Lurin

About a month ago, we added RCI Hospitality (NASDAQ:RICK) to our Core Portfolio when it dipped below $50 per share. Since then, its share price has recovered a bit, but it still remains one of our favorite investment opportunities and therefore, we expect to keep accumulating more shares.

Today, we want to highlight one of the company’s latest acquisitions because it validates our investment thesis.

RCI Hospitality

For those who aren’t familiar with the company, RICK is essentially the only publicly listed strip club company. It buys strip clubs as if it was making real estate investments and then manages them to earn a return on their capital. In that sense, it is a sin stock, just like tobacco company Altria (MO) or alcohol company Anheuser-Busch (BUD).

Sin stocks typically outperform the broader stock market (SPY) because their respective markets are less competitive and enjoy superior economics.

In that sense, we are especially bullish on RICK specifically because it is able to buy high-quality strip clubs at low multiples, earning exceptionally high returns relative to the risk that it is taking.

When you think about a strip club as an asset, it is quite attractive for a number of reasons. Firstly, it is moated since it requires licenses which are today nearly impossible to obtain. No one wants a new club in their backyard and as a result, existing clubs, especially high-quality ones, enjoy near-monopolies in their local markets. Secondly, these are high-margin businesses that generate a lot of free cash flow. There is limited capex, relatively low labor cost, and booze/services sell for large mark-ups. Finally, strip clubs are also fairly resilient to recessions because people still want to party and get an escape during economic downturns. Historically, the sales of alcohol even grow during recessions.

So these are attractive assets, but there are very few willing buyers due to reputational, regulatory, and managerial issues. If you are a successful business owner, your wife or husband probably does not want you to buy a strip club. Similarly, if you run an investment fund, you almost certainly have some L.P.s who don’t want you to buy these businesses. Moreover, managing these clubs requires a very unique skill set since you need to be able (and willing) to sniff out things like drug dealing and prostitution.

Despite there being very few buyers, there are increasingly many sellers of strip clubs. There are roughly 2200 clubs in the US, it is a very fragmented industry, and a large percentage of these club owners are in their late 50s and 60s. Their kids also aren’t interested in running strip clubs in most cases so they have to sell.

Many sellers… but only a few willing buyers… means one thing: buyers are getting these attractive assets at incredibly attractive valuations.

That’s where RCI Hospitality (RICK) comes in.

It is the only strip club company with large scale, professional management, and access to public capital to buy the clubs from retiring owners. Those are major competitive advantages and therefore, RICK is typically the preferred buyer in this industry.

Out of those 2200 existing clubs, RICK believes that around 500 of them fit its acquisition criteria, and currently, it only owns ~50 of them. As such, it already has the scale to close large acquisitions, but its market share is still small enough for new acquisitions to have a major impact on their results.

And here comes the best part: RICK is able to target 25-33% annual cash-on-cash returns on its new acquisitions and that’s for high-quality, market-dominant clubs, including their real estate. This is also before any value-add, which often brings the returns into the 33-50% range. Let that sink in!

Typically, REITs (VNQ) are happy if they can earn ~10% cash-on-cash returns on their real estate investments. RICK commonly gets triple of that and it is simply because it is filling a market void by providing much-needed capital to a sin industry that’s lacking it.

This brings us to one of RICK’s latest acquisitions, which they announced last week:

RICK is acquiring a strip club in Odessa, Texas. It is right off the busy State Highway Loop 338 and it is their third strip club in Ector County, Texas. It is a one-acre property with a ~5k square foot building:

We don’t have the details of the deal, but as we noted earlier, RICK typically targets 25-33% annual returns, before any value-add, and with the real estate. This specific deal appears to be an interesting case of what value-add means in this investment niche:

1) New brand: RICK is essentially just buying the licenses and the real estate and it will then rebrand it as a PT’s Showclub. This is a brand that they operate in 6 states. By simply changing the brand, they may materially boost the profitability of the club. It is similar to adding a famous flag, like Hilton, to a hotel.

2) Creative financing: In this specific case, RICK will only pay $1.4 million in cash, and the rest will be paid via seller’s financing. This means that the return will likely be even greater than usual since it is putting very little cash in the deal and the rest will be a loan to the seller. RICK is able to negotiate such favorable financing terms because sellers have few potential options and RICK is typically the preferred buyer.

