SAND555

Southern Copper Corporation (NYSE:SCCO) might be hard-pressed to deliver on Q3 and Q4 estimates in light of a seemingly endless slide in commodity prices. Because of this, along with subpar near-term growth metrics, we rate the stock a hold. However, with the world’s largest copper reserves and plans to boost production by 90% by 2030, the company is well positioned for the long run. Not to mention, we calculate that SCCO is currently trading about 25% below its intrinsic value. Hence, we plan to revisit the stock once the price of copper stops sliding.

Near-Term Headwinds

Southern Copper is a majority-owned subsidiary of Grupo Mexico, headquartered in Arizona, with mining operations in Peru and Mexico. The copper mining giant registered about $10.9 billion in revenue in 2021 and is estimated to reach about $9.7 billion in fiscal year 2022. About 80% of the company’s revenue is derived from copper with the remainder coming mainly from molybdenum (8.6% of sales), silver (4.3%) and zinc (3.5%).

Southern Copper reported $2.31 billion in sales and $0.56 EPS in Q2, missing estimates by 12% and 42%, respectively, largely due to work stoppage at the Cuajone operations in Peru as the result of protests.

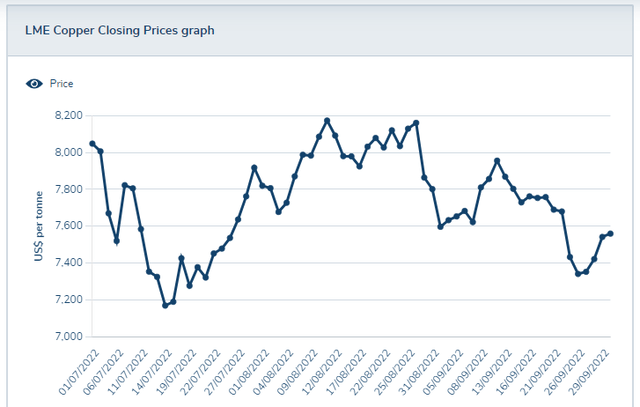

The company, which is expected to announce Q3 earnings on October 25, might be hard-pressed to hit a consensus quarterly revenue target of $2.28 billion in light of the sharp fall in copper prices. The average price of copper in Q2 sat at $4.32/lb on the London Metal Exchange (LME), but fell 18.9% to $3.50 in Q3. This is critical because there is obviously a close correlation between the LME copper price, mining sales which are directly based on the LME price, and stock price.

LME Q3 2022 Copper Prices (London Metals Exchange)

Moreover, the price has continued to slide since the end of the third quarter and now sits at about $3.40/lb (as of 10/14/22), which bodes ill for Q4 earnings as well.

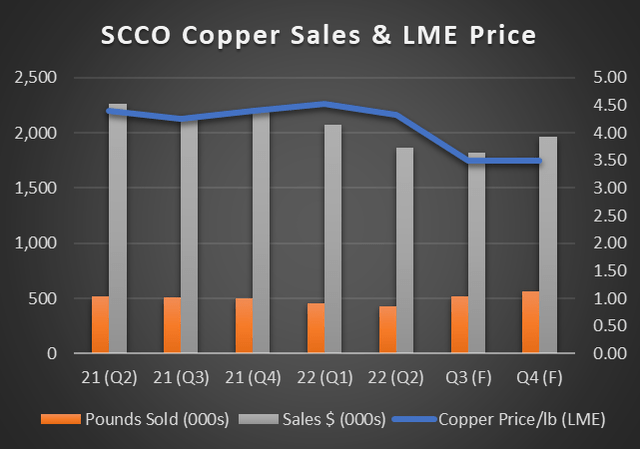

The target $2.28 billion in total sales implies about $1.82 billion in copper sales (or 80% of the total) for Q3 forecast.

SCCO Quarterly Sales (Data Source: SCCO SEC Filings)

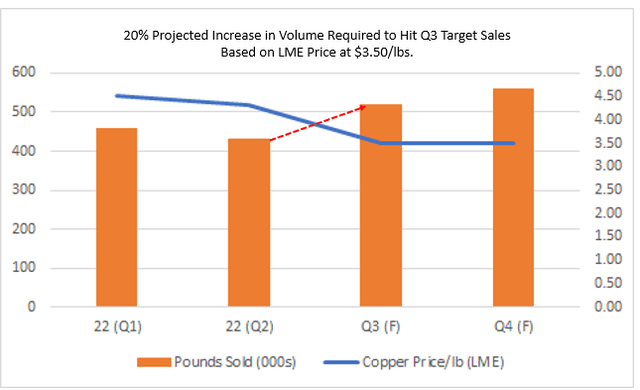

Assuming an average copper price of $3.50 per pound, Southern Copper would have to boost copper sales volumes by more than 20% – from 430 million pounds of copper sold in Q2 to ~520 million pounds.

