Dilok Klaisataporn/iStock via Getty Images

As the markets are cautiously grinding higher, after the painful first half of the year, and not without setbacks, investors focused on short-term returns likely justifiably consider maximizing gains by topping up allocations to high-beta equities, which suffered badly during the downturn.

Invesco S&P 500 High Beta ETF (NYSEARCA:SPHB), an investment vehicle preferring the most volatile stocks from the bellwether S&P 500 index, looks like a solid, liquid option to play that rebound. It has a more or less comfortable expense ratio of just 25 bps, meaningfully below the median.

The allure of this approach is that the ETF could capture more upside during resilient bull market runs, especially when blue chips start recuperating after a phase of softness, the post-March 2020 rally and July 2022 being the perfect examples, while the apparent disadvantage is the inevitably lower risk-adjusted returns as investors must be prepared for standard deviation almost double the iShares Core S&P 500 ETF (IVV) level.

In the article, I would like to take a closer look at the current version of its portfolio, discuss its past performance to elaborate on why the fund can be a solid tactical play but a poor long-term choice, and quickly assess its exposure to the quality factor and then arrive at a conclusion whether it is worth investing in it at this juncture.

The investment strategy and the portfolio

SPHB’s investment mandate is to track the S&P 500 High Beta index, which aggregates 100 stocks with the highest systematic risk manifested in the higher beta.

Its portfolio encompasses one hundred stocks, with rebalances made quarterly, which invites meaningful turnover. For instance, the prospectus shows a 103% figure, which is incredibly high for a passively-managed fund.

Unlike IVV, SPHB is barely a mega-cap-heavy fund. In the current version, the weighted-average market capitalization stands at around $61.2 billion vs. IVV’s approximately $566.4 billion. An important remark is that since the fund does not target the size factor specifically, in case volatility in pricier names increases, it can easily end up having a materially larger WA market cap, so the current figure should not be perceived as something set in stone. However, I do not anticipate it to match the massive one of IVV for one strong reason: the index it tracks uses a beta-focused weighting, so it has a way lighter top compared to the S&P 500 fund. To corroborate, its key ten holdings account for just around 15% vs. over 28% of IVV.

Dear readers will not find Apple (AAPL), the S&P 500’s favorite, amongst the top allocations, at least for now. The heavyweight is only in 85th place, with a weight of 0.84%. Microsoft (MSFT), another IVV’s principal investment, is simply absent. Meanwhile, Nvidia (NVDA) occupies the top spot, with 1.5%. NVDA has a staggering 24-month beta of 1.92, so there is no coincidence SPHB is overweight the stock. Yet this is not the most volatile player in the basket. For example, Tesla (TSLA) has a beta of 2.13. Overall, my calculations show the fund has a 1.42 weighted-average coefficient, which is consistent with the ETF’s focus on the most volatile stocks.

Next, SPHB has unstable, fluid sector allocation, which might be suboptimal for some investors. What we see now is concentration in the IT sector, with around 41.6% weight, followed by consumer discretionary stocks sporting a weight close to 26%. For better context, in January 2021, as shown by the data saved by the Wayback Machine, it had 27.3% in financials and 21.7% in energy. In November 2020, it was even heavier in banks and the like, with over 30% allocated, while consumer discretionary had 18.5%, and energy was just third with 13.4%.

What are the benefits and downsides of the strategy? Let us look at performance

In a nutshell, instead of running from risk, this strategy embraces it. There is no denying this approach implies theoretically higher reward, but there is also only a little evidence that robust returns delivered by the high-risk assets will last. To assess the hypothesis, we can look at the table below comparing its total returns since inception to IVV.

