Pgiam/iStock via Getty Images

Investment Thesis

21st Century paces of change in technology and rational behavior (not of emotional reactions) seriously disrupt the accepted productive investment strategy of the 20th century. Passive investing that worked back then can’t compete now.

The most important strategy change is the shortening of forecast horizons, with a shift from the multi-year passive approach of buy&hold to the active strategy of specific price-change target achievement or time-limit actions, with reinvestment set to new nearer-term targets.

That change avoids the irretrievable loss of invested time spent destructively by failure to recognize shifting evolutions like the cases of IBM (IBM), Kodak (KODK), GM (GM), Xerox (XRX), GE (GE) and many others.

It recognizes the evolutions in medical, communication and information technologies and enjoys their operational benefits already present in extended lifetimes, trade-commission-free investments, and coming in transportation ownership and energy usage.

But it requires the ability to make valid direct comparisons of value between investment reward prospects and risk exposures in the uncertain future. Since uncertainty expands as the future dimension increases, shorter forecast horizons are a means of improving the reward-to-risk comparison.

That shortening is now best invoked at the investment entry point by learning Market-Maker [MM] expectations for coming prices. When their targets are reached the expanded capital is then reintroduced at the exit/reinvestment point to new promising candidates, with their own specific near-term of expectations for target prices compounding prior-stock gains.

The MM’s constant presence, extensive global communications and human resources dedicated to monitoring industry-focused competitive evolution sharpens MM price expectations. But the MMs job is to get buyers and sellers to agree on exchanging share ownership – without having to take on risk while doing it.

Others in the MM community provide protection for capital of the transaction negotiators which gets temporarily exposed to price-change risk. Derivative-securities deals to hedge undesired price changes are regularly created. The deals’ prices and contracts provide an honest window to view MM price expectations, the best indication of likely near-term outlook.

This article focuses primarily on CareDx, Inc. (NASDAQ:CDNA)

Description of Equity Subject Company

“CareDx, Inc. discovers, develops, and commercializes diagnostic solutions for transplant patients and caregivers worldwide. It provides AlloSure Kidney, a donor-derived cell-free DNA (dd-cfDNA) solution for kidney transplant patients; a gene expression solution for heart transplant patients; a dd-cfDNA solution for heart transplant patients; and a dd-cfDNA solution for lung transplant patients. The company offers its products directly to customers, as well as through third-party distributors and sub-distributors. It has a license agreement with Illumina, Inc. for the distribution, development, and commercialization of products and technologies. The company was formerly known as XDx, Inc. and changed its name to CareDx, Inc. in March 2014. The company was incorporated in 1998 and is headquartered in South San Francisco, California.” Source: Yahoo Finance

Alternative Investments Compared

The investment selections most frequently visited by users of Yahoo Finance were added to by principal holdings of stocks in the subject’s ETF, and as a market-proxy the SPDR S&P 500 ETF (SPY) in making up a comparison group against which to match CDNA

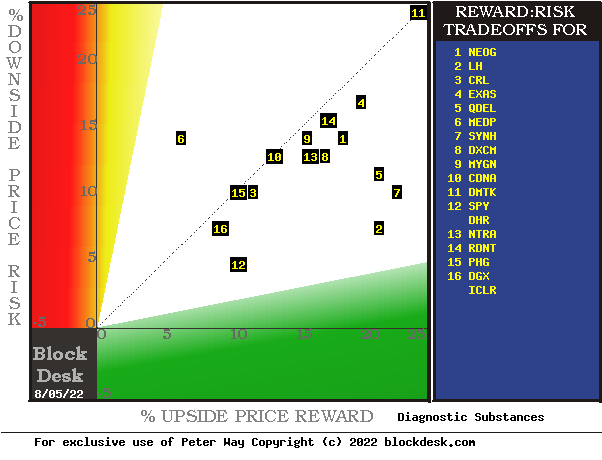

Following the same analysis as with CDNA, historical sampling of today’s Risk~Reward balances were taken for each of the alternative investments. They are mapped out in Figure 1.

Figure 1

blockdesk.com

(used with permission).

Expected rewards for these securities are the typical gains from current closing market price seen worth protecting short positions at prior times like those of today. Their measure is on the horizontal green scale.

The risk dimension is of actual price draw-downs at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain attractive to-buy issues are in the directions down and to the right.

Our principal interest is in CDNA at location [10], on the dotted diagonal at its midpoint. A smaller “market index” norm of reward~risk tradeoffs is offered by SPY at [12].

Comparing features of Alternative Investment Stocks

The Figure 1 map provides a good visual comparison of the two most important aspects of every equity investment in the short term. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely” are present other comparative tables, like Figure 2, may be useful.

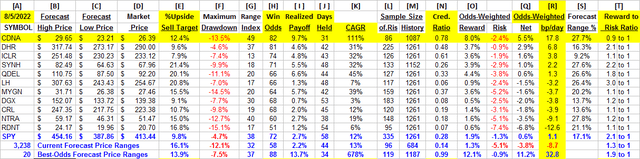

Yellow highlighting of the table’s cells emphasize factors important to securities valuations and the security CDNA, most promising of near capital gain as ranked in column [R].