SCCO Quarterly Sales (Data Source: SCCO SEC Filings)

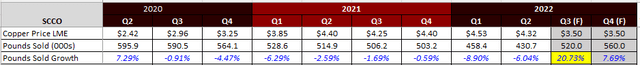

As this table shows, the company has seen a decline in sales volume for eight consecutive quarters.

SCCO Copper Sales Volume vs. LME Price (SCCO SEC filings)

At the end of Q2 there was just over $1.07 billion worth of inventory on hand, much higher than the average as % of sales, which could help. However, we suspect the problem will no longer be one of production constraint, but one of demand, as the company alluded to in its Q2 filing.

The company said fears of a simultaneous recession in the U.S., Europe and China are driving down the price of copper. The company also said relevant market intelligence houses expect a small deficit for 2022 of about 200,000 tons, which assumes growth in demand of 1.0-2.5%. However, this will likely not be enough to fill the aforementioned gap.

(For more on last quarter’s results see the analysis done by Seeking Alpha’s Fun Trading).

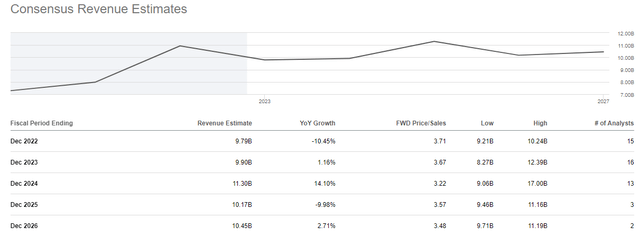

In terms of beyond Q3, the stock is projected to grow by only 6 percent from now through 2026, which means less than 2% on an average annualized basis.

SCCO – Consensus Revenue Estimates (Seeking Alpha Premium)

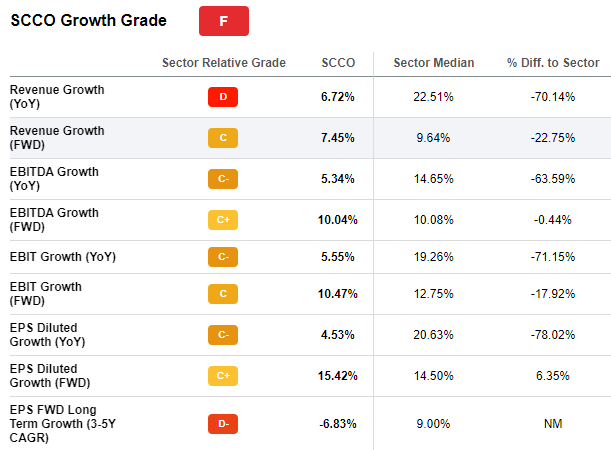

SCCO garners an “F” grade overall in the Seeking Alpha quant metrics for growth. Southern Copper underperforms the sector in almost every growth measure, from sales to EBIT to EPS.

SCCO Growth Metrics (Seeking Alpha Premium)

Long-Term Upside

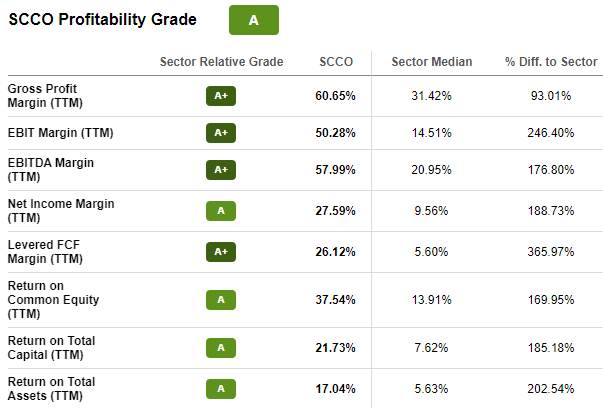

Putting aside growth issues and commodity pricing pitfalls, there is good reason to be excited about SCCO’s stock in the long run. For starters, its profitability numbers significantly surpass the field including its closest competitors. In the mining industry, return on capital is a critically important metric that analysts constantly look at and SCCO right now is at 21.73% versus 7.62% for the field.