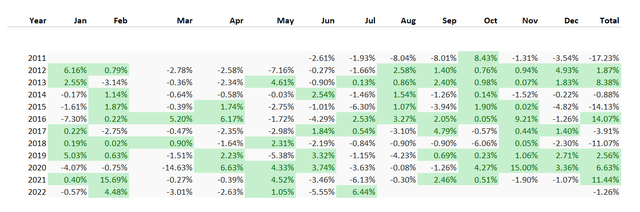

Created by the author using data from Portfolio Visualizer

As you can see, the fund beat the S&P 500 ETF mightily in recent years, with 2021 being especially successful, with a double-digit alpha. However, during the 2022 bear market, it lagged, with July, however, being a bright spot. So as I said above, the fund certainly could be used to play vigorous rebounds. But the issue is that it is not that easy to time a rebound, so holding the ETF for the long term does not appear to be worth it. Here is why:

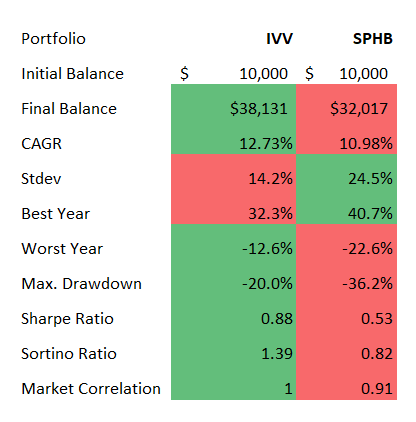

Created by the author using data from Portfolio Visualizer

Over the period encompassing June 2011 – July 2022, SPHB underperformed IVV, delivered a standard deviation 1.7x higher, had a deeper loss in its worst year, deeper drawdown, and, of course, far bleaker risk-adjusted returns. As can be seen, the Sharpe and Sortino ratios which measure the relationship between returns and volatility are meaningfully better for investors who stuck to the S&P 500 bellwether portfolio.

Does high beta mean weaker quality?

There is a hypothesis that higher risk (higher beta) is mostly a function of softer quality. Another way of saying, this premise implies volatility is principally driven by lackluster profitability or capital efficiency illustrating a company cannot deliver attractive fundamentals, which weigh on investor sentiment, with the share price swings supervening. The major issue with this assumption is that quality should not be assessed in isolation from the size factor. That is to say, even high-beta portfolios could have more or less adequate profitability characteristics in case components are drawn from the mega/large-cap league. And SPHB provides a nice example here. Sure, it has vulnerabilities, as 10% is invested in companies with sub-zero EBIT, while 9% were also incapable of delivering positive ROE (hence, net profit). Nevertheless, there are strong positives. For example, the share of stocks with at least a B- Quant Profitability rating is north of 87%. This is lower compared to IVV, but still large enough not to worry about poorly run companies significantly influencing the ETF’s returns. Delving deeper, around 52% of the holdings (excluding financials) have an EBITDA margin of 20% or higher, while less than 4% is allocated to EBITDA-negative players. Overall, thanks to its tilt towards large caps, SPHB’s quality is just fine. Does it make it worth investing in?

Conclusion

With more than 11 years in the books, SPHB’s strategy proved successful over a few time frames, with the coronavirus-torn 2020 and 2021 being notably lucrative. However, during periods when bear forces took control, and here 2018 and 2022 to date justly spring to mind, it suffered steep losses.

Additionally, investors who prioritize certainty about how a fund’s exposure to the key return-driving factors like size, growth, value, and quality changes over time would likely be dissatisfied with SPHB’s fluidity. As of now, we see over 21% of the net assets deployed to value stocks (B- Quant Value grade and better), while only 36% are clearly overpriced (D+ and worse), which is nothing short of surprising given SPHB’s high-beta focus. But there is no guarantee the mix will not change upon the next rebalancing; the only factor that will more likely be stable is quality, as discussed above.

That is to say, risk-tolerant investors would find enough arguments to invest in SPHB. The fund is simply racier than IVV when the underlying forces of the bull run are in place, confidence being the primary one. But those who prioritize safety over gains, targeting risk-adjusted returns rather than quick and rich short-term gains, and who are highly opposed to frenetic price swings and disdain steep unnerving drawdowns would likely say it is a pass. In this regard, since the market has barely become safer, with new risks percolating into the mix, my point is that sticking with bellwether ETFs to play stocks’ recovery is the most rational strategy.

In sum, SPHB might be considered a tactical play to benefit from improving market sentiment. For the longer term, it is a suboptimal investment worth avoiding.

Be the first to comment