Piotr Mitelski

Spirit AeroSystems’ (NYSE:SPR) stock price has tanked significantly following the release of the second quarter earnings call. Having reviewed the second earnings results, I would say it are mostly the prospects of the Boeing 737 MAX that are somewhat disappointing but there are other elements that are pressuring the business in the short and longer term. In the end, I do believe that while the current environment is challenging for aerospace suppliers shares of Spirit AeroSystems remain attractive for the longer-term prospects of the company as I discuss in this investor report.

Russia Related Charges Push Spirit AeroSystems Into Loss

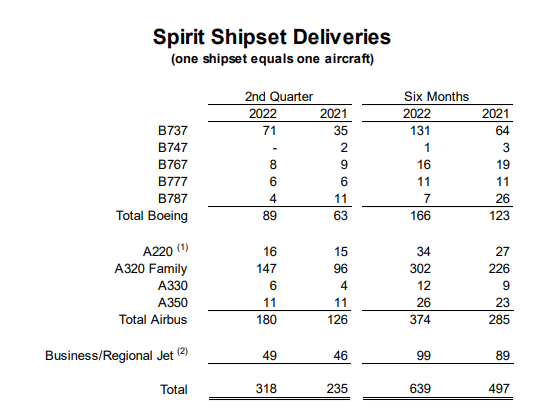

Spirit AeroSystems shipset deliveries (Spirit AeroSystems)

Looking at shipset deliveries, we see that Boeing shipset deliveries grew by 26 units or 40% primarily reflecting higher Boeing 737 shipset deliveries offset by lower deliveries for the Boeing 747 and Boeing 787 with Boeing 777 and Boeing 767 deliveries being more or less stable. Airbus shipset deliveries increased by 54 units also reflecting a roughly 40% increase as A320 family deliveries grew while Business/Regional jet deliveries was slightly higher. What we are seeing is that while the Boeing 737 MAX should have significant room to run up in ship set deliveries. That is simply not happening. Boeing 737 shipset deliveries don’t even come close to deliveries for the competing platform from last year. That itself is disappointing for Boeing as it shows how much it is behind and for Spirit AeroSystems it means results are not improving as fast as previously hoped.

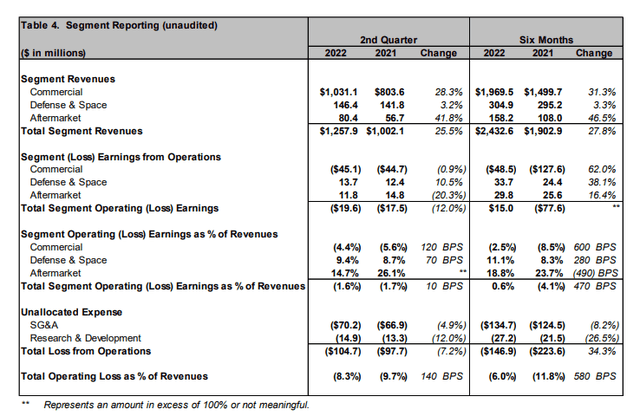

Q2 2022 results Spirit AeroSystems (Spirit AeroSystems)

Overall, delivery of shipsets increased by 35% and translated to a 28.3% increase in Commercial revenues. The revenue growth was lower than the shipset growth due to the mix being less focused on the Boeing 787 program. In Defense & Space, we saw revenues increase modestly due to development programs and P-8A Poseidon deliveries. On aftermarket sales, there was a big bump of 42% as higher flight activity drives aftermarket sales opportunities. Spirit AeroSystems saw total revenues increase by 25.5%, held back by supplier issues as well as a slowdown in production ramps on the single aisle programs that are meaningful to Spirit AeroSystems.

What is somewhat disappointing is that improvement in shipset deliveries did not help the company improve its margins significantly as margins improved only 10 basis points to -1.6%. However, the commercial business saw margins improve from -5.6% to -4.4%. So, it can be said that higher shipset deliveries are improving the margins. It is important to keep in mind that the company is also carrying excess capacity costs as it largely carries a footprint to hike rates to 52 shipsets per month for the Boeing 737 program over time. During the quarter these costs were $43 million for Commercial, $2 million for Defense & Space while forward losses were $64 million and $8 million in unfavorable adjustments. I don’t really want to adjust for those earnings as they are temporary cost items but not one-off items.

