Magnifical Productions/iStock via Getty Images

Quick Intro/Thesis

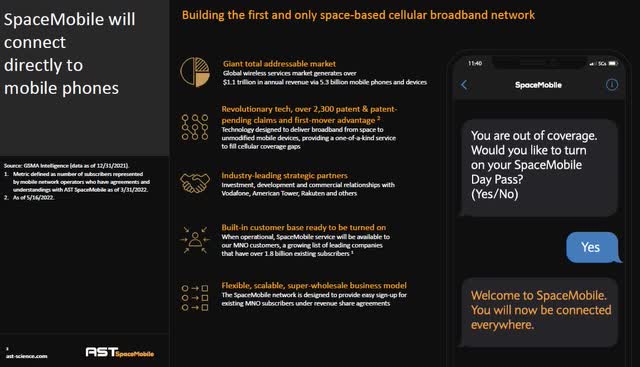

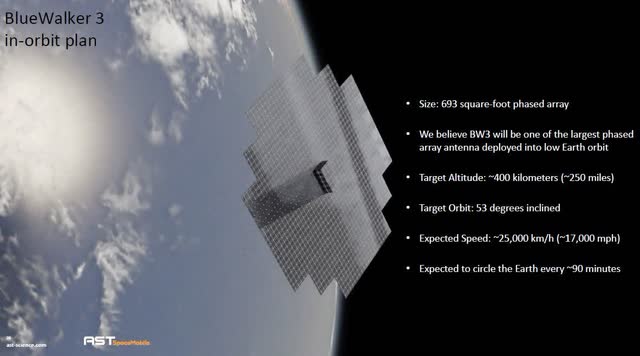

For those not fully aware of the company, AST SpaceMobile, Inc. (NASDAQ:ASTS) (ASTSW) is building SpaceMobile, a unique space-based cellular broadband network accessible by standard smartphones. A major catalyst is expected in early-to-mid September as the company will launch its BlueWalker 3 satellite and will be testing the service for the next ~6 months. ASTS should be considered a unicorn, despite being a pre-revenue and speculative bet currently, it could uncover a compelling opportunity in the future.

ASTS 06-2022 Investor Presentation

A Baby Unicorn

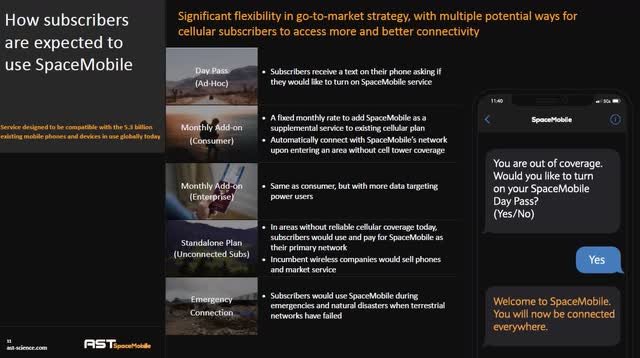

The company is still in an early, pre-revenue stage. Leaving behind the SPAC merger and the early 2021 frenzy a delay on the initial schedule brought the stock price from ~$25 to ~$5. However, ASTS could be destined to be a unicorn as it will be selling a unique space-based mobile service through its satellites that everyone will have the opportunity to access everywhere. The service will be available through ordinary smartphones without any additional parameters or equipment. Mobile subscribers will be able to roam from land networks to the SpaceMobile network automatically, even from the most remote location, or during an emergency occasion, and remain connected. The subscriber will only have to confirm the use of the network with an SMS. The company will be offering stand-alone programs as well as complementary ones to those of the traditional telecom land operators.

ASTS 06-2022 Investors Presentation

SpaceMobile can be a world-class, rare opportunity:

- With a TAM of over $1.1T and a potential reach of ~5.3B mobile phones or other devices, every human being with a mobile device will be able to use SpaceMobile.

- Partnerships with top-tier telecom operators such as Rakuten (OTCPK:RKUNF)(OTCPK:RKUNY) and American Tower (AMT). This also includes Vodafone (VOD)(OTCPK:VODPF) with a strategic partnership; and many more have been established.

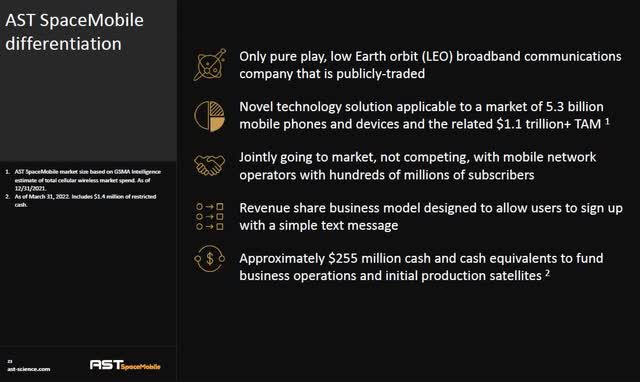

- ASTS’s proprietary technology with more than 2,300 patent and patent-pending claims is leading the way, leaving potential competitors back.

