trekandshoot

Thesis

OneMain Holdings, Inc. (NYSE:OMF) is a high-dividend stock that can provide steady income stream in a diversified portfolio. We believe that the company’s history of dividend payouts, generous share buyback program, and solid loan performance and financials make this company a good investment looking for high dividend yield, capital preservation, and a steady income stream.

Company Overview

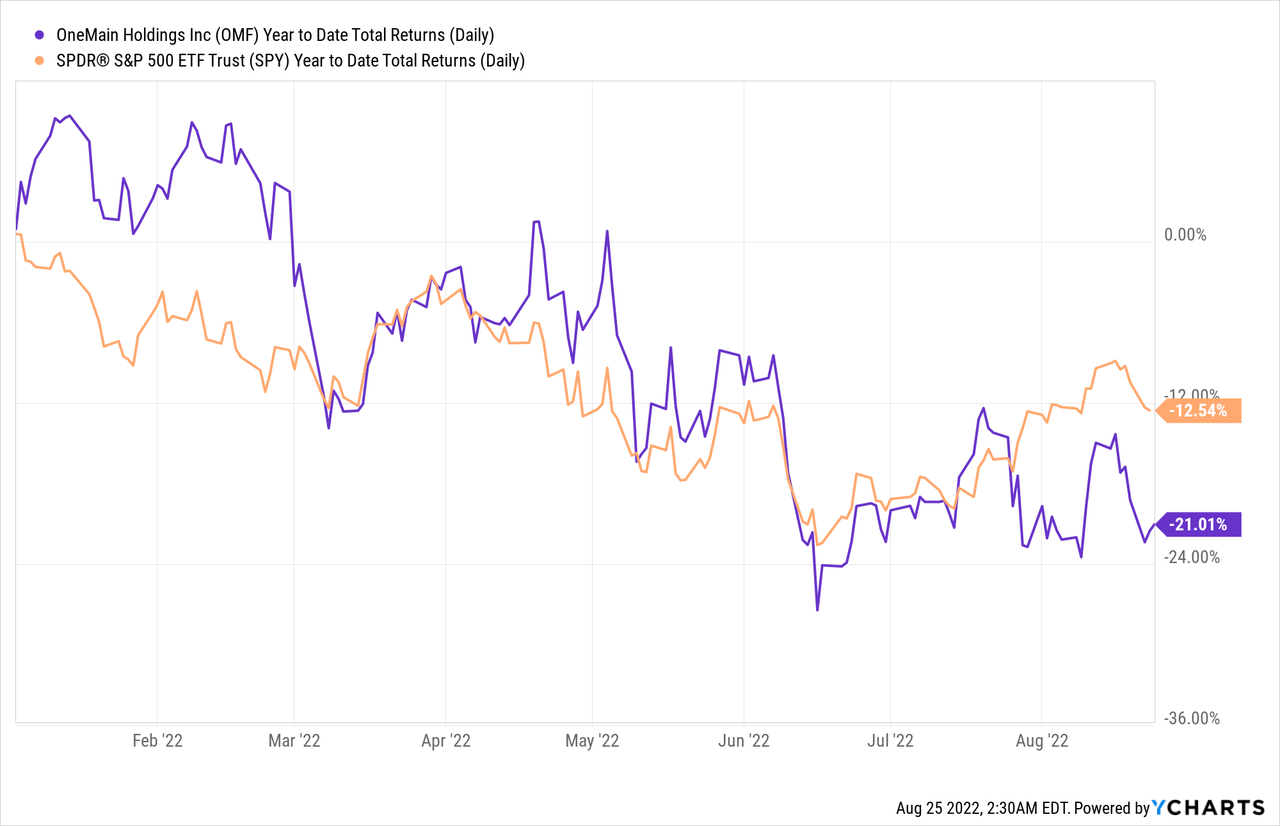

OneMain Holdings is a financial services company that specializes in providing loan services to borrowers with limited access to credit. The company mainly provides personal small loans to borrowers as well as offer credit card services. OneMain Holdings is a national company with 1,400 branch locations nationwide. Year-to-date, the stock price has seen a decline of -21.01%, underperforming the S&P 500 index, which has seen a decline of -12.54% in the same time frame.

