amnarj2006/iStock via Getty Images

Construction and industrial markets require a large number of different devices in order to function. And given how large these markets are, it should come as no surprise that there would be some publicly traded companies dedicated to providing said devices to these spaces. One company that does precisely this is Atkore (NYSE:ATKR). Although the company experienced some pain during the 2020 fiscal year because of the COVID-19 pandemic, the overall trajectory for the company otherwise has been positive. Cash flows have risen over the years and, on a forward basis, shares of the company look quite cheap. Even if financial performance were to revert back to what it was in 2020, it’s difficult to imagine the company being any worse off than fairly valued. Because of this perceived risk-to-reward scenario, I have decided to rate the enterprise a ‘buy’ prospect at this time.

A cheap company by any measure

According to the management team at Atkore, the company operates as a manufacturer of electrical products that are largely used for the non-residential construction and renovation markets. However, it does also service residential markets. On top of this, the company also produces safety and infrastructure products for the construction and industrial markets. To best understand the firm really, though, we should break it down into its two operating segments. Only then can we understand the vastness of its operations.

First and foremost, we have the Electrical segment of the company. This segment produces a variety of products that are used in the construction of electrical power systems like conduit, cable, and installation accessories. It also serves contractors in partnership with the electrical wholesale channel, basically using that as a means for further distributing its portfolio of offerings. To be more specific, the segment produces metal electrical conduit and fittings, plastic pipes, international cable management systems, and more. During the company’s 2021 fiscal year, this segment accounted for 76.2% of the firm’s revenue and for an impressive 91.4% of its profits.

The other segment the company operates is referred to as Safety & Infrastructure. Through this, it produces metal framing, mechanical pipes, perimeter security products, and cable management offerings for its customers in the construction and industrial markets. During the company’s 2021 fiscal year, this segment made up 23.8% of the firm’s revenue but only 8.6% of its profits.

Some other data regarding the company would be useful for investors to know. For instance, as of the end of its latest completed fiscal year, the business had 42 different manufacturing facilities totaling 6.3 million square feet if we include the distribution space that it has. These facilities are spread across eight different countries. Although this technically makes the company a global enterprise, it is worth noting that 90.1% of its revenue in 2021 came from customers located in the US. That’s actually up from the 88.1% exposure the company had to its home market two years earlier. Having said that, it is true that the company is diverse in sales from a different perspective. At present, its top ten largest customers make up about 37% of its revenue. That means that no one customer is terribly significant to the enterprise.

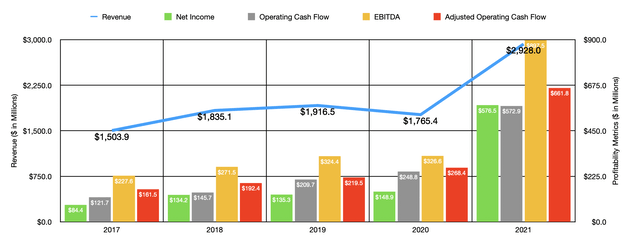

Over the past few years, the general trajectory for the company has been quite positive. Revenue rose from $1.50 billion in 2017 to $1.92 billion in 2019. Then, in 2020, the COVID-19 pandemic pushed revenue down to $1.77 billion. Thankfully, we saw a nice surge in demand for the company’s products in 2021, with revenue skyrocketing to $2.93 billion. This 65.9% increase in revenue it was driven largely by a 55.4% contribution of higher selling prices. Increased volume contributed 5% of the sales increase, while acquisitions added 4.5%. That left the remaining 1% coming from foreign currency fluctuations.

As revenue has risen, profitability has followed suit. Net income rose from $84.4 million in 2017 to $148.9 million in 2020. Then, in 2021, net income jumped to $576.5 million. Clearly, management was able to push more than just their costs onto customers. Other profitability metrics followed suit. Operating cash flow, for instance, rose from $121.7 million in 2017 to $572.9 million last year. A similar trend can be seen when looking at EBITDA, which ultimately increased from $190.3 million in 2017 to $835 million last year. The largest increase was from 2020 to 2021. For context, this metric was just $273.5 million in 2020.

