fizkes

Mortgage rates have pulled back from their June highs that were at one time north of 6% according to Mortgage News Daily data. Last week’s Freddie Mac Primary Market Survey revealed the first weekly sub-5% print on the typical 30-year fixed rate mortgage in months. A recent wave of Treasury buying led to the 10-year Note yield falling from a Q2 high near 3.5% to just above 2.5% early last week. A hot jobs report on Friday brought about the bond bears though, and the 10yr rate settled at 2.84% to cap off the week.

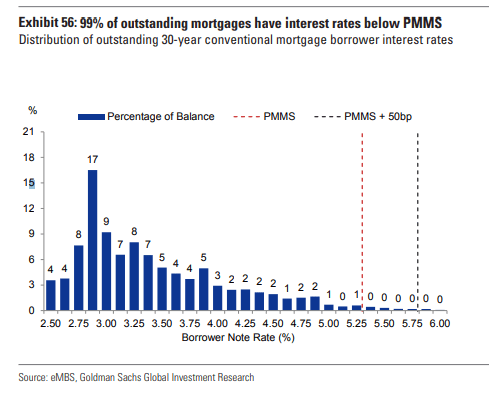

With home-borrowing rates up significantly this year, refinancing activity has fallen off a cliff. Goldman Sachs reports that a whopping 99% of outstanding 30-year conventional mortgages have a rate below the PMMS as of July 28. Consequently, the nation’s biggest mortgage origination firm which is also heavy in the refinancing business seems to be in a tough spot.

Goldman Sachs: Most Mortgages Locked In At Low Rates

Goldman Sachs Investment Research

According to Bank of America Global Research, Rocket Companies (NYSE:RKT) is the largest mortgage originator in the U.S. Rocket was established in 1985 and has grown its market share from 1.3% in 2009 to 8% in 2020. Rocket is a tech-enabled mortgage originator that operates via a centralized model.

The Detroit-based $19.6 billion market cap stock in the Thrifts & Mortgage Finance industry features a cheap earnings multiple of just 7.5, according to The Wall Street Journal. The stock also has a massive 31.3% short float but does not pay a dividend.

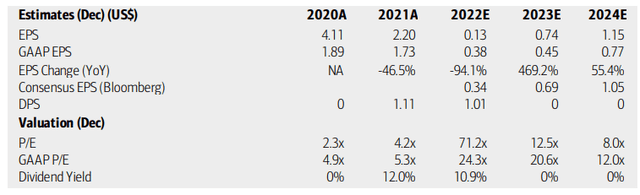

Rocket reported a $0.03 per share loss in its Q2 earnings release last Thursday night. That makes three straight EPS misses in 2022. Shares fell about 3% after the company reported a 48% revenue drop from the same quarter a year ago. Its management team also had guidance that was below market expectations.

BofA analysts expect earnings to recover in the coming quarters. Still, they don’t see a very strong multiple expansion any time soon. Higher mortgage rates will likely pressure margins for Rocket along with stiffer industry competition. On the bright side, RKT’s balance sheet is actually in attractive shape, so there is a chance of shareholder accretive activity or M&A later this year.

RKT: Earnings and Valuation Forecasts

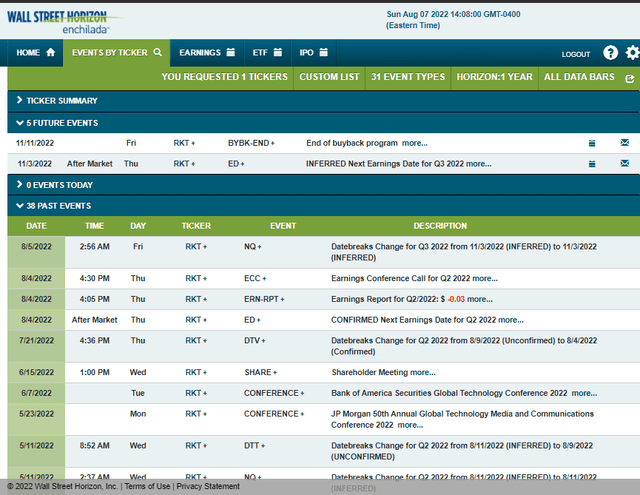

Wall Street Horizon reports that RKT has a Q3 inferred earnings date of Thursday, November 3, AMC. The company’s current buyback program is scheduled to end the following week.

Rocket Corporate Event Calendar

The Technical Take

After rallying 68% off the June low to its high last week, Thursday night’s EPS miss naturally led to some profit taking. On a bullish note, however, the stock finished 13% off Friday’s low. I like that price action given June’s capitulation. I think a swing long here with a stop under Friday’s low makes sense for technical traders.

I also notice a bullish inverse head and shoulders pattern with a measured move price objective to $13.25, just under an old unfilled gap noted on the chart. That seems like a reasonable place share could rise to.

The stock also broke a downtrend resistance line on a bullish breakaway gap in early July.

RKT: Downtrend Reverses, Bullish Breakaway Gap & Inverse Head and Shoulders

The Bottom Line

Given a cheap valuation and much of the bad news seemingly priced into the stock, I think RKT can continue to work off its June low. Friday’s price action showed that bulls still have plenty of juice in the tank for more upside. I’m eyeing an old unfilled gap that is just above a bullish price objective based on an inverse head and shoulders pattern. That’s a lot of technical jargon, but at a macro level, it appears the stock is finally reversing after a bruising first half of higher lending rates.

Be the first to comment