- The first-mover’s advantage will enable ASTS to revolutionize and dominate the space mobile industry.

ASTS 06-2022 Investor Presentation

The Catalyst

ASTS is now very close to a huge milestone. On July 20th the company announced that “BlueWalker 3 will travel to California for final environmental testing and then be delivered to Cape Canaveral, FL for launch into low Earth orbit in early to mid-September”. The market didn’t seem to realize the news immediately and the stock continued trading at low levels, near $6. After another announcement on 08/09/2022 confirming that “its BlueWalker 3 test satellite has arrived at Cape Canaveral”, the market started noticing that it’s really happening, driving the stock as high as $14+ on 08/16/2022.

Assuming a successful launch, “once in low Earth orbit and following initial in-orbit testing and configuration, AST SpaceMobile plans to conduct BW3 direct-to-cell phone testing on every inhabited continent, in coordination with mobile network operators (MNOs)”. This procedure should be completed ~6 months after the launch. Abel Avellan, the company’s CEO, provided some details about the procedure during the Q2 2022 ER conference call:

So, the first test that gets performed is after we launch and get into orbit. We will perform an in-orbit testing, which basically will be to verify that all the components and satellite cells arrive properly into its orbit and all the components are functioning as suspected. That will be the first phase. And we believe that that would be in the first two weeks after launch. Then after that, there will be a phase when we decide to deploy, basically to release the array. And basically, we have a phased array of approximately 8-meter by 8-meter that gets deployed. We have cameras, we have potentially other satellites taking pictures of that event. We’re that close that basically proving the mechanisms and the ability to open the satellite. The last events we start basically, we have a lot of these preplanned and obviously agree with the network operators when we start doing broadband direct to the cell phones with BlueWalker 3. So for that, we will have multiple opportunities to test with leading operators, the satellite. Together with the Nokia and Rakuten equipment on the ground, we basically will be able to demonstrate broadband directly to the handset. That’s kind of the last phase.

If successful, this effort will prove that the technology works, clearing any doubts, and setting the company up ready for the satellite production ramp-up and the commercialization of the service.

ASTS 06-2022 Investor Presentation

Competition

There are no direct competitors at the moment. Existing peers use tech that either applies to satellite phones or requires the use of special and expensive equipment such as antennas etc.

ASTS 06-2022 Investor Presentation

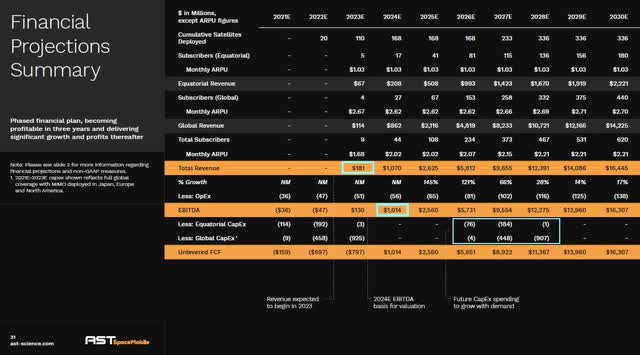

Valuation

According to the company’s initial forecasts, a ~$10B EBITDA could be achieved in 5-6 years with a huge EBITDA margin of 90%+. Assuming an EV/EBITDA ratio of ~10 the company should then be valued at ~$100B. Even if someone prefers to be more conservative or supports that the company is months behind its initial schedule, it is obvious that if the company succeeds it could be valued multiple times more than the current valuation of ~$2.3B.

ASTS 12-15-2020 Investor Presentation

Risks

ASTS is currently a pre-production, pre-revenue, unprofitable company that will need at least a couple of years to post profits. Thus, the stock price could present volatility along the way. The company will probably need additional funding in the future and raising capital could cause dilution to the existing shareholders. Problems or delays regarding satellite launching could also occur. Moreover, financial projections may prove false. Finally, if their BlueWalker 3 test fails the company could end up worthless.

Conclusion

To sum up, ASTS could prove to be one of the most compelling risk/reward cases of the decade with its fascinating world-changing attempt. If the company proves that its product works after the BlueWalker 3 launch and successful testing, speculation will be significantly reduced and a bright future will gradually be reflected in the stock price. Long-term, forward-thinking investors should be seeking momentum to build up a position if they have not already done so.

Be the first to comment