hapabapa

Thesis

Walmart (NYSE:WMT) is aggressively expanding its e-commerce business and focusing on technology to expand margins. In my opinion, Walmart is poised to become Amazon’s (AMZN) biggest competitor. Would Walmart thus merit also an Amazon-like valuation? Yes, I think so.

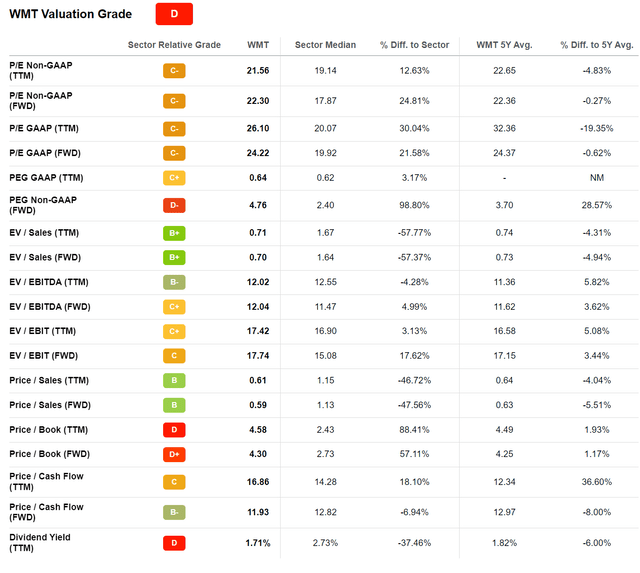

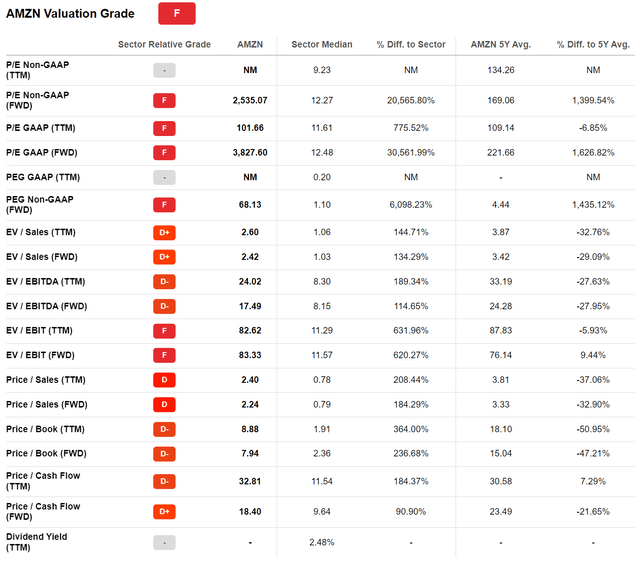

As of October 2022, WMT trades at an EV/Sales of x0.7 and EV/EBIT of x17.7, as compared to x2.3 and x78 for AMZN respectively. These multiples will eventually converge. Amazon’s valuation will likely go much lower, as the growth story fades, and Walmart’s will go slightly higher, as e-commerce expansion and efficiency gains are priced in.

Is the thesis already playing out? Walmart stock lost less than 10% YTD, versus a 37% loss for Amazon stock.

Seeking Alpha

Walmart’s E-Commerce Expansion

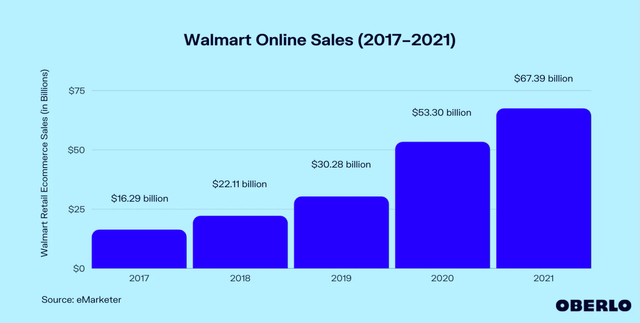

Walmart’s e-commerce sales have expanded rapidly since 2017. Over the past 5 years, this segment has grown at a CAGR of about 33%, jumping from $16.3 billion to $67.4 billion. Although growth slowed down somewhat in 2022, Walmart’s e-commerce ambitions are still developing at an attractive pace: growing about 12% year over year in Q2.