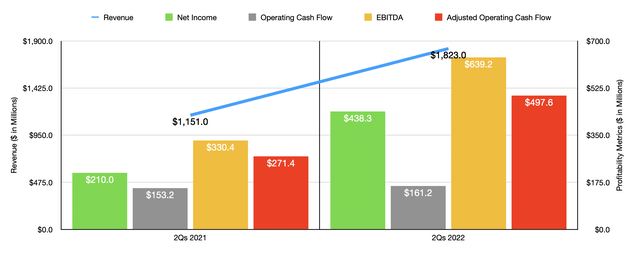

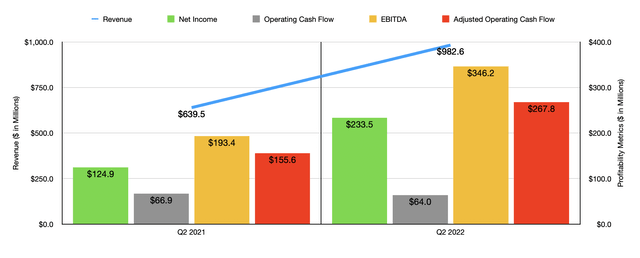

Growth for the company has continued into the current fiscal year. Revenue in the first two quarters of the company’s 2022 fiscal year totaled $1.82 billion. That’s significantly higher than the $1.15 billion generated the same time one year earlier. This 58.5% rise came even as volume hit sales to the tune of 5.1% and as foreign currency fluctuations hit it by a further 0.1%. The company did benefit from acquisitions to the tune of 2.2%. But the real increase came from higher average selling prices, which contributed 61.5% to the company’s top line growth. This growth also had major implications for the company’s profitability. Net income of $438.3 million in the first half of the year dwarfed the $210 million reported one year earlier. Operating cash flow rose more modestly, climbing from $153.2 million to $161.2 million. But if we adjust for changes in working capital, it would have risen from $271.4 million to $497.6 million. Meanwhile, EBITDA at the company nearly doubled, skyrocketing from $330.4 million to $639.2 million.

What’s really interesting about Atkore is how detailed management has been about the near-term outlook for the enterprise. For the 2022 fiscal year, management believes that revenue should climb by between 25% and 30%. That should take EBITDA up to between $1.25 billion and $1.30 billion. However, the company also seems to recognize that this year may not be indicative of the company’s long-term prospects. At present, they are forecasting that EBITDA will come in at between $800 million and $900 million during the 2023 fiscal year. This makes sense when you consider that the pricing will ultimately adjust as supply chain issues work themselves out. No other guidance was given when it came to profitability for the 2023 fiscal year. But management does think that adjusted earnings per share will be between $19.65 in $20.45 during the 2022 fiscal year. At the midpoint, this would imply net income of $864.4 million. If we assume that other profitability metrics will follow the same trajectory that we should see for 2022 and 2023, we should anticipate net income falling to $576.3 million in 2023. For operating cash flow, I estimated a reading of $940.2 million this year, followed up by a decline to $626.8 million in 2023.

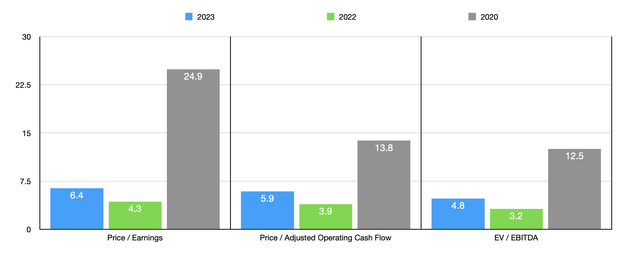

Given how close 2023 estimates are to the results the company achieved in 2021, I have decided to use the 2023 estimates as a proxy for the company’s current valuation. But I also decided to compare the company to its 2022 results that management anticipates and I estimate, and to the 2020 results that the company reported in the event that we forecast a down year for the company. Using the 2023 results, we end up with the firm trading at a price-to-earnings multiple of 6.4. That’s up from the 4.3 reading that we would get using the 2022 estimates. The price to adjusted operating cash flow multiple would be 5.9. That compares to the 3.9 reading that we should get for 2022. Meanwhile, the EV to EBITDA multiple for the company should be 4.8 if we use the 2023 estimates and it should be 3.2 if we use the 2022 estimates.

Even in the event that we forecast a downturn in the broader economy that negatively impacts the enterprise, I cannot imagine the situation coming in worse than what we saw in 2020. In this case, the firm would be trading at a price-to-earnings multiple of 24.9. While that may be a bit lofty, the other profitability metrics are not so bad. The price to adjusted operating cash flow multiple would be 13.8, while the EV to EBITDA multiple would come in at 12.5. As part of my analysis, I also decided to compare the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 3 to a high of 490.2. Using the price to operating cash flow approach, the range was from 3.7 to 26.2. And using the EV to EBITDA approach, the range was from 1.8 to 18.9. In all three scenarios, only one of the five companies was cheaper than Atkore.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Atkore Inc. | 6.4 | 5.9 | 4.8 |

| Encore Wire Corporation (WIRE) | 3.0 | 3.7 | 1.8 |

| Powell Industries (POWL) | 490.2 | N/A | 18.9 |

| LSI Industries (LYTS) | 17.1 | 15.2 | 9.9 |

| Emerson Electric Co (EMR) | 16.6 | 16.2 | 11.0 |

| Eaton Corporation (ETN) | 22.9 | 26.2 | 14.7 |

Takeaway

Based on all the data that I see right now, Atkore strikes me as an interesting company that should offer investors some nice upside potential. Even if financial performance reverts back to what we saw in 2020, it’s difficult to imagine the business warranting a material decline in share price. As such, I see the potential for attractive upside but limited downside. This is further bolstered by the fact that, relative to similar firms, Atkore remains cheap. Because of these factors, I have decided to rate the business a ‘buy’ at this time, reflecting my belief that it will likely outperform the broader market moving forward.

Be the first to comment