David Ramos

In July, 2022, we have published an article about Verizon Communications (NYSE:NYSE:VZ) on Seeking Alpha, titled: 2 reasons to buy Verizon now despite the lowered guidance”. In that article we have highlighted the firm’s valuation and its attractive, safe, and sustainable dividend payments as the main reason for investing in the company’s stocks.

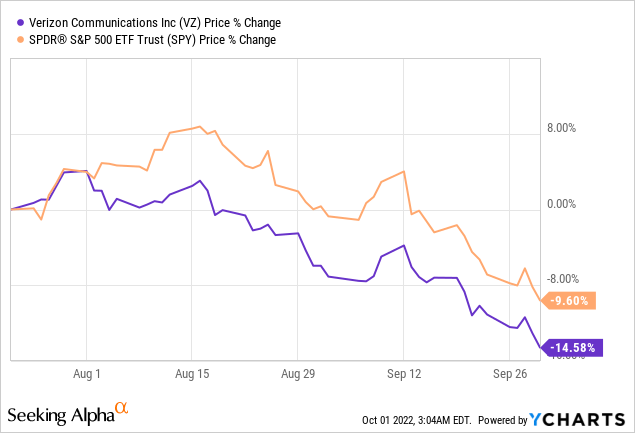

Since our writing, the share price has fallen significantly, underperforming the broader market by as much as 5%.

Today, we are revisiting VZ’s stock and provide an updated view on our investment thesis, taking the latest news into account.

In the last months there have been many interesting developments around VZ:

The firm expects wireless subscriber decline

Earlier in August, the firm has announced that they are expecting a decline in the number of wireless customers. The main driver of the decline is the price hikes introduced recently, which are $6 or $12 based on the type of subscription.

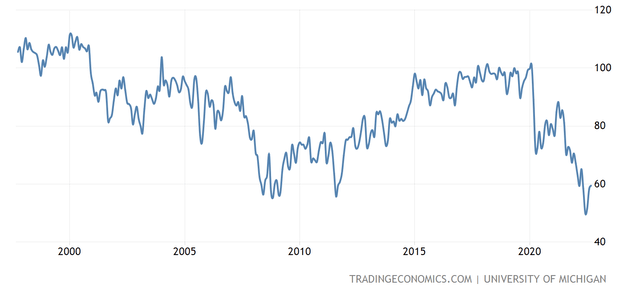

We believe, such a decline in the number of customers can be, at least partially, explained by the current macroeconomic environment, precisely by the low consumer confidence levels.

The demand for services, which are not essential, can materially decline during times of low consumer confidence. When people become more concerned about their financial outlook, they likely switch to lower cost, more affordable providers. We believe that VZ’s services are also not an exception from this trend.

Consumer confidence levels in the United States have been falling dramatically in 2022. Despite the rebound in August, readings remain at extremely low levels.

Consumer confidence (Trading Economics)

In our opinion, subscriber growth is not likely to dramatically change, as long as the macroeconomic environment remains highly uncertain. This may result in further downside for the stock in the near future.

On the other hand, the firm was quite positive on their progress of gaining traction in the lower-end of the market and has hinted on launching promising new products for this segment. In our opinion, this incentive can substantially benefit VZ in the current market environment. We expect the demand for cheaper, lower-end products and services to increase in the near future.

We also have to mention that VZ is actively working offering incentives, like a free Disney+ subscription to customers, when they upgrade to prepaid unlimited plans. In our opinion, this may also help to boost the subscriber growth in the near term.

Verizon pushes home entertainment

Further, to further expand their customer base, Verizon has recently announced a set of new products, which are aimed at the home entertainment experiences, using the firm’s 5G networking technology.

The demand for gaming related services and products in general have slowed in the recent months, due to the challenging macroeconomic environment. As explained earlier, the low consumer confidence is creating substantial headwinds in the segment and we do not see the possibility of a dramatic improvement in the near term.

For this reason, we believe that the demand for the newly announced products may not be as high as expected, however it may create opportunities for growth in the future.

Private 5G network in aircraft hangar

Verizon has been awarded a contract from the U.S. Department of Defense to build a private 5G network in one of the aircraft maintenance hangars.

The contract has a value of $11.5 million, which is represents a minor portion of the firm’s total revenue. While, winning the contract is definitely a positive development, we believe it will not have a material impact on the firm’s financial performance.

This, however, was not the only contract the firm has received this year from the government. In August, VZ has received another contract from the U.S. DoD to provide Naval Computer and Telecommunications Area Mast Station Atlantic with integrated voice and data services. The contract’s value is $28.35 million.

The main benefit of such contracts is that it is independent of the consumer and the consumer sentiment. Government contracts can provide reliable cash flows, even during challenging economic environments.

Expanding connected healthcare partnership

Verizon Business has recently announced the expansion of its connected healthcare partnership with Visionable. The aim of the partnership is to secure a next-generation digital platform that enables healthcare professionals to access and share data and resources and effectively collaborate across the APAC and EMA regions. The platform would also create a mean of communication between frontline respondents and specialist doctors.

While we also do not see a direct impact of this partnership on the financials in the near future, this initiative could also provide interesting growth opportunities for the firm in the years to come.

Verizon Business has been chosen to manage the Astellas Pharma global network infrastructure.

The move builds on the company’s network-as-a-service foundation and supports its private networks, mobile edge compute and business solutions vectors of growth.

Healthcare is another sector, which is relatively independent of the consumer sentiment. While, people may choose cheaper treatment options, the demand for most health-related products and services is considered relatively inelastic.

We like that VZ is broadening and diversifying its customer base, because, in our opinion, it can significantly benefit the firm in the long term.

Expanding the 5G network

American Tower (AMT) and VZ have recently entered a long-term lease deal, which aims to facilitate the expansion the Verizon’s 5G network across the United States. One of the advantages of the deal is that it is aimed at providing a simplified and efficient leasing process.

The expansion of the 5G network could also potentially serve to fuel growth.

Dividend raise

One of the main reasons for rating VZ’s stock as a “buy” in our previous article was the strong track record of dividend payments and dividend growth. Once again, VZ has announced that they are raising their quarterly dividend to $0.6525 per share, representing a 2% increase. This dividend corresponds to a 6.8% yield on an annual basis.

When we valued the firm based on the Gordon Growth Model previously, we assumed a dividend increase of 2% for our calculations. As the firm has in fact increased their dividend payments by 2%, our assumptions for valuing the stock remain intact.

The previously calculated range of fair values was $43.5 to $52.7 per share. As the stock is currently trading in the range of $37-39, we believe the stock remains undervalued.

In our opinion, VZ remains attractive for dividend and dividend growth investors.

Key takeaways

Despite the analysts downgrades in the past months and the declining wireless subscriptions, we believe that VZ remains an attractive investment option, due to its valuation and its quarterly dividend payments.

We find the recent news around the firm also quite positive, showing some potential for cooperations, partnerships and expansions that could fuel growth in the years to come. In our opinion, having a diversified customer base, including the government or healthcare partners, allows the firm to better weather volatile market environments in the future.

For these reasons, we maintain our “buy” rating on VZ.

Be the first to comment