Oberlo

Meanwhile, Amazon’s e-commerce sales are slowing. With reference to the past two quarters, the e-commerce giant’s online sales have stealthy declined, with a 4.3% year over decrease in Q2

True, Amazon still has almost x7 times as much e-commerce market share than Walmart. In the U.S. in 2021 for reference, Amazon claimed 40.4% market share versus 7.1% for Walmart. But Walmart is undoubtedly catching up; with high-potential growth activities also outside the U.S. – for example in China and Brazil.

In any case, investors should not forget that Walmart’s physical stores continue to perform, while providing an almost impenetrable competitive moat (it would be economic suicide if a competitor would build a comparable supermarket near Walmart’s superstores). And investors should not forget that Amazon has gradually attempted to build a comparable physical presence – e.g., Amazon Go, Amazon Books, Amazon 4-star, etc.

Focus on Efficiency And Technology

Both Walmart and Amazon are exceptionally well managed businesses, with strong focus on operational efficiency and customer satisfaction. In my opinion, it is tough to make an argument why one of the shopping giants should lead in these dimensions over the other.

However, Walmart’s margins are in fact stronger than Amazon’s. With reference to the trailing twelve months, Walmart achieved an EBIT margin of 4%, versus 3% for Amazon. Similarly, Walmart’s efficiency ratios are better: 5.6% return on total asset, versus 2.8% for Amazon. How is this possible, if Amazon is supposedly a tech company (FAANG). Well, in my opinion Amazon is no more a tech business than Walmart.

Here are a few things to consider: Walmart has bought Alert Innovations, a robotics business that supports automation in Walmart’s fulfillment centers. Walmart currently supports about 20.000 of technology-focused employees, and plans to add 5.000 more. Walmart already offers drone deliveries, a service that is expected to expand to 4 million households. Walmart is testing the waters of the metaverse – with the launch of Walmart Land and Walmart’s Universe of Play on Roblox (RBLX).

Valuation

Walmart is valued much cheaper than Amazon. According to data compiled by Seeking Alpha, Walmart is valued at a one-year forward EV/EBIT of about x17.7, while Amazon’s one-year forward EV/EBIT is x83. The respective EV/Sales dispersion is even larger: x0.7 for Walmart versus x2.4 for Amazon.

Given the arguments presented in previous sections, I believe that both businesses will eventually converge towards a valuation of about x1 EV/Sales and x20 EV/EBIT (which would give a yield of about 5%). This would mean that Walmart’s multiples would expand by about 30% – 40%, and Amazon’s multiples would contract.

I acknowledge that Amazon’s cloud business provides analysts some difficulties in valuing Amazon. But I argue it is too early to speculatively apply an outlandish EV/Sales multiple to this segment. I would like to highlight to arguments that pressure on valuation: First, note that AWS competes directly with Google (GOOG) and Microsoft (MSFT). Second, AWS competitive strength is mainly based on infrastructure, less on tech SaaS. Accordingly, a software-like valuation for the segment seems unreasonable.

Walmart

Seeking Alpha

Amazon

Seeking Alpha

Conclusion

Amazon has arguably more ‘glamour’ than Walmart. But the actual value is much more competitive. Personally, I see no material reason why Amazon should trade at triple the EV/Sales multiple of Walmart – especially since Walmart’s business is more profitable than Amazon’s.

In my opinion, Walmart’s and Amazon’s valuation will eventually converge to a more competitive ratio. That said, I argue that Walmart’s multiples could expand by about 30%-40% (best case price target of about $182/share), as the company’s e-commerce expansion and tech-based efficiency gains get more attention. Buy.

Be the first to comment