Figure 2

(used with permission)

Why do all this math?

Figure 2’s purpose is to attempt universally comparable answers, stock by stock, of a) How BIG the prospective price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how SOON it may happen, and d) what price drawdown RISK may be encountered during its holding period.

Readers familiar with our analysis methods after quick examination of Figure 2 may wish to skip to the next section viewing Price range forecast trends for CDNA.

Column headers for Figure 2 define investment-choice preference elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stocks of principal interest and of all issues at the ranking column, [R].

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. The most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are emotionally most likely to accept losses.

The Range Index [G] tells where today’s price lies relative to the MM community’s forecast of upper and lower limits of coming prices. Its numeric is the percentage proportion of the full low to high forecast seen below the current market price.

[H] tells what proportion of the [L] sample of prior like-balance forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [ I ] gives the net gains-losses of those [L] experiences.

What makes RDN most attractive in the group at this point in time is its basic strength in capturing much of the forecast upside [E] in realized payoffs of [ I ], shown in [N] as a credibility ratio. Only one of its competitors manages to realize profits of half of what has been implied as an upside price gain forecast target.

Further Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferencing. Figure 2 is row-ranked on [R] among alternative candidate securities, with CDNA in top rank.

Along with the candidate-specific stocks these selection considerations are provided for the averages of some 3000 stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P 500 Index ETF as an equity-market proxy.

Current-market index SPY is marginally competitive as an investment alternative. Its Range Index of 27 indicates 3/4ths of its forecast range is to the upside.

As shown in column [T] of figure 2, those levels vary significantly between stocks. What matters is the net gain between investment gains and losses actually achieved following the forecasts, shown in column [I]. The Win Odds of [H] tells what proportion of the Sample RIs of each stock were profitable. Odds below 80% often have proven to lack reliability.

Price range forecast trends for CDNA

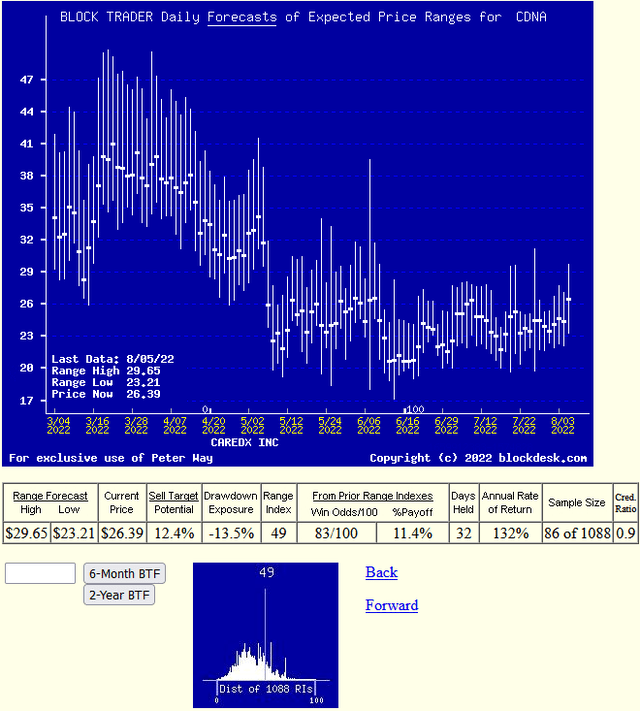

Figure 3

(used with permission)

No, this is not a “technical analysis chart” showing only historical data. It is a Behavioral Analysis picture of the Market-Making community’s actions in hedging investments of the subject. Those actions define expected COMING price change limits shown as vertical bars with a heavy dot at the closing price of the forecast’s date.

It is a picture of the actual expected future, not a hope of the recurrence of the past.

The special value of such pictures is their ability to immediately communicate the balance of expectation attitudes between optimism and pessimism. We quantify that balance by calculating what proportion of the price-range uncertainty lies to the downside, between the current market price and the lower expected limit, labeled the Range Index [RI].

Here a RI at zero indicates no further price decline is likely, but not guaranteed. The odds of 3 months passing without either reaching or exceeding the upper forecast limit or being at that time below the expected lower price (today’s) are quite slight.

The probability function of price changes for CDNA are pictured by the lower Figure 3 (thumbnail) frequency distribution of the past 5 years of RI values with the zero today indicated. Its current position of 49, mid-range, shows a history of more frequent prior appraisals of larger upside. That might be viewed as less promising, but given the “Win Odds” history of 83% of 86 prior experiences it tells of frequent reaching of top-range price targets and other 17% of closeouts of positions induced by profit prospects like today’s +12.4%, holding-period time-induced profits achieved by prior 49-level RIs at +11.4% in the aggregate. Rates of gain previously achieved at an annual CAGR rate of +132% – prospective, not promised, like all investing potentials.

Conclusion

The multi-path valuations explored by the analysis covered in Figure 2 is rich testimony to the near-future value prospect advantage of a current investment in CareDx Inc.

Be the first to comment