courtneyk

Midstream Sector Performance

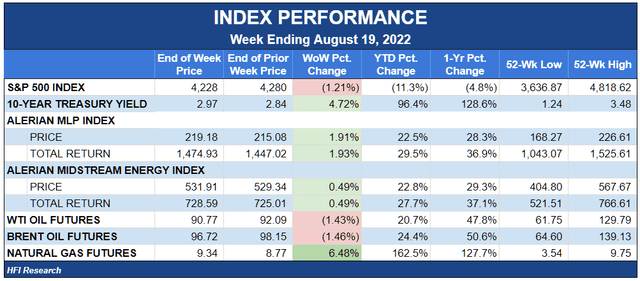

Midstream was a standout performer this week in the face of rising interest rates, declines in the S&P 500, and falling crude oil prices. Midstream’s 1.9% weekly gain outperformed the E&P-weighted (XOP) and the broader energy sector as captured in the (XLE), which rose by 1.7% and 1.3%, respectively.

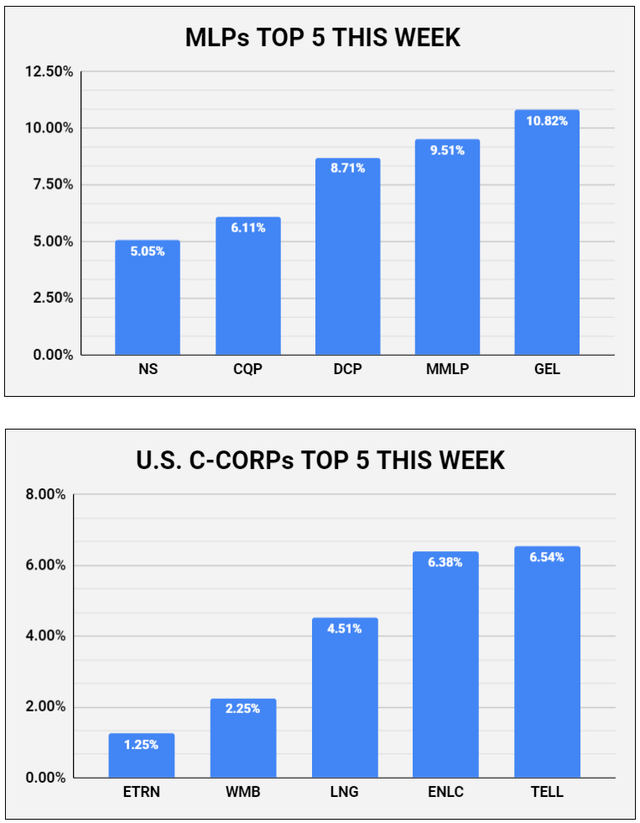

The big news in midstream this week was Phillips 66’s (PSX) proposed acquisition of DCP Midstream (DCP), which we covered here. The offer was made at an EBITDA multiple of 7.4-times, which we view as a lowball offer. DCP unitholders should sit tight for a sweetened offer in the neighborhood of $40.

The acquisition would further winnow the pool of large MLPs, bringing the total with a market cap above $5 billion to seven. The deal sparked speculation over which MLP is next to be acquired, which, in turn, caused investors to bid up sponsored MLPs like Cheniere Energy Partners (CQP), Holly Energy Partners (HEP), and Delek Logistics Partners (DKL). Units of smaller MLPs like Genesis Energy (GEL) and Crestwood Energy Partners (CEQP) also gained after the PSX bid, as investors speculated that they would be acquired by larger energy firms on the prowl for assets selling at discount in public markets.

The speculation caused MLPs to outperform C-corps during the week.

MLPs have long traded at a discount to C-corps. Still, their outperformance closed the gap only slightly. On a valuation basis, midstream MLPs continue trade at a discount to their C-corp peers. We continue to favor MLPs as long-term equity investments due to their superior prospects for appreciation and income growth relative to C-corps.

Royalty trusts and larger MLPs—both of which are less attractive as acquisition candidates—lagged during the week. We used their underperformance to increase our position in MPLX (MPLX) during the week, as we discussed here.

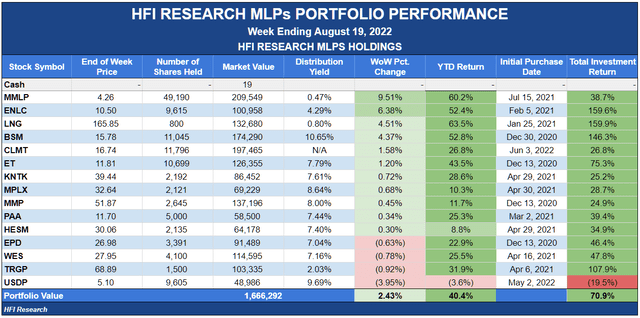

Weekly HFI Research MLPs Portfolio Recap

Our portfolio outperformed its benchmark, the Alerian MLP Index, by 0.5%.

