bymuratdeniz

DexCom, Inc. (NASDAQ:DXCM) is a medical device company that designs and distributes CGMs (continuous glucose monitors). Unlike big tech names such as Amazon (AMZN) and Meta Platforms (META), which have dominated news headlines with sub-par Q3 results, DexCom shareholders had something to look forward to as DXCM stock soared a whopping 17.47%.

The Numbers

DexCom beat estimates on the top and bottom lines, with revenue of $769.6M, implying 18.8% YoY growth. On the bottom line, Non-GAAP EPS of $0.28 beat the Street’s expectation by $0.04.

Further, DexCom took it upon itself to slightly increase its full-year revenue guidance range, from $2.86 – $2.91 to $2.88 – $2.91.

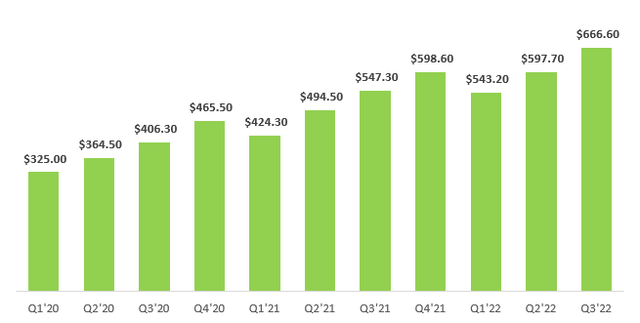

DexCom’s Sensor revenue accounts for 87% of the company’s revenue, while hardware revenue makes up the remainder.

DXCM’s sensor revenue has witnessed exceptional growth over the past 11 quarters, most recently posting 22% YoY growth and 12% QoQ growth.

The graph below exemplifies the strength in DexCom’s sensor segment, most recently posting $666 million in revenue.

Market Remains Large & Growing

In the third quarter, DexCom launched its new G7 CGM system and initiated its international rollout with five countries.

As CEO Kevin Sayer mentioned on the conference call, the company executed in line with expectations.

Our third quarter was characterized by sharp execution and delivering results in line with what we said we were going to do. We’re committed to launching G7 internationally in the third quarter, and now we have G7 in five different countries with more following closely behind.

In the U.S., Sayer mentioned that, by the end of this year, the company should be granted clearance:

In the U.S., we have responded to the FDA, and our G7 regulatory pathway is tracking in line with expectations we shared last quarter.

We completed the necessary software changes in response to the feedback we received from the agency and subsequently validated the data to ensure the software is operating as designed. These efforts position us well to receive G7 clearance before the end of the year.

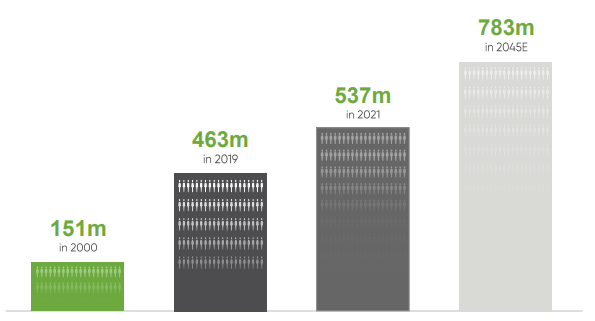

In 2021, global diabetes health expenditure was $966B, compared to $760B 2 years prior (27% growth). While unfortunate for many, diabetes shows no signs of slowing down across the globe, with an estimated 783m people by 2045 expected to be diagnosed.

Investor Presentation

Strong Moat and More To Come

Naturally, DexCom’s sensors have high switching costs for diabetes. While there is no official cure for diabetes, DexCom is the leading player in this fragmented market, with an estimated 41% market share.

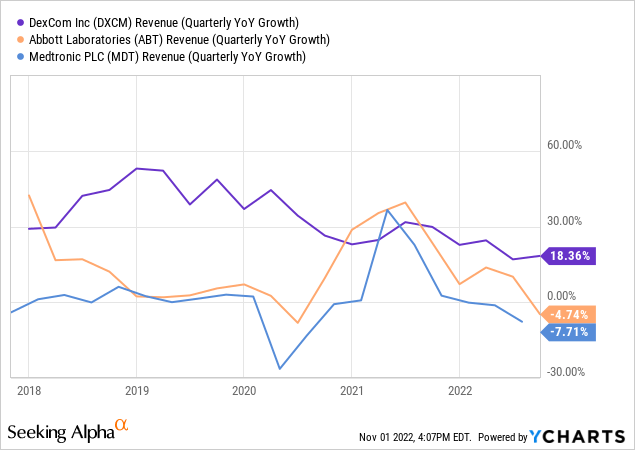

DexCom’s main competitors include Abbott Laboratories (ABT) and Medtronic (MDT).

As a pure-play company with a sole focus on diabetes, DexCom’s revenue growth is larger on a percentage basis. Significantly smaller on a market cap basis than its competitors, who are focused on a variety of medical devices, DexCom allows investors to gain full exposure to the diabetes market.

As DexCom continues to roll out its G7 product, investors should have more to look forward to with the company’s progression in both the U.S. and internationally:

G7 is now available in the United Kingdom, Ireland, Germany, Austria and Hong Kong. We have been looking forward to this day for a long time as we view G7 is not only a major step forward for DexCom but for the entire diabetes technology market. This is a game-changing launch.

Final Thoughts

Despite its strong competitive positioning and market tailwinds, DexCom’s valuation is significantly lofty, trading at over 200x earnings and over 45x sales.

The question investors must ask themselves is if they are willing to pay a premium for a wide-moat, high-growth business that will continue to grow.

With an exceptional business model aimed at tackling a massive global medical issue, there is no arguing the strength of DexCom’s business.

Nevertheless, my final recommendation will be a Hold as I urge investors to keep this quality business on their watchlist.

Be the first to comment