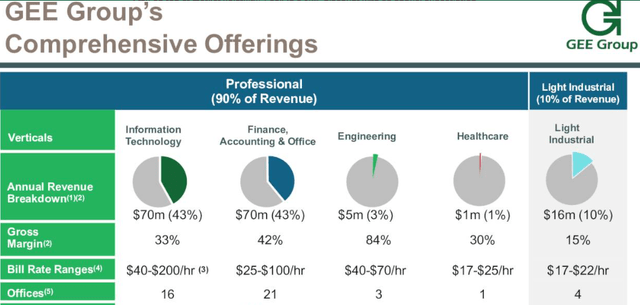

JOB has amassed a varied clientele across several markets, and while its primary concentration is on SMEs, it serves businesses of all sizes.

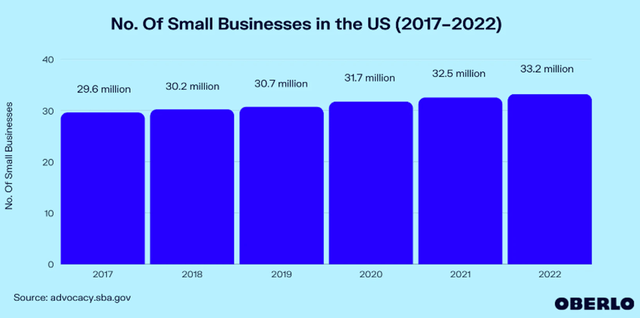

Small and medium-sized businesses (SMEs) are essential to the health of the American economy and the economies of the other TPP members. The over 28 million American SMEs have created nearly two-thirds of recent net new jobs in the private sector. It’s fascinating to see how the SME population has been rising steadily since 2017. These statistics indicate not just a large but also expanding consumer base for the business.

Despite employing fewer than 100 people, small firms have produced millions of employments in recent years. About half of the American labor force now works for small businesses, totaling 61.7 million people.

SMEs being the backbone of the USA economy explains why JOB mainly focuses there. In my view, it is a noble idea considering the high number of employees needed in that sector which forms almost half of the total number of employees. It is a growing sector that tells us the future is bright for this company.

There is no doubt that these small enterprises are dispersed across several industries that require distinct specialties. JOB has a vast and diverse service portfolio to accommodate this diversity, enabling them to compete in the diverse labor market effectively. The diversity allows for them to optimize profits and satisfy various client wants.

Source: Seeking Alpha

Post-Covid Growth and Profitability

After about 22 million jobs were lost in two months in the spring of 2020 due to the COVID-19 pandemic, the labor market has rebounded significantly faster than most had projected in the two years since the pandemic’s upheaval. According to Michelle Bowman, governor of the Federal Reserve, demand for labor remains strong, but supply is constrained. It is due to these strong demand and supply shortages that have led to JOB’s growth. They credit the high worker demand for contributing significantly to their company’s rising revenue.

Kim Thorpe,” Contract staffing services revenues increased by $0.6 million or $600,000 and $8.7 million, or 2% and 9%, for the three and nine months ended June 30, 2022, respectively. These increases were mainly attributable to increased demand in our professional contract services markets as the negative effects of COVID-19 lessen, and the U.S. economy and workforce continue on recovery paths toward pre-COVID-19 conditions.”

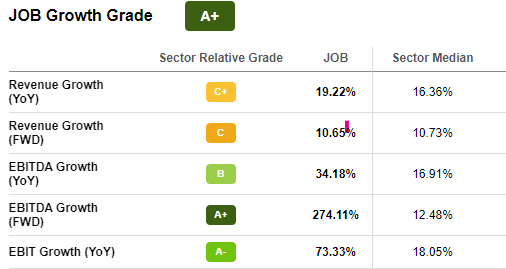

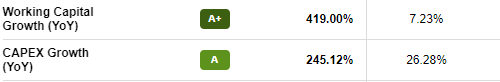

For the three- and nine months ending June 30, 2022, direct hire placement revenues were $8 M and $20.1 M, respectively, up 45% and 60% from the corresponding fiscal 2021 periods. The company’s direct hiring sales for Q3 2022 were a record, and they’ve already surpassed the full fiscal year of 2021. For the three and nine-month periods ended June 30, 2022, consolidated gross profits and margins were $16.5 million, or 40.1%, and $46.6 million, or 37.8%, respectively, a significant increase over comparable fiscal 2021 periods. Further, in terms of growth, JOB is not just growing but outgrowing the entire industry with a growth Grade of A+ as rated by Seeking Alpha. Its revenue, EBITDA, EBIT, working capital, and Capex growth YoY are above the sector median with a significant margin.