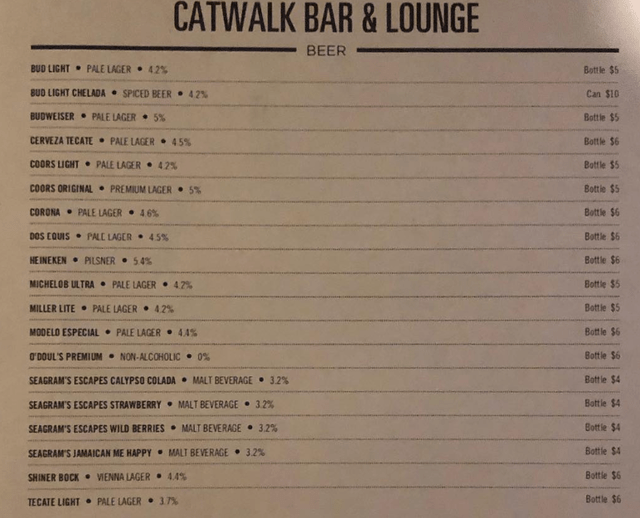

3) Professional management: This specific club appears to have been managed quite poorly and RICK is an expert at improving operations. The club will now enjoy RICK’s national buying power for all supplies (getting large discounts on alcohol) and the management and marketing of the location will improve materially. Just looking at the Instagram page of this club, you quickly realize that the previous owner could have done a lot better job. As an example, the menu on their Instagram page is just a low-resolution picture taken with a phone:

The biggest shareholder of RICK, Adam Wyden, has speculated that RICK probably only paid 3x in-place EBITDA, which means that the return should be exceptional after the rebranding and value-add. We will learn more on the next conference call.

But the point here is this:

RICK is earning phenomenal returns by buying, improving, and managing strip clubs, which are moated, highly profitable, and recession-resistant assets.

We showcased this deal to give you an example, but RICK has bought a total of 15 clubs over the past year, which is very significant for a company that only owns ~50 of them.

That’s nearly 40% unit growth in a year, and the management has noted on recent calls/podcasts that they have a full pipeline of potential deals.

They are today receiving a lot of calls from club sellers and brokers because they have all heard about RICK’s latest acquisitions and know that RICK has the resources to close more deals.

Today, RICK has ~$30 million in cash, and every day that passes, the cash pile keeps getting larger since they generate a lot of free cash flow.

$30 million may not seem like much, but for a company with a $500 million market cap, and the ability to close deals with seller financing, equity, debt, and limited cash contribution, these $30 million could go a very long way.

When asked about their recent share buybacks on the most recent Twitter Spaces, the CEO, Eric Langan noted that they will keep buying back shares, but that he also wants to keep nice reserve of cash for club opportunities.

This leads me to think that they expect to close some big deals in the second half of the year. Why else would he want to keep so much cash in a high inflation world? Remember that this is a company that’s massively free cash flow positive, has little capex, and a fairly conservative debt structure so there is no need for so much cash if it’s not in anticipation of new acquisitions.

Bottom Line

I have previously explained that RICK is my largest non-REIT real estate investment. I started buying it at around $15 per share in 2020, bought more of it all the way to $70 per share, and today, I continue to accumulate more of it at around $55.

I think that RICK is a clear case of an alpha-rich investment opportunity as it directly benefits from the constraints of other investors by buying assets that most couldn’t buy, at valuations that they couldn’t get.

Today, the company’s annual run-rate for free cash flow is estimated to be ~$80 million, which prices the company at just 7x FCF.

The company has been growing its FCF “per share” at 20%+ per year and it can keep doing so for a long time to come by following this investment strategy.

I have no clue how RICK will trade next month, next quarter, or even year, but looking back 5 years from now, I expect shareholders to have earned very substantial returns as it continues to compound its FCF per share at ~20% per year and its FCF multiple also expands closer to 15x.

In other words, I think that there is a realistic path to more than quadrupling your money in 5 years by investing in RICK.

Am I too optimistic? Perhaps. But even if I am off by a lot, our returns should be very compelling over time.

Be the first to comment