undefined undefined/iStock via Getty Images

While I typically don’t post blurbs about individual companies, this one really stands out (emphasis added):

Meta has said it is considering shutting down Facebook and Instagram in Europe if it can’t keep transferring user data back to the U.S.

The social media giant issued the warning in its annual report last Thursday.

Regulators in Europe are currently drawing up new legislation that will dictate how EU citizens’ user data gets transferred across the Atlantic.

Facebook said: “If a new transatlantic data transfer framework is not adopted and we are unable to continue to rely on SCCs (standard contractual clauses) or rely upon other alternative means of data transfers from Europe to the United States, we will likely be unable to offer a number of our most significant products and services, including Facebook and Instagram, in Europe.”

The company added this “would materially and adversely affect our business, financial condition, and results of operations.”

Meta (NASDAQ:FB) (the webpage formally known as Facebook) is a key component of the FAANG group of stocks, the QQQ, and a few key sector-specific ETFs. An announcement that it was shutting down in the ECB bloc would likely tank the markets. Hard.

Did the latest round of government spending and resulting inflation prove and then possibly disprove Modern Monetary Theory? I have to admit that I still don’t think MMT makes sense. But it gained enough traction to enter some economic and political debate. The recent sharp increase in government spending potentially proved the theory’s validity but the resulting inflation has put a large dent in it as well. This article from the NY Times provides a good update on where things stand.

Small business is raising prices (emphasis added):

A record share of U.S. small businesses raised their prices in January to combat high costs of materials and labor.

A net 61% of owners reported increasing average selling prices last month, the most in monthly data back to 1986, the National Federation of Independent Business said Tuesday. Inflation remains a top concern for small businesses, still cited by the greatest share of respondents since 1981.

“More small business owners started the new year raising prices in an attempt to pass on higher inventory, supplies and labor costs,” NFIB Chief Economist Bill Dunkelberg said in a statement. “Owners are also raising compensation at record high rates to attract qualified employees to their open positions.”

This will show up in the upcoming PPI data.

Today, let’s look at two sets of index charts.

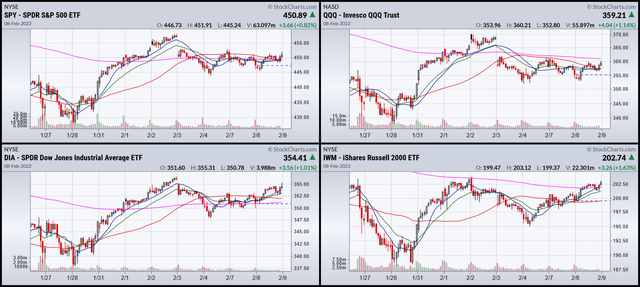

6-month SPY, QQQ, DIA, and IWM charts (Stockcharts)

At the end of January, all the indexes dropped sharply. The SPY and DIA hovered around their 200-day EMAs while the QQQ and IWM broke through that key level. Since then, the indexes have rebounded a touch. During the last few sessions they have consolidated gains.

2-week SPY, QQQ, DIA, and IWM charts (Stockcharts.)

On the 2-week charts, prices on the SPY and QQQ have been trading sideways for the last four trading days. They’ve increased on the DIA and IWM but both indexes are still below recent highs.

Here’s the good news: prices have moved higher after the late January sell-off and are now consolidating those gains.

Here’s the bad news: on the 2-week charts, prices are still using the 200-minute EMA as a center of gravity. They need to pull higher from that level to up the bullishness.

Be the first to comment