SCCO Profitability Metrics (Seeking Alpha Premium)

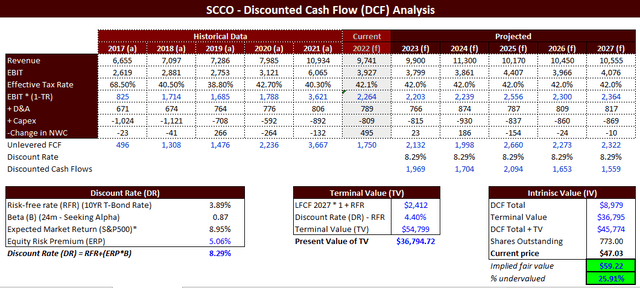

A discounted cash flow analysis based on consensus estimates for the next five years reveals that the stock is trading well below its fair value. This was based on projecting unlevered cash flows for the years 2023-2027. The 10-year t-bond is used as the risk-free-rate input, and the Beta value of 0.87 comes from Seeking Alpha. The analysis shows that the current stock price of $47.03 is trading about 25% below its implied fair value.

SCCO DCF (2023-2027) (Author spreadsheet, Seeking Alpha Premium, SCCO Financials)

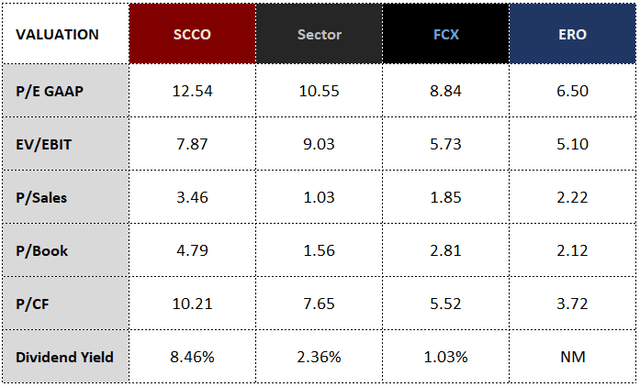

As nice as that is to see, it appears other copper stocks are even more undervalued. Take a look at SCCO key valuation metrics versus two main rivals: Freeport-McMoRan Inc. (FCX) and Ero Copper Corp. (ERO). They beat SCCO in all key metrics listed except for dividend yield.

SCCO Valuation vs. Sector & Key Copper Peers (Data: Seeking Alpha Premium)

It is also important to underscore that in the long run copper demand is forecasted to outpace supply dramatically – with some estimating shortfalls of close to 10 million metric tons (mmt) by 2035.

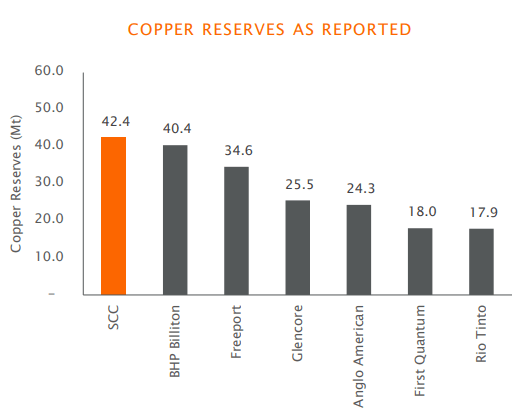

Southern Copper is well-positioned to cash in on the world’s bid to go green and reach net-zero emissions by 2050. The target, set by more than 70 countries, will require a rapid switch to electric vehicles (EV) and renewable electricity on a scale that will send copper demand surging. Southern Copper owns the world’s largest copper reserves at 42.4 Mt, representing about 4.8% of the planet total (which is about 800 Mt according to the U.S. Geological Survey). And the company says it has several projects in the works to boost production from about 898 Mt in 2022 to 1,733 Mt. by 2030 (an increase of ~92%).

SCCO Copper Reserves (SCCO Sept 2022 Investor Presentation)

Conclusion

Southern Copper is a hold at the moment in light of falling copper prices and subpar sector-relative short-term growth expectations. However, once the smoke clears, we will revisit the stock because it is undervalued, highly profitable, and well-positioned for long-term growth.

Be the first to comment