Dividends and Share Buybacks

OneMain Holdings currently has a $300 million share buyback program, which amounts to more than 5% of its market capitalization. In addition to this generous buyback program, the company has recently announced a quarterly dividend of $0.95 per share – resulting in a 10.2% annualized dividend yield. Using the FY 2022 EPS consensus forecast of $7.69 per share, the $3.80 in annual dividends equates to less than 50% dividend payout ratio. While we do not believe that the dividend yield is likely to be sustained in the short-term, we believe that current payout ratio and the history of paying $0.95 per share in the past few quarters show the future long-term dividend potential of the business. The dividend history and payout ratio should provide some degree of safety for the company to continue pay out high dividends (even if it is less than the current $0.95 per share) in the event of an earnings downturn from a recession.

Loan Performance and Reserves

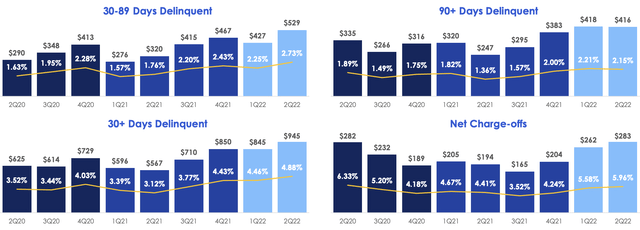

With the recent economic slowdown, potential widespread charge-offs and loan losses should be of concern to investors. Based on the most recent results, the delinquency rates and net charge-offs are still at a reasonable level, though it is important to note that the substantial rise in 30+ days delinquency in the last quarter is worrisome as it is often a leading indicator of future loan losses and charge-offs. Regardless, the current levels are manageable and a deterioration in loans is expected as the economy slows down from the Federal Reserve’s tightening monetary policy. We will continue to assess how the loans performance in subsequent quarters; however, as of now, we believe that the firm is well-capitalized enough and generates enough free cash flow to cover any medium term loan losses.

OneMain Holdings Earnings Presentation

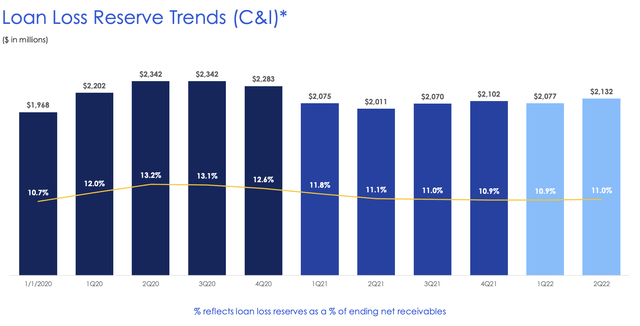

In addition, we find that the firm has done a good job maintaining loan loss reserves with more than $2 billion in loan loss reserve at 11% of its net loan portfolio. Even though the net charge-off increased quarter-over-quarter ($262 million to $283 million), the loan loss reserve increased over the same time period, which shows that management is proactively managing the risk and potential loan loss in the portfolio.

OneMain Holdings Earnings Presentation

Stable Financials

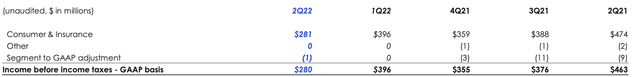

We like the company’s fairly consistent financial performance. Our thesis centers around the sustainability of the dividend and its ability to maintain its generous buyback program. Though there has been a quarter-over-quarter deterioration in the earnings, our focus centers on the continued profitability and free cash flow generation to maintain its dividend and buyback programs. Even in a cyclical downturn, the company has earned $280 million on a GAAP basis this quarter, which far exceeds the $246 million in cash dividends paid during this year (1Q22 and 2Q22). Not only that, the company also has $526 million in cash as of June 30, 2022, and we believe that the excess income and the ample liquidity on hand should give confidence to investors that the company is well-positioned to navigate the economic uncertainty.

OneMain Holdings Earnings Presentation

Conclusion

OneMain Holdings provides investors an opportunity to add a high dividend yield stock with solid fundamentals. We believe that the company’s continued profitability and limited deterioration in loan losses will sustain the company’s high dividend payout for the foreseeable future. If investors are looking for a dividend stock to add to increase the portfolio’s aggregate yield, we believe OneMain Holdings should have a place in the portfolio.

Be the first to comment