However, there were some one-off items that negatively impacted margins. The US sanctions against Russia pressured Commercial by $23.9 million on profit level and $4.2 million for the Aftermarket segment. Absent these pressures, Commercial margins would have been -2% and Aftermarket margins would have been 20% bringing the total segment operating profit margin to 0.7%. So, if it weren’t for the Russia related charges, Spirit AeroSystems would have shown margin improvement and even be profitable on segment level.

While I am not a fan of correcting for the forward losses, I believe two programs carried costs that we would normally not see. The first one is the Boeing 787 program. This program is not a money maker for Spirit AeroSystems and for the Commercial segment we won’t be seeing that being accretive to cash margins for years to come. On the Boeing 787 program there was $31 million in forward losses, half of which was mostly tied to schedule and engineering analysis. These are one off items mostly tied to Boeing and correcting for this the margins would have been 2%. The second program that I think we should take a deeper dive into for the forward losses is the Airbus A220 as there was a $25 million adjustment as a key supplier of Spirit AeroSystems went bankrupt and Spirit had to relocate production to guarantee the supply. So, that would have pushed the segment operating margins to 3.9%. That also means that Spirit AeroSystems I would be looking at adjusting earnings to meet and exceed 5% in the not so distant future.

Spirit AeroSystems Eyes Path To A 16.5% Margin

Boeing 737 fuselages at Spirit AeroSystems (Spirit AeroSystems)

Currently things are very challenging to see a path for Spirit AeroSystems to regrow its margins to 16.5% as it aspires. Admittedly, that jump seems almost impossible going from this quarter’s 1.6% loss margin to a 16.5% profit margin but applying some adjustments which I think is fair, they are already building to get there.

What was a negative for investors was that the MAX shipset delivery target was lowered, but if we look at the numbers it went from 315 expected deliveries to 300 meaning that in the second half of the year sequentially there be 170 shipset deliveries indicating a 30% increase. I for one have not been counting on any increase in the MAX rate this year for Spirit AeroSystems, so the company will continue building shipsets at a rate of 31 per month no longer trailing Boeing in the rate anymore which also provides some padding in the system as the buffer of pre-built fuselages will decline at a lower rate than initially anticipated. At current rates Spirit AeroSystems is breaking even on the 737 program and if you expected another rate increase this year than having the rates being flat for the remainder of the year is disappointing. Rate hikes can happen with a 6 month notice, meaning that if Boeing would want to increase rates it could only do so in Q1 2023. Boeing has signaled it has no intent to raise at this point and that could indicate that throughout 2023 we will not be seeing any upward adjustments on the rates. So, for 2023 the MAX could be a near break-even program for Spirit AeroSystems and I think that certainly is not something that investors were hoping for.

The lower 2022 737 ship set deliveries also triggered an adjustment on free cash flow usage to $250 million to $300 million from $175 million to $225 million expected in the previous quarter also reflecting inflationary pressures and supply chain challenges.

So, that path to a 16.5% margin which can be achieved when a rate of 42 Boeing 737 shipsets per month is achieved is out of sight for 2024 I would say. That, however, does not mean that the margins won’t increase. We already see some one-off items occur this year that shouldn’t occur in the next. Additionally, revival of the Boeing 787 ship set deliveries should reduce forward losses on unit level while a full year of production at a rate of 31 per month should drive shipset deliveries for the program to 375 up from 300 guided for this year. So, there is growth and opportunity for unit performance improvement in 2023.

Airbus A220-300 (Airbus)

There also are some drivers on other programs. As international travel recovers in 20240-2025, I would also expect wide body demand to improve which should benefit the Boeing 787, Airbus A330 and Airbus A350. For the Boeing 787 program, cash margins could turn positive once a new price adjustment takes place after the 1406th delivery in 2025-2026. On the Airbus A220 program, further production hikes to 14 per month should push the program in a profitable position.

So, without doubt 2023 will be a bit too stagnant for the taste of many but we see that on the longer term besides positive adjustments on the Boeing 737 program, there is also a lot coming for the Boeing 787, Airbus A220 and Airbus A320neo as those programs will go up in rate or hit price adjustment points.

Conclusion: Years of Improvement But Buy Points Shifts

Overall, I do believe that short term Spirit AeroSystems is a hold but over the longer term the company is a compelling buy as it is involved in the major platforms that are in demand now and in the coming 15-20 years. So, if you believe in the strength of the air travel demand Spirit AeroSystems is one of the names that should provide returns for the patient investors just like other suppliers likely will.

Be the first to comment