Seeking Alpha Seeking Alpha

Source: Seeking Alpha

This growth has translated to high profitability for the company, with its profitability grade being a B+ as graded by Seeking Alpha. It has a gross profit margin TTM, net income margin TTM, and levered FCF margin TTM of 37.46%, 14.17%, and 5.72%, respectively, compared to the industry median of 29.19%, 6.77%, and 3.53% accordingly. This performance should tell us that the company is highly profitable, and its profitability is outsmarting the industry. With the current demand for labor in the USA, I am confident the company will keep doing better in the coming quarters, and F.Y.s.

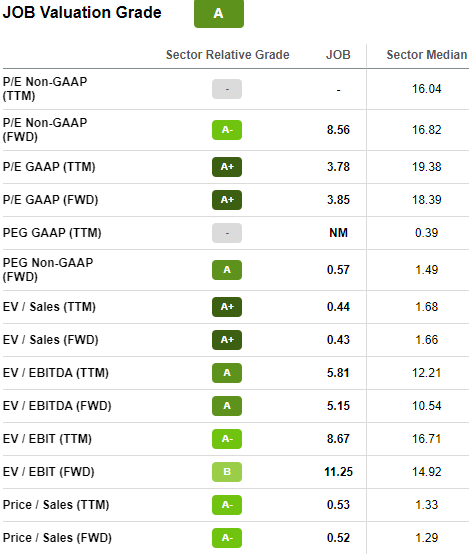

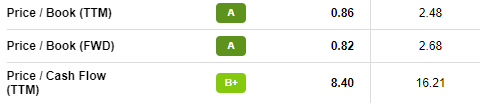

Valuation

Even with the recent uptick, the stock trades at a deep discount to its intrinsic worth. The company is trading cheaply with P/E, P/S, and P/B multiples at 3.78X, 0.53X, and 0.86X, while the sector median is much higher at 19.38X,1.33X, and 2.48X. By Looking at all other valuation metrics, the company is massively undervalued.

Seeking Alpha Seeking Alpha

A DCF model by Finbox further confirms that the company is significantly undervalued. The model shows that the company’s fair value is $1.80, much higher than the current $0.80. Further, the model indicates that the company has an upside potential of 138.8%. I call on investors to leverage this cheap entry point and enter the industry at a discount. The high upside potential speaks of the benefits investors will reap in the future.

Risks

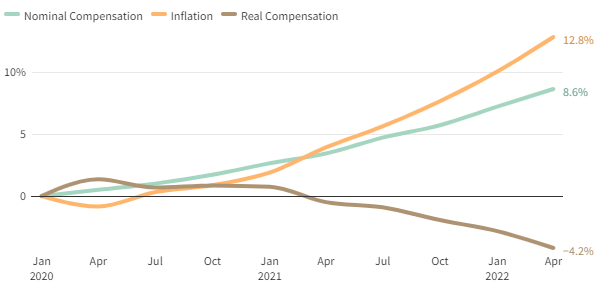

Despite the puff, there are also risks related to investing in this industry. These include inflation and the potential liabilities the company may face from the contractual actions of its staff. Inflation has resulted in wage increases, and employees now have higher bargaining power. The increase in wages translates to higher costs on the company’s part. It is a revenue risk because high costs would mean lower profit margins.

Investopedia

At the moment, the company is adapting to this challenge by pushing the cost forward to their customers, but investors should keep a close eye on the issues because it has double implication;

- The high transferred costs may be unbearable to the customers and thus opt for other options.

- The company’s staff may be attracted by the increased wages and opt to quit in search of better payment, leaving the company with the challenge of retaining staff for an extended period.

The other risk is the potential consequences of a contractual breakdown by the professionals hired on a contractual basis. There are possibilities of breach in any contractual agreement, which comes with consequences. Among the many repercussions are damages and cancelation, among others. In most cases, these consequences come after a legal suit whereby the legal process and the compensation for damages have financial implications. If by chance the company is found guilty, then;

- Business reputation and public image will be harmed, which may severely impact their performance, including the loss of customer trust.

- They may incur large financial losses compensating for the damages and funding the legal processes.

Conclusion

JOB is currently on an upward trajectory, having gained almost 50% in share prices over the last year. The company is exhibiting a strong growth potential with its growth metrics pointing out that the firm is excellent in its growth YoY. The development is due to the strong demand post-Covid. With a large customer base, specifically in the SME sector, the company is reaping from the high demand, resulting in increased revenues and eventually high-profit margins.

Upon examining the valuation metrics, the stock is significantly below the industry median, signifying it is massively undervalued. A DCF model by Finbox shows that the company is trading far below its fair value. With all these promising aspects, investors should keep an eye on the potential risks; as of now, the company has nothing to shake its booming trend. As a result, I am bullish on the company and rate it a strong buy.

Be the first to comment