deepblue4you/iStock via Getty Images

Investment Thesis

One would have expected that Intel Corporation’s (NASDAQ:INTC) lowered guidance for FQ4’22 would plunge the stock to previous October lows. Apparently, Mr. Market is more irrational than we think, since we are dumbfounded by the 19.08% stock recovery since then. We suppose the upbeat October CPI report has much to contribute toward the optimism, since INTC jumped by 11.59% in the days after. If 75.8% of market analysts are right in that the Feds will pivot as soon as December with a 50 basis points hike, we are all in for a real treat indeed since the stock market may sustainably recover from these blood-bath levels.

Of course, no one knows for sure until it truly happens on 14 December. Even then, no crystal ball will be able to predict if the market-wide confidence will hold through the rest of the hikes in 2023, since the terminal rates will likely be raised to over 6%, against previous projections of 4.6%. We’ll see.

Mr. Market Has Kindly Overlooked INTC’s FQ4’22 Faux Pas

INTC has delivered another round of sobering news, with lowered FQ4’22 revenue guidance by -14.79% between $14B and $15B, against consensus estimates of $16.43B. Thereby, also impacting its EPS tragically by -60% to $0.2, against the consensus of $0.5B. Its full-year performance is also affected, with a notable headwind in revenues by up to -$5B and EPS by -22.61% from previous guidance. It is apparent that the tsunami of optimism has lifted all boats as an early Thanksgiving present, even for one as underperforming as INTC. Maybe the previous correction was overly drastic, thereby triggering the compassionate Mr. Market.

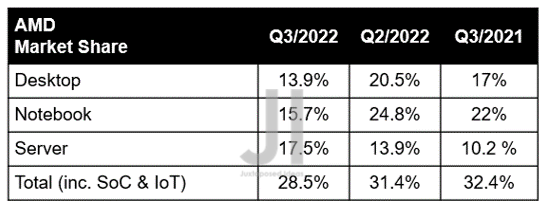

AMD’s Declining Market Share

WCCFTECH

Might as well, since INTC has also favorably reclaimed some of the x86 market shares previously lost to Advanced Micro Devices, Inc. (NASDAQ:AMD). By Q3’22, The former has gained a dramatic 6.6 percentage points in the desktop segment and 9.1 in the notebook segments, putting many bears to sleep.

Much of this success is probably attributed to the Raptor Lake release, which piggybacks on efficiency gains offered by the previous Alder Lake. Inversely, this has also impacted the company’s prospects in the server segment, since AMD recently launched the Genoa platform with an improved price-to-performance ratio. Despite the lower profit margins, a small win is still a win and INTC remains the king of the x86 jungle thus far, with the lion’s share of 71.5%.

In separate news, HP has unfortunately indicated the grave possibility that PC weakness may potentially last longer than expected, through 2025. This is attributed to the management’s announcement of 12% job cuts over the next three years, significantly worsened by the uncertain macroeconomics, rising inflationary pressures, and reduced corporate expenditure.

Furthermore, there are more uncertainties in the short term, since INTC’s head of foundry has just resigned on 22 November 2022. With this new setback, it is unknown if it is a negative indication of the company’s new ambition, though there are also rumors that the management is planning to have Tower Semiconductor’s CEO lead the Intel Foundry Services by Q1’23. So, it could really just be a simple transition of power. We’ll see, since the new acquisition will aid the company in the diversification of manufacturing sites in Israel and Japan.

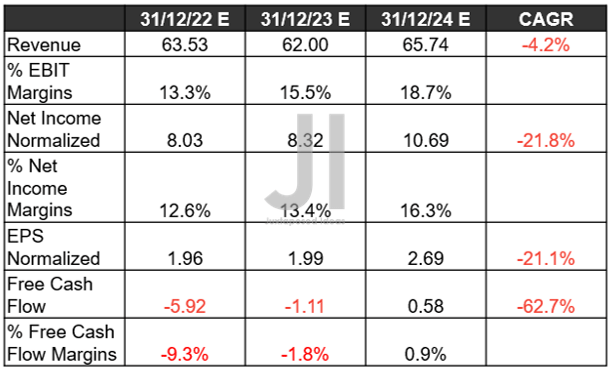

INTC Forward Estimates

S&P Capital IQ

As a result, it is not surprising to see that INTC’s top and bottom line growth has been downgraded again by -9.31% and -17.19%, respectively, since our previous analysis in October 2022. Otherwise, an eye-popping -21.44% and -34.65% since May 2022. Its EBIT and net income margins of 18.7% and 16.3% by FY2024 are also expected to tremendously underperform against pre-pandemic levels of 33% and 33.3%, respectively. Hence, pointing to our conclusion that this pop will be short-lived.

On the other hand, it is somewhat encouraging to see that INTC will continue to aggressively invest in its foundry dreams through FY2024, despite the naysayers and resulting extreme pain.

In the meantime, we encourage you to read our previous article on INTC, which would help you better understand its position and market opportunities.

So, Is INTC Stock A Buy, Sell, or Hold?

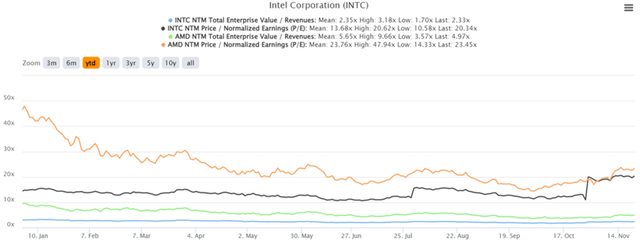

INTC YTD EV/Revenue and P/E Valuations

INTC is now trading at an EV/NTM Revenue of 2.33x and NTM P/E of 20.34x, in line with its YTD EV/Revenue mean of 2.35x though massively inflated from its YTD P/E mean of 13.68x. Oddly enough, the recent rally has also propelled the stock nearer to AMD with an NTM P/E of 23.45x. Strange times indeed, given the latter’s fall from grace at a peak P/E valuation of 65.91x.

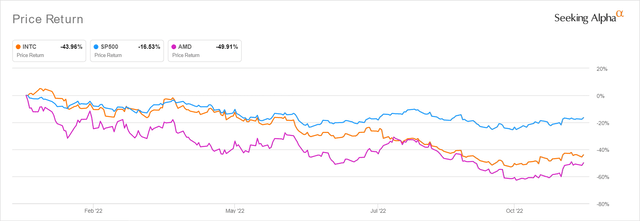

INTC YTD Stock Price

The INTC stock is now trading at $29.82, down -47.01% from its 52 weeks high of $56.28, though at a premium of 21.26% from its 52 weeks low of $24.59. Therefore, maxing out its luck on the basis of market analysts’ price target of $29.80 and zero margin of safety. With the stock trading from massive baked-in premiums, investors should obviously wait for this rally to be moderately digested before adding more. Its forward dividend yield of 5.76% is not appealing enough as well, as we expect things to get ugly again soon, giving bottom-fishing dividend hunters with fairer entry points.

While we admit that we have been overly critical about this underperforming stock of ours that has a rather questionable foundry future, the resulting independence from China’s Chip monopoly is always good. Especially given Apple’s (AAPL) difficulty in delivering its newest iPhone due to the country’s Zero Covid Policy. Therefore, circling back to INTC’s obvious foundry premium.

Be the first to comment