Martin Midstream (MMLP) surged 9.5% on no news. The units had fallen far too low given the company’s improving operating performance and financial position, which have made a refinancing more probable. We used the dip to acquire more units, as we discussed here.

EnLink Midstream (ENLC) units rose 6.4%. Most of ENLC’s weekly gain came on the heels of the DCP announcement and is likely due to a rotation by investors and ETFs into a G&P alternative, even though ENLC is treated like a C-corp for tax purposes.

Cheniere (LNG) showed continued strength amid record high LNG prices that have come about from Europe’s efforts to bid cargos away from Asia. European governments are taking any means necessary to secure natural gas for the winter.

As for the week’s four losers, each was weak on no news.

Our holdings had greater than usual insider buying and selling activity during the week, as shown below.

- Calumet Specialty Products Partners (CLMT) Executive Chairman Stephen Mawer bought 4,321 units at an average price of $16.17 for an investment of $69,867.

- Energy Transfer (ET) CFO Brad Whitehurst purchased 10,000 units at an average price of $11.50 for an investment of $115,000.

- Kinetik Holdings (KNTK) Chief Strategy Officer Anne Psencik sold 2,466 shares of KNTK for $39.10 for proceeds of $96,421. The sale represented only 1.6% of Psentik’s holdings, so we’re not reading anything into it.

- KNTK CEO Jamie Welch bought 1,100 shares at an average price of $38.53 for an investment of $42,383.

News of the Week

Aug. 16. Energy Transfer (ET) completed the sale of its 51% stake in Energy Transfer Canada to a joint venture which includes Pembina Pipeline Corp (PBA) and global infrastructure funds managed by KKR. PBA management is excited about its acquisition of the assets and has plans for additional investment. Meanwhile, the deal helps ET deleverage as per the credit rating methodology of the major rating agencies. It takes ET a step closer to management’s goal of increasing the quarterly distribution to $0.305.

Aug. 16. Plains All American (PAA) is exploring the expansion of its Fort Saskatchewan NGL storage and fractionation facilities. PAA’s Fort Saskatchewan is an attractive asset that is set to benefit from increasing Canadian NGL production and growing global demand. Canadian natural gas prices have recently tumbled as Canadian natural gas production approaches 14 Bcf/d and takeaway constraints in Western Canada. The falling prices could help PAA capture a large fractionation spread as it markets its NGL products in eastern Canadian and U.S. markets.

Aug. 18. Tellurian (TELL) closed on its acquisition of EnSight IV Energy Partners’ Haynesville assets for $125.5 million. TELL expects the deal to increase its natural gas production to 250 MMcf/d. It funded the acquisition with cash on hand. TELL’s objective from the start has been to purchase upstream assets to ensure feedstock for its LNG production, and this deal advances that objective. TELL has yet to secure financing for its Driftwood project. As long as Driftwood’s future remains uncertain, TELL’s stock is far too speculative for our tastes.

Aug. 18. A federal judge kept jurisdiction over Michigan’s lawsuit that seeks to close Enbridge’s (ENB) Line 5 pipeline. Michigan had sought to shift the case to a federal court, so the ruling is a victory for ENB. The judge ruled that regulation of Line 5 is a federal matter and asserted that the state was gaming the judicial machinery by trying to change the legal forum. Michigan’s attempt to shut down such a vital source of propane due to the minuscule risk of a pipeline leak is beyond comprehension to us.

Capital Markets Activity

Aug. 15. MPLX (MPLX) announced the redemption of its $500 million of 2.500% senior notes due December 1, 2022, and $500 million of its 3.375% senior notes due March 15, 2023. The notes will be redeemed at par.

Aug. 16. EnLink Midstream (ENLC) announced the pricing of an upsized offering of $700 million principal amount of 6.500% senior notes due 2030. ENLC plans to use the proceeds to fund the repurchase of its 4.40% senior notes due 2024 and its 4.15% senior notes due 2026.

Aug. 17. Enbridge (ENB) announced that none of its Cumulative Redeemable Preference Shares Series L will be converted into Series M Shares on September 1 since less than the 1 million Series L shares required for the conversion were tendered.

Be the first to comment